2

The Shale Gas Boom and Its Impact on the American Chemical Industry

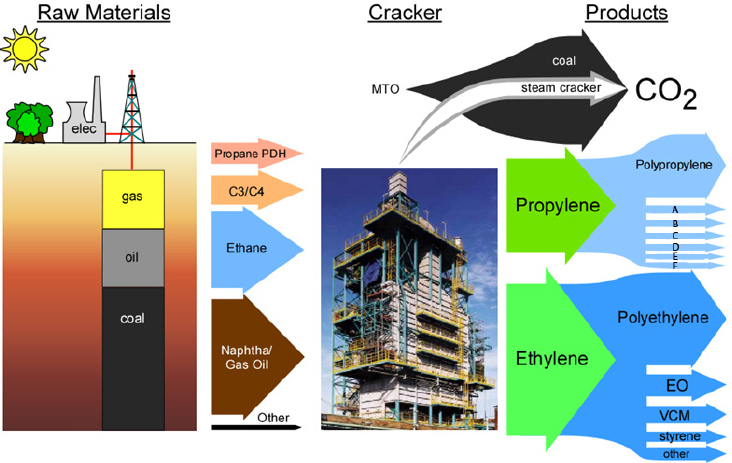

The modern, capital-intensive U.S. chemical industry converts fractions of fossil fuels—naphtha from oil and natural gas liquids from natural gas—into two major chemicals, ethylene and propylene, which it then uses to produce polyethylene, polypropylene, and a limited number of other bulk chemicals (see Figure 2-1). The chemical industry and its customers then use these bulk chemicals to produce a wide range of higher-value products. The technology for converting naphtha and natural gas liquids is based on the steam cracker, which dates to the 1920s and relies on heat, not catalysis, to convert ethane and propane into the corresponding olefins. While this technology is well established, with superior production economics, it is energy- and capital-intensive and emits a substantial amount of carbon dioxide as a byproduct. As such, an economically competitive catalytic process that reduces energy use, capital demands, and carbon emissions could offer significant benefits for the chemical industry.

While olefin production has been growing steadily at more than a 4 percent compound annual growth rate since the 1990s, the U.S. chemical industry has gone through upheavals over that same period. These upheavals resulted from the combined effects of two recessions and several periods when the cost of energy from natural gas exceeded that of oil. Until the first of these cost inversions, oil and natural gas prices had been relatively stable and the U.S. industry had an economic advantage because of two factors: the availability of natural gas liquids that traded below the price of petroleum-derived naphtha and the industry’s reli-

NOTE: A = propylene oxide; B = oxo alcohols; C = acrylonitrile; D = cumene/phenol; E = acrylic acid; F = other; MTO = methanol to olefin; CO2 = carbon dioxide; EO = ethylene oxide; VCM = vinyl chloride monomer.

SOURCE: Jones, 2016.

ance on light steam crackers optimized to use natural gas liquids as the feedstock.

One reality of the global chemical industry, explained Mark Jones, Executive External Strategy and Communications fellow at The Dow Chemical Company, is that feedstocks are not fungible. European and Asian chemical industries primarily use naphtha because they have almost no natural gas resources of their own and it is less expensive to import oil than natural gas liquids. Saudi Arabia and other oil-producing nations in the Middle East primarily use natural gas liquids because of the ready supplies of low-value natural gas that would otherwise mostly be flared. Jones noted that around 2004, proven U.S. reserves of natural gas were falling, and chemical plants were being disassembled and moved to production sites outside of the United States. Chemical industry researchers even began looking at other feedstocks such as syngas—a mixture consisting primarily of hydrogen, carbon monoxide, and carbon dioxide—produced from coal, biomass, and methane.

