Proceedings of a Workshop

| IN BRIEF | |

|

October 2017 |

Returns to Federal Investments in the Innovation System

Proceedings of a Workshop—in Brief

INTRODUCTION

Through grants, contracts, and loans, the federal government invests over $140 billion annually in research and development. Most economists agree that public support for research and development is essential given that the private sector—unable to internalize the social benefits—will underinvest in the creation of knowledge that may lead to innovation. Critics have questioned the adequacy of the return on this public investment, arguing that government investment is ineffective, inefficient, and may simply crowd out private investment. Overlaying these issues are questions about the broader impacts of these federal investments on inequality—that is, the distribution of gains from the fruits of innovation.

On December 15, 2016, the Innovation Policy Forum of the Board on Science, Technology, and Economic Policy held a workshop designed to gather leading researchers to explore the returns to federal investments in the innovation system, which include economic growth, job creation, as well as improved health and quality of life. The workshop was structured into four panels investigating social returns to: (1) federal investments in basic research; (2) federal support to private-sector innovation (which include research and expenditure (R&E) tax credits, small business support, prizes, and the patent system, among other policies); (3) public investments in human capital and supporting infrastructure such as digital infrastructure; and (4) the relationship between innovation, inequality, and social mobility. Jason Furman, then chair of the Council of Economic Advisers, gave a keynote address during lunch about innovation, productivity, and various policies designed to boost innovation.

PANEL I: WHAT ARE THE RETURNS TO FEDERAL FUNDING OF BASIC RESEARCH?

Introducing the first panel, Pierre Azoulay (MIT) noted that although the social returns to R&D are typically estimated to be very high, there are difficult conceptual and empirical challenges in making accurate estimates. The speakers on this panel, he said, would discuss the theoretical frameworks and empirical evidence that bear on assessing the returns to federally funded basic research; limitations on our ability to track and measure these returns; and potentially fruitful directions for further research.

Basic Research as a Public Good

According to Samuel Kortum (Yale University), the existing incentives shaping the behavior of market participants may lead to low investments in basic research, and government funding is one way to ensure more basic research. That is because basic research is non-rivalrous (the consumption of the good by one person does not preclude its use by another) and non-excludable (it is difficult to prevent people from having access to it). While we can create excludability in the form of patents, copyrights, and other property rights, he noted that we may not want to do this for basic research because of the costs that excludability would impose.

Citing data from the National Science Foundation, Kortum reported that in the United States, the federal government is the major source of funds for basic research, with about half of funding coming from federal sources and one-third of all federally funded research and development going to basic research. Kortum next pointed out there are important complementarities in the interaction between basic and applied research, where advances in one can stimulate progress in the other.

![]()

His recent research with Tor Jakob Klette, which uses firm-level data to connect micro-data and macro-models, demonstrates that basic research generates results that make applied research more productive. This in turn has significant positive implications for higher productivity growth and welfare. He also cited work by Akcigit, Hanley, and Serrano-Velarde (2016) that shows uniform R&D tax credits can over-subsidize applied research. Policies geared toward funding public basic research or targeting subsidies toward basic research by firms seem to offer greater rewards, although the basic research cannot be too detached from commercial applications.

Returns to Investment in Basic Research

In his presentation, Benjamin Jones (Northwestern University) turned to the question of measuring knowledge spillovers in the returns to investment in basic scientific knowledge. Measuring those spillovers is very hard. Some of the benefits do not enter into national income accounts, such as increased life expectancy. But this is an important problem because there are no private returns to basic research.

In order to better track the link between basic research and its ultimate economic impacts, Jones drew on a linear model of innovation, popularized by Vannevar Bush, which sees a series of linkages starting from basic research leading to applied research, which then leads to development and then the commercialization of products for the market. This model, Jones noted, has motivated the organization of public science institutions and funding, with public and government provision of funding and university performance of basic research, which the private sector will draw on and develop into patentable inventions.

Jones’s research draws on this linear model to link patentable inventions (understood as outputs of the innovation process) to the prior science. He noted that about 60 percent of patentable inventions seem to connect back to some prior scientific advances. In the other direction, about 80 percent of scientific papers can be ultimately traced forward, however indirectly, to a patent.

He acknowledged, however, that estimating the social returns is “still really hard” although he estimated the rate of return to federal investments in basic research (at about 30 percent) to be very large. The scale of the impact would depend on—among other factors—the nature of the discovery, the duration of time between the publication of the scientific paper and the patent, and the breadth and forward extent of benefits that can be derived from the technological advance created by the federally funded research.

Estimating the Return on Investments in Biomedical Research

Illustrating the downstream value in health care of federal investments in basic research, Robert Topel (University of Chicago) noted that past improvements in health and longevity, brought about by advances in basic science, have had enormous economic value. Further, he predicted that potential gains from future reductions in mortality will also be extremely large. Even modest progress in cancer research, he predicted, would have great value. He estimated that a 10 percent reduction in cancer deaths alone would be worth $4.7 trillion in benefits in productivity and well-being for current and future generations and the reduction in heart disease from 1970-2000 by itself has netted $35 trillion in value. Underlining the long-run benefits of health research, he noted that curing a disease like diabetes provides benefits for the current generation as well as all future generations.

At the same time, he warned that downstream inefficiencies can reduce the value of upstream research and distort research incentives toward higher cost technologies. In addition, potential cost savings from medical research, while large, are partially offset by increased cost of care as people live longer.

