The breadth of the possibilities stemming from the translation of biological knowledge into meaningful applications is substantial. This chapter reviews the resources that the United States devotes to investments in this space and considers how one might measure the bioeconomy and assess its economic contributions to the larger U.S. economy. The chapter begins by characterizing the bioeconomy for economic analysis by examining the elements that set it apart from other sectors and reviewing the divergent approaches used to study the bioeconomy. It then addresses how to measure the bioeconomy by identifying approaches to valuing the bioeconomy and intangible assets, ultimately delineating a path forward.

Several factors make it difficult to measure the contribution of the bioeconomy to the overall economy: (1) definitions of the bioeconomy vary substantially; (2) the bioeconomy is tied to both basic science and its commercialization (innovation), suggesting that a broad range of activities is relevant to assessing the value of the bioeconomy; and (3) data on the bioeconomy have substantial gaps. Furthermore, it is difficult to define the economic boundaries of the bioeconomy, both because there are reasonably different ways to conceptualize the bioeconomy (see the discussion in Chapter 2) and because data identifying aspects of the bioeconomy are difficult to capture (e.g., identifying the fraction of a manufactured chemical that is produced through a biosynthetic pathway; see Chapter 2).

Concepts used to value the bioeconomy present additional challenges. Social welfare analysis, which attempts to quantify benefits to producers (e.g., economic rents1) and consumers (e.g., based on the difference between willingness to pay and price), is a particularly demanding approach to computing value and not ideal for valuing a sector as diffuse and challenging to measure as the bioeconomy. One could instead value the bioeconomy as the sum of the private values or value added of all

___________________

1 The extra amount earned by a resource (e.g., land, capital, or labor) by virtue of its present use.

firms active in the sector, thus revealing the contribution of their production to overall gross domestic product (GDP).2 In practice, however, even this approach is difficult to implement, as many of the firms that operate in this sector are diversified (e.g., Dow Chemical), and it is not possible to determine which fraction of total firm value is attributable to the bioeconomic aspects of such firms. In addition, many firms are privately owned (i.e., they are not public corporations), and their market value cannot be observed. Furthermore, focusing on private values where available (e.g., the sum of firm market values) excludes the considerable value of public-sector investments in university research and development (R&D) that supports the bioeconomy. For example, such an approach would exclude important public values associated with the bioeconomy, such as the potential benefits associated with a reduction in petroleum-based production.

Individual willingness to pay versus price issues aside, economic estimates of the value of the bioeconomy are limited in that they may not appreciate the full social value of its contributions. For example, if gasoline sales are replaced by an equal amount of biofuel sales, the two could show up in GDP calculations as equivalent, thus failing to capture the long-term environmental value to society.

CHARACTERIZING THE BIOECONOMY FOR ECONOMIC ANALYSIS

What Sets the Sector Apart?

One of the things that sets the bioeconomy apart is that it is not a discrete economic sector3 like the production of automobiles or ketchup. As a result, no single approach or set of indictors provides a complete picture of the bioeconomy. Instead, the bioeconomy consists of a collection of products and services whose production is enabled by a set of related technologies (as delineated in the committee’s definition and described in the landscape in Chapter 2) and that yields both inputs to and products

___________________

2 GDP is a broad measure of a nation’s overall economic activity. It may be viewed as the sum of gross value added (GVA) production across all sectors in the economy. Alternatively, it may be viewed as the value of all finished goods and services produced within a country’s borders. In practice, there also are reconciling items in the accounting and issues regarding the prices that are used when summing value added across industries versus summing all final expenditures; for more detailed definitions, see https://www.bea.gov/help/glossary?title_1=All&title=GDP or https://stats.oecd.org/glossary/detail.asp?ID=1163.

3 In this context, and in much of the report, the term “sector” is being used to describe a collection of activities that form part of the economy.

TABLE 3-1 Organizing Framework for Sectors and Technologies

| Sectoral Impact | |||

|---|---|---|---|

| Narrow | Broad | ||

| Applications within sector | Selective | Traditional sectors (e.g., ketchup production) | Selective yet broad impact (e.g., CRISPR; bioeconomy tools) |

| Pervasive | Sector-specific (e.g., hybridization of corn) | General-purpose technologies (e.g., electricity, information technology, artificial intelligence) | |

SOURCE: Scott Stern, Massachusetts Institute of Technology, presentation to the committee, May 2, 2019.

of a range of economic sectors. To help provide an approach for characterizing the bioeconomy as a sector for economic analysis, Table 3-1 presents a typology of economic sectors and technologies. The typology distinguishes sectors on two dimensions, one (the columns of the table) that considers the breadth of a technology’s impact across the various sectors of the economy, and a second (the rows of the table) that considers the scope of the technology’s impact within each sector it affects. The columns distinguish between technologies that have a narrow impact on a small number of sectors, such as the technologies required to make ketchup, which impact mainly ketchup manufacturing, or hybrid corn, which affect mainly agriculture, and those that have a broad impact, such as electricity, information technologies, and applications rooted in the biosciences, which affect production processes across a wide range of sectors. The rows of Table 3-1 distinguish between applications that have a selective impact within each sector and those that have a pervasive impact in the sectors they affect. Whereas the bioeconomy has a selective impact within each sector it affects—for example, it affects parts of the production processes in most of the sectors in which it operates (e.g., the design of large-molecule drugs), general-purpose technologies, such as electricity and information technologies, have a pervasive impact on all aspects of the sectors they affect.4

According to this framework, the bioeconomy is a selective yet broad sector of the economy. It is “broad” because the technologies of the bioeconomy are likely to affect a wide range of industries, including those

___________________

4 General-purpose technologies (GPTs; e.g., electricity, computers and communication technologies, artificial intelligence tools) are applicable in just about any sector of the economy. The concept of GPTs was introduced in the literature on the economics of growth by Breshnahan and Trajtenberg (1995).

associated with the production of food, fuel, and medicine, among others, but these technologies are not likely to displace all aspects of those industries. Additionally, as a result of innovation, the bioeconomy’s outputs have benefits over and above the value of the resources devoted to producing them.

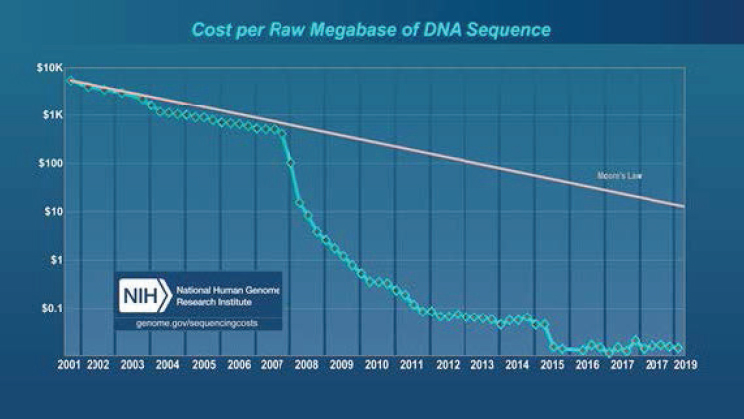

Many scientific breakthroughs associated with the bioeconomy (e.g., gene sequencing and gene editing) are sector-specific. They are “inventions in the method of invention” that create a situation in which biotechnology is a field subject to innovation in its processes (research) and a field whose conduct of research yields innovations for downstream use—that is, for consumers or other industries. The sector’s upstream research inventions have been complemented by advances in computing and data analytic technologies that have led to, for example, dramatic declines in the cost of gene sequencing (see Figure 3-1, which shows that costs are declining faster than the rate at which Moore’s Law predicted cost decreases in electronics) and shorter experimentation times in genomic research.

