4

Employment and Wage Impacts of Immigration: Theory

4.1 INTRODUCTION

This chapter demonstrates how economic theory can be used to analyze the economic impact of immigration. The discussion starts with the simplest case and progresses to more complex specifications in order to illustrate the various channels through which immigration affects labor markets and how the economy’s adjustments mitigate those effects over time. Because adjustments take time, particularly when immigration is unexpected, the initial and longer run impacts of immigration differ. The impact of immigration will also depend on the size of the inflow, the skill composition of immigrants compared to that of the native-born population, and characteristics of the destination country economy such as the ease with which firms can adopt or develop new technologies and the speed at which capital can accumulate or move between industries, as well as the economic links between that country’s regions and its degree of integration with the world economy.

Theory predicts that immigration initially confers net economic benefits on the destination country economy while creating winners and losers among the native-born via changes in the wage structure and the return to capital. Resulting changes in factor prices increase the production of goods and services that use the type of labor that immigrants provide most intensively. With time, the capital stock adjusts and eventually technology may respond as well, pushing up the demand for labor and hence wages toward their original levels. It bears noting that, if firms anticipate immigration and there is no lag in the response of capital and technology, the length of time elapsing between an immigration inflow and the “long-run” adjust-

ment of the labor market could be very short. Either way, if the economy simply returns to a larger version of its pre-immigration state, with the same capital-labor ratio, there are no winners and losers among the native-born, but equally, no net benefit to them from immigration.

This chapter provides a simple, largely graphical description of the often mathematically complex theoretical models that economists use to analyze the impact of immigration (or other labor supply shocks). The analysis relies heavily on the shifting of supply and demand curves, since these are most familiar to a general audience. It should be emphasized that these graphics only partly reflect the dynamic and general equilibrium characteristics of the models described here.

Most of the analysis is qualitative, designed to identify the mechanisms through which an influx of new immigrants is likely to affect wages and returns to capital as well as the overall level of income enjoyed by the native-born population that absorbs them. The concept of an immigration surplus as developed by Borjas (1995b) is introduced to quantify how, abstracting from fiscal effects, the arrival of immigrants affects the welfare of the native-born population on net. The panel quantifies these effects by inserting aggregate measures from national accounts or parameter estimates from empirical research. The emphasis here is on providing plausible orders of magnitude for the changes we model and should not be confused with the statistical estimation that is at the heart of Chapter 5.

4.2 A SIMPLE MODEL WITH A SINGLE TYPE OF LABOR

To understand the impact of immigration as seen through the prism of economic theory, it is easiest to begin by analyzing the simplest possible model, one constrained by highly unrealistic assumptions, and then consider the implications of more complicated models that arise as at least some of these assumptions are removed. We begin by assuming that the economy is inhabited by a large number of identical individuals and firms and that all economic activity is devoted to the production of a single consumption good. Firms produce this good by combining two highly aggregated inputs: work effort or labor, for which the individuals in this economy receive a wage (w) paid by the firm, and the physical capital (the tools, equipment, machinery, and buildings) each firm owns. We assume that all individuals devote a fixed amount of time to work activities (the quantity of labor supply is perfectly inelastic—it does not respond to wage changes) and that the stock of physical capital is initially fixed. For the moment, we also assume that ownership of firms is equally distributed across the population, whose wage income is supplemented by dividends paid by these firms. For simplicity of expression, we use the term “native” to refer to the native-born population.

Initial Labor Market Effects of Immigration

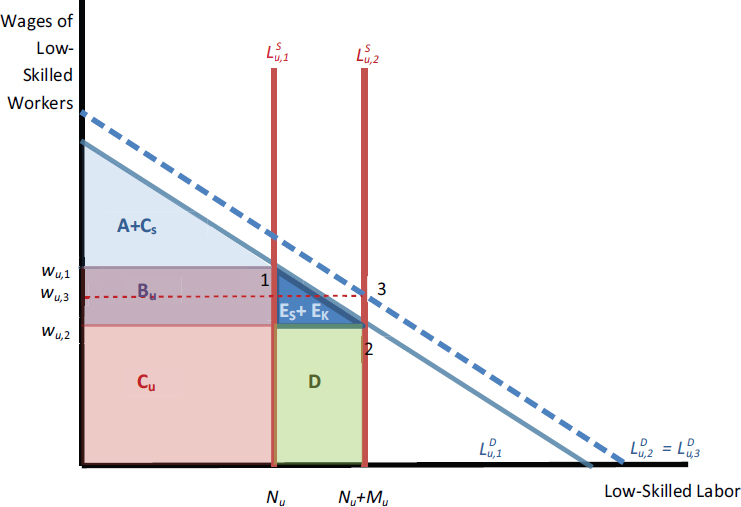

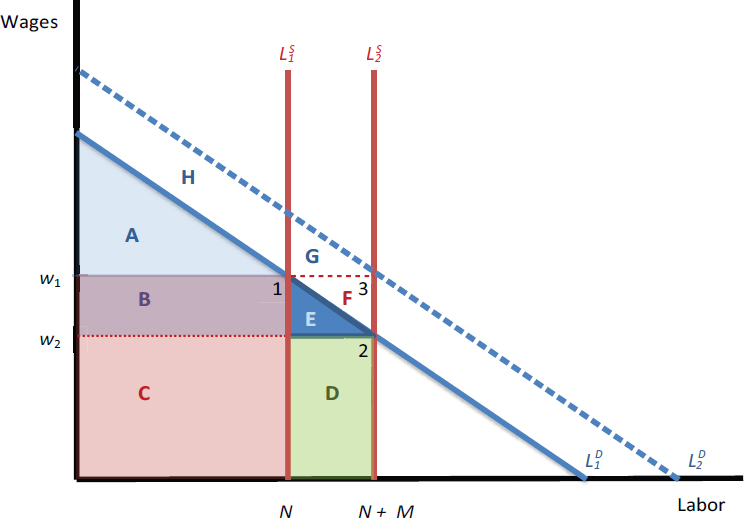

The diagram in Figure 4-1 describes the labor market in this simple model of the economy. For firms, the demand for labor is a decreasing function of wages represented initially by ![]() , and the labor supplied by the native workers is fixed at N. The initial equilibrium (denoted by the number 1) is the point where labor supply

, and the labor supplied by the native workers is fixed at N. The initial equilibrium (denoted by the number 1) is the point where labor supply ![]() and labor demand

and labor demand ![]() cross, and this point determines the wage w1. In this economy, total income is equivalent to the amount produced of the single good and is represented by the area underneath the demand curve: the triangle A and the two rectangles B and C, or A + B + C. The area of the two rectangles B + C represents the income the people in this economy receive from firms as labor earnings (N × w1). The triangle A represents the accounting profits received by firms from the sale of goods after the cost of labor has been paid; these profits are assumed to be remitted to the population as dividends.

cross, and this point determines the wage w1. In this economy, total income is equivalent to the amount produced of the single good and is represented by the area underneath the demand curve: the triangle A and the two rectangles B and C, or A + B + C. The area of the two rectangles B + C represents the income the people in this economy receive from firms as labor earnings (N × w1). The triangle A represents the accounting profits received by firms from the sale of goods after the cost of labor has been paid; these profits are assumed to be remitted to the population as dividends.

Now consider what happens when there is a sudden unanticipated increase in the population due to an influx of new immigrants. These new immigrants increase the total labor supply from N to N + M, and the labor supply curve shifts from ![]() to

to ![]() . Crucially, we assume these new immigrants arrive without capital and that they do not receive a share of the

. Crucially, we assume these new immigrants arrive without capital and that they do not receive a share of the

existing capital, which remains wholly owned by the native-born population. At the new equilibrium (marked with the number 2), wages are w2 (w2<w1), so the immediate effect of the influx of new immigrants is to drive down the wage. Now firms pay wage income to workers (N × w2), corresponding to rectangle C, to the native population, and w2 × M, corresponding to rectangle D, to immigrants; the value of the total amount of goods produced increases to A + B + C + D + E. The profits earned by the firms increase from the area represented by triangle A to A + B + E. Rectangle B represents the amount firms once paid as wages to natives but which now is paid to them as dividends instead. Triangle E represents the part of the overall increase in income (D + E) not captured by the immigrants themselves; this is commonly called the “immigration surplus.” The immigration surplus represents the benefit that accrues to the native population from an inflow of new immigrants.

Although immigrants are consumers as well as workers, the demand curve for labor does not shift outward in this simple model until capital adjusts. The reason for this is that the demand curve is determined by the economy’s productive capacity, and the addition to aggregate consumption created by the immigration-driven population growth is represented as a movement along the demand curve. Although the extra labor causes the aggregate amount of output to rise, per-capita output—output divided by the new, higher number of people in the economy—initially declines. To summarize, in this simple theoretical model of the labor market, the influx of immigrants initially drives down wages but native incomes still rise in the aggregate due to the immigration surplus.