Estimation Challenges

Pierre Azoulay, the final speaker on this panel, identified a series of issues that affect both how we estimate the return on investment to basic research and how we communicate this information to policymakers. First, the skewed distribution of the value of the innovations from basic research means that one really big hit could more than justify the cost of the entire portfolio of research. When the Defense Advanced Research Projects Agency (DARPA) tries to justify itself, he noted, they do not do sophisticated calculations or econometric analysis. “They say, well, we invented the Internet. What else do you need to know?” Second, the process of innovation is not really linear and the stages of the innovation process are not distinct. Using the development of the drug Gleevec as an illustration, he pointed out that there are a lot of different paths and ideas that have to intersect to drive a research idea into a commercial product. Along the way, many lines of research may be lost, some may find applications in areas not anticipated, and dead ends in research might provide illumination for what will succeed. Some of these developments take place in the public sector and some in the private sector, and it is still very hard to tease out the public component of the investment, despite recent progress in forensic research using bibliometric analysis. Third, there are differences in how federal agencies choose research topics and the mechanisms used to select and guide the funding of science. Similarly, operational practices of federal agencies, universities, and other actors can also affect the transmission of the outcomes of basic research into applications for federal funding, which can affect the expected value of public investments in research funding.

Discussion

The discussion focused on the uncertainties and possible leakages in the innovation process and how this affects estimates of returns to federal investments. One discussant mentioned that research can provide negative spillovers. For example, research on opioids has

yielded important medical uses, but it also contributed to deaths from opioid abuse, especially in some rural parts of the country. Citing the example of the Oklahoma Dust Bowl, Benjamin Jones agreed that the potential exists for negative externalities that can come about as a result of introducing new technologies and there is a question of whether technological progress can be viewed as good or bad in light of these outcomes. Another discussant asked about the reliability of patents as an indicator of innovation. Azoulay agreed that patents are a noisy indicator but that in some instances, some signal can be detected from the noise. Finally, a discussant asked if we needed innovation in the analytical tools used to estimate the returns to federal investments in basic research. In response, Azoulay observed that except for the National Science Foundation’s Science of Science & Innovation Policy (SciSIP) program “most funding agencies are very reluctant to experiment; the scientific method applies everywhere except to the scientific enterprise itself.”

PANEL II: WHAT ARE THE SOCIAL RETURNS TO DIRECT PRIVATE-SECTOR INNOVATION SUPPORT?

Introducing the second panel, Heidi Williams (MIT) said that the focus of the workshop would move from the nature of public goods and the broad rationale for policy intervention to specific public policies that seek to direct private sector research efforts. She introduced Timothy Simcoe (Boston University) to discuss the role of R&E tax credits, Sabrina Howell (New York University) to describe models of public and private venture funding, and Bhaven Sampat (Columbia University) to reflect on the effect of patents on how much is spent on research and what types of research are funded. Rounding out the panel, Williams said that she would return to summarize her research on the role of innovation prizes.

In each of these instances of innovation support, she noted, the goal is to align private incentives with public goals in order to accelerate the commercialization of valuable innovations. She hoped that the panel’s deliberations would highlight “those aspects of how you design these different public policies [so that] they can have a tremendous effect of whether the private incentives are really aligned with what we as a society want to be encouraging in terms of research.”

Research and Expenditure Tax Credit

Leading off the panel, Timothy Simcoe noted that U.S. tax expenditures on the R&E tax credit was about $11.6 billion in 2012. He highlighted that a potential benefit of these tax credits is that decisions about which projects to pursue are determined by private parties who have the incentive to pursue positive net present value projects.

However, the R&E tax credit is skewed toward larger firms that can cover the fixed cost of compliance. He cited recent work by the Office of Tax Analysis at the Department of Treasury, which found that firms with more than $250 million in gross revenue represent only 14 percent of the number of firms who claim the tax credit but account for 84 percent of the total dollar value of the credit. Small firms often face financing constraints or other liquidity issues. Other firms may not have tax liability to offset this credit.

Reviewing the evidence on the effectiveness of tax credits, Simcoe said that there is very little research linking the R&E tax credit or tax expenditures to outcomes like patents or productivity at the firm level. Gauging the effectiveness of this policy tool is complicated from a compliance and data perspective, he added, citing longstanding concerns about companies “re-labeling” peripheral activities as R&E expenses. The presence of R&E tax credits can also encourage firms to shift income from higher tax jurisdictions to lower tax jurisdictions making it hard to assess its impacts.

Direct Government Support for Innovation

Sabrina Howell turned the discussion to the direct government funding of R&D in private companies, either through competitive grants to small companies or through subsidizing venture capital. She reported that some observers have raised concerns about whether this funding would crowd out private funding and whether (assuming a certain linearity in the innovation process) the small business project would have proceeded anyway in the absence of the grant. She noted, however, that we might want to subsidize small private firms, because we expect external finance “to be especially costly for these young, new companies because the market knows less about them, has less information about them.”

She then described two models for government to advance new technologies. The first is the connected science model, where there is an idea of the end product and the government funds the basic science and development all the way through. An example of this is the Manhattan Project. The second is the pipeline model, where the government supports the funding of basic research and “frontloads the pipeline and the private sector will take it all the way through.” The challenge for the private sector is to secure funding after the basic research is done but before its technical viability and commercial potential can be demonstrated. Howell then briefly described some noteworthy government innovation programs.

DARPA: Howell described DARPA, with a budget of about $3 billion annually, as an example of the connected model. She noted that a compelling feature of DARPA is its tolerance for failure and “open solicitations” where academics have been free to suggest projects within the DARPA system. Howell noted there has been a falloff in DARPA’s funding for open solicitations in response to security concerns following the terrorist attacks of September 11, 2001.

