Summary1

The U.S. Social Security Administration (SSA) administers the Old-Age, Survivors, and Disability Insurance (OASDI) and Supplemental Security Income (SSI) programs, providing benefits to approximately 64 million Americans. Within OASDI, Old-Age and Survivors Insurance (OASI) pays benefits to retired workers who have paid into the program and their dependents and survivors, while Social Security Disability Insurance (SSDI) provides benefits to adults with disabilities who have worked and paid into the Disability Insurance trust fund and to their spouses and adult children who are unable to work because of disability.2 SSI, a means-tested program based on income and financial assets, provides income assistance from U.S. Treasury general funds to adults aged 65 or older, individuals who are blind, and disabled adults and children. As of December 2014, approximately 48 million individuals received OASI benefits, about 11 million received SSDI benefits, and about 8 million received assistance through the SSI program. Of the roughly 64 million beneficiaries, approximately 3 million received benefits through both OASDI and SSI.

The Social Security Act Amendments of 1939 authorized the Commissioner of Social Security to make benefit payments to an individual

___________________

1 This summary does not include references. Citations to support the text, conclusions, and recommendations herein are provided in the body of the report.

2 Disabled beneficiaries who are now adults but became disabled prior to age 22, which SSA refers to as disabled adult child beneficiaries, receive benefits based on their parents’ Social Security earnings record. To be eligible for disabled widow(er) benefits, the widow(er) must be between the ages of 50 and 59, prove his or her relationship to the disabled worker, and demonstrate his or her disability.

or organization other than the beneficiary when doing so would serve the beneficiary’s interest. SSA uses the term capability to denote the ability of beneficiaries to manage or direct the management of their SSA benefits. SSA presumes that adult beneficiaries are capable unless there is evidence to the contrary. If there is some question as to whether a beneficiary’s mental or physical impairments prevent that individual from managing or directing the management of his or her benefits, SSA makes a determination regarding the beneficiary’s capability. If SSA determines that a beneficiary is incapable, the agency assigns a representative payee to receive and manage the beneficiary’s benefits. The representative payee must use the benefits in the beneficiary’s interest, although he or she may distribute small portions of the payment directly to the beneficiary.3 The main goal of representative payment is to ensure that the beneficiary’s interests are being met. Recognizing the importance of the representative payee program to the well-being of beneficiaries in need, SSA often has sought to improve various aspects of the program, conducting internal reviews and seeking expert advice from external sources. Although the process for determining whether a beneficiary is capable has received some attention, much of the focus of these past efforts has been on the performance of the representative payees assigned to those beneficiaries determined to be incapable.

As part of a full review of the representative payee program, SSA asked the Institute of Medicine (IOM) of the National Academies of Sciences, Engineering, and Medicine to convene a committee with relevant expertise to evaluate SSA’s capability determination process for adult beneficiaries and provide recommendations for improving the accuracy and efficiency of the agency’s policy and procedures for making these determinations (see Box S-1 for the committee’s statement of task). In carrying out this task, the committee was asked to address topics including capability determination processes used in at least three similar benefit programs, requisite abilities for managing or directing the management of benefits, methods and measures for assessing capability, the use of capacity assessment tools, appropriate roles for SSA and state Disability Determination Services employees, and effects on the beneficiary of appointing a representative payee. To address this task, the IOM convened a 12-member committee that included experts in the areas of psychology, neuropsychology, psychiatry, social work, occupational therapy and rehabilitation, behavioral economics, bioethics, and law (see Appendix D for biographical sketches of the committee members).

At the committee’s first meeting, SSA representatives clarified that the committee should focus on adults with disabilities. Although much of the information developed in the present report is applicable to all types

___________________

3 This sentence was modified from the prepublication version of the report.

of beneficiaries, issues unique to retirement beneficiaries and to the transition from child beneficiary to adult beneficiary are outside the scope of this study.

At its open meeting sessions, the committee heard presentations from representatives of SSA, the National Association of Disability Examiners, other benefit programs, and stakeholder organizations. Presentations also were made by experts in the assessment of financial capability, the impacts of the representative payee system on beneficiaries, the abilities needed to manage or direct the management of benefits, and the effects of everyday surroundings and stressors on an individual’s capability (see Appendix A for the open session agendas). The committee’s extensive literature review included reports of the Office of the Inspector General for SSA (OIG-SSA) and the Representative Payment Advisory Committee, as well as previous IOM and National Research Council reports relevant to the topic.