In budgets, however, personnel and other indirect costs typically loom many times larger than capital operating costs, suggesting that total upstream R&D costs may not be lower than they once were. The Biomedical Research and Development Price Index, which was developed by the Bureau of Economic Analysis (BEA) for the National Institutes of Health (NIH) to annually capture current personnel and materials costs, grows about 1 percent per year faster than economy-wide price measures, such as the Consumer Price Index or GDP price index.5

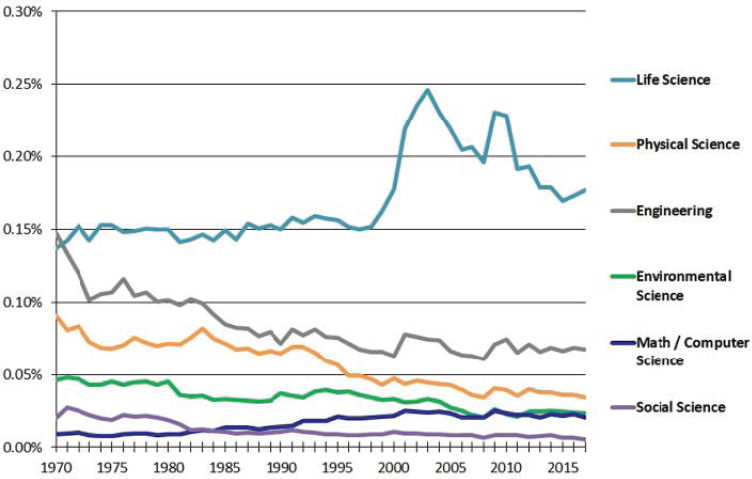

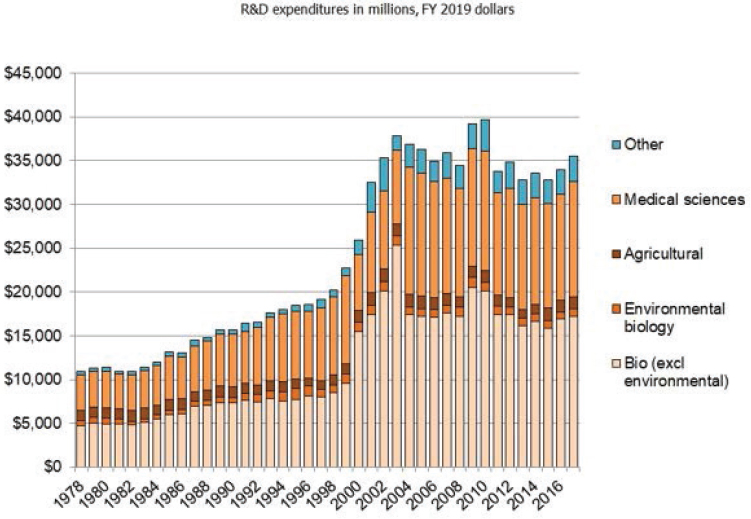

In part because the downstream payoffs to biotechnology are potentially large, the bioeconomy is characterized by large investments in basic and applied research that are funded by the federal government (much of this research is performed at universities or public research laboratories). Public outlays for “R&D in the life sciences” have historically been substantially larger than the outlays for other fields of science. An important function of the federal government not included in conventional R&D statistics is the cost of establishing and managing genomic and other data repositories (see below). The public availability of this information

___________________

5 See https://officeofbudget.od.nih.gov/gbipriceindexes.html for the Biomedical Research and Development Price Index, which begins in 1950 and is available through the most recent year. Note that this index is built from detailed components and captures quality change in its components in two ways (Holloway and Reeb, 1989). First, the materials costs are built from Consumer Price Indexes and producer price indexes that are designed to be quality-adjusted. Second, to the extent that wages by detailed personnel component (e.g., faculty rank and federal General Schedule and step classifications) reflect differences in employee quality (i.e., marginal productivity), they also contribute to the index’s control for quality change.

has aided the creation of new biobased products and processes for commercial gain while furthering scientific research.

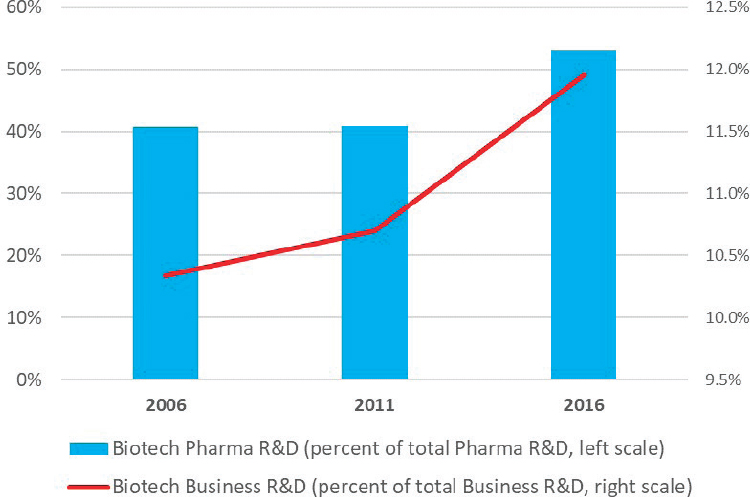

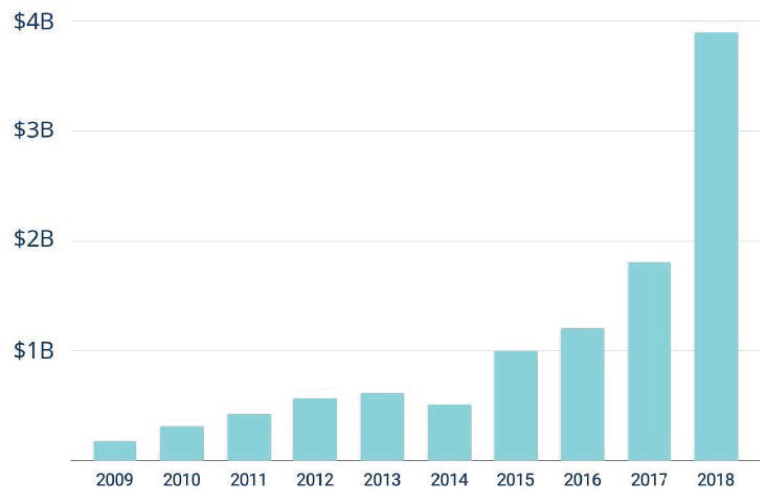

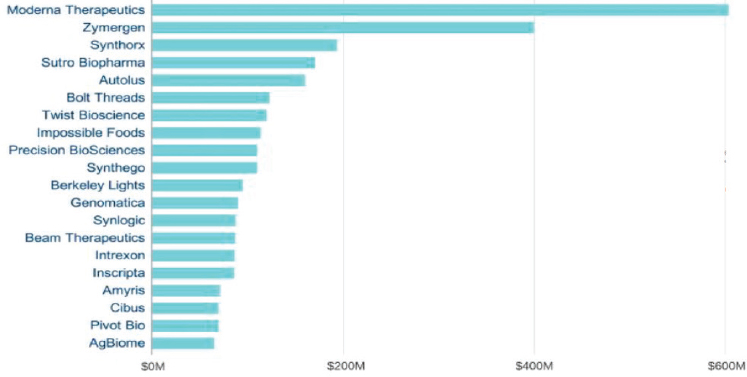

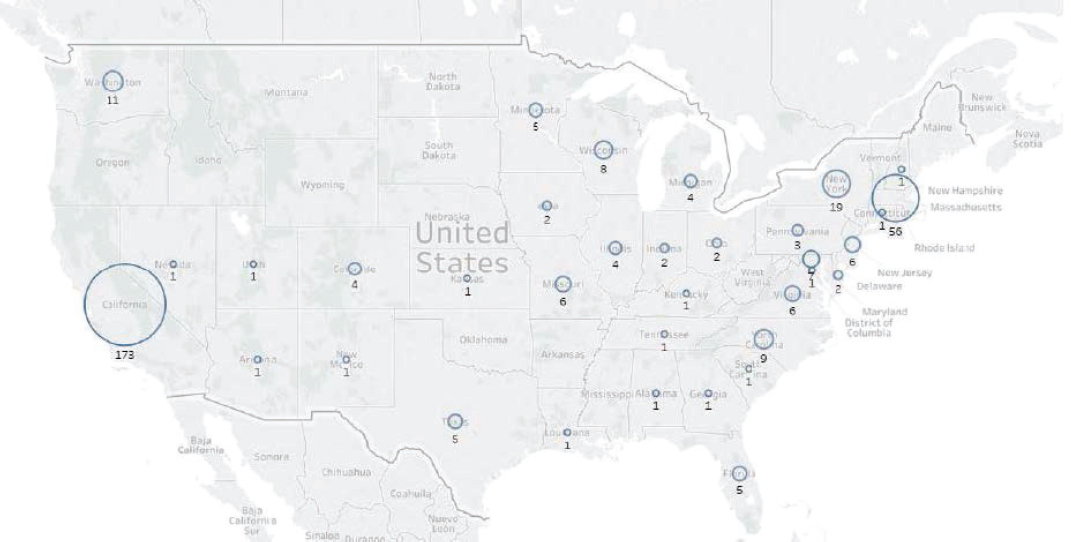

Business R&D investments in the bioeconomy, particularly for the clinical trials stage of new drug development, loom large relative to R&D conducted by other industry sectors. Venture capitalists have recently geared up their investments in start-ups with an edge in synthetic biology. Although these investments are still small (and small in relation to all venture investments), this appears to be a fast-growing segment of the bioeconomy.