ARPA-E: The Advanced Research Projects Agency-Energy (ARPA-E), whose mission is broadly modeled on DARPA, but with a much smaller budget—it has only received $1.6 billion over its first 6 years of existence. Its mission is to advance high-potential, high-impact energy technologies that may be too risky for private-sector investment. Noting that the program is being evaluated by the National Academies, Howell stated that ARPA-E omits two features that she believes to be essential to the DARPA model—that it does not have a dedicated government client to serve as a connected model and that (in her opinion) the agency may have a limited tolerance for failure.

SBIR: She next described the Small Business Innovation Research (SBIR) program. Established in 1983, SBIR currently draws 3.2 percent of the extramural R&D budgets of 11 federal agencies, awarding in all more than $3 billion in competitive grants and awards to small business per year. She cited her own recent research of the Department of Energy’s SBIR program, where she found that winning an SBIR award “approximately doubles the probability that a firm receives subsequent venture capital and has large, positive impacts on patenting and the likelihood of achieving revenue.” She added that SBIR allows firms to de-risk their technology through prototyping, which might make getting subsequent external financing easier.

SBIC: Finally, Howell reviewed the role of the Small Business Investment Company (SBIC), which guarantees leverage to licensed investment funds that in turn make loans and invest equity in both high-technology and other types of small businesses. Today, she noted, there are 313 licensees with $28 billion under management in this program, but added that researchers have not determined whether access to this government financing is increasing overall private equity investment in small businesses nor its impact on economic growth.

The Role of Patents

Bhaven Sampat discussed the patent system and the social returns of support for innovation done by the private sector. The conventional debate around patents is that while they create incentives for innovation by inducing R&D investment, they may restrict output, raise prices, and inhibit future innovation by creating monopolies. He added that while patents are among the most studied policy instruments to promote innovation, it is also very difficult to make broad generalizations about their impacts without considering the institutional contexts and sectors where they are in play.

He made four points regarding patents and innovation. First, the evidence suggests that strengthening patent law does seem to increase patenting and enforcement of patents, but this is not necessarily the same thing as more innovation. While providing incentives for the first innovation, patents may raise costs on follow-on innovations. Second, there is tremendous heterogeneity in the patent system and it is difficult to make general statements on the social returns to patenting. Much of the economic analysis of patents has focused somewhat narrowly on assessing specific questions that matter for patent policy and practice, such as evaluating changes in patent protection brought about by legislation (e.g., the Bayh-Dole Act of 1980) and international agreements (e.g., TRIPS, the Agreement on Trade-Related Aspects of Intellectual Property Rights). Third, while some research suggests that patents contribute to competition by enabling vertical disintegration of markets and the creation of tradable assets for small firms, they may also create monopolies, especially where the innovation is cumulative. Patent assertion entities, companies that obtain the rights to one or more patents in order to profit by means of licensing or litigation, may be used to inhibit innovation. Finally, more research is needed on the effectiveness of patents at accelerating innovation in different institutional arrangements.

Innovation Prizes

Heidi Williams discussed the role of innovation prizes. She noted that according to a 2009 study by McKinsey, the value of prizes issued by governments, private firms, and philanthropies has risen 15-fold since 1970. The America COMPETES Reauthorization Act of 2010, for example, gives authority to federal agencies to design and apply innovation prize policies to further their missions.

While innovation prizes have traditionally sought to incentivize the creation of a desired technology, these prizes can also help orient research efforts toward designing a product capable of being used at scale by consumers. She cited the super-efficient refrigerator program as an example of a prize where money was awarded partly based on technical specifications that had to be met and partly on whether consumers actually bought the product in sufficient numbers.

Another type of innovation prize, advocated by Michael Kremer of Harvard University, works by guaranteeing a “top-up” to the market price of a given technology. This approach would work in cases where the innovation “would be socially valuable, but may not attract a lot of private investment.” Examples include treatments for tropical diseases where the demand is high, but where customers in poor countries may not be able to afford high prices. The innovator would thus be compensated above the marginal price, with a government or philanthropy paying the difference.

Williams noted that innovation prizes can also be designed to spur “not just the development of a desired technology, but also follow-on research in the future” by specifying disclosure requirements and the allocation of property rights in advance. However, it may be difficult to specify a detailed set of technical specifications in advance.

Williams noted that leading analyses, including that found in a 2007 National Research Council report,1 have argued that this feature makes prizes much less useful for basic research.”Even so, she noted that there are high-impact cases, such as for an HIV vaccine, where “even if the technology is at a very early stage, you could still think that the value of an innovation prize would be high.”

She then compared the idea of innovation prizes with the patent system. The patent system, although faulty, creates a rough link between private rewards and social value: that is, firms developing better products will earn higher profits under the patent system. Williams noted that the extent to which innovation prizes also do this depends on the nature of the mechanism triggering reward payments: ex ante fixed-technical specifications may result in products that meet the specifications but are ultimately not socially useful and a process where the impact is judged ex post may make the process less uncertain and potentially susceptible to corruption. A third option, she noted, is to have a trigger for the reward mechanism that is tied to market demand or other clear metrics of ex post use.

Williams noted that an accurate answer to the effectiveness of innovation prizes requires the construction of a clear counterfactual. While prize sponsors may focus on whether the technology was developed, a more complete analysis has to answer if the technology would have been developed at all, or with the same speed and product quality, without a prize.

KEYNOTE: MIDDLE-CLASS INCOMES AND INNOVATION POLICY

Jason Furman opened his keynote address with the observation that the rate of middle-class income growth in America has slowed down over the past four decades. This is attributed to decreased labor productivity, increased income inequality, and declining labor force participation rates. Boosting investment in innovation would address these factors and should be considered as part of an effective policy response to the productivity slowdown, he asserted.

Since 1973, growth of annual real middle-class income (using the Census Bureau’s mean family income of the middle quintile) has declined to 0.4 percent, after experiencing higher growth (3 percent annually) in the decades after World War II. Even after adjusting for benefits, income transfers, and decreased household size, annual real middle-class income growth has still notably declined since the middle of the 20th century.

