2

Lessons from 3 Years of Experience1

The workshop opened with a presentation by Karen Pollitz, senior fellow at the Henry J. Kaiser Family Foundation, on the lessons learned about the challenges in signing up different population groups; perceptions of the cost and affordability of insurance; and how the newly enrolled are using their insurance. These lessons, from 3 years of experience enrolling individuals through state and federal health insurance marketplaces, fall into three broad areas, said Pollitz. The first area is eligibility. Challenges in this area include navigating the system of coverage and determining where individuals belong, what coverage they are eligible for, and how to sign up for coverage. The second area deals with challenges consumers face in choosing a plan, which include distinguishing among the varying features and coverages of the different plans. The third area encompasses the difficulties that newly insured consumers face using their new insurance to connect to the care they need.

In the third year of implementation, the nation has made impressive progress, said Pollitz. “Coverage has been extended to about 20 million uninsured individuals. Private markets have been changed. New rules and new subsidies apply,” said Pollitz. “This is all impressive work.” Still, she said, 32.9 million non-elderly U.S. residents remain uninsured. A study by the Urban Institute released in March 2016 examined those who remain uninsured to see what is known about them and the coverages for which

___________________

1 This chapter is based on the presentation by Karen Pollitz, senior fellow at the Henry J. Kaiser Family Foundation, and the statements have not been endorsed or verified by the National Academies of Sciences, Engineering, and Medicine.

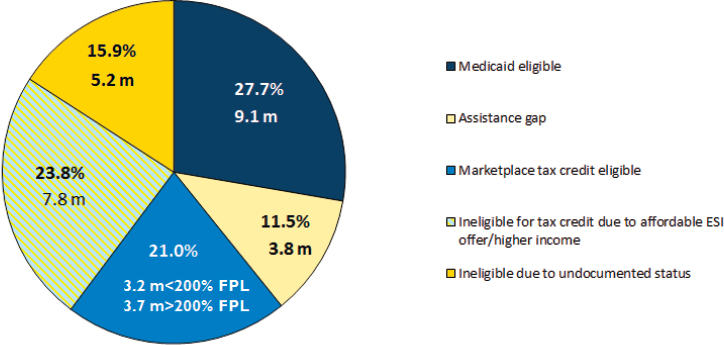

they qualify (Blumberg et al., 2016). Of those non-elderly individuals who remain uninsured, 9.1 million, or 27.7 percent, are eligible for Medicaid coverage, but likely need help navigating the system to get coverage (see Figure 2-1). Another 6.9 million are eligible for premium tax credits to subsidize private coverage through a marketplace. An additional 3.8 million fall into the assistance gap, which refers to those whose incomes are below the poverty level but who live in states that have not expanded Medicaid coverage under the provisions of the ACA. Another 7.8 million U.S. residents are ineligible for a tax credit because they are eligible for affordable employer-sponsored insurance or have a higher earned income. The remaining 5.2 million residents are ineligible because of undocumented immigration status.

The Kaiser Family Foundation’s monthly tracking polls show that public awareness about the details of the ACA remains low. When uninsured individuals between ages 18 and 64 were asked toward the end of the annual open enrollment period if they knew it was open enrollment and when open enrollment closed, nearly two-thirds did not know the answers to those questions. When asked if anyone had contacted them within the past 6 months to discuss signing up for health insurance or Medicaid, only 20 percent said they had been contacted. “To me, this is a prescription for in-person assistance,” said Pollitz. “It is important that there be more information, that we get it out there, and that we get it out in understand-

NOTE: ESI = employer-sponsored insurance; FPL = federal poverty level.

SOURCES: Blumberg et al., 2016, in presentation by Pollitz, July 21, 2016.

able language, but this is complicated and people need to sit down with an expert who holds their hand and walks through this process.”

The ACA establishes a new infrastructure for consumer assistance that can deliver two new consumer assistance resources, Pollitz explained. The first type of enrollment assistance is embedded in the marketplaces, she said. More than 5,000 marketplace assistance programs, employing some 30,000 consumer enrollment assisters, have been established. Most of these have been operationalized for 3 years, and the Kaiser Family Foundation’s polling shows their work to be challenging. Even after 3 years, an average of 90 minutes is needed to walk an individual through the process of figuring out what coverage they are eligible for and which plan is the right one for that individual. Most of the programs, she added, are not funded sufficiently, and two-thirds are uncertain as to what their funding will be in the coming year.