Initial Capital Market Effects of Immigration

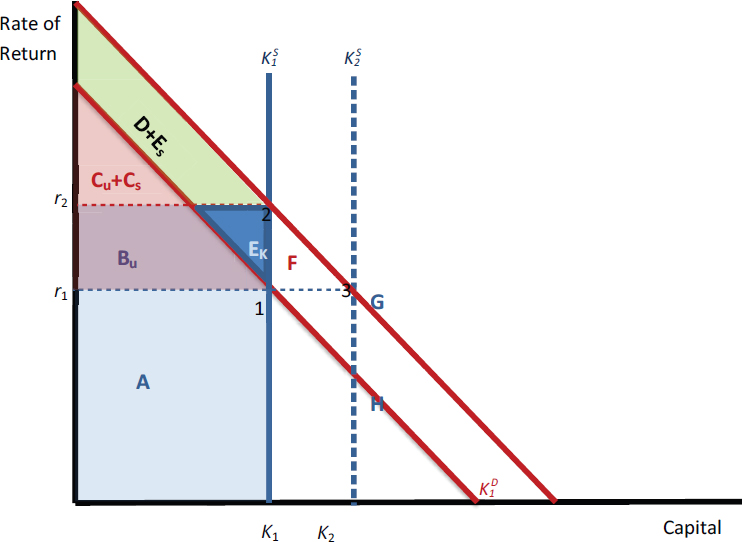

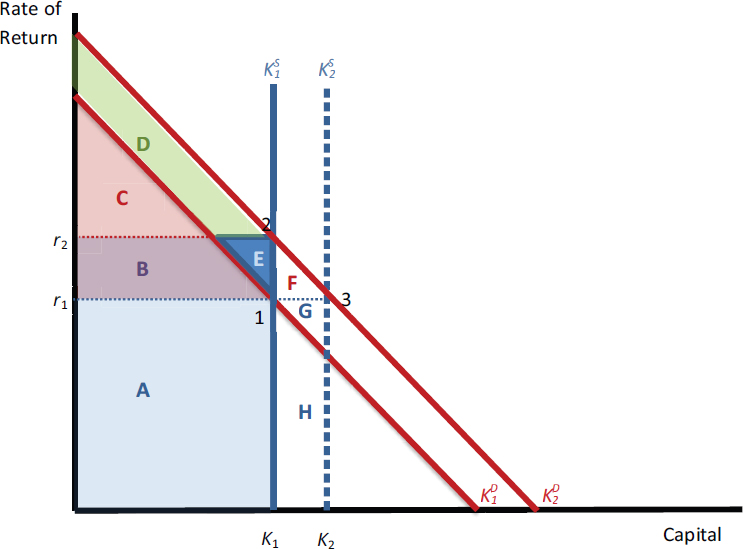

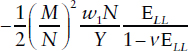

There are two input factors in this model economy, capital and labor, and it is important to also consider how immigration affects the market for capital. The diagram in Figure 4-2, which describes the capital market in this economy, is sufficient to illustrate most of the changes that occur following an influx of additional workers. The cost of capital for firms can be either the interest rate at which they borrow or, if funded from retained earnings, the rate of return available on an alternative investment. In this simple framework, the two are identical. Meanwhile, the economy-wide cost of capital for households is the rate of return on their asset holdings. The demand curve for capital slopes downward since firms choose to acquire less new capital and hold less existing capital at higher rates of return (or cost of capital for the firm).1 The amount of capital available is initially fixed at K1 and the initial equilibrium (denoted by the number 1) determines the initial rate of return r1.

___________________

1 We use the term rate of return rather than cost of capital because our focus is on the two sources of income for households, namely wages and the return on assets.

The area underneath the demand curve once again equals the amount of the single good produced as well as total income. The area of the rectangle A in Figure 4-2 is the amount r1 × K1 paid by firms as dividends and corresponds exactly to the area of the triangle A in Figure 4-1. Likewise, the areas of the triangle C and the right trapezoid B in Figure 4-2 correspond to the areas of the rectangles B and C respectively in Figure 4-1. This once more is the amount the firm initially pays in wages.

An influx of new immigrants (an increase in labor relative to capital) makes each unit of the pre-existing capital stock more productive. The rightward shift in the demand curve for capital from ![]() to

to ![]() in Figure 4-2 captures this rise in the rate of return to capital. If one assumes that the production technology has an attribute economists call constant returns to scale—which specifies that output quantity increases by the same proportion as the quantity of all inputs—the horizontal distance between

in Figure 4-2 captures this rise in the rate of return to capital. If one assumes that the production technology has an attribute economists call constant returns to scale—which specifies that output quantity increases by the same proportion as the quantity of all inputs—the horizontal distance between ![]() and

and ![]() , measured in percentage terms, is equal to M/N (the ratio of immigrant to native labor).2 The right trapezoid B is the amount of income once paid

, measured in percentage terms, is equal to M/N (the ratio of immigrant to native labor).2 The right trapezoid B is the amount of income once paid

___________________

2 Constant returns to scale means that if all the inputs increase by x percent, the output they produce increases by the same x percent.

as wages but now paid as dividends, and the wages paid to the natives are reduced to the triangle C. The area in trapezoid D represents the wages paid to immigrants, and triangle E once again represents the immigrant surplus. Modeling the impact of immigration in terms of its impact on the market for capital is admittedly less intuitive than modeling it in terms of its impact on the labor market. However, the rise in the rate of return to capital from r1 to r2 in Figure 4-2 underlines an important insight: the immigration surplus arises because the labor supplied by new immigrants makes native-owned capital more productive. Restating, immigration raises the return to capital, making capital more productive and increasing income to owners of capital.

How Big Is the Immigration Surplus?

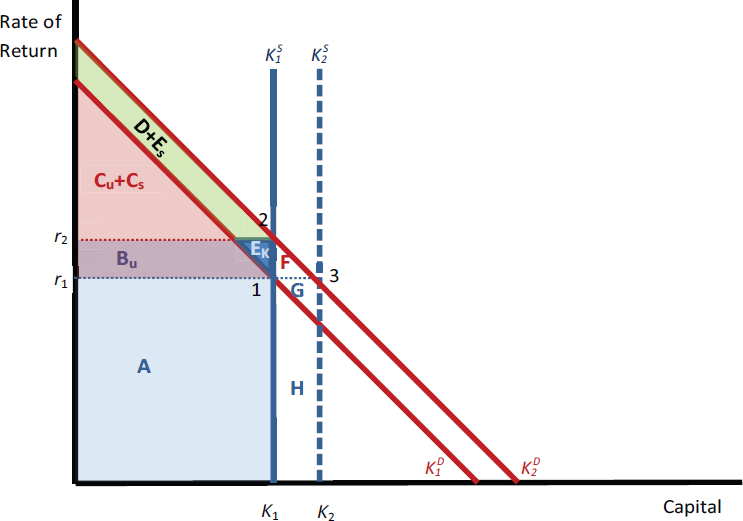

How can one quantify the size of the immigration surplus? A simple approximation for the area E in Figure 4-1 yields ![]() or, restated as a fraction of total output Y, E equals

or, restated as a fraction of total output Y, E equals ![]() , where ΕLL is the elasticity of the own-factor price for labor (that is, the percentage change in wages divided by the percentage change in labor between point 1 and point 2),

, where ΕLL is the elasticity of the own-factor price for labor (that is, the percentage change in wages divided by the percentage change in labor between point 1 and point 2), ![]() represents the share of income initially paid to natives, and

represents the share of income initially paid to natives, and ![]() is the size of the immigration surge relative to the native workforce.3 In the United States, 65 percent of total national income is paid as employee compensation; it is therefore reasonable to assume that the elasticity of the own factor price for labor is −0.35 and the elasticity of the rate of return with respect to labor is 0.65.4 The area represented by triangle E grows quadratically with the increase in the proportion of new immigrants so, unless the increase in the workforce generated by an influx of new immigrants is very large, the overall increase in income will be relatively small. A 1 percent increase in the workforce caused by an influx of immigrants

is the size of the immigration surge relative to the native workforce.3 In the United States, 65 percent of total national income is paid as employee compensation; it is therefore reasonable to assume that the elasticity of the own factor price for labor is −0.35 and the elasticity of the rate of return with respect to labor is 0.65.4 The area represented by triangle E grows quadratically with the increase in the proportion of new immigrants so, unless the increase in the workforce generated by an influx of new immigrants is very large, the overall increase in income will be relatively small. A 1 percent increase in the workforce caused by an influx of immigrants

___________________

3 From Borjas (2014), we define the factor price elasticity ![]() which is the inverse of the elasticity of labor demand. Therefore

which is the inverse of the elasticity of labor demand. Therefore ![]() and

and ![]() .

.

4 For a simple Cobb-Douglas production function, these elasticity values follow directly from the share of national income paid as employee compensation (equal to 0.65) and the approximation ![]() . In this case the immigration surplus is

. In this case the immigration surplus is ![]() .

.

lowers wages by 0.35 percent, raises the rate of return to capital by just under eight basis points (or 0.08%) and generates an immigration surplus of $199 million for the native population in an economy with an annual gross domestic product (GDP) of $17.5 trillion.5 An increase in the workforce twice as large, equivalent to 2 percent of the U.S. workforce, generates a decline in wages of 0.75 percent and an immigration surplus four times larger, equivalent to $796 million.6 Rather than focus on an incremental inflow of workers, the model can also generate estimates of the wage impact and immigration surplus of the entire immigrant population. Immigrant labor accounts for 16.5 percent of the total number of hours worked7 in the United States, which, using this methodology, implies that the current stock of immigrants lowered wages by 5.2 percent and generated an immigration surplus of $54.2 billion, representing a 0.31 percent overall increase in income that accrues to the native population. However, it bears noting that it is problematic to apply the same static methodology used for small temporary inflows to measuring the impact of the entire population of immigrants, which has grown over the course of decades. Over such a long period of time, capital has had plenty of time to adjust, and so these estimates can at best be described as upper limits that exaggerate the real impact of immigration on native wages and overall incomes.8

In summary, natives’ incomes rise in aggregate as a result of immigration; the size of the increase depends on the number of immigrants relative to natives, natives’ share of income, and the size of the wage effect of immigration.