Furman identified the main determinants of middle-class income growth and their hypothetical effects on today’s middle-class household income levels if the contributions from those determinants had stayed the same. He observed that labor productivity growth has declined since 1973, that income inequality as measured by the share of income going to the top one percent has increased, and that the labor force participation rate has declined. (The data on labor force participation has been historically masked by increasing participation by women, although participation by women has been declining of late as well.) Furman pointed out that these factors have had a real impact on real middle-class incomes. He illustrated this by comparing what would happen to 2015 middle-class incomes if each of the following had remained constant: pre-1973 rates of labor productivity, the share of income earned by middle-class families in 1973, or post- WW II female labor force participation (see Table 1).

Table 1 Counterfactual Scenarios for Productivity, Inequality, and Participation

| Thought Experiment | Factor | Base Period | Percentage Impact on 2015 Average Income | Income Gain to 2015 Typical Household |

| Productivity | Total Factor Productivity Growth | 1948-1973 | 65 | $37,000 |

| Inequality | Share of Income Earned by Middle 20% | 1973 | 19 | $10,000 |

| Participation | Female Labor Force Participation Rate | 1948-1995 | 6 | $4,000 |

| Combined Impact | All of the Above | 108 | $61,000 |

Source: Presentation of Jason Furman, Council of Economic Advisors, at the 15 December 2016 National Academies of Sciences, Engineering, and Medicine Workshop on “Returns to Federal Investments in the Innovation System,” Washington, DC. Data adapted from the World Wealth Income Database; U.S. Census Bureau; Congressional Budget Office; U.S. Bureau of Labor Statistics, Current Population Survey; Bureau of Economic Analysis; and CEA calculations.

_________________

1 National Research Council. 2007. Innovation Inducement Prizes at the National Science Foundation. Washington, DC: The National Academies Press. https://doi.org/10.17226/11816.

Productivity, income inequality, and labor force participation all affect household income levels to different but significant degrees, suggesting a need, according to Furman, for policies that address these factors. Substantial decreases in total factor productivity (TFP) growth and in capital deepening in the past two decades have contributed to a slowdown in labor productivity across the G-7 countries. He summarized possible explanations for the slowdown in TFP growth over the same period: an increasingly older and less innovative workforce, lags between innovation and deployment, subpar investment in innovation, decreasing returns on innovation investment, and reduced dynamism, competition, and churn in and among firms. But he cautioned that other explanations are possible.

A focus on innovation may be one mechanism to address the productivity slowdown. In aggregate terms, the share of total R&D funded by the government has continuously declined from its peak in the 1960s, although the federal government is disproportionately the largest funder of basic research.

He added that private R&D investment should still be encouraged, describing different mechanisms to encourage private investment and accelerate innovation. One way is to have more expansionary fiscal policy when it is needed, such as funding infrastructure investment during recessions. Another way would be to reform business taxes to equalize tax rates and reduce distortions, resulting in better allocation of capital and more productivity growth.

Furman commented on some of the funding mechanisms discussed in the preceding panel: R&E tax credit, which subsidizes inputs to research and enables firms to take more risk, and an “innovation box,” which allows for a lower tax rate on income earned from IP. According to Furman, an R&E credit is preferable to subsidizing the outputs of research as it encourages future innovation rather than rewarding past research or behavior. Patents (and similar innovation mechanisms such as prizes) lead to windfall gains by rewarding luck, market power, and supernormal returns. In addition, patents don’t improve cash-flow, nor do they provide certainty about paying for research costs. He also stated that tax reform that is revenue neutral has potential benefits as long as it encourages more innovation and productivity growth rather than just capital accumulation of legacy technologies.

Furman then addressed intellectual property and competition policy, noting the rapid increase in revenue earned from patents and its share of GDP over the past half-century and a concurrent increase in patent litigation and suits by non-practicing entities (although also noting a more recent decline in the number of litigation cases in part due to administrative and court actions to improve patent quality). In competition policy, Furman described a general decreasing trend in labor and firm dynamism marked by a decline in firm entry rates, and declines in both the job creation and destruction rates. While it is unclear whether these declines are the result of more efficient job matches and mature industry make-up, there may be public policy distortions (such as increased use of occupation licenses) that are inhibiting labor and firm turnover. Moreover, the increased return to capital and low real interest rates in the past 30 years may have reduced incentives for firms to innovate and pursue technological change.

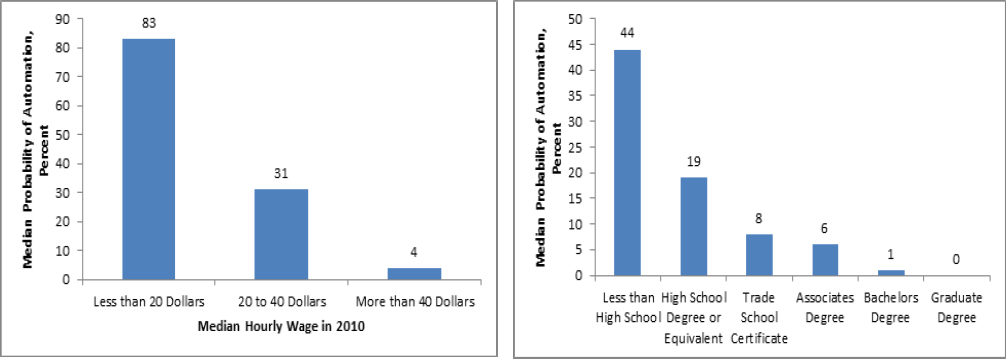

Furman turned to the subjects of automation and education and how they are impacted by—and affect—innovation. He referred to a study by Carl Frey and Michael Osborne2 that examined the susceptibility of jobs to automation. That study showed that lower wage, less educated workers are more likely to have job losses as a result of automation (See Figure 1).