In addition, said Pollitz, many of the marketplace assisters do not get paid or receive credit when they help someone enroll in Medicaid instead of a marketplace plan even though the marketplaces were created to provide consumers with a single point of entry to the world of health insurance. “I think there needs to be more investment in in-person marketplace assisters in addition to funding support,” said Pollitz. She also called for better technical assistance and improved call centers as part of a strategy to making health insurance more understandable for consumers. She also thought it was important to make contact with marketplace assisters to determine what they understand about the literacy shortfalls among those they are trying to serve and to get input that can help design tools and resources that will help them do their jobs more effectively.

Aside from the assistance provided through marketplaces, statewide consumer assistance programs are designed to help all consumers with enrollment and postenrollment issues, including how to use coverage effectively and resolve problems with coverage once enrolled. These programs, said Pollitz, are also underfunded. Forty state programs were established in 2010, and they have not received federal funding since 2012.

Data from the Department of Health and Human Services (HHS) suggest that the top 10 states in terms of marketplace enrollment have enrolled nearly 60 percent of the people that the Kaiser Family Foundation estimates are eligible for tax credits in marketplace plans, while the bottom 10 states are nearly 30 percent. Based on those same estimates, an additional 3.6 million people would be enrolled if all states performed as well as the top 10 states. Pollitz suggested that consulting with the assisters in the most successful states could yield new strategies to help the other states boost their enrollments.

The available data also show that enrollment peaks during open enrollment and that attrition occurs during the year. This is not unexpected, said

Pollitz, because people get jobs, marry, and move, for example, but by the same token, just as many people should be enrolling or become eligible to enroll because of qualifying events that happen after the open enrollment period. In 2015, she noted, some 1.5 million people signed up in special enrollment periods. “I think that adds to the literacy challenge,” said Pollitz. “Not only do we need to help people understand what they are eligible for [in terms of benefits]. We need to let them understand it when they are eligible because it is a narrow window of time.”

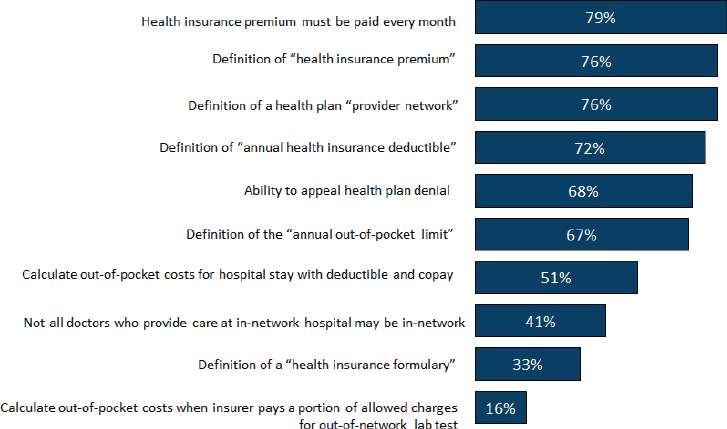

People do not understand health insurance, a statement Pollitz said is supported by a poll her colleagues conducted in 2014. The polling team administered a simple quiz to a random sample of adults that assessed their understanding of basic health insurance terms and asked them to calculate out-of-pocket costs for two straightforward scenarios. Just over half of the people polled answered at least 7 of the 10 correctly (see Figure 2-2). “They did pretty well on the basic terms, not well at all on the math problems,” said Pollitz. “People just could not figure out how to apply the deductible and co-insurance and did not really understand allowed charges and billed charges.”

The challenge of understanding health insurance is critical to picking a plan because there are so many plan choices. “On average, in federal marketplace states, participants have a choice of about 50 plans this year

SOURCES: Norton et al., 2014, presentation by Pollitz, 2016.

and oftentimes the differences are many and pretty nuanced,” said Pollitz. Policy makers in some states and at the Centers for Medicare & Medicaid Services (CMS) are looking at more standardized plan options so there would be fewer differences for people to master and compare, she noted.

