1

Introduction1

The National Academies of Sciences, Engineering, and Medicine’s (the National Academies’) Roundtable on Population Health Improvement has been focused on the subject of dependable resources for population health since its inception in 2013,2 said Sanne Magnan, adjunct assistant professor of medicine at the University of Minnesota. The roundtable’s vision is of a strong, healthful, and productive society that cultivates human capital and equal opportunity. This vision rests on the recognition that outcomes such as improved life expectancy, quality of life, and health for all are shaped by interdependent social, economic, environmental, genetic, behavioral, and health care factors, and that achieving this vision will require national and community-based policies and dependable resources. A range of roundtable activities have focused on resources, including workshops and their proceedings (see, for example, IOM, 2014; NASEM, 2018), individually authored perspective papers (see, for example, Hester and Stange, 2014), and a working group (next paragraphs). Continuing in this direction, on December 7, 2017, the roundtable convened the workshop, hosted by

___________________

1 The planning committee’s role was limited to planning the workshop, and the Proceedings of a Workshop was prepared by the workshop rapporteur as a factual summary of what occurred at the workshop. Statements, recommendations, and opinions expressed are those of individual presenters and participants, and are not necessarily endorsed or verified by the National Academies of Sciences, Engineering, and Medicine, and they should not be construed as reflecting any group consensus.

2 The definition of population health used by the roundtable is available at https://nas.edu/pophealthrt (accessed September 10, 2018).

The California Endowment in Oakland, California, to explore tax policy as it relates to advancing population health, health equity, and economic prosperity.

As background for the workshop discussions, Bobby Milstein, a director of ReThink Health and the leader of the Roundtable Working Group on Resources, explained that the working group began by acknowledging that “to get better results, we are going to have to invest differently.” It is imperative that the economic incentives that support population health are changed and the flow of resources shifted, he said. Milstein referred participants to the Institute of Medicine (IOM)3 consensus study report For the Public’s Health: Investing in a Healthier Future, which he said established the clear stance that resources matter, both at the individual level and in terms of the investments that are capable of advancing health programs, policies, and practices (IOM, 2012).

Through the roundtable, the resources working group strives to explain the complicated terrain of financing, investments, and resource allocation; elevate exemplars of redirecting resources; and enhance fiscal fluency about the intersection of health policy and investment decisions. This workshop, titled Exploring Tax Policy to Advance Population Health, Health Equity, and Economic Prosperity, was designed around the objectives outlined above and builds on a 2016 roundtable workshop on sustainable (i.e., dependable) financial structures (e.g., mechanisms through which funds are allocated) for population health (NASEM, 2018). Milstein noted that at the 2016 workshop a menu of major sources of financing for population health initiatives was discussed (see Table 1-1), and this workshop highlights one of the streams of sustainable financing: public revenues, including taxes and tax credits.

WORKSHOP OBJECTIVES

The agenda for this workshop was developed by an independent planning committee, which included Ella Auchincloss, Kathy Gerwig, Alan Gilbert, Jeremie Greer, James Hester, Giridhar Mallya, and Milstein. (The planning committee’s Statement of Task is provided in Box 1-1.) The goals of the workshop, as explained by Milstein, were to help participants understand what has been done and what might be done next with regard to tax policies that affect population health, and to enhance the fiscal fluency of participants so they might become more confident proponents

___________________

3 As of March 2016, the Health and Medicine Division of the National Academies of Sciences, Engineering, and Medicine continues the consensus studies and convening activities previously carried out by the Institute of Medicine (IOM). The IOM name is used to refer to publications issued prior to July 2015.

TABLE 1-1 Menu of Financing Structures for Population Health Initiatives

| Type of Resource | Financing Stream |

|---|---|

| Seed funding | Grants |

| Debt and working capital | Bonds, loans, pay-for-success contracts |

| Sustainable financing | Reimbursement, reinvestment, anchor institutions, public revenues (taxes, tax credits), appropriations, mandates, the private market |

SOURCES: Milstein presentation, December 7, 2017, adapted from Becker, 2017, and NASEM, 2018. Reproduced with permission from The Rippel Foundation. The Rippel Foundation is not providing an endorsement of the content within this presentation and provides permission for this to be used for non-commercial purposes only.

of tax policy that advances population health. Specifically, the workshop was designed to meet the following objectives:

- Explain how tax policies have been used to channel resources and shape economic incentives that affect population health, with

-

attention to the basic features of taxes (such as on tobacco), as well as tax breaks (such as for low-income housing);4

- Examine several examples to discuss how tax policies can be designed both to attract willing investors and to advance a range of health and economic goals, while also noting any insights about pitfalls to avoid; and

- Equip each participant with the basic knowledge and language to further explore how to advance tax policy in favor of health and well-being across sectors (e.g., education, housing, economic development).