Source: Presentation of Jason Furman, Council of Economic Advisors, at the 15 December 2016 National Academies of Sciences, Engineering, and Medicine Workshop on “Returns to Federal Investments in the Innovation System,” Washington, DC. Data adapted from the U.S. Bureau of Labor Statistics, Occupational Employment Statistics; Frey and Osborne (2013); Arntz, Gregory, and Zierahn (2016) calculations based on the Survey of Adult Skills (PIAAC) 2012; and CEA calculations.

_________________

2 Frey, C., and M. Osborne. 2013. The future of employment: How susceptible are jobs to computerisation? Available at http://www.oxfordmartin.ox.ac.uk/downloads/academic/The_Future_of_Employment.pdf.

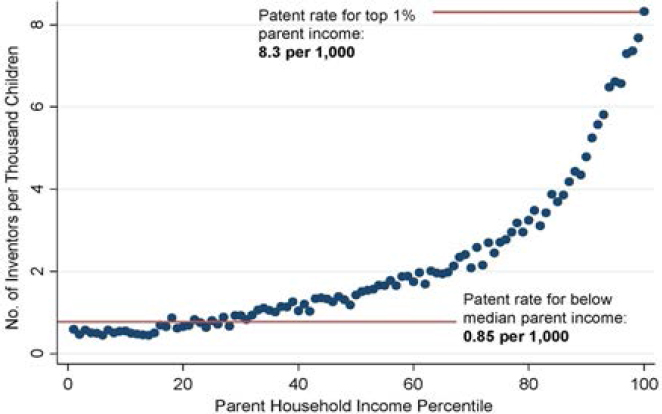

Finally, Furman spoke about the link between parental income and innovators. He cited work by Alex Bell, Raj Chetty and others3 showing that children of higher income parents are much more likely to become inventors than children of lower income parents. Although other factors, such as parental involvement, may be part of the reason for this difference, Furman said that inequality and the policies associated with this have caused uneven investments in public education that is potentially neglecting “an awful lot of innovation and talent.”

PANEL III: WHAT ARE THE SOCIAL RETURNS TO PUBLIC INVESTMENT IN HUMAN CAPITAL AND INFRASTRUCTURE?

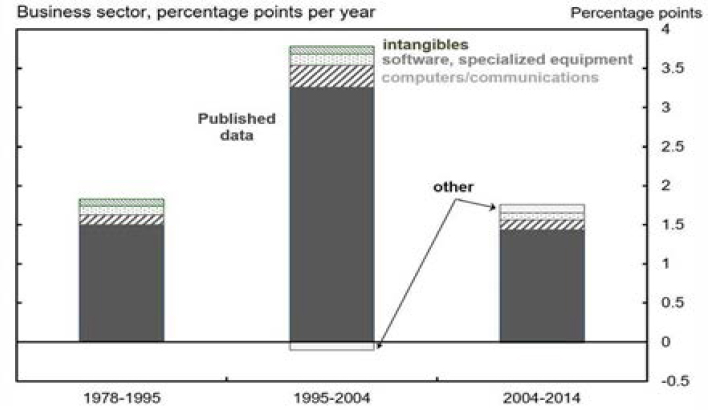

Introducing the third panel, Lee Branstetter (Carnegie Mellon University) said that the conversation would now turn to the issue of social returns to public investments in education and infrastructure. Reviewing the evidence on the growth in labor productivity, he noted that the sharp downturn in recent years is reason for pause and reflection (see Figure 2). The economist Robert Gordon, he noted, has predicted that this slowdown is “only the beginning of a slump from which we may never emerge.”

He next cited work by Claudia Goldin and Larry Katz,4 that shows that for most of the 20th century, labor productivity has risen by about 2 percent per year on average. In recent decades, however, the pace of human capital accumulation has slowed sharply: “The growth in the fraction of American workers willing or able to keep making that additional investment through and past the college years appears to have come to an end.” Branstetter warned that if the next generation of workers is no better educated than the one that preceded it, inequality related to education will continue to widen.

He acknowledged that financing K-12 education in the United States is mostly a state and local responsibility, with the federal investment focusing primarily on graduate-level training in STEM fields. However, he added that the federal government could play a role in developing and disseminating transformational educational technologies that could improve student learning, such as effective online learning modules for algebra. While federal investment in infrastructure can increase the profitability of private capital investment, he warned of wasteful and ineffective spending, such as what happened in Japan in the early 1990s and the late 2000s.

_________________

3 Bell, A., R. Chetty, X. Jaravel, et al. 2016. The lifecycle of inventors. Available at http://cep.lse.ac.uk/conference_papers/2016_06_08/vanreenen.pdf.

4 Goldin, Claudia, and Lawrence F. Katz. 2007. “Long Run Changes in the Wage Structure: Narrowing, Widening, Polarizing.” Brookings Papers on Economic Activity 2: 135–165.

Social Returns to Public Investment

In his presentation, Shane Greenstein (Harvard University) urged the audience to go beyond the standard model of innovation, especially in information technology. This is for two reasons: first, because the linear model of innovation is not correct, and second, because traditional measures of returns, including national income, do not include the value of certain internet activities.