Pollitz said that one tool that could help individuals better understand their coverage is the Summary of Benefits and Coverage (SBC) that the ACA requires of every plan, regardless of whether it is a marketplace plan or a grandfathered plan. These standardized, blue and white charts all contain the same information on deductibles, out-of-pocket expense limits, out-of-network providers, accessing care from specialists, and the services a plan does not cover. Subsequent pages of the SBC document go through each essential health benefit and explain in plain language why an individual might need this benefit and how it is covered. Slowly improving and not yet perfect, SBC is a tool that can help people learn about health insurance and their coverage. They are now on the marketplace websites for all marketplace plans, though they are not always easy to find and are not interactive. “As you talk about developing tools, I hope you will take a look at SBC and the structure of information that it provides and see if there is a way to build that into your lessons for consumers,” said Pollitz.

The ACA provides another type of transparency tool that has not yet been implemented. Under the ACA, all health plans will be required to report data on how they work and practice. These transparency reporting requirements, which Pollitz believes can be useful for consumers as they evaluate plan choices to see how well a given plan works, include

- claims payment policies and practices;

- periodic financial disclosures;

- data on enrollment;

- data on disenrollment;

- data on the number of claims denied;

- data on rating practices;

- information on cost sharing and payments with respect to any out-of-network coverage;

- information on enrollee and participant rights under this title; and

- other information as determined appropriate by the Secretary.

Other metrics that have been proposed include performance measures such as the reliability and accuracy of claims handling and out-of-network use and costs for key services and diagnoses.

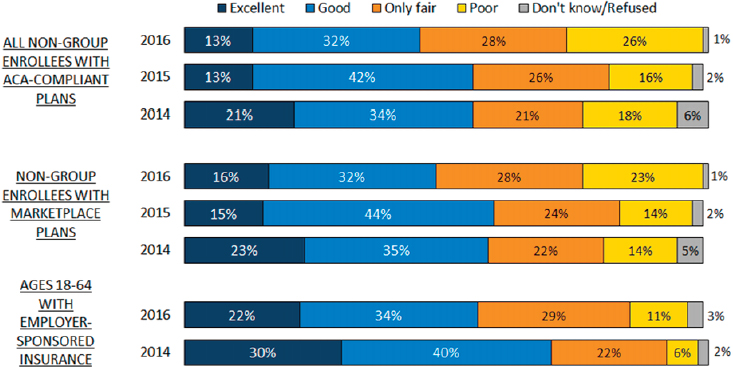

A Kaiser Family Foundation poll showed that the uninsured are finding a regular source of care more often than did the newly insured when they were uninsured. However, a smaller proportion of individuals who are not insured by a group plan have become less satisfied with their health plans.

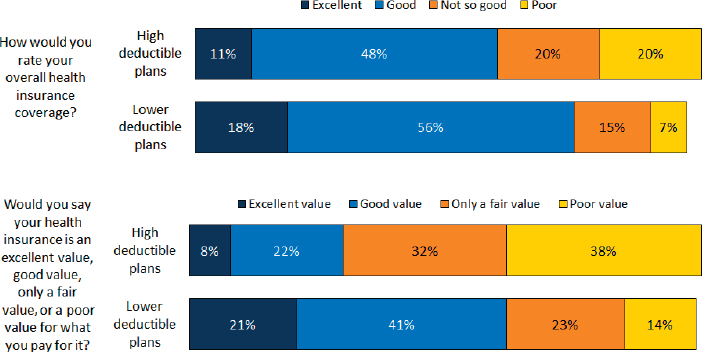

The most recent survey found that 52 percent of these individuals rate the value of their non-group plan as fair or poor, compared with 42 percent in the prior year and 39 percent the year before that (see Figure 2-3). The reason, said Pollitz, seems to be the high deductibles associated with these plans (see Figure 2-4). “Whether people realize it when they sign up, they are learning about high deductibles once they get their plan and try to use it and they are having difficulty with this,” she explained. In fact, when navigators and marketplace assisters were surveyed this year and asked if they could change one thing in the ACA to make it better for people, the top answer by a 2-to-1 margin was to lower the deductibles. Those surveyed reported that high-deductible plans make it harder for people to get the care they need, Pollitz said.