That bleak scenario, which dominated the chemical industry’s outlook from 2000 to 2006, vanished with the successful demonstration that

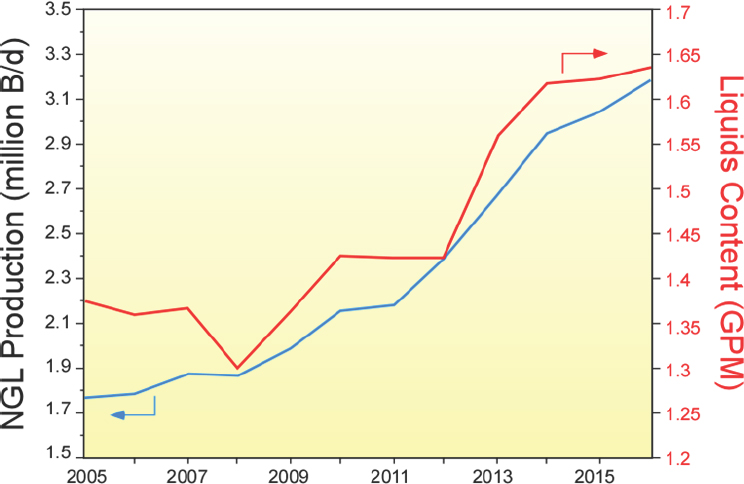

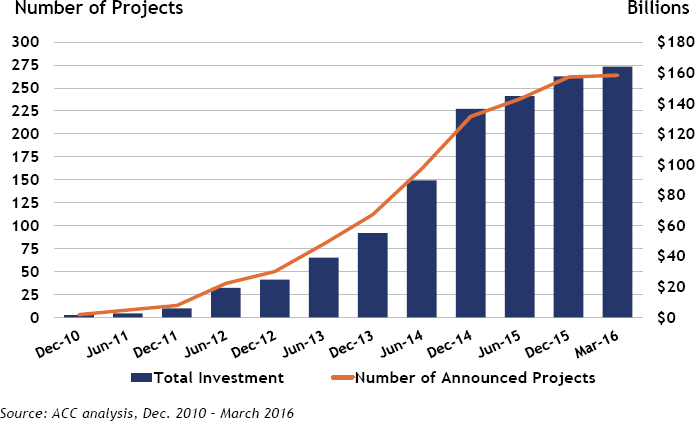

oil and gas from the huge shale deposits in the United States could be recovered economically. By 2010, shale gas production was rising dramatically. More importantly for the U.S. chemical industry, natural gas from shale is “wetter” than from other sources, meaning it has a higher percentage of the natural gas liquids that the chemical industry desires. As a result, the shale gas boom has led to a concomitant increase in the supply of natural gas liquids (see Figure 2-2), and the U.S. chemical industry moved from being disadvantaged from a cost perspective to highly advantaged relative to all but some Middle Eastern countries.

Of even greater importance to the rebirth of the U.S. chemical industry is the fact that proven reserves of shale gas have also risen. As Jones explained, the shale gas boom is not a revolution of geology but of technology. That is, the locations of shale deposits had been known for years, but it took technological development to tap those deposits economically. He also noted that because the locations of shale are well mapped, the risks involved with extraction of oil and natural gas from those deposits is greatly reduced compared with traditional exploration and drilling ven-

NOTE: B/d = barrels per day; GPM = gallons per thousand cubic feet; NGL = natural gas liquids.

SOURCE: Jones, 2016.

