1

The Affordability Conundrum

“Every system is perfectly designed to get the result it gets.” Credited to various individuals, this quote is descriptive of the U.S. health care system and, specifically, the biopharmaceutical sector.1 The subject of many commentaries—often political, occasionally technical, and frequently humanitarian—the U.S. health care “system” is antithetical to the very concept of a system, with its components pursuing differing and often contradictory goals. The system’s participants—from patients to clinicians and health plans to product manufacturers, as well as various intermediaries such as pharmacy benefit managers—constitute and interact within a complex enterprise that is projected to consume 20 percent of the nation’s gross domestic product by 2025 (Keehan et al., 2017).

The high cost of health care is—and has been for some time—a burden on individual patients, their families, and society as a whole. People with chronic health conditions are particularly vulnerable because their illnesses or the treatments for their illnesses impede their ability to work, with some patients losing employment altogether. Such individuals frequently incur significant financial debt and deplete the assets they need to pay for treatment, some to the extent that they must resort to bankruptcy. Cancer patients especially face severe financial risks—or “financial toxicity” (NCI, 2017)—and have a materially higher rate of personal bankruptcy than

___________________

1 The term “biopharmaceutical sector” used in this report encompasses a wide range of participants from researchers to physicians to industrial producers, from public and private payers to intermediaries such as pharmacy benefit managers, and from health care organizations and care providers who prescribe medications to patient advocacy organizations.

those who have not been diagnosed with cancer (Ramsey et al., 2013). One important factor in this economic reality is the nation’s highly complex system of creating, manufacturing, and supplying prescription drugs—products that are critical to improving health, saving lives, and enhancing public welfare.

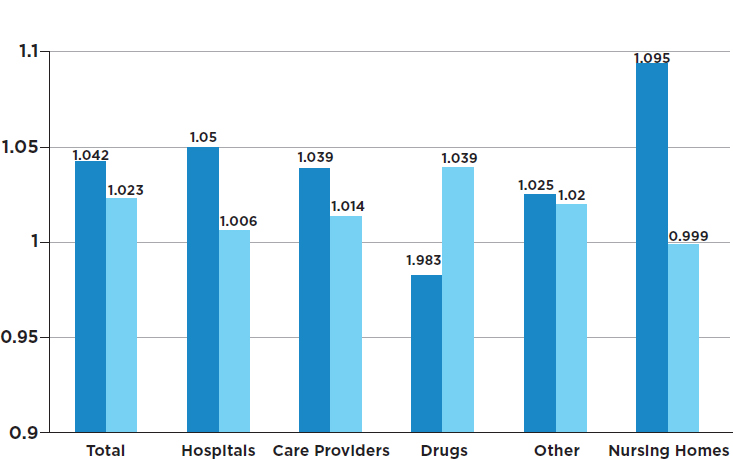

The past half-century has seen a steady rise in the expenses associated with prescription drugs and other key elements of the health care system. To illustrate the growing importance of prescription drugs as a driver of medical spending, Figure 1-1 displays compound annual growth rates in inflation-adjusted, per capita spending for various segments of the health care system. The graph shows two relevant periods: 1960 to 1980 and 1981 to 2015. The year 1980 creates a convenient separation both for hospital and clinician payments as well as for biopharmaceutical products. While spending relating to hospital and clinician payments fell because of Medicare reforms, the growth pattern for prescription drugs followed an entirely different path as influenced by three legislative changes: the Bayh–Dole Act of 1980, the Orphan Drug Act of 1983, and the Hatch–Waxman Act of 1984. Since the early 1980s, spending on drugs has increased at

SOURCE: Data from Phelps, 2018, Table 1.8.

nearly 4 percent annually, even after adjusting for general inflation and population growth.

THE MICROCOSM OF PRESCRIPTION MEDICINES

Prescription drug expenditures in the United States are currently about 17 percent of the overall cost of personal health care services (Kesselheim et al., 2016) (see Box 1-1 for additional discussion). Referred to by some as “priceless goods,” prescription medicines are becoming steadily more expensive and have become both a regular topic in the popular press and a major sociopolitical concern (KFF, 2017a). However, it is difficult to determine exactly what corrective measures should be introduced because both the biopharmaceutical sector, which is responsible for developing and delivering medicines to the public, and the policies that govern this sector are exceptionally complex and non-transparent—more so than nearly any other sector of the health care system or, indeed, any other sector of the entire economy.

Prescription drug policies at both the federal and the state level are the result of extensive technocratic decision making. However, individual patients and their families relate to the biopharmaceutical sector in a very direct manner, responding to such issues as access, cost, and efficacy on a very personal level. More than half of all people in the United States routinely use prescription drugs, and 15 percent of the population regularly takes five or more drugs (Kantor et al., 2015). For example, a woman in the initial stage of treatment for one type of breast cancer may take cytotoxic chemotherapy drugs and a monoclonal antibody (a specialty drug) along with anti-nausea drugs and perhaps an antidepressant.