CAPABILITY DETERMINATION IN NON-SSA BENEFIT PROGRAMS

The committee compared SSA’s capability determination process with those of the U.S. Department of Veterans Affairs (VA), the U.S. Office of Personnel Management (OPM), and Service Canada’s Canada Pension Plan (CPP) and Old Age Security programs. In addition, with America’s Health Insurance Plans (AHIP)4 acting as an intermediary, the committee received information compiled from five private disability income protection insurers regarding their approaches to determining capability.

All of the programs reviewed focus on some combination of legal, medical, and lay evidence5 in determining whether a beneficiary needs a representative payee, although the type of evidence emphasized varies across programs. For example, SSA considers medical evidence but requires lay evidence of incapability in making a determination. The VA and Service Canada require evidence from a medical professional, and OPM requires information from both a medical provider and two sources familiar with the beneficiary. SSA, OPM, Service Canada, and private insurers accept legal evidence of incompetency as sufficient evidence of incapability, while the VA does not consider legal evidence, such as a court decree of incompetency, to be binding.

The committee found no gold standard for determining financial capability among the programs it reviewed. Nonetheless, each program has unique aspects that the committee considers good practice and that, taken together, can contribute to a more procedurally sound process. These include SSA’s and OPM’s requirement for lay evidence to find a beneficiary incapable, which provides the opportunity to obtain information about beneficiaries’ real-world financial performance; the VA’s supervised direct payment option for individuals who are determined incompetent but able to manage their benefits with supervision, which reflects a model of supported decision making; and OPM’s instructions to individuals providing evidence to inform capability determinations.

EFFECTS OF APPOINTMENT OF REPRESENTATIVE PAYEES ON BENEFICIARIES

Representative payee programs have been found to have significant and positive effects on a beneficiary’s ability to live independently, which

___________________

4 AHIP is the national trade association representing the health insurance industry.

5 SSA defines “lay evidence” as anything other than legal or medical evidence. It can be provided by anyone with direct knowledge of facts or circumstances regarding the beneficiary in his or her daily life; this may include nonprofessionals (e.g., relatives, friends, neighbors) and health and social service professionals (e.g., social workers, occupational therapists, rehabilitation specialists, adult protective services workers).

in turn affects the individual’s health and well-being. Appointment of representative payees is associated with increased ability to meet basic needs; declines in homelessness, victimization, and arrests; fewer hospitalizations; and improved substance abuse outcomes. Although research results are mixed as to whether the representative payee arrangement actually reduces substance abuse, clients with representative payees are more likely to stay engaged in treatment.

Despite such positive effects, appointment of a representative payee also has potential negative consequences. SSA representative payees are most commonly friends or family members of the beneficiaries. Such an arrangement can have significant negative effects on beneficiaries’ relationships with those serving in this role; for example, beneficiaries can be negatively affected by strain in their familial relationships resulting from conflict over the money management responsibilities of family members acting as representative payees. In addition, being able to control how one’s money is spent is considered an essential element of self-determination and for many is critical to feelings of self-worth. Loss of control over finances can provoke fear and anxiety, be seen as a threat to autonomy, and encourage dependence. In addition, having a representative payee may be perceived as stigmatizing.

Ultimately, the decision to appoint a representative payee entails weighing the beneficiary’s personal autonomy and preferences against interventions that, while infringing on the beneficiary’s autonomy, are meant to protect his or her best interests. Errors in either direction can have substantial negative effects on beneficiaries. To deem someone incapable when he or she is not erodes personal liberty, creates stigma through labeling, leaves the individual open to exploitation, and deprives the person of the freedom to direct personally appropriate actions based on long-held values and preferences. On the other hand, permitting someone who is not financially capable to continue to manage personal financial affairs may cause the person preventable harm as a result of the mismanagement of funds and an increased potential for victimization by others.

FINANCIAL CAPABILITY

SSA defines (financial) capability as a beneficiary’s ability to manage or direct the management of his or her benefits. In keeping with the goal of ensuring that a beneficiary’s interests are met, the committee understands financial capability as involving the management or direction of the management of one’s funds in a way that routinely meets one’s best interests. Consistent with SSA’s guidance to employees and representative payees, the

committee interprets meeting one’s best interests as routinely6 satisfying the basic needs of food, shelter, and clothing—a standard that is minimally restrictive of the liberty of beneficiaries to manage their own affairs.