___________________

5 The cross-factor elasticity that measures the increase in gross returns in response to the increase in the labor force is defined as ![]() . For a simple Cobb-Douglas production function,

. For a simple Cobb-Douglas production function, ![]() . If one assumes a capital output ratio of 3 and a rate of depreciation of 0.05, the initial net real rate of return to capital is 6.67 percent.

. If one assumes a capital output ratio of 3 and a rate of depreciation of 0.05, the initial net real rate of return to capital is 6.67 percent.

6 An immigration influx 10 times larger than the 1 percent example—one that increases the labor force by 10 percent—will have an impact on both wages and the return to capital that is also about 10 times larger. Wages drop by 3.5 percent and the rate of return to capital rises by about 75 basis points. However, because of the squared term in the formula for the immigration surplus, the surplus increases 100-fold, to $19.9 billion. Hence the ratio between the benefit that accrues to natives as a group (total income = wages + dividends) from immigration, compared to the amount of redistribution between different sources of income (wages versus dividends), rises rapidly with the immigration influx.

7 U.S. Census Bureau, Current Population Survey (CPS), unweighted average across years 2013, 2014, and 2015.

8Ben-Gad (2004) demonstrated that dynamic calculations of the surplus are considerably lower than those obtained using Borjas’ (1995b) static approach.

Who Gets the Immigration Surplus?

Consider the factors that affect the decrease in the wage bill paid to natives, represented by the area of rectangle B in Figure 4-1. A decline in wages of 0.35 percent in this simple model economy, assuming a GDP of $17.5 trillion, implies that as much as $39.6 billion that was once paid as wages is now paid as returns to capital (for the 1% immigration-induced workforce increase scenario). Of course this is immaterial if our initial (unrealistic) assumption holds that all the natives are identical and own equal shares of the nation’s capital stock. Indeed, even if people have radically different levels of income, as long as everyone shares the same proportion of income derived from wage earnings and capital income, the shift between the two generated by immigration has no impact on the distribution of income. But what if the proportions are not equal? If, to take an extreme example, the population is divided between those who derive all their income from work and others who derive all their income from capital, the shift in resources described in this example is potentially substantial. Even for the case of a 1 percent increase in the number of workers, the shift from wages to income from capital outweighs the immigration surplus by a factor of nearly 200.

In practice, most people derive at least some of their lifetime income from capital, if not directly through capital gains, dividends, rents, or interest payments, then indirectly through the ownership of their own residence and through pension savings. Still, the composition of income varies significantly across the income distribution, with those at the very top receiving larger shares of their income from capital than those at the bottom.9 This means that not only does a disproportionate share of the immigration surplus accrue to people who enjoy higher incomes but the shift in overall income composition in response to immigration can at least initially exacerbate income inequality and could leave some people absolutely worse off.

In summary, the immigration surplus stems from the increase in the return to capital that results from the increased supply of labor and the subsequent fall in wages. Natives who own more capital will receive more income from the immigration surplus than natives who own less capital, who can consequently be adversely affected.

___________________

9 The Gini coefficient for earnings is 0.489 but 0.898 for interest, 0.789 for dividends and 0.753 for rents, royalties, estates or trusts (U.S. Census Bureau, 2014). Zero on the Gini scale indicates perfect equality in distribution (of earnings, or income, or whatever is being measured), and a score of 1.0 indicates total inequality. Salaries, wages, and pension income account for 91.17 percent of income for people in the top 10 to 5 percent of the income distribution, 83.35 percent for people in the top 5 to 1 percent, 72.34 percent for people in the top 1 to 0.5 percent, 60.46 percent for the top 0.5 to 0.1 percent, 46.65 percent for the top 0.1 to 0.01 percent, and 33.47 percent for the top 0.01 percent (Alvaredo et al., 2013).

The Effects of Capital Adjustment: What If Immigrants Bring Capital with Them?

All the changes in wages and the distribution of income analyzed above are predicated on the assumption that the aggregate stock of capital remains fixed even as the income each unit generates increases. More likely one should expect that, as the influx of immigration raises the rate of return to capital from r1 to r2 in Figure 4-2, an incentive is created for more of it to be produced or to flow from abroad. The accumulation of additional capital has a number of effects: wages are restored to their original level, the return to capital falls, and the immigration surplus dissipates. As noted below, this is typically referred to as the long-run impact of immigration because capital responds with a lag when immigration is unanticipated.

One can also illustrate the impact of capital’s response to immigration with the following thought experiment: What would happen if each immigrant not only supplied additional labor, but arrived in the country with an amount of capital that matched the capital holdings of the natives? Once again the supply curve for labor shifts from ![]() to

to ![]() , but now this is accompanied by a shift in the demand curve from

, but now this is accompanied by a shift in the demand curve from ![]() to

to ![]() as the additional capital the immigrants bring raises the marginal product of labor. If one further assumes a constant returns to scale production technology, the economy reaches equilibrium points marked by the number 3 in both Figures 4-1 and 4-2, where neither the wage nor the rate of return to capital changes, there is no immigration surplus or change in the composition of income, and the initial ratios between capital and output and labor and output are restored. The economy is larger, of course, but all the benefits of immigration, whether in terms of wage earnings, represented by the areas D, E, and F, or the income generated by the capital imported by the new immigrants, represented by areas G and H, accrue to the new immigrants. This implies that programs designed to facilitate the immigration of people who agree to invest in the domestic economy will indeed ameliorate or even reverse the impact of immigration on wages and the distribution of income; but, perhaps counterintuitively, such programs will also reduce or eliminate the immigration surplus that otherwise would accrue to natives.

as the additional capital the immigrants bring raises the marginal product of labor. If one further assumes a constant returns to scale production technology, the economy reaches equilibrium points marked by the number 3 in both Figures 4-1 and 4-2, where neither the wage nor the rate of return to capital changes, there is no immigration surplus or change in the composition of income, and the initial ratios between capital and output and labor and output are restored. The economy is larger, of course, but all the benefits of immigration, whether in terms of wage earnings, represented by the areas D, E, and F, or the income generated by the capital imported by the new immigrants, represented by areas G and H, accrue to the new immigrants. This implies that programs designed to facilitate the immigration of people who agree to invest in the domestic economy will indeed ameliorate or even reverse the impact of immigration on wages and the distribution of income; but, perhaps counterintuitively, such programs will also reduce or eliminate the immigration surplus that otherwise would accrue to natives.

Assuming constant returns to scale, if immigrants bring enough capital with them such that the capital-labor ratio does not change, then the economy simply grows larger. There is no negative wage impact nor is there an immigration surplus.10

___________________

10 If production is characterized by increasing returns to scale, where a particular fractional increase in all inputs yields more than the same fractional increase in output, an influx of immigrants together with capital may generate a rise in wages and a positive immigration surplus.

How Else Can Capital Adjust?

Of course immigrants need not arrive with capital for immigration to prompt an adjustment to the stock of capital. Instead, the upward pressure on the rate of return to capital generated by the arrival of new workers provides an incentive for capital to either flow from abroad or to accumulate domestically. Here it is important to emphasize the unique attributes of the U.S. economy compared with smaller counterparts. Often it is appropriate to analyze the behavior of an economy using a small open-economy model. This is particularly appropriate if a large fraction of the economy’s output is devoted to exports, if it is very open to inflows of capital from abroad, and if it represents such a small share of world output that changes in economic conditions originating in that country are unlikely to have meaningful effects on the global economy. In the context of a small open economy, an influx of immigrant workers is likely to be accompanied by an inflow of capital from abroad. Those who own the newly invested capital also own a claim to the income it generates, represented by the area of G + H in Figure 4-2. Once again, if capital flows into the economy along with the additional new immigrants, there is no change to native welfare or to the distribution of income between capital and labor.

Yet, even if capital flows freely into a small open economy and all the additional capital is readily purchased and easily transportable, there can still be substantial delays between the arrival of new immigrants and the time when new capital is ultimately installed. If the unexpected influx of new immigrants is relatively small, the resulting increase in the rate of return to capital will not be very large and will probably be very short-lived because the additional capital can be easily procured and installed at a low cost. Alternatively, if the influx of new immigrants is relatively large, the inflow of capital required to lower the rate of return to its long-run value will necessarily be large as well. Any effort to expedite the process of procuring and installing large amounts of additional capital, particularly as the immigrant influx was unforeseen, carries additional costs.11 Meanwhile, during the period of adjustment, immigration exerts downward pressure on wages.

Of course the United States economy is not small and, as a consequence, transactions with the rest of the world account for a smaller share of its economic activity than for any other industrialized country. This means that much of the new capital added to the economy following an influx of new immigrants is likely to be produced locally. Higher rates of

___________________

11 Small open economy models typically include convex capital adjustment costs to ensure that investment is not more volatile than what one typically observes in the data. See, for example, Hansen et al. (2015). Klein and Ventura (2009) analyzed the impact of enlarging the European Union and creating a common labor market in North America in a model where capital flows freely across borders.

return induce higher savings rates and some shifting of production from consumer goods to capital. Yet, because people generally dislike sharp fluctuations in the amount they consume, this capital adjustment process may occur gradually, even in the absence of capital adjustment costs. Of course, if immigration is anticipated, then capital may adjust much faster. In fact, if the immigration episode is fully anticipated, capital can be increased in advance, reducing or eliminating the adjustment period.