Specialty drugs2 are among the most expensive of all drugs, and in recent years their prices have grown at a double-digit rate (Hartman et al., 2015). This sharp increase in prices is due in part to the introduction of expensive new drugs (such as those for hepatitis C, multiple sclerosis, and cancer) and in part to rapid price hikes for existing specialty drugs (QuintilesIMS, 2016). For illustration, a recent analysis showed that a

___________________

2 “Specialty drug” is a general term for medications that feature one or more of the following characteristics: highly expensive, complex molecularly (often derived from living cells), non-standard administration process such as via injection or infusion, limited availability or having a specialized distribution network, or indicated for a rare or complex syndrome. Historically, drugs in the specialty category have included biologic agents that require special handling and ongoing monitoring and that are administered by injection or infusion. The Centers for Medicare & Medicaid Services considers any drug that exceeds a cost threshold of $670 per month to be a specialty drug, and this applies only to Medicare Part D but not Medicaid. There is no uniform definition of a specialty drug, and different pharmacy benefit managers have different collections of drugs that make up their specialty lists.

branded injectable synthetic progestin used to lower the risk of preterm birth costs more than 50 times that of the identical generic formulation, consuming on a national level more than $1.4 billion per year compared to the $27.5 million costs associated with the generic option (Fried et al., 2017). Although specialty drugs accounted for about 2 percent of prescriptions dispensed in 2016, they represented more than one-third of total prescription drug spending (Express Scripts, 2017; QuintilesIMS, 2017).

The general public considers lowering the cost of prescription drugs as one of its highest health care priorities. In 2017, 61 percent of the respondents in a poll assigned the issue a top priority (KFF, 2017a), with another survey ranking it first among domestic issues requiring priority action from the U.S. Congress (Politico, 2017). Although the vast majority of the public believes that prescription drugs have improved the lives of people in the United States, most also have an unfavorable view of pharmaceutical companies and believe that they make excessive profits (KFF, 2017b). Not surprisingly, patients who take multiple prescriptions as well as low-income and uninsured patients are most likely to report having difficulty affording prescription medications (KFF, 2017b). Reflecting this public sentiment, in the past 2 years, state legislators have proposed a multitude of bills focusing on unfair drug pricing and price transparency. Several of these bills have passed into law.

Efforts to reform the market for prescription drugs in the United States have often become entangled in larger policy debates about overall health care financing and delivery. Health care in the United States is financed by a variety of payers, including federal and state government insurance programs, private employers, unions, and households (CMS, 2015). Individual payers, such as insurers and health plans, negotiate prices—often unique—for the prescription drugs they cover. These negotiations are generally promulgated through intermediaries such as pharmacy benefit managers (PBMs). Individuals without prescription drug plans self-pay and are unable to take advantage of the lower prices that can be negotiated by large insurers or PBMs (Danzon, 2014). Accordingly, the uninsured often depend on financial assistance programs from pharmaceutical companies or others. The size and structure of the U.S. health care system and the sheer number of participants and roles in the biopharmaceutical sector complicate the manner in which drugs are valued and costs are determined.

THE REAL PRICE OF A “PRICELESS GOOD”

Determining the “value” of a drug and what constitutes “fair” pricing is a contentious and confounding topic. Various stakeholders have different concepts of the value of a drug and what a fair price for it would be. Within this dynamic, participants in the biopharmaceutical sector can each assert

that their ultimate goal is to make safe and effective medicines and provide “value” to patients. However, an inherent conflict exists between the desire of patients (and society) for affordable drugs and the expectations of—as well as legal obligations to—corporate shareholders and other investors in biopharmaceutical companies for a competitive return on investment.3 In short, patients emphasize value in terms of their direct personal benefit rather than in business or economic terms (Buzaglo et al., 2016).

Presently, different patients pay different prices for identical drugs, with individual prices depending mainly on the specifics of their health insurance plans, which generally include cost-sharing features such as copays, deductibles, and coinsurance. In severe financial circumstances, patients’ health care expenses also adversely affect other members of their families. Consider, for example, an individual with rheumatoid arthritis who has an annual income of $55,000 (near the national median), a spouse, and two dependents. Assume that the individual’s monthly payroll contribution to purchase health insurance is $400 ($4,800 yearly) and that the deductible is $3,500, coinsurance is 20 percent, and the annual out-of-pocket maximum under the individual’s insurance policy is $7,000. The yearly cost of that person’s medications may well reach $30,000 if the rheumatoid arthritis is treated with an expensive specialty drug; thus, that individual will need to pay $11,800 ($4,800 for the insurance plus $7,000 for the maximum out-of-pocket expenses) each year for health-related expenses. The individual would then need to cover the rest of the family expenses with the remainder of his or her income, after taxes. This is a reality that many patients face when medical expenses consume much of their gross income. For those who are uninsured, the situation is far bleaker.