Milstein emphasized that the workshop was not designed to address or intended to consider the federal tax legislation that was pending in Congress at the time. Rather, the discussions were intended to transcend the current legislative landscape, and move beyond the positions of political parties, to consider how tax policies have been designed (in terms of their direct or indirect effects on health) and what more could be done to support population health.

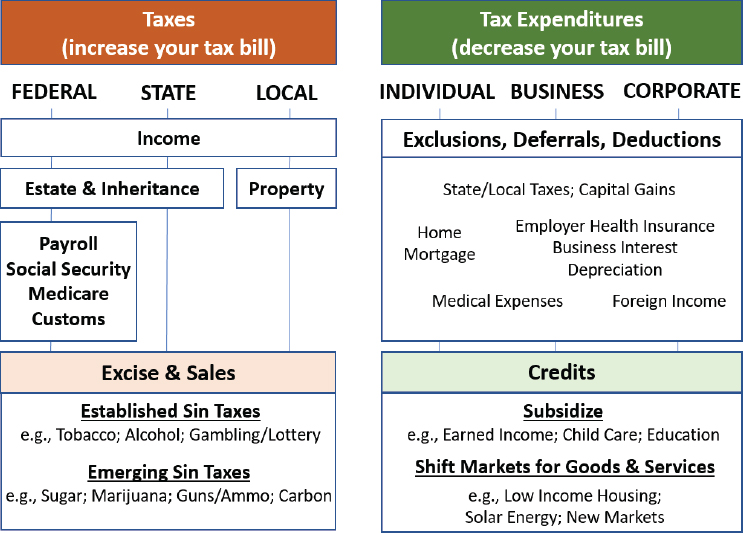

To aid the discussions, Milstein presented a typology of tax policy options relevant to the workshop objectives (see Figure 1-1). The options include taxes, which increase individual or corporate tax bills and generate revenue for a government to allocate, as well as tax expenditures (e.g., exclusions, deferrals, deductions, and credits),5 which decrease tax bills and shape the economic incentives to achieve a goal. Regardless of these distinctions, all tax policy requires judgments and trade-offs, and is inherently controversial, he said. Guiding principles for a dialogue about tax policy could include considering how effective the policies are, how predictable their flow of resources is, and how simple and fair they are.

ORGANIZATION OF THE WORKSHOP AND PROCEEDINGS

The planning committee intended this workshop to be interactive. Using Poll Everywhere (PollEv.com) to engage both in-person and web-cast attendees, Milstein surveyed participants’ comfort level with the subject matter at the start of the workshop. In response to the question: “How much expertise do you have in designing tax policies to enhance population health and well-being?,” about half of the participants responding

___________________

4 To provide a common framework for discussion, a typology of tax policy is offered on page 1 of the attendee packet.

5 For definitions of common terms used in tax policy, see, for example, https://www.cbpp.org/research/policy-basics-tax-exemptions-deductions-and-credits (accessed September 10, 2018).

SOURCES: Milstein presentation, December 7, 2017. Reproduced with permission from The Rippel Foundation (Menu of Tax Policy Options, December 7, 2017). The Rippel Foundation is not providing an endorsement of the content within this presentation and provides permission for this to be used for non-commercial purposes only.

categorized themselves as “beginners.” One-quarter of respondents felt they had a basic level of expertise; about one-quarter felt they were of “intermediate-level” expertise or were “proficient” in this area. When prompted to respond regarding how confidently they could act as a proponent of sound tax policy for population health and health equity, the majority of respondents said they were generally confident and willing to learn and try. Several were “extremely confident,” and about one-third were “not very confident.”6

The majority of expert presentations were conversational in style, directly engaging participants. The first session of the workshop provided an overview of the basics of tax policy, which was followed by

___________________

6 Responses to the second question were reported by Milstein based on a show of hands, due to technical issues with the polling website.

a discussion of the fiscal environment of state budgets (see Chapter 2). The discussion then moved to opportunities for shaping incentives and creating a pipeline of resources for population health purposes, with two panels focused on sin taxes and tax credits (see Chapter 3). Over the lunch break, a moderated Twitter chat kept the conversation flowing.7 In the afternoon, participants broke into small groups to propose hypothetical tax policies to support a statewide wellness fund (or other broad-based funding approach) to improve population health in the fictional state of “Ourlandia” (see Chapter 4). The final discussion session provided case examples of population health-related tax policy in the current environment (see Chapter 5). The workshop concluded with observations and reflections shared by speakers and participants (see Chapter 6).

___________________

7 An overview of the #PopHealthRT lunchtime Twitter chat is available at http://nationalacademies.org/hmd/Activities/PublicHealth/PopulationHealthImprovementRT/2017-DEC-07/Twitter-Chat.aspx (accessed February 2, 2018).