Ben-Gad (2004) used a general equilibrium optimal growth model—the standard macroeconomic model where savings and investment are endogenously determined—to investigate the behavior of wages, returns to capital, and the size of the immigration surplus following an unanticipated change in immigration policy. To understand the overall effect of immigration flows, the change considered is a radical one—the permanent suspension of all future immigration to the United States. The result is a gradual increase in wages until they are 0.8 percent above their previous trend, and the rate of return to capital falls by 6 basis points, the equivalent of a decrease in interest rates from 4.06 to 4.00 percent.12 Pursuing such a policy would mean relinquishing the immigration surplus. Yet, since capital gradually adjusts following the suspension of immigration, the loss measured in terms of the size of the U.S. economy in 2014 would amount to only about $4 billion.

Summarizing, even if immigrants arrive without capital, domestic savings and investment will rise as a result of the higher return to capital. Once the capital-labor ratio is restored, the adverse wage effect of immigration and the immigration surplus disappear.

4.3 EMPLOYMENT EFFECTS OF IMMIGRATION WITH ELASTIC LABOR SUPPLY

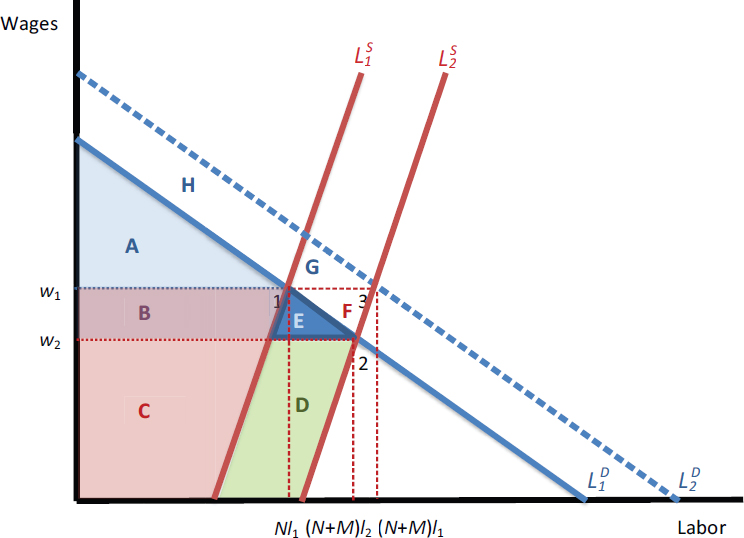

In exploring these simple models of the economy so far, we have assumed that the amount of labor each worker supplies is fixed rather than a function of wages or other income. Suppose instead that for each percentage increase in wages, workers, whether native or immigrant, increase the amount of labor l they supply to the market by v percent. The initial labor supply curve in Figure 4-3, ![]() , is no longer vertical but slopes upwards and the total amount of labor supplied in equilibrium is N × l1. The arrival of M additional immigrants shifts the labor supply curve by the horizontal distance M to

, is no longer vertical but slopes upwards and the total amount of labor supplied in equilibrium is N × l1. The arrival of M additional immigrants shifts the labor supply curve by the horizontal distance M to ![]() , which exerts downward pressure on wages. Lower wages mean the equilibrium amount of labor supplied by each worker drops from

, which exerts downward pressure on wages. Lower wages mean the equilibrium amount of labor supplied by each worker drops from

___________________

12 Unlike the static analysis, here the change in immigration represents a change in long-run flows. The flow of immigrant workers dilutes the capital stock, hence any change in the flows has permanent (albeit small) effects on wages and the rate of return to capital.

l1 to l2 while the aggregate amount of labor increases to (M + N)l2. Qualitatively, the results from the previous section do not change: the unanticipated arrival of immigrants increases the amount of labor in the economy and initially lowers wages. The difference is quantitative: the higher the value of the own-wage supply elasticity, v, the more the per capita amount of labor rather than the wage adjusts with the arrival of the immigrants.

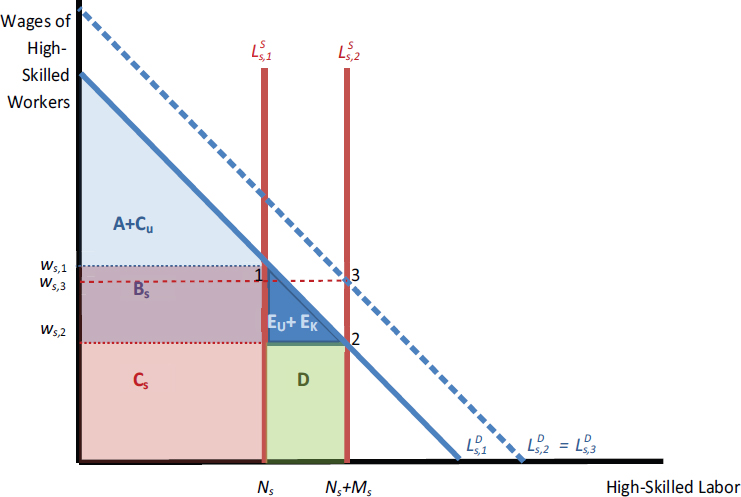

If the factor price elasticity of labor demand is ΕLL< 0, the change in wages from w1 to w2 in Figure 4-3 following an immigration influx of size M is ![]() or

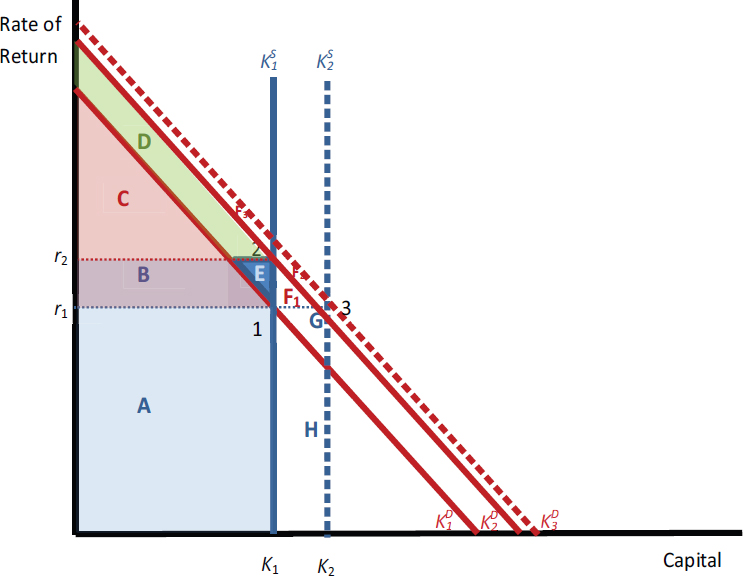

or ![]() when measured in percentage terms. The increase in the rate of return on capital is also mitigated by the adjustment of labor supply in response to lower wages; the demand curve for capital in Figure 4-4 initially shifts only part of the way outward and only shifts further as the supply of capital adjusts. The smaller the decline in wages the immigrants create, the smaller the immigration surplus they generate.

when measured in percentage terms. The increase in the rate of return on capital is also mitigated by the adjustment of labor supply in response to lower wages; the demand curve for capital in Figure 4-4 initially shifts only part of the way outward and only shifts further as the supply of capital adjusts. The smaller the decline in wages the immigrants create, the smaller the immigration surplus they generate.

The area of triangle E in Figure 4-3 corresponds to the immigration sur-

plus. When measured as a fraction of output, it is  and it also declines as the value of v increases. How large a value of v could one reasonably assume? Few econometric studies estimate a single elasticity of labor supply for the entire population. At minimum, labor econometricians divide the population by gender and marital status and estimate elasticities for each subpopulation. The highest value for v found by Blau and Kahn (2007) is 0.4 (for married women). If one treats v = 0.4 as an upper bound, and assuming once again that compensation of employees accounts for 65 percent of national income, the immigration influx that raises labor supply by 1 percent now yields an immigration surplus of only $175 million, an influx of 2 percent yields $698 million, and the entire stock of current immigrants, who contribute 16.5 percent of total hours worked, yields $47.5 billion.13

and it also declines as the value of v increases. How large a value of v could one reasonably assume? Few econometric studies estimate a single elasticity of labor supply for the entire population. At minimum, labor econometricians divide the population by gender and marital status and estimate elasticities for each subpopulation. The highest value for v found by Blau and Kahn (2007) is 0.4 (for married women). If one treats v = 0.4 as an upper bound, and assuming once again that compensation of employees accounts for 65 percent of national income, the immigration influx that raises labor supply by 1 percent now yields an immigration surplus of only $175 million, an influx of 2 percent yields $698 million, and the entire stock of current immigrants, who contribute 16.5 percent of total hours worked, yields $47.5 billion.13

___________________

13 By contrast, in Ben-Gad’s (2004) dynamic model with endogenous capital, if the elasticity of labor supply is 0.75, the loss to natives of abolishing future immigration flows is only $3 billion.

In summary, if some natives exit the labor force in response to immigration, then there is an employment effect of immigration in addition to a wage effect. The wage effect is smaller, however, than in the case where native labor supply is fixed.

4.4 MULTIPLE TYPES OF LABOR

Complementarities Between Worker Types

The simple models presented thus far have assumed there is a single labor market in the economy where all workers supply the same amount of labor and where this labor is qualitatively identical. In reality, workers differ in their levels of skill, experience, and education and in their occupations. Thus, in a modern economy there is not one uniform labor market but many.