Drug manufacturers often attribute the high cost of medications to the complexity of the technology and of the testing required of new products, the high failure rates associated with drugs under development, and national and international regulations intended to ensure that medicines are safe and effective (Rosenblatt, 2017; Rosenblatt and Termeer, 2017). Drug candidates must first be discovered and then tested, with each step requiring a series of intricate experiments. If the initial tests are promising, the drug candidate is then put through a series of clinical trials to determine its safety and efficacy. Gaining approval from the U.S. Food and Drug Administration (FDA) requires large, complex, multicenter—and often multinational—trials that are carried out by a network of clinical investigators, statisticians, consultants, and other professionals, all of which is very expensive.

Despite the generally recognized expense of developing drugs, many individuals believe that drug companies and intermediaries in the supply

___________________

3 Some members of the committee disagree with this statement. Please see Appendix B for a minority perspective.

chain are exploiting the complexity of the system by charging high prices for drugs without transparency and without justification. These views are common even for drugs that have moved into the generic market (Bach, 2015).

To understand this concern among the public, consider, again as just one example, the case of the leukemia drug imatinib (Gleevec). Upon its U.S. release in 2001, it cost $4,540 per month of treatment. In 2016, after 15 years on the market, it cost $8,500 per month in the United States, but cost $4,500 and $3,300 per month in Germany and France, respectively (Bach, 2016). This increasing cost over time is not unique to Gleevec; cancer drug prices, for example, have on average quadrupled in the United States over the past 20 years (Bach, 2017; Conti et al., 2015; Dusetzina, 2016). In the case of Gleevec, this price increase occurred despite the presence of two factors that would normally bring prices down. First, because leukemia patients are living longer due to the drug’s effectiveness and because new indications for the drug have been approved (Bennette et al., 2016), the population treated with the drug has expanded, which has increased sales volume of the drug. Second, other drugs that target the same abnormal protein have entered the market. For most types of non-medical products, such a combination would result in more options and lower costs and prices.

Most other cancer drugs are considered to be less effective than Gleevec in extending the lives of cancer patients, yet when new cancer drugs enter the market, their prices are similarly high (Dusetzina and Keating, 2015). A lack of competition, combined with state and federal regulations specifying that insurers must include cancer drugs in their formularies (Bach, 2009), provides sellers with considerable pricing flexibility. These factors—and others—tend to drive the already high prices of drugs in the United States even higher, but it is not clear exactly how large a role each factor plays or how the various factors interact. One powerful force, however, is the extensive and increasing health insurance coverage for prescription drugs that blunts—and in the case of full coverage, eliminates—normal consumer-related market forces that might otherwise control prices.

A SYSTEM OF CONFLICTING SYSTEMS

The current structure of the biopharmaceutical sector often gives rise to conflicting interests and positions. The principal conflict is between two desirable objectives: (1) making drugs affordable from the standpoint of patients and society, and (2) making new drugs available from research and development efforts. Affordability refers to how easy or feasible an individual (or, more broadly, society) finds it to pay for a drug. It is a function of drug prices, insurance coverage, a family’s financial circumstances, and, sometimes, the purpose of the drug. To some, for example, $200 might be

an unreasonable amount to pay for a migraine prescription, but it might not be too much to pay for a drug that extends a person’s life. Availability refers to the presence or absence of particular types of drugs in the marketplace. As described above, drugs become available only after a long process of discovery, development, approval, manufacturing, and marketing, and might be unavailable because they have not been discovered and developed or because of a failure in the supply system.

Policy interventions can and often do advance one of these two objectives at the expense of the other. As a simple example, it has frequently been proposed that restrictions should be imposed on the launch prices of medicines in order to make them more affordable. However, such price controls could erode incentives and make drug companies less likely to make the investments necessary to pursue the research and development that leads to future therapies (Maitland, 2002; Scherer, 2000).

An alternative to price control is formulary control. For example, the setting of copayment tiers by PBMs and insurance plans can be an effective tool to influence patients’ choices among competing treatment options. It can also influence the prices manufacturers offer for their products in order to gain access to a more favorable tier. But providing greater insurance coverage for individuals, without other mitigating changes can increase both the quantities of the medications consumed and their prices (Newhouse, 1988). This in turn would drive total insurance expenditures further upward.

Most policy changes introduced to address these and other issues have been, at best, incremental and have often been subject to substantial compromise among the entities possessing market power and political influence. These issues are not entirely unique to the United States; however, a major challenge in the United States is that the market is exceptionally large and highly fragmented. Efforts to consolidate this market are likely to create substantial backlash from the diverse groups that benefit from the current market arrangement.