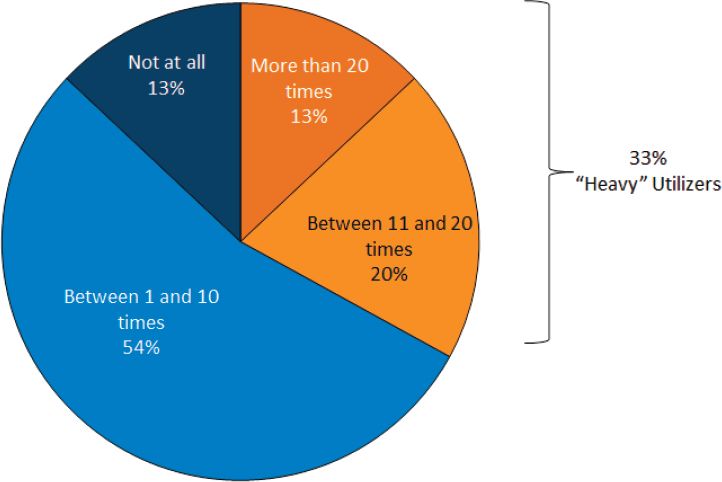

One thing it is important to recognize when teaching people how to use their health insurance, Pollitz explained, is that some individuals get a health insurance card, stick it in their wallets, and never use it again because they are healthy and do not need much care. At the other extreme, some people go to the doctor at least once a month (see Figure 2-5). “Educating consumers about how to use health insurance has to recognize where they are in their own health care needs and structure the lessons toward that,” said Pollitz. She noted that a majority of the high users questioned in this

NOTE: ACA = Patient Protection and Affordable Care Act.

SOURCE: Presentation by Pollitz, July 21, 2016.

SOURCE: Presentation by Pollitz, July 21, 2016.

SOURCE: Kaiser Family Foundation Survey of Non-Group Health Insurance Enrollees, Wave 3 (conducted February 9 to March 26, 2016), presentation Pollitz, July 21, 2016.

survey reported they had a range of troubles with their plans, including the following:

- Plan paid less that expected for a bill (36 percent)

- Plan would not cover a prescription drug or required a very expensive co-pay (26 percent)

- Were surprised to find out that plan would not pay anything for care (21 percent)

- A particular doctor you wanted to see was not covered by your plan (20 percent)

- A particular hospital you wanted to visit was not covered by your plan (10 percent)

- Reached the limit on the number of visits or services insurance company would pay (4 percent)

SOURCES: Kaiser Family Foundation Survey of Non-Group Health Insurance Enrollees, Wave 3 (conducted February 9 to March 26, 2016), presentation by Pollitz, July 21, 2016.

She suggested those problems may arise because the consumers did not understand how to use their coverage and they did not do it correctly or because the insurance company did not cover it right.

Pollitz said that the problems that high users are experiencing argue for increasing the in-person assistance available for consumers. “If they are high users and they are encountering these problems and they do not know how to use their health insurance, they are also sick and they are going to need to get some help at that point, not just a piece of the Federal Register to read,” said Pollitz. “In-person assistance is important.” She added that plans are required by the ACA to report on the problems their clients are experiencing, and the Secretary of HHS is supposed to make those data available and to incorporate them into oversight. She believes such data will help insurers correct problems, but also provide insights into how to make insurance information simpler and more intuitive for consumers.

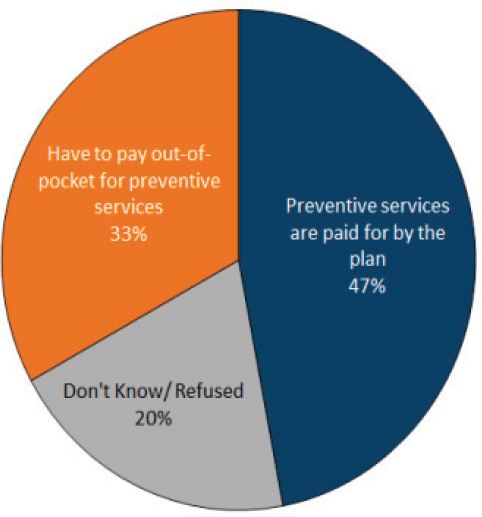

On a final note, Pollitz said polling data show that consumers, and particularly those enrolled in high-deductible plans, lack awareness about the free preventive services covered by their plans (see Figure 2-6). She concluded her presentation by saying, “I think we have many challenges still arising in helping people use their coverage effectively. I think in addressing this we need to go back to the professionals who are working one-on-one with consumers and make sure that we have captured all of their expertise as we move forward.”

This page intentionally left blank.