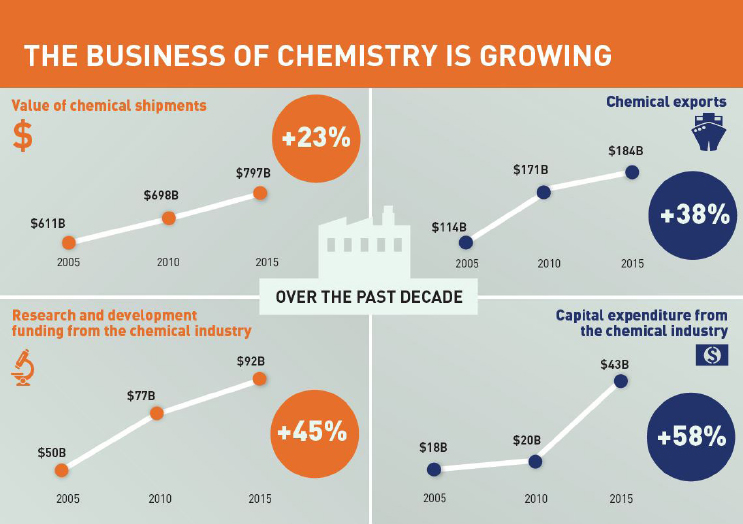

tures. The end result for the U.S. chemical industry is that it should have ready access to lower-cost feedstocks, relative to most other countries, for the foreseeable future, which bodes well for the U.S. economy, given what has already transpired over the past decade. Between 2005 and 2014, the value of chemical shipments increased by 48 percent, chemical exports doubled, capital expenditures in the United States rose by 77 percent, and chemical industry research funding jumped 50 percent (see Figure 2-3).

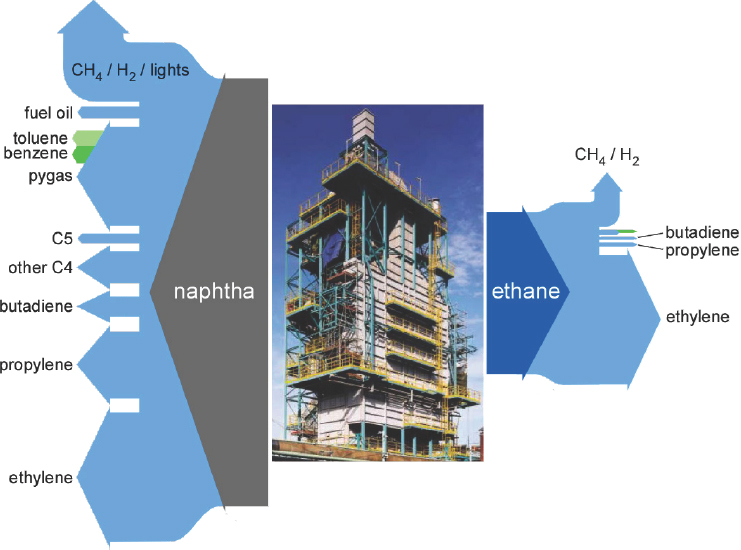

Jones noted that even with the recent fall in oil prices, natural gas liquids still maintain a significant cost advantage over oil-derived naphtha. In addition, natural gas crackers are less expensive to build and operate than naphtha crackers, and ethane cracking is more efficient than naphtha cracking. Approximately 30 percent of the naphtha fed into a steam cracker is converted to ethylene, while approximately 80 percent of the ethane is converted to ethylene (see Figure 2-4). The tradeoff is that naphtha cracking produces chemicals such as propylene, butadiene, benzene, and toluene that the chemical industry had found uses for when naphtha cracking was more prevalent. In addition, some chemicals, such as cyclo-

NOTE: B = billions.

SOURCE: ACC, 2014. Reproduced with permission by Ryan Baldwin.

NOTE: CH4 = methane; H2 = hydrogen.

SOURCE: Jones, 2016.

pentadiene, are only produced economically via naphtha cracking. Jones said that the rapid growth in propylene-based products and the move to lighter feedstocks that reduced the supply of propylene has resulted in ethylene and propylene being nearly at price parity, while butadiene and benzene prices have risen substantially. Many of these molecules are now the subjects of development efforts as chemists search for catalytic processes that can convert methane, ethane, and other lighter hydrocarbons into these in-demand chemical intermediates. He also noted the low cost of natural gas liquids and the high demand for ethylene and propylene has created an optimal scenario for the chemical industry, one in which the price spread between raw material and product makes chemical production highly profitable.

Natural gas liquids contain a significant amount of propane, with the result that propane prices have fallen far enough that it has become economical to produce high-demand propylene directly from propane via catalytic propane dehydrogenation. As many as seven new propane dehydrogenation plants have been announced in the United States, and up to 17 are slated for construction in China, which is importing propane

SOURCE: ACC, 2016.

from the United States. Jones noted that the United States is also exporting smaller amounts of ethane and butane relative to propane.