MARKET FORCES

One approach to the resolving conflict between biopharmaceutical affordability and availability is to let the “free market” determine the best course forward. For most consumer goods, free market maximizes consumer choice and makes decisions based on the economic “votes” of people participating in a particular market. In the United States, market forces are generally considered to be the most economically efficient way of determining what goods are provided and at what price—and also the fairest way of determining how limited resources should be allocated (Elegido, 2015; Friedman, 2009). However, relying entirely on free market

solutions in the case of prescription drugs is complicated because describing the biopharmaceutical supply chain in the United States as largely driven by competitive market forces would be substantially misleading.

The dynamics of the biopharmaceutical supply chain reflect the actions of profit-seeking enterprises operating within an extremely complex array of privileges and constraints set by the government. The nature and significance of these government interventions—which include the funding of research, the granting of market exclusivity, the enforcement of strict product requirements and standards, and acting as the ultimate purchaser for large segments of the population—mean that the market is distorted in many ways. Simply stated, the typical presumption that market forces will work—and work best—does not hold well for the biopharmaceutical sector. The nature of these market forces is powerfully shaped by government and other interventions, and is also contingent on specific diseases and their overall impact. In contrast with the market for most household goods, in which consumers are the primary decision makers, consumers wield relatively modest influence over decisions related to medicines. Instead, prescribers largely determine which drugs are to be purchased and in what quantity, and patient cost-sharing arrangements specified by prescription drug insurance plans influence whether patients obtain the medicines prescribed.

Another unique characteristic of the biopharmaceutical supply chain relates to the number of intermediaries. One approach frequently posed as a solution to make current drugs affordable while not affecting future drug development is to reduce the value extracted by the biopharmaceutical intermediaries in the supply chain. The profits generated by PBMs, wholesalers, and retail pharmacies, coupled with insurer’s profits and the margins on reimbursement for drugs administered in the hospital or outpatient setting, ultimately affect the patients and their ability to pay for therapies, and do not increase the incentives to develop new drugs.

This is not to say that intermediaries play no useful function. Managing drug plans, wholesale logistics, and retail dispensing are among the essential functions performed by intermediaries in the biopharmaceutical supply chain. Another benefit intermediaries offer is to negotiate lower prices for their clients, including insurers and self-insured employers who can potentially turn those savings into lower insurance premiums or cost sharing for their enrolees. The question is whether market forces in the biopharmaceutical sector work effectively enough to ensure true competition and prevent excessive profits that otherwise might have been passed on to patients. The answer to this question is hotly contested, with participants in the biopharmaceutical supply chain typically pointing at each other, while claiming that their own activities deliver substantive benefits to patients.

Another form of market failure relates to externalities, which occur

when an economic activity (such as the purchase or sale of a product) has costs or benefits for others not directly involved in the transaction. Many choices about drug treatments carry societal externalities, both positive and negative. The use of effective vaccines and drugs for infectious diseases, for example, has benefits that are widely diffused across society, as people who might otherwise have been exposed to the disease are protected by others’ use of the pharmaceuticals (Boulier et al., 2007). Yet, vaccinated patients and their insurers are generally asked to bear the entire cost of the preventive action. Conversely, a person who chooses not to receive vaccines or drug therapies may cause negative externalities, including reduced herd immunity and greater spread of the disease as well as the associated costs to society when resources need to be devoted to subsequent medical interventions that could have been avoided. In certain cases, a treatment can eliminate substantial non-drug medical expenses later in life (e.g., the use of a hepatitis B vaccine), and the financial and emotional benefits of treatments are thus realized by both individuals and society as a whole.

SOCIAL JUSTICE

Market failures aside, another reason to question the wisdom of allowing the market to determine the optimal balance between affordability and availability of medications is the potential consequences of this approach for vulnerable populations. Because the organization of the market requires, or allows, high prices to be charged for many drugs, individuals with serious health needs may be unable to afford effective medications and will therefore fail to enjoy the health gains and higher quality of life that would otherwise have been possible. In some cases, the outcomes include death. As was true with HIV/AIDS in Africa, millions of people died despite the development of effective antiretroviral drugs because they were not affordable. Only the advent of generic antiretroviral combination therapy that cost $100 (versus $12,000 for branded combination medicines) allowed millions of Africans to gain access to lifesaving medicines. A similar situation exists today for patients around the world with hepatitis C, who cannot afford treatment because generic medicines will not be available for many years to come (Kamal-Yanni, 2015).

There is a degree of public consensus in the United States that allowing individuals to suffer or die because they cannot afford health care is morally wrong (Lynch and Gollust, 2010). However, there are deep disagreements about the extent to which the government should or can intervene to ensure that patients get the care they need. Overall, there is little agreement in the United States concerning the extent to which patients are ethically entitled to health care.