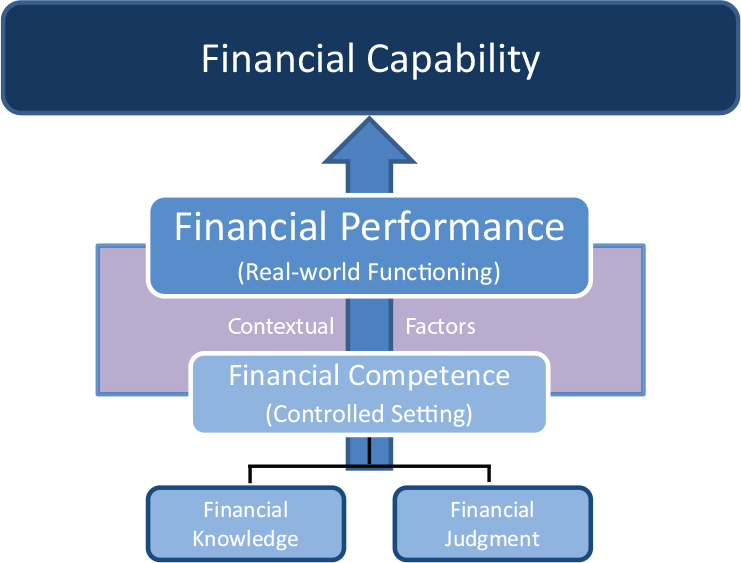

In evaluating financial capability, the committee distinguishes between financial performance and financial competence (see Figure S-1). It defines financial performance as an individual’s degree of success in handling financial demands in the context of the stresses, supports, contextual cues, and resources in his or her actual environment. Financial competence refers to the financial skills one possesses, as demonstrated through financial knowledge and financial judgment, typically assessed in a controlled (e.g., office or other clinical) setting.

Financial knowledge is possession of the declarative knowledge (i.e., information that a person knows) and procedural knowledge (i.e., knowing how to perform a task) required to manage one’s finances (e.g., the concept of money, values of currency, making change, check writing, use of automatic teller machines, and online banking procedures). Financial judgment is possession of the abilities (understanding, reasoning, and appreciation) needed to make financial decisions and choices that serve the individual’s best interests.

An individual may be financially competent in an office or clinical setting but may not exercise his or her financial knowledge and judgment in a real-life setting sufficiently to meet his or her basic needs. Conversely, an individual may fail to demonstrate financial knowledge or judgment in a controlled setting but may perform effectively with the assistance of support systems in his or her environment. Because contextual factors can enhance or diminish individuals’ (real-world) financial performance relative to what would be expected based on the financial competence they exhibit in controlled settings, it is important to consider more than financial competence when thinking about financial capability.

Successful financial performance reflects sufficient financial competence (knowledge and judgment) to implement financial decisions in the real world, that is, the presence of sufficient cognitive, perceptual, affective, communicative, and interpersonal abilities to manage or direct others to manage one’s benefits. For this reason, the committee concludes that evidence of beneficiaries’ real-world financial performance in meeting their basic needs is the best indicator of their financial capability. Preference for financial performance in determining financial capability is consistent

___________________

6 The committee recognizes that circumstances and personal preferences at times may require or lead individuals to forgo a basic need, such as food. Nevertheless, individuals’ overall behavior may still reflect an ability to use their benefits to meet their basic needs over time. When that occurs, their needs are being met routinely, in the sense in which that term is used in this report.

both with the movement toward conceptualizing disability in terms of the interaction between an individual’s environment and his or her functional capacity and with the reform of guardianship laws during the past 25 years.

MENTAL AND PHYSICAL DISORDERS THAT MAY AFFECT FINANCIAL CAPABILITY

The presence of certain cognitive disorders, such as a well-documented history of severe intellectual disability or advanced Alzheimer’s disease, may be sufficient for a determination of incapability, but such examples are few in number.

Disorders with Cognitive Effects

Evaluation of financial capability is important for individuals with disorders severe enough to lead to work-related disability that negatively affect the cognitive domains relevant to financial competence (e.g., general cognitive/intellectual ability, attention and vigilance, learning and memory,

executive function, social cognition, language and communication). The challenge is that while the presence of such disorders increases the need for assessment of financial capability, ordinarily neither a diagnosis nor medical evidence alone is sufficient for making a capability determination.