He illustrated the appeal and limitations of the linear model with the widely shared story of how DARPA’s and NSF’s early investments in computer science and the forerunners of the Internet led to very large payoffs. Greenstein listed the ways by which the real world experience differs from this model. First, the technology underpinning the Internet advanced because managers at DOD and NSF faced incentives to develop the technology to realize their own mission goals, which were different from the broader public benefit that was to emerge. Second, the government played an essential role in establishing the standards needed to develop the relevant applications for the Internet—such as email, file transfer, and electronic commerce. “Private firms had experimented plenty in this world, but none of them are going to do an open standard. That was critically what the government ended up doing.” Third, and relatedly, the development of widely used protocols by NSF and DARPA spurred significant investment by the private sector once NSFNET was privatized. “Sure, the government helped unleash economic growth by funding the Internet, but that is an ex post rationalization, and at best, an explanation for only part of the experience.”

Greenstein observed that some of our digital investments leave little economic trace in traditional national income measures, and that this makes the social returns from government investment hard to measure. In calculating the return on federal investment in developing the Internet, Greenstein turned his attention to what he called “digital dark matter,” which are assets that mix aspects of public and private goods play a role in economy but are difficult to observe. He noted that the digital economy “lends itself to a set of activities where you see either no price for output or no prices for inputs or you just see a free good on one side of a multi-sided market and a price at another site.” For example, the value of a search in Google is not measured in our national income accounts. Instead, the only thing that counts in our measure of gross domestic product is advertising revenue.

Workers as a Pathway to Calculating the Social Return from Federal R&D

Richard Freeman (Harvard University) began his presentation with the claim that much of the social return from R&D grants and support for doctoral studies comes via students and workers transferring knowledge to industry rather than through university patents and other formal mechanisms of technology transfer.

Freeman contrasted what he called the standard “paper methodology” for calculating the returns on federal R&D, which follows the flow of knowledge through published papers, filed patents, and other traditional indicators against a “people methodology.” He said that this new approach would measure effects of investments in research on products, processes, and productivity by following students and post-doctoral researchers as they enter academia or industry as well as knowledge workers as they move from one employer to another.

Research is underway on this approach. This analysis “takes workers from a firm that has, let’s say, high R&D intensity and watches them move and then sees what happens on the firm to which they move.” He said that this analysis would “look at the effect, not only on the productivity of the firm using Census data, but also the wages of the firm.”

He also called attention to a forthcoming paper that examines whether establishments with higher share of science and engineering workers have higher productivity. It also examines whether that effect is larger for firms with greater R&D intensity. Finally, it explores if non-research workers create more value when their firm does R&D. This research finds that “recent hiring of workers (tenure less than 5 years) from an R&D firm raises establishment productivity; that movers from a high R&D firm earn a wage premium at new workplace; and that having coworkers with experience in high R&D firm raises wages of worker, with some evidence of inverse U shape to productivity and wage gains.”

Returns to Federal Investment in Graduate Training

Speaking via a previously recorded video, Paula Stephan (Georgia State University) observed that the federal government supports large number of doctoral students and postdoctoral fellows in university laboratories—either indirectly as research assistants, or directly through principal investigator grants and fellowships. Despite this substantial investment, she said, little is known about return on this investment, subsequent to their training, especially for those going to work in industry.

According to the NSF, the federal government (NIH, NSF, DOD, and DOE) supports around 70,000 graduate students and 25,000 post-doctoral researchers in some way, with most of the funding coming from NIH and NSF. The benefits of this federal investment can come from university laboratories where discoveries and patents can be transferred into commercial products. Stephan said that, based on authorship patterns of articles in Science magazine with 10 or fewer authors, 42 percent of the first-named authors were postdocs, 30 percent were graduate students, and 2 percent were either students or post-docs. The remaining 26 percent were categorized as “other.” The returns on federal investments can also accrue after the period of training. The trainee can go on to an academic position, where further knowledge created is embedded in articles and the training of new students, or go on to nonacademic positions.

Stephan noted that, increasingly, people with science training are going into nonacademic, nonresearch positions. Of those not pursuing a tenured academic position, a few continue as post-doctoral researchers, but many of them have gone to work for industry, and many of the ones who go to work for industry are in non-R&D firms.

Stephan then discussed how to measure the impact on industrial productivity of trainees who take their skills and knowledge to firms. She drew attention to the UMETRICS data project, which collects administrative data from universities regarding research funding coming to the university. These data are then deposited at IRIS, a research institute at the University of Michigan. Based on this growing database, Stephan said that “we are able to routinely know where students go by matching Ph.D. records at the U.S. Census Bureau.”

Using UMETRICS data from eight Midwestern universities that tracks students who were awarded their doctorates between 2010 and 2012, Stephan and her colleagues found that 20 percent of students who received federal support were going to R&D establishments, 21 percent to non-R&D establishments, 50 percent to academia and 7 percent to government. In addition, she found that 50 percent of the Ph.D. students who find jobs in industry go to older, larger, and higher wage firms.

She concluded by highlighting potential research opportunities that will emerge with the growth of the UMETRICS database, including to improve understanding of patterns of innovation; to model how knowledge stocks embedded in human capital contribute to innovation and firm performance; to examine how the type of support relates to the employment outcomes of Ph.D.s.; and to explore the role of social networks, networks between firms and universities, and networks across firms in the placement of graduate students and postdoctoral fellows.

Discussion

One participant asked for suggestions on how we can better capture the value of digital dark matter. Lee Branstetter replied that measurement is less a problem for multi-sided markets where, like Uber, there is a matching market where the customer is paying money for a defined service. The challenge emerges for one-sided markets, like Google, where there is no direct price observed with the information search and retrieval service, and particularly where the quality of that service has changed over time. Commenting on the mismeasurement problem, Benjamin Jones added that perhaps our productivity slowdown measurements might not reflect this information. Another participant asked the panel for their priorities to improve the collection of federal data. Shane Greenstein noted that the federal statistics system does not collect information on the occupations of workers in startup companies. The bulk of our statistics for the Longitudinal Employer-Household Dynamics (LEHD) data come from the unemployment insurance records. He also posited that it would be easy to collect this information by asking companies to include the actual occupation of the worker in forms for unemployment insurance. Pierre Azoulay added that this information could also be collected by funding agencies by requiring grantees to provide information at the end of their grant cycle about the people who actually worked on the grant.