To keep the analysis simple, we now assume that there are only two types of workers. One type supplies high-skilled labor and the other supplies low-skilled labor. The distinction between the two types of workers is sometimes made on the basis of what type of jobs they perform, but more often it is imputed on the basis of how many years of schooling or educational qualifications they have accumulated. In the model explored here, firms employ both types of workers along with capital to produce final goods. For simplicity, we once again assume that each worker supplies a fixed amount of his or her type of labor in the market.

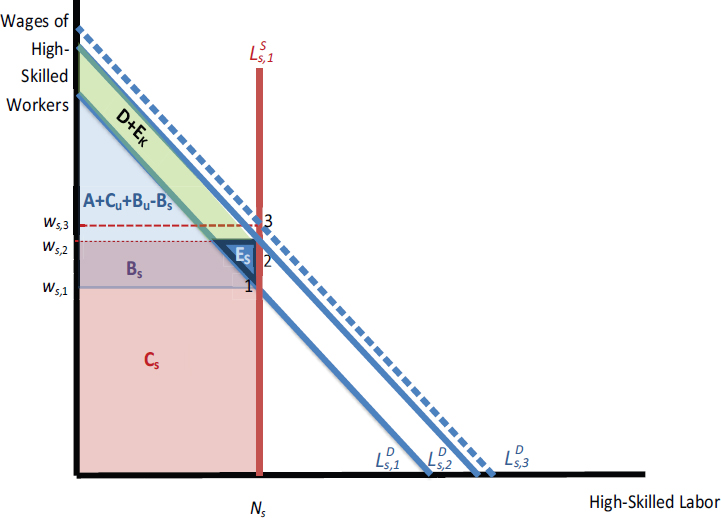

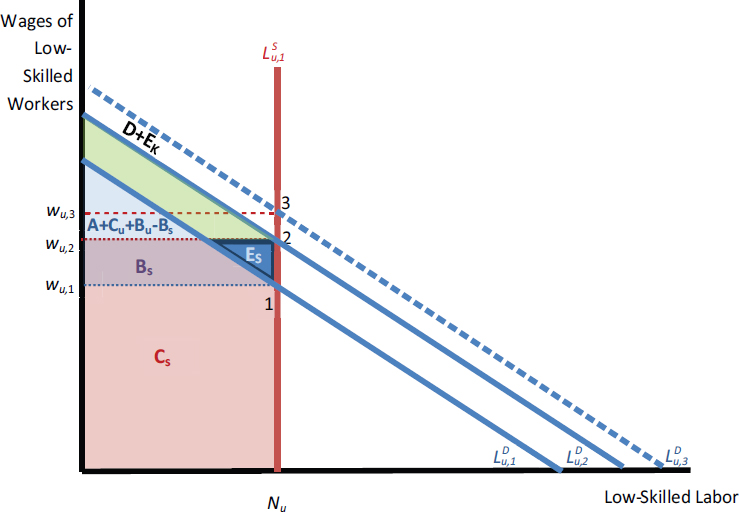

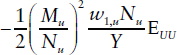

Immigrant worker type will be crucial in determining how their arrival will affect wages and the returns to capital. In Figures 4-5, 4-6, and 4-7, the panel considers the case in which all immigrants fall into the low-skilled category—this is of course a gross simplification. In Figure 4-5, the arrival of Mu low-skilled immigrant workers, augmenting the population of low-skilled native workers Nu, means that, just as in Figure 4-1, the supply curve in the market for low-skilled labor ![]() shifts to

shifts to ![]() . Wages for low-skilled workers decline from their initial value of wu,1 to wu,2. In the economy with undifferentiated labor, the influx of immigrant workers in Figure 4-1 raised the productivity of the second factor of production, capital, as shown in Figure 4-2. Likewise, here, the influx of low-skilled workers complements the other two factors of production, capital and high-skilled labor, and raises their productivity. This change in the market for high-skilled labor is captured in Figure 4-6 by the shift in the demand curve

. Wages for low-skilled workers decline from their initial value of wu,1 to wu,2. In the economy with undifferentiated labor, the influx of immigrant workers in Figure 4-1 raised the productivity of the second factor of production, capital, as shown in Figure 4-2. Likewise, here, the influx of low-skilled workers complements the other two factors of production, capital and high-skilled labor, and raises their productivity. This change in the market for high-skilled labor is captured in Figure 4-6 by the shift in the demand curve ![]() to

to ![]() and the rise in wages for high-skilled workers from ws,1 to ws,2. As before, the increase in the supply of one factor of production, in this case low-skilled labor, increases the value of the remaining factors, both high-skilled labor in Figure 4-6 and capital in Figure 4-7, where the influx of new immigrants once more causes the outward shift in the demand curve from

and the rise in wages for high-skilled workers from ws,1 to ws,2. As before, the increase in the supply of one factor of production, in this case low-skilled labor, increases the value of the remaining factors, both high-skilled labor in Figure 4-6 and capital in Figure 4-7, where the influx of new immigrants once more causes the outward shift in the demand curve from ![]() to

to ![]() and raises the rate of return from r1 to r2.

and raises the rate of return from r1 to r2.

How large are the initial changes in the two wages and the returns to capital likely to be? Start with the low-skilled natives who now face direct competition from immigrants in their labor market. Generally, the smaller the share of workers in a given category, the greater in absolute value the corresponding value of the factor price elasticity will be.14 Take the example in which the labor force is equally divided between high-skilled and low-skilled workers. In this case, a 1 percent increase in the overall number of workers will not depress overall wages as much as the wages of low-skilled workers would fall when the influx is only half as large but completely confined to the ranks of the low-skilled. When comparing the effects of an influx of equal absolute size, this contrast becomes yet more pronounced.

Moreover, the way the model distinguishes between different types of workers crucially affects how the wage rate will respond to influxes of new immigrants. The more the labor force is disaggregated, the larger the own-wage response will be to an increase in immigration if all the immigrants are

___________________

14 For Cobb-Douglas production functions, this is precisely true. The factor price elasticity of workers in category i is equal to ![]() .

.

confined to one particular category of labor. Even if the analysis is restricted to just two types of labor, the more broadly the category of high-skilled workers is defined, the more narrow the category of low-skilled workers will be and, in all likelihood, the larger (in absolute value) the corresponding elasticity of the own-factor price for low-skilled labor ΕUU. What this means is that the slope of the low-skilled labor demand curve ![]() in Figure 4-5 is likely to be steeper than the slope of the aggregate labor demand curve

in Figure 4-5 is likely to be steeper than the slope of the aggregate labor demand curve ![]() in Figure 4-1.

in Figure 4-1.

The effect of low-skilled immigration on the other two factors of production largely depends on the value of elasticities ΕSU and ΕKU, which represent the percentage change in high-skilled wages and returns to capital, respectively, divided by the percentage change in the number of low-skilled workers. Most evidence suggests that these elasticities are positive but not very large. In other words, there is a relatively low degree of complementarity and comparatively high degree of substitutability between low-skilled labor and both high-skilled labor and capital. This means that the shifts in the demand curves ![]() to

to ![]() and

and ![]() to

to ![]() are not likely to be very large, and consequently the initial increase in wages from ws,1 to ws,2, and the increase in returns to capital r1 to r2 are unlikely to be very large either.

are not likely to be very large, and consequently the initial increase in wages from ws,1 to ws,2, and the increase in returns to capital r1 to r2 are unlikely to be very large either.

The bottom line here is that immigration is predicted to raise native wages in the case where immigrant and native workers are complements, meaning their productivity rises from working together. Native workers who are substitutes for immigrants, however, will experience negative wage effects.

The Immigration Surplus with Immigrant–Native Complementarity

In the model above, the two elasticities ΕSU and ΕKU determine the size of the short-term immigration surplus, which now comprises two elements: the surplus that accrues to native high-skilled workers, represented by the triangle ES in Figure 4-6, and the surplus that accrues to whichever natives own capital, represented by the triangle EK in Figure 4-7.15 The size of each triangle is determined by the magnitude of the shift in the demand curve which is, in turn, determined by the elasticities ΕSU and ΕKU. The sum of the two surpluses represented by ES and EK is equal to the area of the triangle marked ES + EK in Figure 4-5. Indeed, as long as the influx of immigrants is confined to one skill category, it is sufficient to know the elasticity of

___________________

15 If one assumes the constant returns aggregate production function F(x) applies, there is a close relationship between all the factor price elasticities: ![]() , where

, where ![]() . The elasticity of complementarity between factors i and j is

. The elasticity of complementarity between factors i and j is ![]() .

.

demand for that type of labor to determine the size of the immigration surplus, which can then be calculated as it was in the case of undifferentiated labor, using the formula  .

.

Suppose again that the population is equally divided between high- and low-skilled workers and that the former receive a wage twice as high as the latter. The share of income paid for low-skilled work is now one-third of 0.65 (the overall share of earnings in total national income), or approximately 0.22, against 0.43 (the remaining portion) for high-skilled work. Finally, assume the value of ΕUU = −0.6. Together these values imply that an influx of low-skilled immigrants that increases the overall labor force by 1 percent but raises the size of the low-skilled workforce by 2 percent lowers low-skilled wages by 1.2 percent. The influx generates an immigration surplus of just under $462 million for the $17.5 trillion U.S. economy, which is substantially larger than the immigration surplus in the model above that assumed only one type of labor. If one now assumes that ΕKU > 0, the value of ΕSU can be at most no higher than 0.31, which means wages for high-skilled workers increase by no more than 0.62 percent in response to the influx of low-skilled immigrants. Borjas (2014a) cited ΕSU = 0.05 as a more empirically plausible number, which implies a rise in wages of 0.1 percent. Furthermore, if ΕUU = −0.6 and ΕSU = 0.05, the income shares imply ΕKU = 0.32, so the losses experienced by low-skilled workers represent for the most part gains to owners of capital rather than to high-skilled wage earners.