One difficulty is the variable impact of disorders on the individuals affected; different people experience and respond to medical conditions differently. Another difficulty is the lack of correlation in many cases between the severity of clinical symptoms and functional limitations. Furthermore, the impairment severity threshold for determining work-related disability may reasonably differ from that required to justify interference with beneficiaries’ autonomy in managing their disability payments. For this reason, it would be imprudent to attempt to map the level of impairment associated with financial incapability onto the level of impairment for work-related disability, such as that contained in SSA’s Listing of Impairments. Finally, as noted above, environmental factors may support continued successful financial performance in individuals experiencing a level of cognitive impairment sufficient to qualify for SSA disability benefits.

Disorders with No or Minimal Cognitive Effects

Individuals with certain physical impairments may require assistance to accomplish the physical tasks entailed in managing their benefits, but in the absence of cognitive impairment, they retain the ability to direct others to manage their benefits. They therefore are financially capable. Rare exceptions to this observation are physical impairments that completely preclude communication with others to direct the management of benefits even with the use of assistive communication devices—for example, myopathies (e.g., mitochondrial myopathies) and neuromuscular disorders (e.g., advanced ALS [amyotrophic lateral sclerosis] or locked-in syndrome) of such severity that any form of communication has become impossible.

ASSESSMENT OF FINANCIAL COMPETENCE AND PERFORMANCE

Assessment Instruments

The committee reviewed various instruments used to assess different components of financial capability (i.e., financial capacity, financial judgment, financial performance). In principle, such instruments could be helpful to medical and other professionals in gathering evidence of beneficiaries’ financial performance. However, many of the instruments identified by the committee are designed to assess financial competence in an office or clinical setting. Some of the instruments appear to measure financial

performance in a real-world setting, but most of them rely primarily on self-reported behavior. This is a limitation in that information provided by the individual being assessed may reflect that person’s lack of awareness of his or her impairment or deliberate efforts to conceal it. While some of these instruments show good psychometric properties in relation to other assessment methods, sufficient data on reliability and validity across populations are not yet available to warrant recommending their routine use.

Sources of Evidence

Financial performance in real-world situations can best be captured by those professionals and others who have first-hand knowledge of and experience with how an individual functions in his or her environment and who have sufficient opportunities to observe the individual in that environment over an extended period of time. Reliable first-hand or collateral information regarding an individual’s real-world financial performance is particularly helpful, because, as noted above, information provided by the individual being assessed may reflect that person’s lack of awareness of his or her impairment or deliberate efforts to conceal it. However, the reliability of information provided by third-party informants varies as well. Some informants lack the opportunity to observe financial performance, while others spend insufficient time with the individual to assess his or her performance accurately. Informants also may under- or overestimate an individual’s financial abilities for a variety of reasons. A relative might underestimate or underreport an individual’s financial abilities in the hope of gaining access to the person’s funds or overestimate an individual’s abilities so as not to alienate the person.

RECOMMENDATIONS

Evidence for Determining Financial Capability

SSA’s requirement for “lay” evidence of beneficiaries’ financial performance in making capability determinations is consistent with the committee’s conclusion that evidence of real-world financial performance is the most reliable basis for making such determinations. As noted, however, the reliability of third-party informants varies. In addition, most informants, including professionals, are not trained specifically in assessment of financial performance and competence and would benefit from detailed direction as to the type of information that is helpful to SSA in making capability determinations. Currently, SSA provides little formal guidance to medical professionals and no formal guidance to other informants. The committee therefore makes the following recommendation:

Recommendation 1. The U.S. Social Security Administration (SSA) should provide detailed guidance to professional and lay informants regarding the information it would find most helpful for making capability determinations, including (1) information about specific aspects of beneficiaries’ financial performance in meeting their basic needs and, when information about performance is unavailable, about their financial competence; and (2) information that would enable SSA to judge the validity of the evidence provided by the informant.

With respect to financial performance, SSA’s guidance to all informants could be based on the questions it currently provides to field officers. There are times when no or very limited information is available about a beneficiary’s financial performance—for example, when the person has had no funds to manage or when no third-party informant with knowledge of the person’s performance can be identified. In such cases, evidence of financial competence may need to be used to inform capability determinations. Guidance pertaining to financial competence could include questions such as those developed by CPP along with requests that the basis for informants’ answers be specified.