The abundant supplies of cheap ethane, and to a lesser extent propane, from shale gas are fueling a rebirth of the U.S. chemical industry (see Figure 2-5), but the predominant component of shale gas is still methane and it, too, has uses as a chemical feedstock. For the most part, methane is first converted to syngas, which is then turned directly or indirectly via catalytic processes into ammonia, methanol, acetic acid, and formaldehyde. During the natural gas price spike, ammonia and methanol production also moved offshore, but as with ethylene and propylene production, methanol and ammonia production is now returning to the United States with the ongoing renaissance in the U.S. chemical industry. This resurgence bodes well for the U.S. balance of trade, as the chemical industry has historically contributed positively to the balance of trade. In fact, from a low of $18.1 billion in 2005, the balance of trade surplus generated by the U.S. chemical industry as a whole, excluding pharmaceutical production, increased to $36.7 billion in 2014 (American Chemistry Council, 2015b). It has also led to a growth in employment: Since 2010, the number of chemical industry jobs has grown from 786,500 to 805,600, with a concomitant increase in the average hourly wage from $21.07 to $22.75.

IMPLICATIONS FOR CATALYSIS

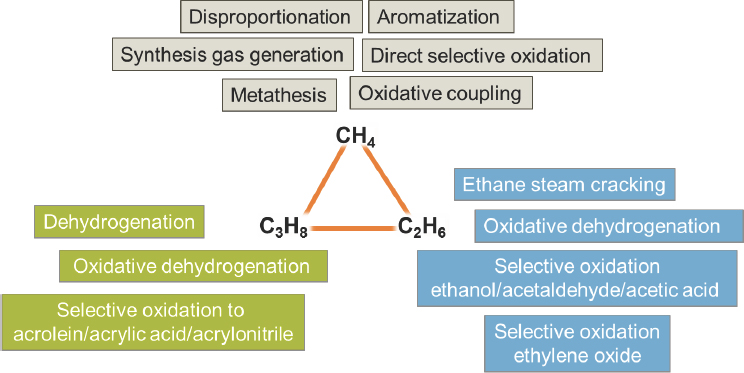

Today, the availability of low-cost methane and natural gas liquids offers a transitional opportunity to lower the carbon footprint of the chemical industry if new catalytic approaches (see Figure 2-6) can be developed, said Johannes Lercher, professor of chemistry at the Technical University of Munich and director of the Institute for Integrated Catalysis at the Pacific Northwest National Laboratory. He noted that one of the bigger challenges facing chemists is to link what is known about catalysis with insights from materials science research to create industrial-scale catalysts that will be stable and resist sintering under the sometimes harsh conditions required for many conversion processes involving light alkanes (e.g., reforming to synthesis gas (syngas), dehydrogenation, and aromatization). Other major drivers for new research in catalysis are related to the economic demand to convert small amounts of stranded or associated gases to condensable energy carriers to curtail well-head methane flaring with regulations aimed at reducing greenhouse gas emissions, said Lercher.

Catalytic Conversion of Methane

The idea of converting methane into higher-value chemicals is not a new one, and chemists have developed a number of catalytic systems for doing so. One approach converts methane to methanol, which is then converted to ethylene. Another approach uses catalysts to achieve oxidative coupling of two methane molecules to produce ethylene. Given that ethane today costs less than methane on the U.S. Gulf Coast, neither of these approaches makes sense economically at today’s prices. However, new regulations with the goal of restricting the wasteful practice of natural gas flaring could change the economics rapidly.

There are several routes by which methane could be converted catalytically into higher-value chemicals, including production of synthesis gas (syngas) via processes known as reforming, oxidative coupling, conversion into aromatic compounds, coupling it, e.g., with propane via a reaction known as metathesis, and direct selective partial oxidation of methane into methanol (see Figure 2-6). Note that the use of methane metathesis has been introduced by Basset et al. (2010) for the reaction of methane with an alkane. In the case of propane, the result is two molecules of ethane. The reaction is, thus, the reverse of the ethane metathesis. Production of syngas is widely commercialized at large scale and is a usual process component in the production of ammonia, Fischer–Tropsch synthesis of hydrocarbons and methanol synthesis. There are well-established laboratory and in some cases even pilot plant-scale catalytic processes for the other routes, but all require further research

NOTE: C2H6 = ethane; C3H8 = propane; CH4 = methane.