Summarizing, the immigration surplus is larger when immigrant workers are complementary to natives. Income from the surplus accrues to both owners of capital and high-skilled workers when immigrants are low-skilled.

Capital Accumulation in a Model with Immigrant-Native Complementarities

As in the one-labor-category model (Section 4.2), the rise in the rate of return to capital in the two-category model induces capital inflows or capital accumulation. This process raises the wages of both types of workers. Wages of high-skilled workers rise still further as the stock of capital grows, and the wages of low-skilled workers partially recover as well. Yet with more than one type of labor, neither the process of capital accumulation nor even the free flow of capital from abroad is sufficient to guarantee that wages return to their previous levels for both groups following an unexpected immigration episode, even in the long run, unless it also affects native occupational choice and investment in education. And even then this adjustment is a very long-run phenomenon. What this means is that

the shift in low-skilled wages from wu,2 to wu,3 only partially mitigates the initial decline from wu,1.16

Restating this, once the capital-labor ratio is restored, average wages are also restored, as in the model with just one type of labor. However, in a framework with two types of labor and regardless of any complementarities, relative wages may not return to pre-immigration levels. If immigrants are low-skilled, the deterioration of the relative wages of low-skilled workers may persist in the long run.

The Role of Capital-Skill Complementarity in the Immigration Surplus

There is one more aspect to the dynamic impact of capital accumulation in this context. Empirical work on U.S. manufacturing, dating back to work by Zvi Griliches (1969) and confirmed by subsequent research, suggests there is evidence of what economists call “capital-skill complementarity.”17 Indeed, consistent with this evidence, in representing the demand curves in Figures 4-5 and 4-6, we assumed that the factor price elasticity of the demand curve for high-skilled workers is higher in absolute value than that corresponding demand curve for low-skilled workers—that is, that the demand curve for high-skilled workers is more steeply sloped than the demand curve for low-skilled workers. The result is that additional increments of capital raise the productivity and hence the wage of high-skilled workers more than they raise the wage of low-skilled workers. Though wages for both may rise, the additional capital also partly substitutes for low-skilled labor to a degree it does not substitute for high-skilled labor.

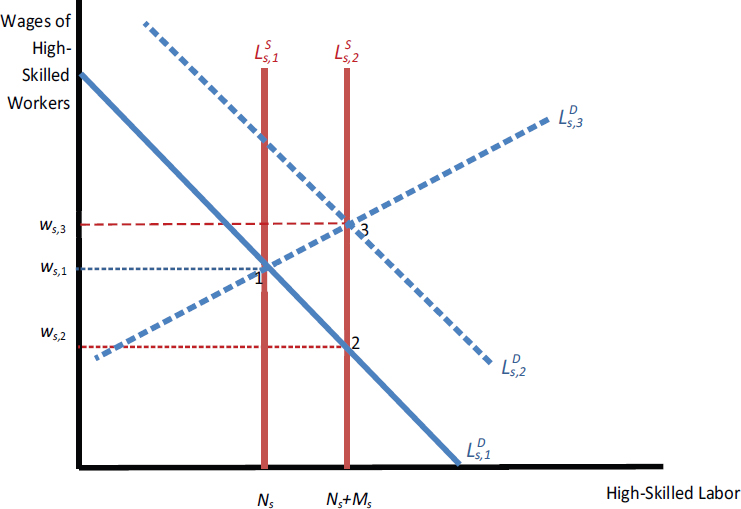

Capital-skill complementarity has another implication: The immigration surplus generated by an increase in the number of high-skilled workers is potentially much larger than for a similar-sized influx of low-skilled workers. To see this, consider what happens in the market for high-skilled labor when the population of high-skilled native workers Ns is augmented by Ms high-skilled immigrant workers. The labor supply curve shifts from ![]() to

to ![]() in Figure 4-8 and wages decrease from ws,1 to ws,2. The immediate impacts of

in Figure 4-8 and wages decrease from ws,1 to ws,2. The immediate impacts of

___________________

16 This is the pattern found by Ben-Gad (2008), who simulated the dynamic behavior of wages and returns to capital following a temporary surge in either low-skilled or high-skilled immigration in a model with a nested constant elasticity of substition (nested CES) production function that incorporates capital-skill complementarities. In Table 5-1 in Chapter 5, the panel considers a different configuration of the nested CES production function in which the elasticities of substitution between different types of labor vary but the elasticities of substitution between capital and the different types of labor are identical.

17 Studies by Fallon and Layard (1975) and Krusell and colleagues (2000) for the United States and by Duffy et al. (2004) using international data all confirm this finding. Goldin and Katz (1998) suggested that capital-skill complementarity emerged during the early 20th century with the transition from artisanal to mass production.

an influx of each category of immigrant labor skill on the demand for the second category in Figures 4-6 and 4-9 are qualitatively identical, as is the impact on the demand for capital in Figures 4-7 and 4-10.

What is different is that because of capital-skill complementarities, the outward shift in the demand curve from ![]() to

to ![]() in Figure 4-10 is assumed to be substantially larger than the shift in Figure 4-7. This means the rise in the rate of return is larger and the value of the capital-related component of the short-term immigration surplus EK is larger as well. Indeed, if one assumes that the share of national income captured by high-skilled immigrants is larger than the share captured by low-skilled immigrants and that the elasticity ΕUS is greater than ΕSU, then the demand curve in Figure 4-9 shifts outward more than in Figure 4-6. Hence, a percentage increase in the number of high-skilled workers raises the wages of low-skilled workers by more than the same percentage increase in low-skilled workers raises the wages of the high skilled.

in Figure 4-10 is assumed to be substantially larger than the shift in Figure 4-7. This means the rise in the rate of return is larger and the value of the capital-related component of the short-term immigration surplus EK is larger as well. Indeed, if one assumes that the share of national income captured by high-skilled immigrants is larger than the share captured by low-skilled immigrants and that the elasticity ΕUS is greater than ΕSU, then the demand curve in Figure 4-9 shifts outward more than in Figure 4-6. Hence, a percentage increase in the number of high-skilled workers raises the wages of low-skilled workers by more than the same percentage increase in low-skilled workers raises the wages of the high skilled.

Assume once again that the initial population is divided equally between high- and low-skilled workers, and that high-skilled workers receive a wage twice that of the low skilled. Assume further that the demand for high-skilled workers is more elastic than for low skilled, such that ΕSS = −0.9.

The immigration surplus generated by high-skilled immigrants, here equal to  , of a 1 percent increase in the number of workers, all now high-skilled immigrants, is equal to just over $1.35 billion in a $17.5 trillion economy.

, of a 1 percent increase in the number of workers, all now high-skilled immigrants, is equal to just over $1.35 billion in a $17.5 trillion economy.

Furthermore, because the rise in the rate of return is higher when high-skilled rather than low-skilled immigrants are added to the economy, the inflow or accumulation of capital will be larger as well. This means that the further increase in low-skilled wages from wu,2 to wu,3 will be somewhat higher and that, in particular, a more significant portion of the loss in high-skilled wages will be corrected in the long term as the demand curve in Figure 4-8 shifts from ![]() to

to ![]() . This means that even after the long-run accumulation of capital is accounted for, here the immigration surplus does not completely disappear. Simulations by Ben-Gad (2008) found that even if university-educated workers are only 2.7 times more productive than workers without degrees, university-educated immigrants generate a surplus for natives 10 times larger than the surplus generated by other immigrants.

. This means that even after the long-run accumulation of capital is accounted for, here the immigration surplus does not completely disappear. Simulations by Ben-Gad (2008) found that even if university-educated workers are only 2.7 times more productive than workers without degrees, university-educated immigrants generate a surplus for natives 10 times larger than the surplus generated by other immigrants.

Immigration generates a surplus that accrues to both immigrants and natives, but the latter capture a larger share of the surplus when immigrants are skilled. Capital is likely more complementary to high-skilled than low-skilled labor, which has implications for the immigration surplus.

Immigration Surplus in the Long Run

It might seem odd that the influx of the same number of immigrants who are exclusively either high-skilled or low-skilled can each generate a surplus larger than the influx generated by immigrants in the model with undifferentiated labor. The reason for this result is that by altering the skill distribution in the economy, immigrant labor creates shifts in wages that represent opportunities for native-born workers. In other words, the arrival of new workers from abroad disrupts the relative supply of different factors of production, and it is this disruption that generates the immigration surplus. The more disruptive the influx—here not only the number of workers but the mix of different skill types is altered—the greater the magnitude of the surplus.