To enable SSA to judge the validity of information from informants, it is important that evidence provided for capability determinations specify how well and for how long the informant has known the individual and the nature of their relationship.7 It is also important to specify the extent to which (1) the informant’s judgment is based on observed behavior; (2) the informant’s judgment is based on the individual’s self-report; (3) the informant’s judgment is based on information from collateral informants, and the perceived quality of these informants; and (4) in the case of professionals, the judgment is based on the individual’s medical record and the assessments of other health care professionals (including other physicians, psychologists, social workers, and nurses). Such specification of the basis for the evidence provided will allow for greater understanding of the quality of the evidence as support for a judgment regarding financial capability.

Systematic Identification of Adult SSA Beneficiaries at Risk for Financial Incapability

The following conclusions and recommendations address systematic identification of individuals who are risk for financial incapability.

___________________

7 This would include, to the extent possible, the beneficiary’s perspective on the relationship as well as the informant’s.

Risk Criteria

Reliance on diagnostic criteria alone for determining financial (in)capability is inadequate for a number of reasons, including the likelihood of identifying too many people as incapable in some diagnostic categories and missing people in others, a central concern raised by the OIG-SSA reports. Identification of easy-to-apply, efficient approaches, including the development of screening criteria, that could be incorporated into the disability application process to identify people at high risk for incapability would be valuable in helping to ensure that potentially incapable beneficiaries receive further evaluation.

Recommendation 2. The U.S. Social Security Administration should create a data-driven process to support the development of approaches, including screening criteria, for identifying people at high risk for financial incapability.

SSA has the opportunity, whether through the development of formal screening criteria or other approaches (e.g., identifying risk markers to inform the judgment of field officers), to improve its ability to identify beneficiaries who may lack financial capability. The committee envisions the development of a model based on existing data, such as age, gender, impairment code assigned by SSA, and education level, to identify predictors of incapability. The resulting model could be refined and its reliability and validity improved through pilot projects involving samples of beneficiaries who would undergo more detailed assessments of capability. Prior to large-scale implementation, the success of the resulting approach in identifying incapable beneficiaries who would not otherwise have been found could be tested.

Dual Beneficiaries

A 2012 SSA-OIG report indicated that more than 6,000 individuals who were receiving benefits from both the SSI and SSDI programs had been assigned a representative payee in one program but not the other. In addition, SSA beneficiaries also may receive benefits from another federal agency, such as the VA or OPM. While acknowledging the potential technological, legal, and procedural challenges to data sharing, the committee concludes that sharing information about incapability determinations within SSA and among relevant federal agencies could increase the likelihood of each agency’s identifying potentially incapable beneficiaries. Agencies could then use the information to trigger their own capability assessments of beneficiaries identified in this way.

Recommendation 3. The U.S. Social Security Administration (SSA) should ensure intra-agency communication regarding capability determinations within its different programs. In addition, SSA, the U.S. Department of Veterans Affairs, and other relevant federal agencies should assess the extent of inconsistency in the identification of beneficiaries who are incapable among persons receiving benefits from more than one agency. Based on the findings of this assessment, the relevant agencies should explore mechanisms to facilitate ongoing interagency communication regarding the capability of beneficiaries.

OPM, for example, uses computerized matching to identify beneficiaries who receive other federal benefits. Although such matching is used primarily to analyze whether benefits from other programs may affect OPM benefits, a process of this sort can also provide information that indicates whether other programs have identified the beneficiary as having impaired capability.

Responding to Changes in Capability Over Time

Many psychiatric and cognitive conditions are characterized by progression or fluctuation over time in the presence, severity, and nature of symptoms. Such changes suggest the value of a process for periodic reassessment of a beneficiary’s capability. SSA’s lack of a formal process for periodically reviewing a beneficiary’s capability is a significant weakness. Some mechanism for periodic reassessment is needed to ensure that beneficiaries with fluctuating, deteriorating, or improving financial capability are classified accurately. Accordingly, the committee makes the following recommendation:

Recommendation 4. The U.S. Social Security Administration should develop systematic mechanisms for recognizing and responding to changes in beneficiaries’ capability over time.

For disability beneficiaries, SSA procedures call for periodic continuing disability reviews (CDRs). Although CDRs provide an opportunity for capability (re)assessments, their purpose is to identify any changes (improvements) in the medical basis for a beneficiary’s disability award. Thus, even if the CDRs were to occur on schedule, they would not fully serve the purpose of reassessment of financial capability. SSA could apply the same principle used in the CDR process to develop an analogous process for recognizing and responding to changes in capability over time. Reassessments initially could be targeted toward (1) beneficiaries who had been determined to be incapable but who might improve over time as their

conditions or environmental supports changed; and (2) beneficiaries who, although capable, were at risk for becoming incapable as their condition progressed or their environment changed. As screening criteria or other systematic methods for identifying people at high risk for financial incapability were developed, they might be used to broaden the target population for periodic reassessment.