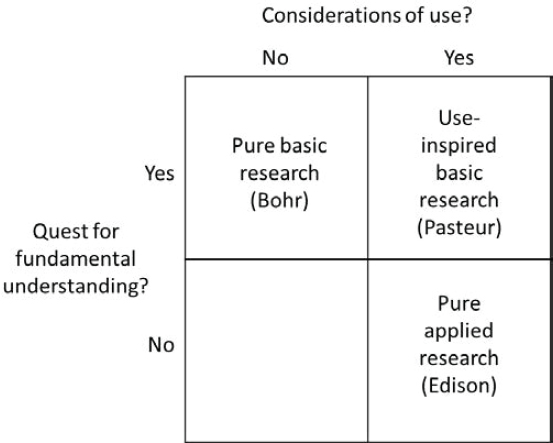

Two interrelated characteristics of the bioeconomy flow from the considerable size of its science base and the economic nature of its commercial applications. The first is that the applicability of a sector’s science base (measured in terms of cited research articles in patents) is “close” to its commercial innovations. That is, the sector falls in “Pasteur’s quadrant,” meaning that it can be categorized as “use-inspired basic research,” referring to the classification system for research developed by Donald Stokes (1997) (see Figure 3-2). In his work, Stokes divides research into three classes on the basis of whether the research has use considerations (purely applied research, such as that conducted by Thomas Edison) or is simply a quest for fundamental understanding (purely basic research, such as that conducted by Niels Bohr), or both (use-inspired basic research, such

as that conducted by Louis Pasteur) (Stokes, 1997).6 This should not be surprising given the sector’s use of breakthrough research that provides new tools that further advance commercial gain.

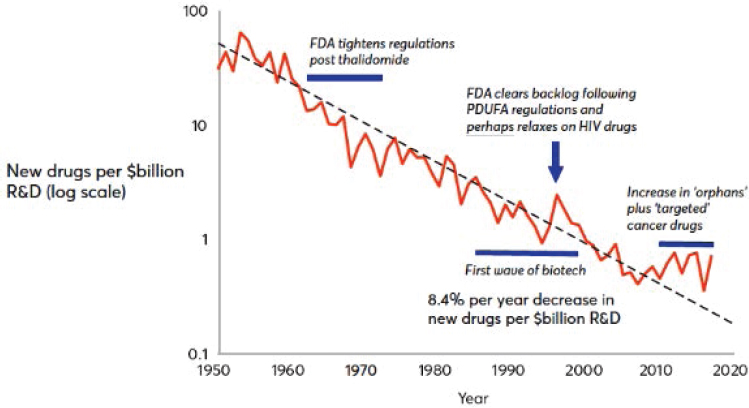

Second, the outcomes of many investments in bioeconomy innovation are highly regulated, as their potential for manipulating human, animal, and plant genetic material is closely connected with human health and the condition of environmental ecosystems. As a result, the bioeconomy’s commercial innovation process is increasingly costly in relative terms. Firms throughout the larger economy are undergoing digital transformation in their business platforms and marketing processes, and those in sectors with containerized digital platforms7 can not only implement

___________________

6 The extent to which scientific advances support marketplace inventions is difficult to quantify, but this statement is generally consistent with theories that emphasize fruitful connections between certain types of patenting and prior scientific inquiry. Ahmadpoor and Jones (2017) devised a metric for the intellectual distance between patentable inventions and prior research to study the relationship between patents and scientific advances. The estimated distance varied by discipline, with multicellular living organisms and computer science having the shortest distance, and nanotechnology and biochemistry/molecular biology close behind (biotechnology was not identified separately).

7 A containerized digital platform is a flexible, portable platform that allows for separating out the application’s architecture into isolated environments that can be combined and organized without affecting the other elements of the application. For more information, see https://learn.g2.com/trends/containerization.

an innovation in back-end processes in nanoseconds but also conduct A/B tests on customers at little cost, regulations permitting.8 Thus, there may be a growing relative cost premium for economic competencies for many types of firms in the bioeconomy compared with nonbioeconomy firms. Economic competencies are a broad category of intangible assets that include firms’ go-to-market capabilities; see Annex 3-2 for further information on these assets.

These sector-specific aspects of the bioeconomy—its diffusion across industries, its potential for large societal benefits, its large science base and reliance on data-intensive research, the closeness of commercial innovation to a science base, and costs of commercial innovation that are fractions of large organizations’ R&D budgets—make it difficult to track the bioeconomy’s contribution to the economy and, as a result, assess its prospects for future innovation.

Official economic statistics are classified primarily by industry. This classification, as described above, is especially unhelpful for delineating much of the bioeconomy because its impact is selective within industry, and it operates across a wide array of industries. Furthermore, as noted earlier, official statistics cannot be used to translate the impact of the bioeconomy’s innovations on social welfare as a result of the shortcomings of the economic estimates reflected in official statistics.9 Finally, as spelled out in more detail below, the standard indicators used by science and innovation policy analysts do not include R&D in bioengineering and biomedical engineering in statistics on government R&D spending on life sciences or on business R&D in biotechnology; it is also likely that business investments in the building of private microbial databases are not included in biotechnology R&D.

Studies of the Bioeconomy: One Economy, Divergent Approaches

This report defines the U.S. bioeconomy as economic activity that is driven by research and innovation in the life sciences and biotechnology,

___________________

8 A/B testing is a way to compare two versions of a single variable, typically by testing a subject’s response to variant A against variant B, and determining which of the two variants is more effective. See Wikipedia, “A/B testing,” for more information (https://en.wikipedia.org/wiki/A/B_testing).

9 Although the price index was constructed by a researcher at BEA, the government agency that issues the national accounts for the United States, the work currently is not included in headline real GDP. Thus, one cannot look to official statistics on real output to “see” the welfare impacts of innovations in pharmaceuticals, although in time, BEA’s initiative to build a health care “satellite” account may prove useful in this regard. Satellite accounts are discussed later in this chapter.

and that is enabled by technological advances in engineering and in computing and information sciences (see Chapter 1). Although existing studies do not generally align with this definition, current approaches to valuing the bioeconomy tend to fall into two broad categories. Some focus on industrial activity, aiming to detect how biobased activity may be substituting for petroleum-based activity (or promoting sustainability more broadly). Identified activities typically include products for downstream industrial use (including crops). Accounting for the value created in downstream use and industry input linkages is typically an important component of these studies. The second category consists of approaches that focus on biomedical activity and entail studying how breakthroughs in the biological sciences and biotechnology feed through to innovations in the pharmaceutical, medical device, and health care industries (as a whole or in part). Studies with this focus tend to look broadly at the innovation ecosystem, inclusive of the significant research in the biological sciences conducted in government and university laboratories.

Why such different approaches? The innovation ecosystem would appear to be as important for analyzing the drivers of bioindustrial activity as it is for analyzing biomedical activity. Enabling science and technology may be featured less in the former because measured R&D spending in the relevant industries does not loom as large as it does in the biomedical industries. The go-to-market costs of biopharmaceuticals include very costly clinical trials, and these trials are counted in R&D because they involve scientific experimentation and discovery. For biotechnology companies working to develop new microbial products for industrial use, the costs of testing and obtaining approval for new commercial applications are not commonly included in R&D because while these steps do require testing and experimentation, they are not counted as part of the basic research that led to the product’s creation. It is also possible that emerging companies in the biotechnology space (including synthetic biology companies) escape the statistical net cast by R&D surveys because they are small and/or improperly sampled.10 Still another possibility is that some companies’ new-product discovery processes involve mainly modifying existing (or open-source) software tools to access microbial data. The creation and use of tools based on known methods, including the added

___________________

10 The R&D survey conducted by the U.S. Census Bureau on behalf of the U.S. National Science Foundation has traditionally collected data on firms with five or more employees. Beginning with the survey for 2017 (unlikely to be published until 2020), R&D data will be collected from businesses with one or more employees.

value due to data processing that results from using existing tools, falls outside the scope of R&D surveys.11

All of these possibilities suggest that a targeted and specialized framework for analyzing the bioeconomy’s innovation ecosystem is required—an approach that both looks broadly at investments in innovation (including investments in existing data analytic tools) and accounts for all bioeconomy-specific new product investments (e.g., improvements in the efficiency of regulatory testing). To encompass the full bioeconomy, this framework would capture data-driven innovations in health care that are intended to improve treatments (including drugs) on the basis of outcomes achieved relative to costs invested in designing the treatment. Finally, the framework would recognize that existing organizational structures do readily accommodate change, inclusive of data-driven approaches to revamping existing processes (from selection of patients for clinical trials to patient care itself). This implies recognizing that investments in new models are needed for organizations to execute data-driven plans, and that a period of time may elapse before the fruits of these changes will be seen in outcome data.12

MEASURING THE BIOECONOMY: APPROACHES FOR VALUATION AND IDENTIFICATION OF BIOECONOMY INTANGIBLE ASSETS

This section first summarizes existing approaches to studying innovation, focusing on those that attempt to place investments in knowledge, both scientific and commercial, at the center of the process. Second, in light of this discussion, the economic activities encompassed by the committee’s definition of the bioeconomy, which include knowledge production as well as the tangible final and intermediate products produced by the bioeconomy, are described. Third, existing approaches and studies addressing measurement of the industrial bioeconomy are reviewed. Fourth, a range of estimates for valuing the bioeconomy, which potentially

___________________

11 With regard to software and Internet applications, the R&D survey instructs respondents to include “only [those] activities with an element of uncertainty and that are intended to close knowledge gaps and meet scientific and technological needs” and to exclude “creation of new software based on known methods and applications.” There are no instructions regarding the processing of data.