This last point is emphasized by Borjas (2014a), who examined the immigration surplus for varying proportions of high- and low-skilled immigration.18 In his model, the high-skilled group consists of workers with more than a high school education. Applying this criterion to data from the 2000 Decennial Census, 61.4 percent of natives can be categorized as

___________________

high skilled, but only 48.9 percent of immigrants classify as such. Given that immigrants comprise approximately 15 percent of the U.S. workforce, the theoretically derived calculation of the short-run immigration surplus (where capital remains fixed) yields an estimate of between 0.24 percent and 0.5 percent of GDP, but the long-run surplus (after the stock of capital has adjusted) reduces to between 0.02 and 0.03 percent of GDP. Immigrants fail to generate a substantial surplus because they are too similar to the population absorbing them. By contrast, if all the immigrants were low skilled, the short-run surplus would be between 0.45 and 0.9 percent and the long-run surplus between 0.42 and 0.77 percent. If all the immigrants were high skilled, the corresponding numbers are 0.75 and 1.35 percent in the short run, and 0.16 and 0.31 percent in the long run. In the short run, natives benefit most from the arrival of high-skilled immigrants because of capital-skill complementarities, but in the long run, low-skilled immigrants generate the larger surplus because they are more dissimilar to natives. In all cases, once capital adjusts, capital-skill complementarity is less important to the immigration surplus. The extent to which the immigrant skill set differs from that of natives has, in theory, comparatively more effect on the magnitude of the immigration surplus in the long run.

4.5 MULTIPLE TECHNOLOGIES AND MULTIPLE GOODS

Immigration and Output Mix

So far, this discussion has assumed that people in this model economy produce and consume some aggregate good (or, similarly, that there are many goods but they are produced using the same production technology). It is instructive to consider the impact of immigration under a set of alternative assumptions about the nature of markets, including in the context of a model designed to analyze the impact of international trade.

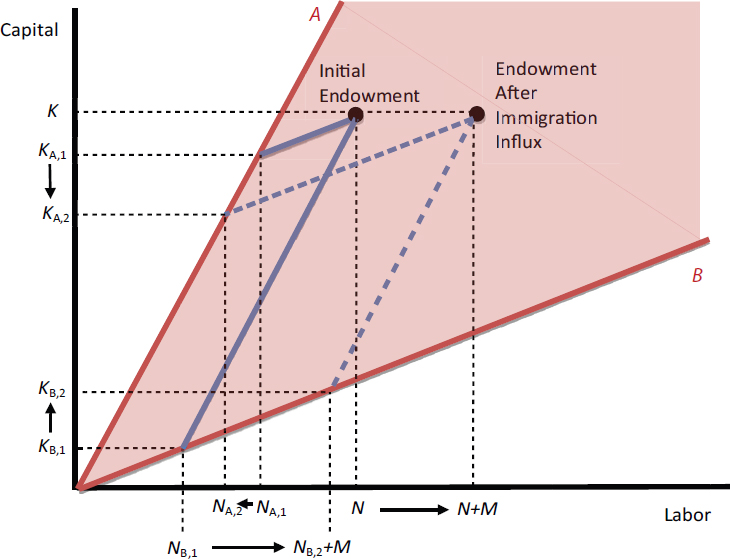

Assume once again that the economy being modeled produces the goods it consumes by combining two factors, capital and labor, but instead of one type of good it now produces two distinct goods, designated A and B in the Lerner diagram in Figure 4-11.19 The technology represented has the familiar characteristic of constant returns to scale, but allows for different combinations of capital and labor in the production of different goods. More specifically, to produce each unit of good A requires relatively large amounts of capital and less labor, while the production of good B employs relatively more workers and uses less capital. Assume further that all goods are freely traded internationally. This assumption simplifies the analysis because it implies that the prices of each good are set in global markets.

___________________

19 The diagram was developed by Lerner (1952).

The rays from the origin labeled A and B each represent the combination of capital and labor that is required to produce one of the final goods. The shaded area between the two rays is referred to as the cone of diversification. This means that, if the economy’s total initial endowment of productive inputs—its stock of capital K and available labor N—falls within this area, one expects this economy to produce both goods. The alternatives are that the economy exclusively produces good A if the initial endowment is to the left of the shaded area or exclusively produces good B if the initial endowment is to the right of the shaded area.

In the case assumed in Figure 4-11, initially—before the arrival of new immigrants—the production of good A employs most of the labor NA,1 and capital KA,1, leaving only a comparatively small amounts NB,1 and KB,1 employed in the production of good B. All this changes when the initial work force N is supplemented by the arrival of M new immigrants, causing the initial endowment to shift horizontally to the right. Still, as long as the shift is not large enough to carry the new endowment point outside the cone of diversification, the economy continues to produce both types of goods.

Since both goods are traded on world markets, and at fixed world prices, the amount of each good consumed does not change. What does change is the pattern of this economy’s trade with the rest of the world.

Suppose that before the arrival of the immigrants, the economy exported A and imported B. After the arrival of the immigrants, the volume of trade would decline and, if the effect is sufficiently large, one expects a switch toward importing A and exporting B. Alternatively, if initially this economy imported A and exported B, the volume of this trade would increase. To provide a concrete example, suppose the garment industry in this economy is relatively labor intensive. Its domestic garment industry produces less than the total amount of garments consumed and the remainder is imported. The arrival of more labor will reduce the volume of these imports and increase the amount produced domestically.

Of course none of these rather extreme assumptions is particularly representative of the condition of the U.S. economy as it absorbs new workers from abroad. Neither the prices of different goods nor the wages or returns to capital are fixed in global markets, and this simple example abstracts from the way trade can shift production within sectors between different firms. Yet even if the assumptions are mostly unrealistic, the analysis is useful because it captures in a relatively extreme fashion an additional dimension through which immigration alters the U.S. economy: reallocating output between the production of different goods. Adjustment through changes in the mix of goods produced, along with the subsequent changes in both the volume and pattern of international trade, implies less adjustment through factor prices and so will dampen, to some degree, the downward pressure immigration might otherwise exert on wages in the short run.

Of course final goods are not the only things traded—factor inputs including capital are imported and exported. Indeed the very process of international migration represents a flow of the factor input labor between countries and can serve as a substitute for trade in final goods. Workers can produce a good in a foreign country and export it to the United States, driving down both the price of the good paid by U.S. consumers and the wages of their American counterparts. Alternatively they can migrate to the United States and expand domestic production. Qualitatively the effect would be similar. Hence, there is some degree of substitution between international migration and international trade.

Summarizing, firms that use relatively labor-intensive technology benefit more from immigration and respond by increasing production and, hence, their demand for labor. The subsequent change in the economy’s output mix is larger the closer the trade ties are between the receiving economy and the rest of the world, and this change further reduces any adverse impact of immigration on wages.

Immigration and Technology

Thus far, the models discussed in this chapter have assumed that the technology for any given firm or industry is fixed and exogenously determined. In reality, technology progresses. Recognition that firms may have a choice of technologies, that the evolution of technology is likely to be influenced by changes in the composition of labor, and that immigrants themselves may hasten the process of technological change leads to an appreciation of additional links between immigration and wages.

Consider the possibility that a good may be produced with either of two technologies. Instead of assuming two different goods as above, Figure 4-11 now models an economy such that A and B represent different technologies.20 Method A is more capital intensive than method B, but if one assumes that wages and the rate of return to capital are determined on world markets, the analysis illustrated by Figure 4-11 does not change. An influx of new immigrants now causes the amount produced using technology B to increase and the amount produced using technology A to decline.

The aggregate amount of capital remains constant as long as its rate of return is determined on global markets, but the amount used by type A firms declines from KA,1 to KA,2, and the amount used by type B firms increases from KB,1 to KB,2. The shift in the allocation of capital reinforces the shifts in the allocation of labor, so that even though the total amount of labor in the economy grows, the amount employed by type A firms always declines from NA,1 to NA,2. Since this case assumes that the labor supplied by natives and by immigrants is identical, one can assume furthermore that all M new immigrants join type B firms. Even so, the number of native workers employed at type B firms increases as well, from NB,1 to NB,2. Hence, if one assumes the economy is completely open and all the relevant prices, including wages and rates of return are determined on global markets, the economy can still absorb large numbers of immigrant workers by reallocating both capital and labor between the different types of technologies available.

As with the introduction of multiple goods, the introduction of different modes of production for the same good provides an additional channel through which immigration may alter the economy and absorb some of the impact that might otherwise force down wages. In the case analyzed by Lewis (2013), this result extends beyond the two-factor example with only one type of labor to models with multiple types of labor. Namely, an influx of immigrants who supply a particular type of labor once again causes a portion of output to shift toward those firms that employ that labor most intensively. Adding more types of technology increases the range of possible responses of industry to an influx of new immigrants.

___________________

20 See Trefler’s (1998) analysis of the Heckscher-Ohlin model of international trade.

Of course, it is unlikely that the transition between different modes of production is instantaneous. Beaudry and Green (2005) modeled an economy that is gradually transitioning between older and newer, more advanced technologies that rely more heavily on both capital and high-skilled workers. They found that the pace at which the older technology is replaced is determined by the pace at which both physical and human capital accumulate. (Chapter 6 examines the role of human capital in more detail.) An influx of new immigrants alters not only the supply of overall labor relative to capital but also the relative supply of different types of labor, potentially changing the pace of the transition. Another implication of the Beaudry and Green model is that an increase in the number of high-skilled workers may not only lower the wages these workers can command in the market but, in contrast to the analysis in Section 4.4, may also lower the wage of low-skilled workers as well, since capital shifts away from the traditional sector.

It is useful to go a step further, and ask how these different technologies arise. The shifting availability of workers with different levels or types of skill alters the incentives for the development of different types of technology. Hence, an influx of high-skilled workers would spur the development of new technologies that complement the type of labor they supply. Acemoglu (1998, 2002b) raised the possibility that while the arrival of a particular type of worker may lower wages in the short term, the new technologies that develop in response raise these workers’ productivity and ameliorate the decline in wages over time.