Another participant asked the panelists about ways to improve communication channels between academic research and policymakers. Acknowledging that a communication gap exists between academia and policymakers, Lee Branstetter noted that some organizations such as the Peterson Institute and Brookings Institution’s Hamilton Project do a good job of translating research into policy briefs that policymakers can understand. They are also proactive in reaching out to mass media and social media, he added. Richard Freeman added that students who do internship programs in Washington DC, such as the AAAS fellows, are a valuable channel for converting knowledge from academia to bear on policymaking. Sabrina Howell pointed to the need for better graphics and visuals to convincingly communicate with policymakers, and inform them about the costs and benefits of alternative public policies. Finally, another participant suggested that universities should do more to highlight the impacts of their research on their own regions to state and federal legislators.

PANEL IV: SOCIAL RETURNS TO INNOVATION IN LIGHT OF INEQUALITY

Introducing the final panel, Benjamin Jones noted that economists have long separated the issue of inequality from their analysis of the innovation process. However, he noted that there may be a growing belief that the dynamics unleashed by innovations in products and processes may lead to greater disparities in wealth, potential, and cross-generational mobility, which in turn may affect the nation’s innovative potential in the longer run.

The Lifecycle of Inventors

Neviana Petkova (U.S. Department of Treasury) described her joint work with Alex Bell, Raj Chetty, Xavier Jaravel and John van Reenen, previously mentioned by Jason Furman in his keynote. This work found that children from low income backgrounds are less likely to become inventors, even controlling for measures of early ability. This conclusion was based on tracking the population of inventors—drawn from the U.S. Patent and Trademark Office database and merged with tax files from the U.S. Treasury—to create a list of 1.2 million inventors that could be tracked on U.S. tax returns filed between 1996 and 2012.

This research also suggests that exposure to science and technology in childhood is critical for their future potential as innovators, with exposure coming from innovator parents or from parents’ colleagues if the parents work in innovation-heavy industries.

According to Petkova, the propensity to patent is highest if your parents fall in the top one percent of the income distribution, with 8.3 out of 1000 children in that group patenting by age 30 compared to .85 out of 1,000 children whose parents made less than the median income (see Figure 3). She posited three possible mechanisms driving the correlation between parental income and children growing up to be inventors: First, there may be disparities in talent; second, lower income children may prefer other occupations; or third, lower income children may face higher barriers to entry, including a lack exposure to inventors in early life. She noted that there is little evidence supporting the first mechanism since third grade math scores explain less than one-third of this difference in patenting between children of rich and poorer parents.

To evaluate whether the environment in which the children grow up matters for whether they become innovators or not, the authors looked at exposure to innovation. They found that children of parents that work in innovative industries are more likely to become inventors as well. The data revealed that patent rates of children of inventors were strikingly higher than for children whose parents were not inventors. The data also show that the neighborhood where the child grows up matters.

These results, Petkova said, show that that “there are large potential gains from supply-side policies that seek to draw low-income children into the innovation pool.” One policy recommendation is to increase children’s exposure to innovation, perhaps through gifted and talented programs that provide youth in low-income communities with opportunities to receive such exposure.

Source: Bell, Chetty, Jaravel, Petkova, and Van Renen, “The Lifecycle of Inventors,” Figure 1, working paper, June 13, 2016, http://scholar.

harvard.edu/files/ambell/files/2016_06_14_patents.pdf.

Innovation, Inequality, and Social Mobility

Participating remotely, Philippe Aghion (College de France and Harvard University) next presented research that innovation is an important factor behind the observed acceleration in wage and income inequality in the United States.5 He and his co-authors found parallel evolutions from 1963 to 2013 between the growth of innovation (measured by either the flow or quality of patents in the state) and the share of income held by the top one percent in that state in the same period, although this effect is smaller when broader income inequality measures such as the Gini coefficient are used.

Aghion et al.’s model predicts that innovation by entrants and incumbents increases income inequality (as measured by the share of income going to the top one percent). The increase in the share of income that accrues to an entrepreneur after innovation should be temporary as rival firms imitate the innovator. However, this increase in the entrepreneur’s share of income relative to workers can persist if entrepreneurs can raise entry costs or barriers, for example by lobbying to keep out rivals.

_________________

5 Aghion, P., U. Akcigit, A. Bergeaud, R. Blundell, and D. Hemous (2015) “Innovation and Top Income Inequality”, CEPR Discussion Paper No 10659.

Aghion then presented research on the relationship between innovation and increasing wage inequality across firms.6 Using U.K. data, this work shows that more R&D-intensive firms pay higher wages on average and that the wage premium for working in more R&D-intensive firms seems to be higher for low-skilled workers than for high-skilled workers. As technology advances, demand for high-skilled workers increases and they do better overall, but low-skilled workers in innovative firms do better than other low-skilled workers.

Finally, he discussed the relationship between innovation, inequality, and social mobility using individual data from Finland.7 In this work, Aghion and his colleagues merged individual census data, individual patenting data, and individual IQ data from the Finnish Defense Forces to look at the probability of becoming an innovator and at the returns to invention. Similar to Neviana Petkova’s research discussed earlier in this panel, they found that the probability of becoming an innovator is strongly correlated with parental income, although this correlation greatly decreases when they controlled for parental education and child IQ.

Unequal Gains from Product Innovations

The last panelist, Xavier Jaravel (Stanford University) presented work on innovation and inequality from the point of view of consumers rather than workers.8 His work shows that product innovations disproportionately benefit high-income households.