12 This is in fact an argument made now for the case of artificial intelligence and its impact on general business productivity, but note that this topic is both frequently discussed in management consultancy newsletters and reports in the context of heath care organizations (e.g., Close et al., 2015) and widely acknowledged as a characteristic of innovation episodes (e.g., see the discussion in Brynjolfsson et al., 2018).

includes aspects of both the biomedical economy and intangible assets for the entire bioeconomy, are articulated.

Existing Approaches to Valuing the Bioeconomy

At the broadest level, the bioeconomy includes the economic activity stemming from advances in the life sciences. But while the broad scope of the bioeconomy is widely acknowledged, the bulk of academic and policy analysis has focused on biomedical activity and the impact of its innovations on human health (Hermans et al., 2007). By contrast, studies of bioindustrial activity attempt to capture the size and reach of biobased production activity (excluding biomedical activity). Whereas the previous subsections have reviewed general approaches to studying innovation, including measuring inputs to innovation, this subsection reviews approaches to measuring and valuing the agricultural and industrial bioeconomy (hereafter, referred to as industrial for the sake of brevity). Innovation outcomes in biopharma are discussed later in the chapter.

Broadly speaking, there are three approaches to measuring biobased production. Each begins by delineating the bioeconomy as a subsector of the total economy, and the most straightforward approach is to use the gross value added (GVA) of the delineated subsectors relative to total GDP (as raised earlier). A well-known study (Carlson, 2016) points out the limitations of this approach, suggesting that a delineation based on detailed products is more appropriate for the bioeconomy.

A second approach uses input-output (I-O) analysis to assess how the industry sectors included in the bioeconomy interact with other industry sectors in the broader economy.13 This analysis can be conducted at the detailed product level, where the production of a particular “commodity” is connected to other economic activities, including impacts on final demand and/or industry value added. A step in this analysis can be the estimation of GVA for a delineated set of products. Although this approach narrows the estimate for these products (GVA for manufactured products is less than half of the gross value of the products), much of the industrial bioeconomy consists of physical products or industrial materials that are distributed to customers via intermediaries (retailers, wholesalers, transporters) whose margins are included in the final price and ultimate value of economic activity generated by biobased production. This suggests that the bottom line of the GVA approach—measurement of GVA in bio-producing sectors—is a partial impact that does not account

___________________

13 I-O analysis is a form of macroeconomic analysis based on the interdependencies between economic sectors or industries.

fully for the interdependencies between industries, both backward and forward.

I-O analysis yields two levels of “multipliers” beyond the direct value of primary producer activity. These multipliers may be expressed relative to total final demand or relative to GVA of an industry. That is, the analysis calculates the effects of an extra unit of output in an industry on activity in other industries due to their interdependencies. As typically stated, the first multiplier, expressed relative to GVA of an industry, is calculated as the intermediate demand necessary to produce an additional dollar of value added for a particular type of product: it captures indirect effects via supplying industries to the industry producing the product (“backward linkages”) plus those involved in the chain that supplies the product to ultimate users (“forward linkage”). This is called a type I multiplier. The second multiplier considers induced effects of the household and other final spending that results from the sum of direct and indirect effects (a type II multiplier).14 Both multipliers rest on the assumption that inputs to an industry’s production of output follow a fixed proportional relationship; this assumption is typically viewed as not very stringent for short-run analysis.15

Popkin and Kobe (2010) studied the major sectors of the U.S. economy, calculating type I multipliers for 15 major industry sectors, and found that the type I multipliers for the manufacturing, information, and agriculture sectors were the largest, while those for finance, retail trade, and wholesale trade were the smallest. Professional services, education, and government were below the median. Many key products of the bioeconomy are in high-multiplier industries (often called “upstream” industries, such as feedstocks), whereas others are in the low-multiplier ones (R&D services), suggesting that the diffuse nature of the industrial bioeconomy lends itself to an I-O approach.

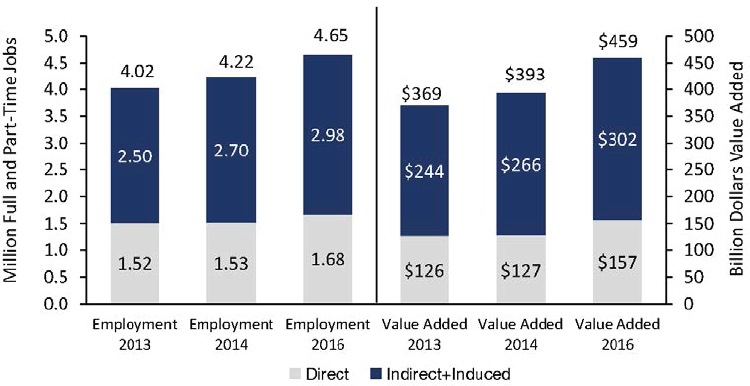

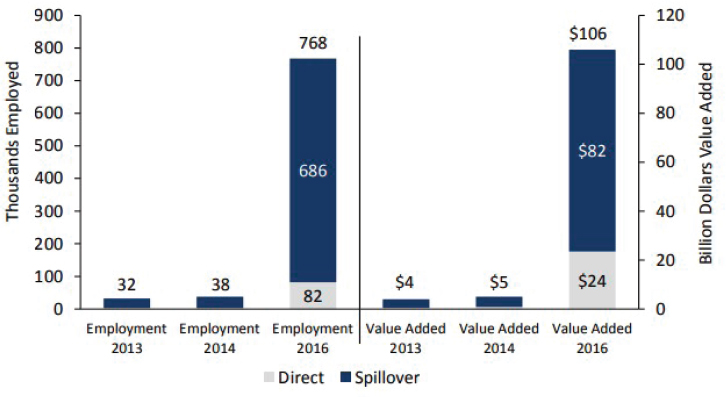

A recent study commissioned by the U.S. Department of Agriculture (USDA) (Daystar et al., 2018) entailed an I-O analysis of industries covered by USDA’s BioPreferred program. Although the components of that study included in this analysis do not align perfectly with the committee’s tech-driven bioeconomy definition (see Chapter 1), the study’s summary results reflect the potential size of the indirect and induced effects relative to the value added of important segments of the industrial bioeconomy.

___________________

14 For further information regarding I-O modeling, see Miller and Blair (2009).

15 Biobased production uses different inputs than petroleum-based production, however, and when these activities occur within the same industry, the I-O system’s data will need to be augmented to reflect the appropriate inputs to each type of production. Failing to do so is not a first-order concern for calculating impacts in value terms (i.e., in dollars of value added), but for certain questions, such as how much carbon has been saved from the shift to biobased production, the validity of the underlying I-O relationships is relevant.

All told, those results suggest that the bioeconomy has a rather large type II multiplier (see Figure 3-3). The ratio of the total effect on value added to “direct” value added in USDA’s BioPreferred industries was 2.92 in 2016. Referring to the stacked bar on the far right of Figure 3-3, the ratio of $459 to $157 is 2.92.

A third approach to valuing the U.S. bioeconomy is computable general equilibrium (CGE) analysis, which is grounded in formal economic theory.16 This approach models the functioning of an economic system as a whole and focuses on the equilibrating role of the price mechanism in multiple markets (labor, capital, product). Models are usually calibrated to suit the analysis of an aspect of economic activity (e.g., energy consumption and climate change), and rely on consensus values for “deep,” or fundamental, economic parameters (i.e., households’ discount rate or the efficiency of firms’ production processes). The models simulate economic outcomes under alternative assumptions and initial conditions. CGE models have proved fruitful in the analysis of climate change, where supplying a range of values for assumptions (e.g., for consumers’ price sensitivity to energy prices or for the substitutability of energy for other factors of production) is not unrealistic (see the use of such a model in the

___________________

16 “CGE models are simulations that combine the abstract general equilibrium structure formalized by Arrow and Debreu (1954) with realistic economic data to solve numerically for the levels of supply, demand and price that support equilibrium across a specified set of markets.” See www.rri.wvu.edu/CGECourse/Sue%20Wing.pdf and Arrow and Debreu (1954).

Fourth National Climate Assessment [USGCRP, 2018]). Some studies have analyzed the benefits to the environment of shifting to biobased industrial activity using stylized general equilibrium models (often in conjunction with results from an I-O analysis, as in Daystar et al., 2018), but these studies have tended to focus on traditionally defined sectors (e.g., all of agriculture, forestry, and wood products).