In addition, beneficiaries, family members, representative payees, and professionals who were likely to come into contact with beneficiaries could be alerted systematically to notify SSA if they believed that beneficiaries’ capability had changed so as to warrant redetermination. SSA might also implement a process to survey payees and/or beneficiaries periodically, similar to that of OPM, integrating screening questions that could trigger the need to further investigate the beneficiary’s financial capability.

Supervised Direct Payment

By their nature, SSA capability determinations are dichotomous; that is, beneficiaries are either capable or incapable of managing or directing the management of their benefits. As noted, however, a beneficiary’s capability may change as a result of progressive or temporary diminution or improvement in his or her financial competence and performance over time. When information available about a beneficiary’s financial performance is insufficient to determine the need to appoint a representative payee, the use of a supervised direct payment option may be helpful. Under such a model, benefits are paid directly to the beneficiary, but an individual is designated to supervise the beneficiary’s expenditures. Reassessment after a trial period during which the beneficiary’s use of benefits is observed and assessed permits more accurate determination of the beneficiary’s capability in indeterminate or borderline cases.

Supervised direct payment may have other advantages. By adopting a supported decision-making model, supervisors can provide guidance and instruction to beneficiaries on managing their benefits and help respond to the challenges posed by the fluctuations in some beneficiaries’ financial competence and performance. Supported decision making encourages beneficiaries’ expression of preferences, beliefs, and values; allows collaboration in decision making; and provides opportunities for beneficiaries to make independent decisions whenever possible. Appropriate use of this approach may provide a beneficiary with greater control over his or her life than would be the case for someone without such support. Supervised direct payment may enable some beneficiaries who might otherwise require the appointment of a representative payee to manage or direct the management of their benefits to meet their basic needs, thus maximizing their decisional autonomy. For these reasons, the committee makes the following recommendation:

Recommendation 5. The U.S. Social Security Administration should implement a demonstration project to evaluate the efficacy of a supervised direct payment option for qualified beneficiaries.

“Qualified beneficiaries” refers to two groups of individuals. The first is beneficiaries who may be incapable of managing or directing the management of their benefits but for whom there is insufficient information regarding financial performance to render a determination. The second is beneficiaries who are determined by SSA to be incapable, but who either display financial performance in some but not all areas of benefit management or successfully manage their benefits some but not all of the time. The VA’s supervised direct payment option for individuals who are determined to be incompetent but able to manage benefits with supervision provides a model for such an approach. Instead of the VA’s appointing a fiduciary for such individuals, they receive their benefits directly but under the supervision of a Veterans Service Center Manager. This approach could provide a model for a demonstration project by SSA.

Program Evaluation

Data are limited on the effectiveness of current SSA processes for identifying beneficiaries who should be evaluated for capability and on the accuracy of capability determinations among those identified for evaluation. Reports issued by OIG-SSA in 2004, 2010, and 2012 suggest that SSA’s current capability determination process fails to identify all the beneficiaries who would benefit from the appointment of a representative payee. The committee has made a number of recommendations that could increase the identification of beneficiaries in need of a representative payee. Without baseline data and ongoing data collection, however, the effectiveness of current policies or the impact of the recommended changes cannot be evaluated. The committee therefore makes the following recommendation:

Recommendation 6. The U.S. Social Security Administration should develop and implement an ongoing measurement and evaluation process to quantify and track the accuracy of capability determinations and to inform and improve its policies and procedures for identifying beneficiaries who are incapable of managing or directing the management of their benefits.

The measurement and evaluation process envisioned in the present report would need to be designed and carried out by trained experts (whether in house or external) with detailed knowledge of SSA work flow and procedures. Such a process could comprise a variety of steps, including

assessments of the interrater reliability of the capability determination process, in-depth assessments of selected beneficiaries to determine the accuracy of earlier determinations, and evaluations of the impact of the recommendations in this report (e.g., guidance on the evidence to be provided for capability determinations). A robust measurement and evaluation process would provide substantial and much-needed insight into what SSA is currently doing well and what it may, at reasonable cost, be able to do significantly better.