SOURCE: Lercher, 2016.

to turn them into economically viable commercial processes. Methane steam reforming, in which methane reacts with water to a mixture of carbon monoxide and hydrogen in the presence of a catalyst is a mature technology, but the challenge, said Lercher, is to understand the process by which carbon deposits on the catalyst and renders parts of the catalyst inactive. The probability and rate of the carbon deposition increases as the C-O-H ratio in the reacting mixture changes, for example, by replacing water with carbon dioxide in the reacting mixture. If thermodynamically feasible, carbon will form under many operating conditions, though it is more severe at higher pressures.

The kinetically relevant step in reforming, regardless of the reactants, is breaking the carbon–hydrogen bond in methane (Wei and Iglesia, 2004), and the rate of carbon removal depends on the oxygen coverage at the catalyst surface (Chin et al., 2013). A high concentration of active oxygen at the catalyst surface reduces the carbon concentration and helps the surface remain active even under harsh conditions. However, if activity only depends on surface oxygen level and the amount of carbon present, the support should not influence the rates of reactions. Under severe conditions strong impact of the support on the stability of the catalyst is observed, suggesting that the support or the interface between the support and the metal provides alternative routes to remove carbon formed in the reforming pathway. This observation, said Lercher, points to a

better understanding of how to design catalysts so that they maintain their activity under industrially relevant conditions.

For oxidative coupling of methane to produce ethylene, besides the challenge of selectivity, the main challenges are to reduce the temperature needed to activate the carbon–hydrogen bond and to generate reactive oxygen at the catalyst surface, given that the catalysts currently available are not stable under high-temperature conditions (Salehi et al., 2016; Schwach et al., 2015). Aromatization, which involves methane dehydrogenation to produce reactive carbene and carbyne species and subsequent reactions of these species in combination with acid-catalyzed ring closure to generate aromatic molecules, faces the challenge that excessive dehydrogenation as well as reactions among aromatic molecules will cause the formation of carbon that will block the active catalyst and deactivate the catalyst. Several molybdenum-containing zeolites have been reported to catalyze this reaction slightly below 1,000 kelvin (K), though carbon deposition requires the catalyst to be regenerated regularly (Liu et al., 1999). Lercher pointed also to a recent report of an iron–silica catalyst operating at 1,360 K that remains stable (Guo et al., 2014).

Incorporating methane into larger alkanes via the relatively low-temperature dehydrogenation of propane and metathesis of the resulting olefin or the parent alkane in the presence of methane can be achieved using tantalum-based catalysts supported on a silica surface (Soulivong et al., 2004). Problems to be solved with this reaction include the tight specifications for operating the catalyst, the extremely low rates achieved with the current catalysts, and thermodynamic limitations that require the resulting alkanes to be separated from the hydrogen produced.

Direct partial oxidation of methane to methanol using electrophilic late metal catalysts has, at times, generated excitement from chemists (Periana et al., 1993, 1998, 2003), but these reactions require concentrated sulfuric acid and/or sulfur trioxide dissolved as oxidant. The process requirement to regenerate the diluted sulfuric acid to reform concentrated sulfuric acid/sulfur trioxide in this catalytic cycle is the major reason this technology has not been developed toward commercialization. While the sulfate provides a stable product, which can be hydrolyzed to methanol, continuous-direct methane-to-methanol processes have poor selectivity that leads easily to over-oxidation. Enzymes, however, have routes to convert methane and oxygen into methanol under mild conditions and at low temperatures. Two types of enzymes are known, one is a membrane-bound enzyme known as Cu-methane monooxygenase, while one enzyme in the cell itself is based on iron. The active site of this enzyme contains 2–3 copper atoms (Chan and Yu, 2008; Lieberman and Rosenzweig, 2005), and chemists are trying to recreate the active site to enable this reaction without the need for the enzyme. Zeolite-based catalysts have been found