Selected studies that use these approaches are reviewed in Annex 3-1 as illustrative examples.

Identifying Intangible Assets

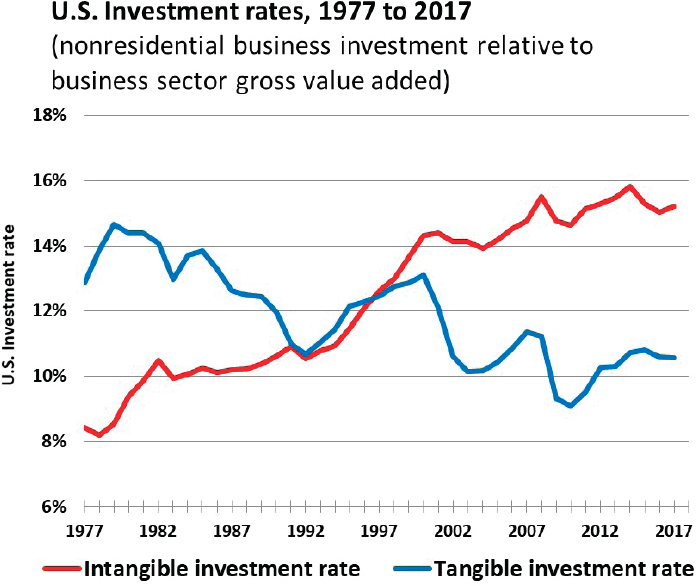

Existing approaches to measuring the bioeconomy need to account fully for investments in research, methods of invention, and data-driven commercial innovation. This involves recognizing that successfully developing and commercializing an innovation requires many ingredients other than scientific proof of concept. As described in Box 3-1, innovation requires market insights, data, and plans; product designs and market testing; branding; licenses; and human resources—all of which converge in business models and business processes. Spending on all of these components is included under the broad umbrella of intangible investment. Intangible investment has emerged as a key value driver in today’s knowledge economy and a key factor in competitive advantage for firms.17 A widely used framework for studying intangible investment is summarized in Annex 3-2.

The framework set out in Annex 3-2 is suitable for valuing intangible assets that are common to most companies in the U.S. economy, such as intellectual property, brand equity, software programs, and business process know-how, but two aspects of the framework require further development for in-depth analysis of the bioeconomy. The first is the fact that the public sector also creates and holds intangible assets, and it does so on behalf of society more broadly. Research on public intangibles is more limited than that on company intangibles, but the framework set out in Annex 3-2 can be adapted to the public sector.18 The second is that the adaptation of the framework in Annex 3-2 to both the bioeconomy and the public sector involves putting the spotlight on information assets, or data.

In the public context, it is necessary to account for publicly collected data that are curated and issued for public use. Such assets loom large in

___________________

17 For an accessible, recent review of this development in the context of the whole economy, see Haskel and Westlake (2017); for earlier reviews, see Corrado and Hulten (2010), NRC (2009), and OECD (2013). For developments at the firm level, see Lev (2001) and Lev and Gu (2016).

18 See Corrado et al. (2017) for a systematic review and adaptation for public-sector activities and expenditures.

many countries, and some public-use data spur economic development (as well as further research or cultural enrichment). For example, the U.S. Census Bureau’s 1991 release of the Topologically Integrated Geographic Encoding and Referencing dataset is commonly credited with bootstrapping the nation’s industries that develop, make, and use products based on geospatial data. Similarly, the public release of data from the National Aeronautics and Space Administration’s Landsat satellite mapping program had a documented positive impact on the productivity of gold exploration projects (Nagaraj, 2018).

Although there is no one-to-one correspondence between the users of public biological data and particular industries of the U.S. economy, it is generally agreed that public biological data, especially digital data containing genomic sequences (digital sequence information, or DSI), have spurred commercial biotechnology-based economic activity.

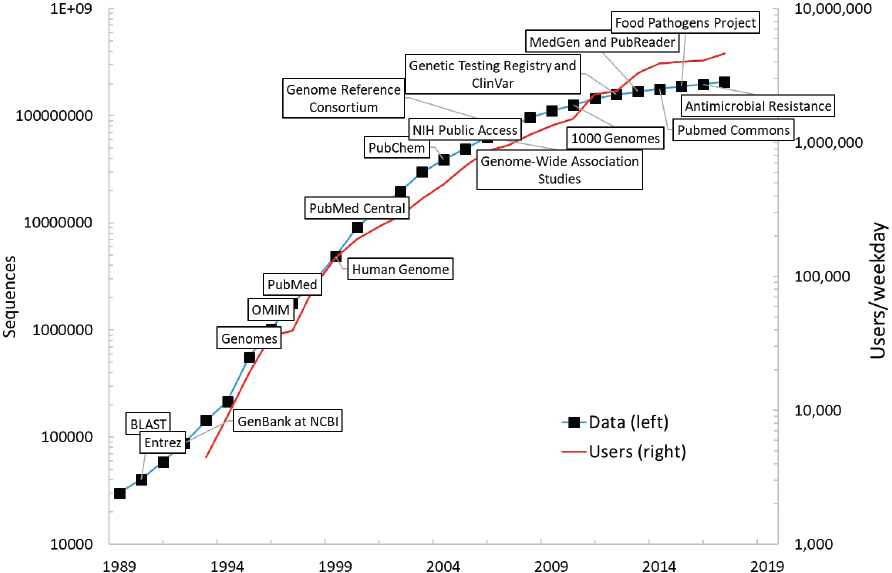

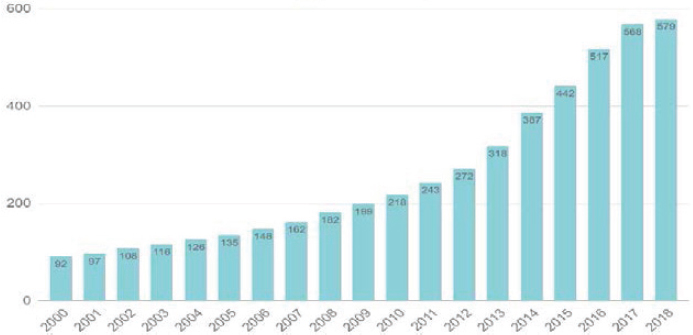

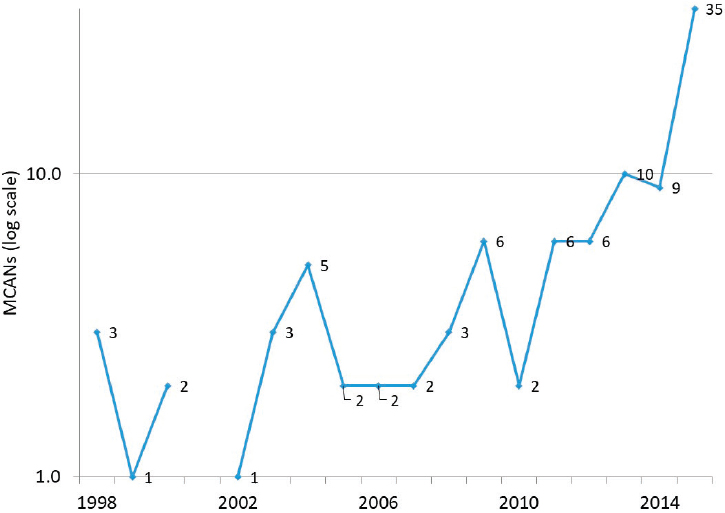

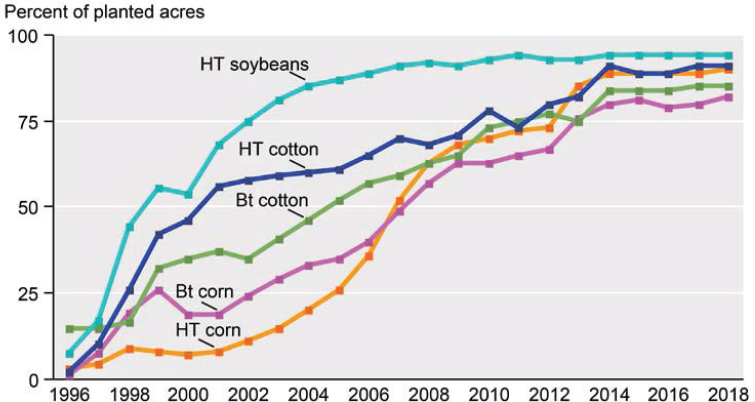

Consider the GenBank sequence database, an open-access, annotated collection of all publicly available nucleotide sequences and their protein translations. This database and certain software used to access it are produced and maintained by the National Center for Biotechnology Information (NCBI), a division of the National Library of Medicine (NLM).19 Since GenBank’s inception at NCBI in 1992, use of the database and the number of sequences (i.e., data) it contains have grown at a very rapid rate (see Figure 3-4). This suggests that public data inputs have significant value for biomedical and bioindustrial scientific analysis.20 If biological data assets are important inputs to further scientific and commercial advances, the beneficial impacts of open biological data will both spill over to productivity in the business economy (via new industrial and consumer biotechnology products) and generate benefits to human health via improved treatments for certain diseases (as discussed in detail in Chapter 6).