One view is that justice requires providing individuals with access to a

universal health insurance benefit that includes effective medications. There are several arguments made in support of this claim. One argument is that health insurance is important because access to health care eliminates needless suffering, which is a morally important end in and of itself. Another line of reasoning is that providing access to health care that includes effective medicines is important to advancing other fundamental goals of social justice. For example, health care helps advance equality of opportunity—the ability of people to fully develop their innate talents and skills regardless of their financial status (Daniels, 2007; Rawls, 1971).

Access to health care and equality of opportunity are causally linked because of the role that such access plays in preventing disease or disability that would otherwise affect an individual’s ability to pursue socially meaningful goals. Having access to health care helps an individual maintain his or her health-related functioning (e.g., the ability to hold a job, earn a living, pursue activities of self-care, and maintain one’s role in the family and society). On the other hand, maintaining these functions makes it possible for individuals to pursue a broad range of opportunities that society may offer them. For example, access to bronchodilator medication can control the symptoms of chronic asthma, enabling people with that condition to pursue occupations that would otherwise be closed to them.

This linkage between access to health care and equality of opportunity is a major argument for certain policies, such as those that provide government subsidies to increase the affordability of health care. However, there is no clear guidance or even agreement as to how society should prioritize which prescription drugs should be covered and to what extent subsidies should be provided. There are disagreements, for example, about the extent to which payers should balance subsidies to purchase drugs against tools to manage overall spending on drugs, such as formulary restrictions or cost sharing for patients.

Further complicating matters, policies that are optimal for some patients may not benefit other patients (e.g., the small numbers of people with rare diseases often require the most costly medicines). Some even question the extent to which society should be responsible for diseases that are attributable to behaviors of choice. In light of such issues, insurance plans need explicit and transparent processes for setting priorities, yet there is little national agreement as to what those processes should be.

THE ROLE AND RESPONSIBILITY OF FIRMS

Beyond the sorts of moral considerations that are applicable to all firms, some ethicists believe that biopharmaceutical companies have a special obligation to ensure that their products are accessible to patients who need them—even if doing so reduces profitability and returns to share-

holders (De George, 2005). But even among those who hold this view, there is widespread disagreement about the nature and extent of this obligation. No widely agreed-upon approach has emerged to prescribe the ethical obligations of pharmaceutical companies to patients or to assist management in making decisions involving such obligations. This has been a longstanding challenge, and it exists for certain other types of for-profit providers of health care goods and services as well (Vagelos, 1991).

Patients who depend on unique lifesaving drugs are especially vulnerable. If they cannot survive or maintain a tolerable quality of life without drug therapy, they arguably have no meaningful choice but to pay whatever price is demanded. Some commentators argue that this creates an ethical obligation on the part of the seller to not extract excessive profits—or perhaps in some instances even to suffer losses—in providing drugs to those who cannot refuse the seller’s offer (Valdman, 2009). However, others argue that although this morally distressing situation may generate an obligation on the part of society—or, more specifically, on the part of government—to ensure that the patient has access to the drug, it does not create such an obligation for the drug’s producer (De George, 2005; Maitland, 2002).

As for-profit entities, biopharmaceutical firms must compete for capital and talent in the same marketplace as other for-profit firms in other sectors of the economy, and they must therefore offer competitive returns to investors and rewarding careers to employees. Yet, unlike providers of most consumer goods and services, they are at times delivering lifesaving products to highly vulnerable individuals. Indeed, drug companies appear to see themselves as more than just another business. Their mission and vision statements often announce the intention to bring transformative therapies to patients around the world. Box 1-2 explores the potential of new business models—beyond traditional profit maximization—in the biopharmaceutical sector.

Because of the dual identity of biopharmaceutical companies as both for-profit manufacturers of goods and providers of medical products that significantly contribute to the public good, there is today no agreed-upon approach for applying ethical standards to their operations. The ordinary principles of business ethics (focusing, for example, on honesty and adherence to commitments) seem to not go far enough in defining drug companies’ obligations to their patients and shareholders. Alternative frameworks, such as principles of medical ethics, demand an absolute fidelity to patients’ interests. But at this point there is no agreement on what ethical obligations to patients, if any, spring from the distinctive and very important role of biopharmaceutical companies. Nor is there broad understanding of the impact “an absolute fidelity to patients’ interests” might have on a firm’s viability—and on its contribution to future patients.