Higher income households (those making over $100,000 per year) have a larger increase in product variety and see smaller price increases on existing products compared to lower income households (those making under $30,000 per year). These results are based on barcode-level scanner data in the U.S. retail market between 2004 and 2015 for five major product areas: household supplies, small appliances, health and beauty products, alcohol, and food.

Using BLS expenditure data, Jaravel built a price index for lower income households and higher income households. The data show that lower income households experience high inflation rates. This has policy implications for food stamp recipients since food stamp increases are indexed to an overall food consumer price index, not an income-adjusted food inflation index. According to Jaravel, food stamp benefits should have increased much more than they did. While the overall food stamp CPI increased by 26 percent, the lower income food CPI increased by 36 percent over the sample period.

Discussion

One participant observed that being an inventor on a patent is only one measure of innovation and asked about other measures. He also asked the panel to consider the risks and benefits of expanding the pool of inventors and innovators in the economy. Responding the first point, Pierre Azoulay admitted that economists “end up using patent data way more than we would like to and probably should” and hoped research would lead to alternative measures that provide better insights into the formation and growth of new entrepreneurial firms.

Phillipe Aghion added that “innovation is a social process” where the activities of an inventor are linked to those of that inventor’s customers, financiers, and colleagues. His or her activities can impact the income, experiences, and decisions of others.

Turning to the issue of the population of inventors and innovators, Xavier Jaravel noted “we are potentially losing in the United States a lot of talented children from low-income households who could have been very highly skilled, but who do not make it into this realm of innovation.” He called for a shift of focus to drawing these populations into the innovation economy. It could be that they are not exposed to innovation, but it could also be that “they do not know that they have the abilities to do well in these sectors, or they do not know that these sectors exist at all.” He suggested that the return on investment from drawing out the possibilities of talented individuals in these neglected populations is higher than “trying to get more innovation at the margin from those who already do innovation.” Dr. Petkova agreed, noting that the evidence shows that “what you are actually missing is a chunk of potentially very good inventors because they did not get the right kind of exposure.”

Lee Branstetter noted that the relationship between innovation and inequality is complex. It is not always that innovation increases inequality. He pointed out that globalization of R&D has broadened the size and distribution of inventors and innovators, and that rapid innovation-led growth in emerging economies has, in fact, reduced poverty levels in many emerging nations. Applications of new research are also, in many cases, focused on the needs of the poor in low income countries and can improve their standard of living. This growth in the worldwide population of researchers and innovators can be a benefit to the United States. Noting that “a third of all of IBM”s patents have inventors who are physically outside the United States at the time of their patent application,” Branstetter said that by drawing talent that exists outside the United States into the modern innovation system, multinational companies can also raise productivity and income in the United States.

_________________

6 Philippe Aghion, Antonin Bergeaud, Richard Blundell, and Rachel Griffith, Innovation, Firms and Wage Inequality, Harvard University, March 2017, https://scholar.harvard.edu/files/aghion/files/innovations_firms_and_wage.pdf.

7 Philippe Aghion, Ufuk Akcigit, Ari Hyytinen, and Otto Toivanen, Living the American Dream in Finland: The Social Mobility of Inventors, Harvard University, January 6, 2017, https://scholar.harvard.edu/files/aghion/files/living_american_dream_in_finland.pdf.

8 Jaravel, Xavier. “The Unequal Gains from Product Innovations: Evidence from the U.S. Retail Sector,” 2016. https://scholar.harvard.edu/files/xavier/files/unequal_gains_innovation_april7_2017.pdf.

Benjamin Jones noted that “innovation can raise all boats, at least in the long run.” At the same time, he pointed out that the distributional consequences of innovation can give rise to short-term political concerns that seek to limit markets and trade. Phillipe Aghion added that there is also the danger that the “innovators of yesterday … become the entrenched incumbents of today that prevent innovation and mobility.”

DISCLAIMER: This Proceedings of a Workshop—in Brief was prepared by Gail Cohen and Sujai Shivakumar as a factual record of what occurred at the meeting. The statements made are those of the authors or individual meeting participants and do not necessarily represent the views of all meeting participants, the planning committee, or the National Academies of Sciences, Engineering, and Medicine.

PLANNING COMMITTEE: Benjamin F. Jones (Chair), Northwestern University; Pierre Azoulay, Massachusetts Institute of Technology; and Heidi Williams, Massachusetts Institute of Technology. STAFF: Gail Cohen, Director, STEP; David Allen Ammerman, Financial Associate (until June 2017); Paul Beaton, Senior Program Officer; David Dierksheide, Program Officer; Cynthia Getner, Financial Officer (from June 2017); Frederic Lestina, Senior Program Assistant; Eric Saari, Senior Program Assistant; and Sujai Shiva-kumar, Senior Program Officer.

REVIEWERS: To ensure that the Proceedings-in-Brief meets institutional standards for quality and objectivity, it was reviewed in draft form by David Hart, George Mason University and Yael Hochberg, Rice University. The review comments and the draft manuscript remain confidential to protect the integrity of the process.

SPONSORS: The workshop was supported by the National Science Foundation, Economic Development Administration, and IBM.

For additional information regarding the meeting, visit http://sites.nationalacademies.org/PGA/step/PGA_176589.

SUGGESTED CITATION: National Academies of Sciences, Engineering, and Medicine. 2017. Returns to Federal Investments in the Innovation System: Proceedings of a Workshop—in Brief. Washington, DC: The National Academies Press, doi: https://doi.org/10.17226/24905.

Board on Science, Technology, and Economic Policy

Policy and Global Affairs

Copyright 2017 by the National Academy of Sciences. All rights reserved.