NIH reports that by 2016, the Human Genome Project had contributed to the discovery of more than 1,800 disease genes.21 Taking advantage of

___________________

19 NCBI is part of the International Nucleotide Sequence Database Collaboration, a joint effort to collect and disseminate genomic databases. The collaboration involves computerized databases in Japan and Europe (the DNA Data Bank of Japan and the European Nucleotide Archive in the United Kingdom); data submissions are exchanged daily among the collaborators.

20 NIH supports many open-data repositories, including ClinicalTrials.gov, the world’s largest publicly accessible database for exploring clinical research studies conducted in the United States and abroad. This database provides researchers and health care professionals—as well as the general public and patients and their family members—with easy access to information on clinical studies on a wide range of diseases and conditions. For a full list of open data at NLM, see https://www.nlm.nih.gov/NIHbmic/nih_data_sharing_repositories.html.

21 See https://report.nih.gov/NIHfactsheets/ViewFactSheet.aspx?csid=45.

the publication of the human genome, today’s researchers can find a gene suspected of causing an inherited disease in days rather than years. The costs of maintaining NCBI at current standards are rather small. NLM’s annual budget hovered at about $400 million from 2015 to 2018 and rose to just under $442 million in 2019. This budget includes library operations and some intramural R&D, with NCBI accounting for about one-third of NLM’s total budget in 2019, or $134 million.22 If expansion of and/or improvements to the protection and curation of open data at NCBI are deemed warranted, it is worth noting that the current rate of public investment in making these assets freely available is very small relative to the likely benefits. While the economic value of NCBI has not been investigated specifically, economists have documented the importance of public databases for the progress of knowledge in science and innovation. These authors include Furman and Stern (2011), who demonstrate that public libraries for biological materials enhance the rate of knowledge generation associated with deposited materials; Biasi and Moser (2018), who show that reducing the cost of access to science books during World War II boosted scientific output in regions in which libraries purchased such books; and Furman and colleagues (2018), who document that patent deposit libraries had a positive impact on regional innovation in those areas that received such libraries in the pre-Internet age.

Valuation of Intangible Assets

Knowledge creation underlies the value of intangible assets. From an economic point of view, the value of a resource such as a gene database developed and owned by a for-profit company derives from its commercial value, that is, how the knowledge it contains can be used to introduce new and profitable products or services. For public companies, the firm’s market capitalization will reflect this value to the extent that it is transparent (e.g., if the designs for new products are patented or if technology agreements between one company and another are public knowledge).23

___________________

22 See https://www.nlm.nih.gov/about/2020CJ_NLM.pdf.

23 Firm market capitalization captures market estimates of firm value, incorporating assessments of the values of tangible assets, such as plant and equipment; intangible assets, such as the expected fruits of R&D; and expectations about future macroeconomic, industry, and firm conditions. Recent research documents that the issuance of patents has a statistically significant and economically meaningful impact on firm value, as measured by market capitalization (Kogan et al., 2017). See also the Innovation-alpha Stock Price Indexes developed by M-CAM that outperform market indexes (e.g., S&P 500) using a quantitative, rule-based methodology that exploits the control and deployment of intellectual property, including patents, by public firms. See https://www.conference-board.org/data/bcicountry.cfm?cid=18 for further information.

The value for individual assets cannot readily be discerned this way, however; rather, the value of a company’s portfolio of intangible assets is reflected in market capitalizations. This value encompasses not only the quantity and quality of the company’s databases, patents, and other innovative property, but also its capabilities to exploit those assets for profit.24

Investments in certain intangible assets are included in GDP, and values for their corresponding stocks are estimated and published regularly as part of the U.S. national accounts. In other words, official economic statistics are available for the following types of intangibles:

- software and databases;

- R&D;

- mineral rights; and

- entertainment, artistic, and literary originals.

The official asset estimates are not based on market valuations but on a valuation method known as “replacement cost.” The replacement cost method has long been used to value tangible assets, and these same methods are applied to intangible assets. Once intangible assets have been identified—a major step in its own right—replacement cost estimates for their values are developed from time-series data on investments using the perpetual inventory method (PIM). The following economic data and estimates are needed to implement the PIM:

- Time series for investments in each intangible asset

- Investments may be the value of purchases, or they may be the costs of developing the asset “in-house” (or both).

- Investments in both current dollars and constant (or “real”) dollar terms are required.

- A depreciation rate for each intangible asset

- The idea is to capture the expected period of time for which the investment will yield a stream of returns (i.e., it is an economic rate of depreciation, not a rate of physical decay).

- Depreciation rates for some asset types may differ by industry, requiring multiple estimates for such asset types.

___________________

24 This is not to say that business valuation analysts do not independently value intangible assets; they do, but typically in the context of an exchange between owners—that is, a transaction—as in a merger/acquisition (also for estate and gift tax purposes or as part of litigation). This leads to a situation in which company financial reports show values for intangible assets exchanged as part of a merger or acquisition, whereas values for assets created within firms that have not undergone a merger or acquisition are generally omitted; exceptions include certain mineral rights and, at the discretion of firms, software produced internally for the company’s own use.

The PIM then cumulates real investments, period by period, after subtracting an estimate of economic depreciation during the period (the loss in the asset’s value due to aging). This calculation produces an estimate of the volume of the asset stock; the value of the stock at replacement cost is obtained by multiplying the volume estimate by today’s price.25

The advantage of the replacement cost approach that is used in national accounting is that it is comprehensive. Market valuations of public for-profit companies do not reflect the assets of privately held firms, which include start-ups, nor do they include the assets of private nonprofit organizations (e.g., private universities) or the nation’s federally funded laboratory system. These are serious omissions for the upstream research-dependent bioeconomy, but all such institutions are in scope for national accounts. The valuation methods used for assets in national accounts do not depend on whether assets are held by the for-profit, nonprofit, or public sectors, although differences in the sectors’ character, such as the longevity of services derived from the assets, are recognized: basic research in the life sciences funded and conducted by the public sector is deemed to yield assets with a longer service life than a commercial software package/tool.

The analysis of biological databases, especially DSI, requires a fresh look, beginning with defining the data types of interest and identifying where each type is being held, stored, and likely to be transformed for commercial use. In recent academic research using data pulled from LinkedIn, firm-level information on employees classified by skills held (e.g., data science) has been used to estimate the value of investments in artificial intelligence (AI) (Rock, 2018).26 The idea is that AI may be included in the currently available estimates for software (albeit perhaps not comprehensively), but to analyze how investment in this area may be mismeasured and/or growing relative to other types of software requires a more granular approach. Rock’s skills-based approach is potentially relevant for developing estimates of own-produced biological data knowledge as an intangible asset of the bioeconomy. If biological data knowledge is in fact the outcome of work done by employees with specialized technical skills (rather than by employees classified in a generic occupation, such as “software engineer”), this approach is promising.

___________________

25 Note that a simple accumulation and correction for economic depreciation assumes that there no natural disasters or noneconomic events that diminish the volume of net stocks; in practice, these “other changes in volume” are accounted for when such events (e.g., a hurricane) destruct capital. Note also that replacement cost differs from both the historical cost approach used in U.S. Generally Accepted Accounting Principles–consistent company financial accounts and the mark-to-market, or fair value, method that the International Financial Reporting Standards allows.

26 See also Brynjolfsson et al. (2018).

For the bioeconomy, skills may include proficiency in software such as the Basic Local Alignment Search Tool, ClustalW, DNA sequence analysis software, Mendel, PhyLOP, RTI International SUDAAN, SAS/Genetics, and Ward Systems Group GeneHunter.27 As with the skills-based estimates of investments in AI versus investments in software, employees with these skills may be engaged in life sciences R&D, the idea being that even if life sciences R&D includes investments in biological data knowledge (in part or in whole), its own underlying dynamics are obscured.

With regard to valuing public databases, the value of the sequence data shown in Figure 3-4 can be considered as included in the value of R&D stocks in the bioeconomy’s research fields. This is because the outcomes of the conduct of this R&D include not only new scientific findings (or new drugs), but also genomic data or other DSI made available to the public for future use via NCBI (as discussed earlier in the section on valuation of intangible assets). It is tempting to suggest that the relationship of biological databases to total R&D stocks is proportional (acknowledging that it may not be possible to specify an absolute value), but Figure 3-4 suggests that the number of NCBI users (an indicator of the user value of those stocks) is growing faster than the accumulation of those stocks themselves (which partly reflects outcomes of R&D). Perhaps, then, the pattern of use of the NCBI data could be exploited to estimate a depreciation rate for biological data stores, thereby providing an essential ingredient for their independent valuation. The same might be said of ClinicalTrials.gov if statistics on user-ship and age of data accessed were available.