A considerable controversy also exists regarding what constitutes a fair

return on investment in biopharmaceutical research and development. One particular conception of the principle of fairness relies on the notion of just rewards for effort expended and risk incurred. Because biopharmaceutical companies incur substantial risk and invest considerable time, money, and effort in the development of new products, the argument goes, fairness in pricing implies that they should be able to reap the returns of their investments (De George, 2005). The argument is bolstered by the fact that pricing its products very affordably could even drive a drug company out of business. Those who apply this particular framework in discussions about drug pricing are likely to be resistant to suggestions about restricting prices or intellectual property rights in the biopharmaceutical sector.

The idea that investments in research and development must be fairly rewarded is closely related to another general concern for biopharmaceu-

tical companies: leaders of public companies have a fiduciary obligation to maximize shareholder value while operating within the law. Similarly, leaders of smaller companies that rely on venture capital to finance their research and development feel obliged to fulfill their promise to deliver highly competitive returns to their investors. Corporate leaders, then, may not feel at liberty to price prescription drugs in a way that maximizes affordability to consumers.

The principle of near-absolute fidelity to shareholders is itself controversial, especially when profits are derived from non-market circumstances. In at least some cases, drug companies may be able to take advantage of market failures caused by aspects of the regulatory process. As one example, the backlog of applications for generic drugs at the FDA has at times resulted in situations in which one generic firm may be the sole manufacturer of a lifesaving drug. On occasion, firms appear to have taken advantage of this situation by increasing the price of the drug beyond what would be justified based on the cost of developing and producing the drug. In this situation, the company is exploiting a weakness in the regulatory process to enrich itself at the expense of patients. Some argue that it is unjust for businesses to enrich themselves from such market dysfunctions (Heath, 2014).

Persuasive arguments have been made that corporate executives are not, in reality, obliged to maximize profits. They may instead pursue long-run shareholder value by sacrificing some short-run profit in the pursuit of the public interest, although most legal advisors suggest that doing so is not without risk to the firms and their managements (Elhauge, 2005). Some have advanced the proposition that executives may sacrifice shareholder interests under some (usually unspecified) conditions if by doing so they can alleviate human misery (Dunfee, 2006; Hsieh, 2009). Indeed, some corporate leaders have urged keeping price increases consistent with general inflation (Vagelos, 1991) and encouraged product donations—as was seen in the case of Merck’s donation of medications for eradicating river blindness—in the interest of public health (Mackey et al., 2014; Vagelos and Galambos, 2004).

Whichever of these arguments, if any, one accepts, the basic tension between affordability and availability remains: there are inevitably tradeoffs between maximizing affordability in the short term and rewarding investment in order to promote the development of the greatest number of effective therapies in the long term. Some believe that drug companies will be more likely to develop new therapies if they perceive that the market will reward them for their research and development (Taurel, 2005). To some commentators, this justifies allowing markets to set higher prices even for the most essential medications (Maitland, 2002).

Humans have a natural tendency to prefer short-term benefits to “identified lives” as opposed to more distant benefits that “some people” in the

future may enjoy (Cohen et al., 2015; Frederick et al., 2002). Indeed, the public conversation about drug prices has been galvanized by publicity surrounding highly sympathetic cases in which particular patients cannot afford particular drugs.

Ultimately, however, the tension between taking steps to help patients and continuing to foster additional research and development for public health and future patients is fundamental and must be explicitly confronted if a defensible pricing policy is to be established in the United States. This will not be easily done.

GLOBAL TRADE-OFFS

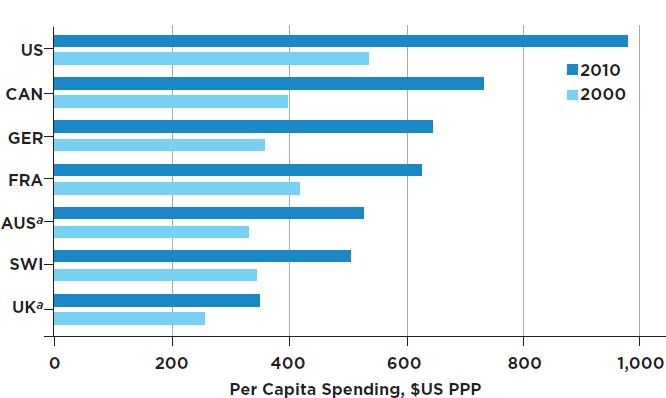

The issue of drug affordability has in recent years become highly politicized, with frequent references to the fact that drugs, often developed in the United States, are priced lower in many other parts of the world. On a per capita basis, the United States indeed spends more than any other country on prescription drugs, more than twice than what the United Kingdom spends (Kanavos et al., 2013) (see Figure 1-2). Something of a crisis atmosphere has been created by congressional and media attention to the issue,

NOTES: “Expenditures are in 2000 U.S. dollars, purchasing power parity (PPP). OECD data on total pharmaceutical spending (spending for both brand-name and generic drugs) per capita generally do not include the cost of pharmaceuticals consumed in an inpatient setting. [a] Because of lack of data for 2010 from Australia and for 2009 and 2010 for the United Kingdom, 2010 expenditures for those countries are from 2009 and 2008, respectively” (Kanavos et al., 2013). AUS = Australia; CAN = Canada; FRA = France; GER = Germany; SWI = Switzerland; UK = United Kingdom; US = United States.