to be the best models so far both with iron (Wood et al., 2004) as well as with copper (Groothaert et al., 2005; Grundner et al., 2015; Woertink et al., 2009). These materials work only stoichiometrically and methanol has to be purged out (or hydrolyzed), which requires the regeneration of the zeolite after each cycle producing methanol. Lercher explained that the challenge here is not so much to find a more active catalyst, but to identify a material that maintains the copper atoms in the right configuration regardless of the environment in which the reaction was conducted. There is also the economic reality that methanol currently has a 30 percent price premium compared with methane, which is produced via methane steam reforming followed by methanol synthesis. This makes it very challenging for direct processes to be successful, Lercher estimated. “We should focus on this type of chemistry, but not be under the illusion that it will lead to quick results,” he said. “What it should do is to lead us to new chemistry that will teach novel pathways to functionalize methane as well as other light alkanes.”

Catalytic Conversion of Ethane

Turning to the possibilities of developing catalysts for converting ethane into higher-value chemicals, Lercher said that the economics of ethane steam cracking make this a particularly challenging problem. Researchers have been investigating catalytic approaches aimed at wringing costs out of today’s steam-cracking ethylene plants, largely by reducing the costs of separating ethylene from unreacted ethane, which accounts for 80 to 90 percent of the capital costs of an ethylene plant. “It only makes sense to go from steam cracking to oxidative dehydrogenation if we can operate with 95-plus percent selectivity and a 60 percent conversion operating in a pressure range that works for industry,” said Lercher. The main challenge to achieving those parameters is that ethane, when activated by a catalyst in the presence of oxygen at the desired operating pressures, not only from ethene, but will be further functionalized with oxygen. One successful approach, for example, coats a redox active oxide carrier with a layer of molten chloride salt (Gärtner et al., 2013, 2014). Another approach uses complex oxides of molybdenum, vanadium, tellurium, and niobium as catalysts, in which the catalytic activity subtly depends on the exact atomic arrangement within the crystal (Melzer et al., 2016). Ethane has also been directly oxidized with hydrogen peroxide, using an iron/copper/zeolite, to produce acetic acid, ethanol, and ethylene (Forde et al., 2013), and efforts to convert ethane into aromatic compounds using gallium-based catalysts have demonstrated some promise, said Lercher, as have catalytic processes for converting propane to acrylic acid and catalytic propane dehydrogenation.

Catalytic Conversion of Propane

Propane is a significant component of natural gas liquids and is readily available. As a result, propane prices have fallen far enough that it has become economical to produce high-demand propylene directly from propane via catalytic propane dehydrogenation (PDH). Thermal (no catalyst) cracking of propane yields predominantly ethylene, not propylene. A catalyst is required to convert propane to a high yield of propylene. Thermolysis of propane predominantly breaks the CH3-CH2 bond, giving a methyl radical and an ethyl radical, which ultimately give ethylene and methane as products. Of all of the technologies that have been developed that produce propylene, PDH provides the highest yield, and because of the price differential between propane and propylene, PDH economics are quite favorable and continued investment in plant construction are being supported.

Several challenging characteristics of PDH technology include temperatures that exceed 600°C and low-pressure conditions. Another challenge of PDH technology is that coke formation is unavoidable, leading to a catalyst life of days and the need for frequent regeneration. As in all catalytic–process technology, the process and catalyst are intertwined and cannot be separated.

POSSIBILITIES FOR CATALYSIS

Summarizing the possibilities for catalysis, Lercher said that conversion of light alkanes may be challenging, but it also holds significant untapped potential. In his opinion, a concerted research effort combining kinetics, spectroscopy, and theory should be used to understand the catalytic process on an atomistic and molecular level and to translate that knowledge into the development of catalysts with precisely tailored properties that will retain their integrity under industrial operating conditions. He also suggested that chemical engineers and chemists work together with the goal of creating optimal reactor designs for specific catalytic processes. Achieving this vision for catalyst development, said Lercher, transformative developments in analytical capabilities that will enable characterizing catalysts structurally and chemically in a timely and spatially resolved manner is important. It will also require collaborations between materials science and chemistry aimed at synthesizing robust, single-site catalysts and between reactor engineering and chemistry to create processes that allow development at variable scales.

This page intentionally left blank.