When thinking about the value of data, Varian (2018) argues that data exhibit decreasing returns to scale, citing the example that an increase in the size of training data for AI algorithms yields diminishing returns in prediction accuracy. While this is an aspect of how the value of data declines (or depreciates) over time, consider the following: There are multiple dimensions of use for biological data—especially genomic data, or DSI—and the fruits of combining publicly available DSI with privately collected personal lifestyle data have yet to be fully realized (even if it could be said that the fruits of exploiting public DSI alone are diminishing). This observation suggests that diminishing gains to data may occur only as new dimensions/combinations in use diminish.28 The capability

___________________

27 These skills are listed on O*NET as skill requirements for a geneticist; see https://www.onetonline.org/link/tt/19-1029.03/43232605. Data on geneticists are obscured because the occupation is included in the higher-level category “Life Scientists, Other,” which includes a collection of miscellaneous occupations, such as “Life Science Taxonomist.” (O*NET is sponsored by the U.S. Department of Labor’s Employment and Training Administration and is the nation’s leading source of information on occupations.)

28Li and colleagues (2019) explore this observation for the influence of data assets on market valuations of digital platform companies.

to value long-lasting public DSI data is thus important for both businesses that use and augment these data and governments that support and fund the data’s ongoing development.

Implications of Unmeasured Intangibles for Valuing the Bioeconomy

Studies that measure biologically based economic activity use several economic approaches. Each begins by delineating the bioeconomy as a subsector of the total economy. Typically, the bioeconomy is defined in terms of industry subsectors, and its economic contribution can then be measured from the national accounts using a value for the subsector’s GVA relative to total GDP.

An industry’s value added includes that industry’s own production of investment goods, that is, its own conduct of R&D and generation of other intangible assets, including tools that enable data-driven capabilities. Some of these assets are not currently capitalized in the national accounts, suggesting that delineating the bioeconomy using official statistics for sector value added represents an approximation, indeed an understatement, unless this shortcoming is remedied.

A Path Toward Identifying and Valuing the Bioeconomy

There are no studies identifying and quantifying the bioeconomy using a definition consistent with that of this committee. In the following subsections, activities that fall within the committee’s definition of the bioeconomy are described, and measurement tools required for future analyses of the bioeconomy are discussed.

Delineating the Bioeconomy

The primary user-driven segments of the bioeconomy—agricultural, bioindustrial, and biomedical—are considered first as the major categories of activity encompassed by the landscape and definition explored in Chapter 2. It is important to note that the committee’s definition and explanation in the landscape discussion in Chapter 2 groups the activities within the bioeconomy into these three major scientific domains. However, when moving from a conceptual map based on scientific domains toward an economic mapping of the activities included in the bioeconomy, the groupings change to account for the limitations of the current classification system. For example, when considering the scientific domain of agriculture, the committee identified crops (genetically engineered or created via marker-assisted breeding programs) as being included in the

bioeconomy (criteria #1 and #2; see Chapter 2). The committee also identified as being included the use of plant biomass in a downstream bioprocessing and/or fermentation process utilizing recombinant DNA technology (criterion #4; see Chapter 2). However, in an economic mapping, the economic activity stimulated by plant biomass is grouped with the industrial activity of biobased chemical production. This is a function of how and where the economic activity is collected, categorized, and attributed.

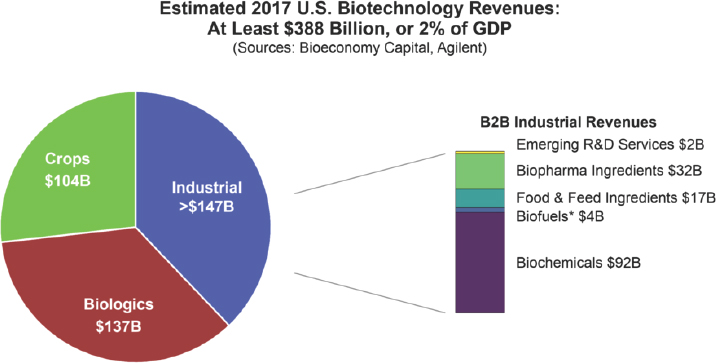

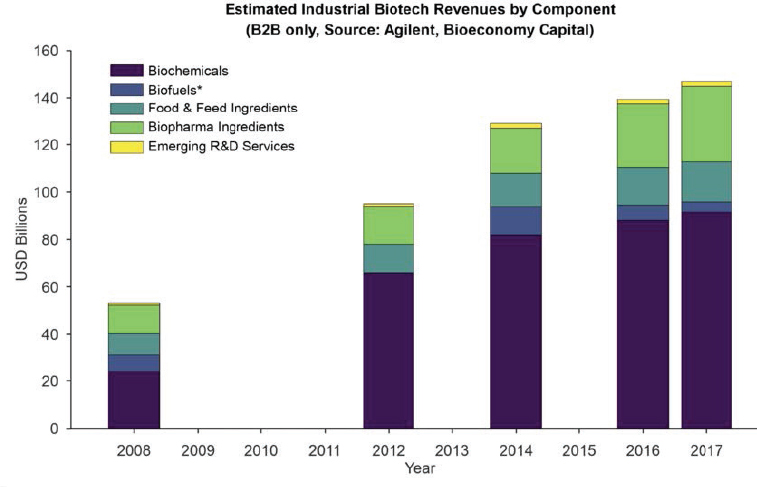

A study whose circumscribed bioeconomy activities are wholly contained within the committee’s definition (Carlson, 2016, 2019) is reviewed in detail in Annex 3-1. Like the committee, Carlson focuses on agricultural and industrial revenues generated through the use of genetically modified (GM) biological organisms and systems. His accounting includes crops, biopharma and biologics, and biobased industrial products (e.g., biofuels, enzymes, and biochemicals). He acknowledges that North American Industry Classification System (NAICS) code categories are too broad to capture value added in these activities accurately. Indeed, a major contribution by Carlson (2016) is his suggestion to revise the system used to classify official statistics on economic activity by industry (see Box 3-2). As noted in Annex 3-1, Carlson focuses mainly on business-to-business activity, which leaves out the value added in products that are further processed and/or are delivered to consumers (e.g., biobased plastic bottles [although resins are included]), in contrast to the committee’s approach.

Moving from primary segment to the details that would enable data capture requires identifying the relevant codes within that category that cover the scope of the committee’s definition. For example, biomedical activity usually encompasses three relatively well-defined (yet detailed) industry sectors: pharmaceuticals, biotechnology R&D services, and electromedical equipment and medical instruments (Hermans et al., 2007). In NAICS, the system currently used to classify economic activity by industry,29 these industry sectors are represented by four categories of codes: Pharmaceutical and Medicine Manufacturing, NAICS 3254; Electromedical Instruments Manufacturing, NAICS 334510, 334516, and 334517; Surgical and Medical Instrument Manufacturing, NAICS 339112; and Research and Development Services in Biotechnology (except nanobiotechnology), NAICS 541714. According to the committee’s definition, NAICS 541715 should also be partially included, as it covers Research

___________________

29 NAICS organizes industry activity by sectors and subsectors using a hierarchical structure and six-digit code. The first two digits identify the sector, the third digit identifies the subsector, the fourth digit identifies the industry group, and the fifth identifies the NAICS industry. The first five digits are standardized across the United States, Canada, and Mexico. Each country can use a sixth digit to identify the specific national industry (which is therefore specific to the country and not standardized). For examples and more information, see https://www.census.gov/programs-surveys/economic-census/guidance/understanding-naics.html.

and Development Services in the Physical, Engineering, and Life Sciences (except Nanotechnology and Biotechnology). According to the North American Product Classification System (NAPCS)30 product list for NAICS 5417 (see Box 3-2), the latter would include bioengineering and biomedical R&D services, which covers the mechanical engineering of robotic systems for health care.31 Many studies of biotechnology consider activity in NAICS 541714 as in scope for their analysis, but this approach misses the other life sciences, biomedical engineering, and bioengineering R&D services activity included elsewhere in the overall R&D services industry.