SOURCE: Kanavos et al., 2013, Exhibit 1. Data from World Bank and Organisation for Economic Co-operation and Development.

much of which has focused on alleged “price gouging” by some biopharmaceutical companies. Under these conditions, public demands for quick actions are at odds with the otherwise deliberative policy-making processes.

Furthermore, there may be trade-offs between improving the affordability of drugs domestically and maintaining their affordability to patients in other countries. In many cases, if not in most, the prices of branded prescription drugs abroad are lower than they are in the United States, even though the drugs significantly rely on research funded by the tax dollars of the United States.4 Pharmaceutical manufacturers argue that the potential for higher profits creates incentives for continued research and development, which can ultimately benefit people in all nations. Thus, decisions about drug prices in the United States could potentially affect drug availability and pricing in other countries, particularly those with developing economies.

The counterargument is focused on whether people in the rest of the world, particularly in high-income countries, also have any obligations to boost their research, development, and investments that lead to global health benefits. The higher prices paid by people in the United States typically benefit people in the rest of the world who are paying relatively less for their drugs. In a sense, people in these other countries may be taking advantage of the benefits of high drug prices in the United States without having to pay those high prices themselves. Most other developed countries have explicit price controls or bargaining mechanisms in place for prescription drugs, some of which use cost-effectiveness metrics. In the United States, currently there are no centralized price controls, and payers do not explicitly deny access to treatments on the basis of costs, thus enabling biopharmaceutical companies to set higher prices than in other countries. To the extent that the higher profits the companies accrue can lead to more research and development, paying higher prices for drugs in the United States could confer benefit to the people of other countries. Moreover, if purchasers in other advanced economies paid more for their drugs, there might be a benefit to the patients in the United States through more research and development, but it would likely have no direct impact on the prices paid in the United States because manufacturers could still price their products based on what the various markets will bear.

These arguments also raise a question about global justice: what obligations, if any, do the United States and other advanced economies have to patients in the less developed countries of the world? Some theories of global justice posit that members of wealthier states have moral obligations

___________________

4 The United States commonly pays less for generic drugs than many other countries, an outcome thought to be due to greater emphasis on competition in the generic market than observed in other countries. This topic is discussed further in Chapter 3.

to consider the welfare of individuals in poorer states in their internal decision making (Beitz, 2005), but other observers have questioned the extent to which such duties can exist (Nagel, 2005). If such obligations do exist, what sacrifices would be reasonable to expect from the United States and other developed countries in order to keep drugs affordable to the rest of the world?

INSURANCE COVERAGE

The basic concept behind health insurance is that the financial risk borne by individual patients can be ameliorated by spreading the risk across large populations. This reduces the cost of treatments to some individuals, but at a cost of increasing the financial burden on others. The presence of insurance can affect people’s behavior in many ways. For example, with a lower effective price, people will generally seek more and more expensive treatments than they might without insurance (Cutler and Zeckhauser, 2000). The extent to which this occurs is measured by the “elasticity of demand”—the degree to which consumers will purchase more or less of something as the price goes down or up—which appears in the prescription drug market in two distinct ways: decisions concerning whether to seek prescriptions (and care) from clinicians and choices among different prescription drug options.

In the United States, as of 2016, about 50 percent of individuals gained health insurance coverage through their employers and about 14 percent through Medicare, which is available to those older than age 65 and those who are disabled, among others. More people are covered under Medicaid and the Children’s Health Insurance Program than under Medicare (19 percent).5 Others are covered through public programs including the U.S. Department of Veterans Affairs, military service benefits, individual insurance contracts (supported in recent years by the Patient Protection and Affordable Care Act’s [ACA’s] health insurance exchanges) and prison systems.

Because people over the age of 65 use considerably more medications than younger people, Medicare has a substantially larger role in drug expenditures than suggested by the proportion of the population enrolled. The Medicare Modernization Act created the Part D drug benefit, which started in 2006, and was later modified in the ACA. The original Medicare structure included Part A to cover hospital services and Part B to cover clinician services and some other medical costs. Prescription drug expenses are covered under these parts if they are directly purchased and administered by the hospital or the clinician. Many Medicare enrollees also purchase private

___________________

5 Estimates from the Kaiser Family Foundation are based on the U.S. Census Bureau’s Current Population Surveys (Annual Social and Economic Supplements).