Indeed under certain conditions, particularly if there is a high degree of substitutability between the different workers in the economy, the long-run labor demand curve will slope upward.21 Consider once more an influx of high-skilled immigrants MS in Figure 4-12 that shifts the supply of labor from ![]() to

to ![]() . In the initial phase, the wage drops from ws,1 to ws,2 along the short-run labor demand curve

. In the initial phase, the wage drops from ws,1 to ws,2 along the short-run labor demand curve ![]() . Over time, as new technologies are developed to take advantage of the now more plentiful supply of high-skilled labor, the demand curve shifts out to

. Over time, as new technologies are developed to take advantage of the now more plentiful supply of high-skilled labor, the demand curve shifts out to ![]() and wages increase from ws,2 to ws,3. The long-run demand curve for high-skilled labor is upward sloping.

and wages increase from ws,2 to ws,3. The long-run demand curve for high-skilled labor is upward sloping.

It is further possible that immigration could speed technological progress for any given skill group if skilled immigrants are themselves innovative or provide entrepreneurial skills complementary to native innovators. This would reinforce the endogenous technological change just described. The theoretical link between immigrants and innovation is considered further in the context of immigration and economic growth in Chapter 6.

Once again, even for relatively small countries most of the assumptions made in the models discussed in this chapter are unrealistic. Even in small

___________________

21Acemoglu (2002a) used this mechanism to explain why the relative wage of college-educated workers increased even as the supply of these workers grew.

countries, wages and prices are not solely determined on international markets, and to a degree neither is the return to capital. Furthermore, not all goods are tradeable across different countries or even different regions. For a country as large as the United States, with its enormous and relatively autarkic internal market, these assumptions are even less realistic. However, it is important to emphasize that the assumptions for these models have been made to simplify the analysis and to isolate effects that are still likely to exist to some degree, even if none of the assumptions are strictly true in a real economy. What this means is that many of the wage effects described in earlier sections are likely to be diluted by the response of firms (for example, altering the mix of goods and services they produce, shifting between modes of production, or developing new technologies) as the labor supplied by new immigrants is made available in the market.

Summarizing, firms can also respond to immigration by implementing technologies that are complementary to the type of labor immigrants’ supply; this is another adjustment mechanism that mitigates adverse wage effects.

4.6 RESPONSES BY NATIVES

Finally, we briefly note that there are other margins of adjustment to immigration that are not related to technology or even firms but also serve to reduce the wage impact of immigration. Of particular importance is that responses by natives may mitigate the wage effects of immigration. Individuals who compete with immigrants may choose to better exploit their comparative advantage in language or to upgrade their human capital. For example, if immigrants are not native speakers of English, immigration changes the comparative advantage of the native-born toward tasks that are more language and communication intensive and encourages them to shift into occupations utilizing these skills. This response mitigates negative wage impacts of immigration (Peri and Sparber, 2009). Furthermore, incentives to increase education are influenced by the wage structure, which is in turn affected by the entry of immigrant workers (Chiswick, 1989; Chiswick et al., 1992). If immigration causes increased wage inequality, younger natives may increase their education in response, mitigating negative wage impacts on the unskilled in the long run. Evidence of these effects is examined in the next chapter.

4.7 THE LINK BETWEEN IMMIGRATION AND FRICTIONAL UNEMPLOYMENT

How does immigration affect the rates of employment or unemployment of native workers? For the case of an elastic labor supply, the influx of immigrant workers in Figure 4-3 initially lowers the wage from w1 to w2, and the amount of work supplied by an average native declines from l1 to l2. Yet this decline in the amount of work performed by natives does not correspond to an increase in the rate of unemployment as economists usually define this term. By the conventional definition, people are considered unemployed if they are willing to work at the prevailing wage but cannot find a firm willing to hire them.

In modern economies there are nearly always some people who are unemployed and, at the same time, some number of firms with vacancies they wish to fill. Over time, as the unemployed fill existing vacancies, others lose or quit their jobs and new people enter the labor market. Similarly, even as some firms die or shrink in size, causing workers to become unemployed, other firms expand or are established, creating new vacancies. Diamond (1982) and Mortensen and Pissarides (1994) constructed models in which this type of frictional unemployment emerges from the behavior of the unemployed searching for new jobs and firms searching for new employees. In these models, an unemployed individual must decide in each period whether to accept a job offer rather than remaining unemployed for

another period, in which case he or she remains available to accept some better job that might be offered in the future.

To date, there are only a few published papers that simulate and analyze the impact of immigration within this search and matching framework. Ortega (2000) analyzed immigration between two countries in a stylized model with only one type of labor. Liu (2010) analyzed the impact of unauthorized low-skilled immigration between 1970 and 2005 on unemployment in the United States. Chassamboulli and Palivos (2014) generalized these two papers and analyzed the impact of immigration between 2000 and 2009 on the U.S. labor market. Finally, Chassamboulli and Peri (2015) analyzed the impact of curtailing illegal immigration from Mexico. What these studies share is the seemingly paradoxical result that although larger immigration flows may generate higher rates of unemployment in some sectors, overall, the rate of unemployment for native workers declines.

In the baseline version of the Chassamboulli and Palivos (2014) model, immigration increased the size of the overall labor force by 6.1 percent over the course of a decade. A slightly larger share of the immigrants had college degrees compared to natives, 28.8 percent versus 27.4 percent. The influx caused a decline of 0.31 percent in the wages of high-skilled native workers and a rise of 0.24 percent in the wages of low-skilled native workers. These results mimic the patterns of change in wages implied by the analysis in Figures 4-8 and 4-9. At the same time, the long-run rate of unemployment simulated by the model dropped as a result of immigration from 6.10 percent to 5.46 percent for low-skilled natives and from 2.40 percent to 2.02 percent for high-skilled natives. Why do both unemployment rates decline?

The explanation is that in all of these search and matching models, searching for new workers is costly for firms. The entry of new workers through migration increases the likelihood of filling a vacant position quickly and thus reduces the net cost of posting new offers. The fact that immigrants in each skill category earn less than natives reinforces this effect. Though immigrants compete with natives for these additional jobs, the overall number of new positions employers choose to create is larger than the number of additional entrants to the labor market. The effect is to lower the unemployment rate and to strengthen the bargaining position of workers. Hence, aggregating across the two skill types, wages for all natives increase by 0.07 percent.

According to the simulations performed by Chassamboulli and Palivos (2014), the new immigrants who arrived between 2000 and 2009 had a particularly large and positive impact on the wages paid to the pre-existing stock of immigrants, whether high or low skilled. This result contradicts much of the empirical literature on wage effects, which generally finds that new immigrants are close substitutes for previous waves of immigrants.

In the simulations performed by Chassamboulli and Peri (2015), a drop of 50 percent in the stock of unauthorized immigrants from Mexico, accomplished by either stricter border enforcement or more deportations, will raise the wages of low-skilled workers by 0.56 percent and lower wages for high-skilled workers by 0.35 percent. At the same time, the removal of these unauthorized immigrants lowers the rate of employment for high-skilled workers from a baseline rate of 87.00 percent to 86.94 percent. The now smaller number of unauthorized immigrants, all assumed to be low skilled, impedes firms’ overall incentive to search for these types of workers, causing the employment rate for low-skilled workers to drop from 73.0 percent to 72.4 percent.

What one learns from the papers investigating the effect of immigration on unemployment using search and matching models is that whatever the short-term impact of immigration on unemployment found in empirical studies, it would be wrong to automatically assume that an increase in the flow of new immigrants must necessarily push up the rate of unemployment in the long run. In short, immigration can lower native unemployment by reducing search costs for employers.

4.8 CONCLUSIONS

The theoretical models point to many ways in which economic responses by individuals and firms are expected to mitigate the initial impact of immigration on the labor markets of receiving countries. Once immigration changes the relative prices of labor and capital, factor inputs are reallocated across sectors and firms may adjust their technology and output mix to make more intensive use of workers. The existing labor force may also respond by investing in certain skills and upgrading their human capital (as discussed further in Chapter 6). However, theoretical models are at best partial representations of the real-world objects they seek to analyze. For models to be tractable, assumptions are made to ignore certain phenomena or to fix the values of some key economic variables. For example, aggregating across different types of workers and across different types of immigrants and natives necessarily means a loss of detail. Still, a few important insights into the impact of immigration on the receiving economy emerge.

First, the arrival of an unanticipated inflow of immigrants initially affects the economy by changing the wage structure—reducing the wages of those natives most similar to immigrants but possibly raising the wages of other natives—and by increasing the return to capital. Second, the responses of capital and technology mean many, though not all, of these initial changes may be transitory in nature. In the long run, changes in the economy’s output mix and the adoption of technology that favors

immigrant labor provide potentially important adjustment mechanisms to mitigate adverse wage effects of immigration. Decisions of natives to move into occupations where they have a comparative advantage or to invest in their human capital may also reduce adverse wage effects.

Third, the arrival of immigrants raises the overall income of the native population that absorbs them: the immigration surplus. This surplus is directly related to the degree to which immigration changes wages and returns to capital. In the simplest models, the more wages decline, the larger the surplus. Moreover, the size of the surplus is likely to be small—far smaller than the effect immigration has on the distribution of income. Immigration enlarges the economy while leaving the native population slightly better off on average, but the greatest beneficiaries of immigration are the immigrants themselves as they avail themselves of opportunities not available to them in their home countries.