“Medigap” insurance that pays for copayments and deductibles in Parts A and B and previously also often covered prescription drug expenses. With the advent of Medicare Part D, the Medigap plans ceased to cover prescription drug costs. Medicare Part D specifically covers outpatient prescriptions. The Part D benefit is voluntary and is purchased through commercial insurance providers approved by the federal government.

The Medicaid prescription drug benefit is an optional outpatient drug benefit that all states provide. Until 2006, Medicaid provided the benefit to enrollees dually eligible for Medicaid and Medicare. However, with the passage of the Medicare Modernization Act, Medicaid ceased to provide outpatient prescription drugs to this population, which in 2013, totaled 10 million. Due to certain changes resulting from the ACA, states have increasingly been providing the benefit through managed care, an approach focused on controlling health care costs, use, and quality. Even though cost sharing is minimal for the drug benefit in Medicaid, the high cost of prescription drugs is an important issue in Medicaid, because states must fit Medicaid expenditures into their state budget.

The financial risk associated with an individual’s cost of prescription drugs has increased in recent years because of the significant increases that have occurred in drug prices and in their usage. As knowledge of the complexity of human biology has increased, researchers have uncovered more and more pathways through which to treat and prevent illnesses using complex and costly biopharmaceutical products. This growing capability has also played a major role in the steady increase in the amount being spent on prescription drugs and related insurance.

For many medical conditions multiple treatment options exist, often involving choices among different types of drugs. In some cases the choices involve alternatives between using prescription drugs and other forms of medical intervention. The latter might include, for example, psychotherapy in lieu of psychoactive drugs (although the two are often used in parallel) to treat depression or other mental illnesses. Similarly, surgical alternatives and prescription drugs sometimes compete or complement one another. This commonly occurs with cardiovascular disease, where many prescription drugs (the most common class being statins) can reduce the incidence of coronary artery blockage. Without the use of such drugs, clogged coronary arteries regularly result in the need for surgical intervention or inserting stents to ensure adequate blood flow.

Pursuing this example further, among the drugs that might reduce cardiovascular risk, some statins are now available as generic products at far lower cost than their branded counterparts. Thus, clinicians and patients often confront an array of choices when deciding among various treatment options. For patients with health insurance, the cost-sharing provisions of their health plan can influence these decisions. For example, nearly

all prescription drug insurance plans create multiple tiers of drugs, with increasingly higher consumer out-of-pocket costs for the higher-tier drugs. This “tier pricing” is widely viewed as a means of steering patients to lower-cost alternatives—commonly, generics. Overlaying this is the complexity of health insurance plans in the United States, which makes it difficult for patients to become familiar with the specifics of their plan, including its cost-sharing provisions.

THE STUDY CONTEXT

Given the sheer complexity of the subject—and its high stakes—it is clear that much greater clarity is needed to guide the biopharmaceutical sector that serves the nation’s (and to some extent the world’s) health and economy. It is in this context that the National Academies of Sciences, Engineering, and Medicine conducted this study at the request of multiple sponsors.6

An ad hoc committee7 composed of individuals with diverse professional and personal backgrounds (biographical information is provided in Appendix E) examined the structural, policy, economic, and ethical factors that influence the cost of prescription medicines. The study was focused on developing and issuing findings and recommendations for policy actions that address the fundamental tension between affordability and availability of medicines (as noted in Box S-1).

The committee held five multi-day meetings, three of which included sessions open to the public, with the other two having closed deliberations. Numerous subgroup discussions within the committee were conducted via teleconference and email exchanges. Various individuals who presented information and engaged in discussions with the committee during the public sessions are listed in Appendix D. Additionally, various stakeholders offered comments during the public sessions. Over the course of the study, letters and position statements from individuals and organizations were received, each of which was carefully considered. Several thousand pages of publicly available documents pertaining to the issue were also reviewed.

Finally, a note on how analysis was conducted for this report. There were numerous instances where the materials used by the committee cited a direct connection to—or financial support from—participants in the biopharmaceutical sector. The same was true of many persons making

___________________

6 The study sponsors were the American College of Physicians, Breast Cancer Research Foundation, Burroughs Wellcome Fund, California Health Care Foundation, The Commonwealth Fund, Laura and John Arnold Foundation, Milbank Memorial Fund, and the Presidents’ Committee of the National Academies of Sciences, Engineering, and Medicine.

7 The committee originally contained 18 members. One member died during the course of this study; another member resigned for personal reasons.

presentations in the public stakeholder sessions. In each instance, the committee resolved conflicting and contradicting information to the best of its ability, with the understanding that the presentations and publications it accessed may have reflected the particular points of view of the authors or presenters or their organizations. No materials were discarded from consideration based purely on financial or other connections that their authors may have had with participants in the biopharmaceutical sector or other interested parties; however, this circumstance was considered in interpreting such materials.