Moving from the three primary segments (agriculture, bioindustrial, and biomedical), the committee needed to determine the subset of the primary segments for which economic activity data are captured. Thus, the committee identified the six segments within the broad category of goods and services, which includes materials, business services, and consumer products. At the level of these segments, the following six segments are taken as an approximation of the bioeconomy, as best as can be determined from the available data, and recognizing that they incompletely capture the bioeconomy as the committee has defined it:

- GM crops/products;

- biobased industrial materials (e.g., biobased chemicals and plastics, biofuels, agricultural feedstocks);

- biopharmaceuticals and biologics, other pharmaceuticals;

- biotechnology consumer products other than drugs (e.g., genetic testing services);

- biotechnology R&D business services, including laboratory testing (kits) and purchased equipment services (e.g., sequencing services); and

- design of biological data-driven patient health care solutions (i.e., precision medicine inputs), exclusive of patient care services per se and drugs counted elsewhere.

The bioeconomy also includes investments in specialized equipment and services, including

___________________

30 NAPCS is a coding system that categorizes products (good and services) independently of industry of origin. These codes can be linked back to the NAICS industry classification and are also consistent across Canada, Mexico, and the United States. For more information, see https://www.census.gov/programs-surveys/economic-census/guidance/understandingnapcs.html.

31 See https://www.census.gov/eos/www/napcs/finalized/web_5417_final_reformatted_edited_US060409.pdf.

- specialized equipment purchased for use in bioeconomy-related research, product development, and testing (e.g., mass spectrometers, sequencing machines);

- specialized instruments developed for research laboratories and medical care (selected medical devices, including medical robots); and

- long-lived services (intangible assets) purchased by bioeconomy firms for product development (e.g., specialized software and consulting services, including data analytic services).

In addition, the bioeconomy includes the production of intangible assets within bioeconomy organizations for their own use, such as

- own production of value added via the development of databases for further use in product development and testing (as in the example given in the earlier section on estimation of investments within organizations); and

- R&D and other generic intangible assets, including training of employees in specialized bioeconomy skills.

The activities listed above reflect the orientation of this committee’s definition of the bioeconomy toward activities stemming from advances in the life sciences as enabled by engineering, computing, and information sciences. The list of activities is highly diverse and ranges from GM crops to such activities as the production of medical robots and biological data as an intangible asset. The committee’s definition potentially encompasses innovative applications of precision medicine to nonscientific domains (patient care or health insurance), although these extensions are not included in this economic analysis. All told, a comprehensive and “living” approach to measurement is necessary (i.e., one that encompasses future activities affected by biobased technological advances).

A Satellite Account for the Bioeconomy and Its Assets

An accounting of the bioeconomy as a subsector of the economy requires a comprehensive set of measurements. A dedicated bioeconomy satellite account built as an adjunct to the U.S. national accounts would provide a necessary tool for economic analysis of the bioeconomy.

A satellite account is a system of economic data that portrays expenditures, production, and income generated by a defined set of activities. Satellite accounts typically design tables with specific users in mind (up to the limits of the data), especially when the extent of the detail on production and expenditures illuminates a collection of activities not aggregated elsewhere in economic data (see Box 3-3).

A satellite account system for the bioeconomy would, ideally, develop the appropriate interindustry relationships for biobased production, include a full accounting of intangible assets and bioeconomy databases, incorporate quality-adjusted price deflators for relevant products (e.g., biopharmaceuticals and biomedical equipment), and facilitate accounting for certain environmental benefits (e.g., as in Daystar et al., 2018). The sources of supply, domestic and foreign, for bioeconomy products and for inputs to bioeconomy domestic production should also be illuminated, along with financial flows relating to inward and outward transfers of the bioeconomy’s technology and information assets, necessitating the development of new data.

The design of the bioeconomy satellite account could possibly exploit available administrative data,32 as well as U.S. Census Bureau

___________________

32 “Administrative data” refers to data collected and maintained by government agencies and used to administer (or run) their programs or provide services to the public (e.g., Medicare data).

survey-based microdata, to ensure the necessary scope and coverage. Additionally, the horizon-scanning and forecasting efforts envisaged in Chapter 6 could provide further insight into designing the bioeconomy satellite account and ensure its utility for addressing specific policy and forecasting questions.

Valuing the Bioeconomy

In lieu of a satellite account, the committee approached valuing the bioeconomy and its intangible assets in the context of the committee’s definition as a pilot experiment: What can existing tools, data, and studies demonstrate about the bioeconomy and its reach? Consider, then, marrying the committee’s components discussed earlier with the I-O approach set out in Daystar et al. (2018). The Daystar et al. (2018) study provides value added for many relevant bioeconomy products, estimates that are not otherwise available using official data alone.

A Valuation Pilot Experiment and Framework

Can elements from Daystar et al. (2018) be supplemented with others to bridge at least most of the gap between the relevant products in that study and the more comprehensive set of goods and services covered by the committee’s definition? The answer to this question would appear to be yes, by using elements from Carlson (2019) where possible, by estimating gross output values for bioeconomy goods and services and converting them to GVA using the ratio of the latter to the former for the industry as a whole, and by drawing on a set of estimates for R&D and other intangible investments by detailed industry conforming to the detail set out by BEA in the U.S. national accounts. Box 3-4 summarizes the steps taken to generate the figures developed for the pilot experiment.

The specific segments of the bioeconomy included in the experiment’s estimates are listed in Table 3-2 and cover items that can readily be identified based on previous studies and simple extensions based on the committee’s definition (e.g., the addition of electromedical equipment). The conclusion of this pilot experiment is not meant to be definitive, and may err either on the short side to the extent that the delineation of activities associated with the committee’s tech-driven definition falls short or on the high side to the extent that too much of an identified activity is ascribed to the bioeconomy.

That said, and as may be seen from inspection of Table 3-2, publicly vetted estimates (or simple translations of gross output data) are available for most of the segments listed in the earlier subsection describing the path toward identifying the value of the bioeconomy. Where segments

involve biobased production, two value added estimates for the activities listed in columns 2 and 3 of the table are used: the first, shown in column 4, represents an estimate of the current value added in biobased production, and the second is an estimate of the potential for biobased production (using current technology). These estimates come from Daystar et al. (2018), where that study is listed as a source in column 3 of the table. For other estimates, modest assumptions were made based on the available literature (e.g., that biopharma now accounts for 25 percent of all pharmaceuticals, and that its potential is 80 percent, where the upper limit represents the capability possessed by the leading-edge global firm in 2014) (Otto et al.,

TABLE 3-2 Illustrative Bioeconomy Segments and Their Value Encompassed by the Committee’s Definition

| Segments | Classification (North American Industry Classification System [NAICS] code, where relevant) | Source of Estimate for Value Added1 | Value Added in 2016 (millions of dollars) |

||

|---|---|---|---|---|---|

| Current | Potential | ||||

| Private Industry Sector Segments | |||||

| 1. | Crop products | 11111-6, 11119, 111900pt | Committee calculations; Carlson (2019) | 36,740 | 46,141 |

| 2. | Biorefining (food) | 311210, 221, 224, 225; 311300 | Daystar et al. (2018) | 3,023 | 36,830 |

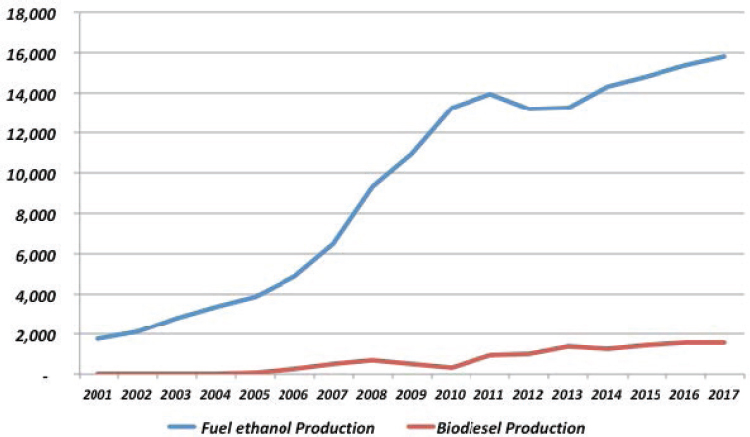

| 3. | Biofuels (ethanol) | 324110pt | See note2 | 8,361 | 12,553 |

| 4. | Biopharmaceuticals | 325412pt | See note3 | 31,118 | 99,575 |

| 5. | Biologics (enzymes) | 325414 | Daystar et al. (2018) | 16,918 | 16,918 |

| 6. | Other pharmaceuticals | 325412pt | See note3 | 93,354 | 24,894 |

| 7. | Biobased petrochemicals | 35211 | Carlson (2019) | 6,726 | 16,304 |

| 8. | Other enzymes | 32519pt | Daystar et al. (2018) | 11,918 | 11,918 |

| 9. | Other biobased chemicals | 325211, 32519, 32522, 325510, 325998, 325611, 325612, 325520, 325991, 325992, 325910, 325613 | Daystar et al. (2018) | 8,081 | 50,505 |

| 10. | Biobased plastic products | 326 | Daystar et al. (2018) | 997 | 68,436 |

| 11. | Electromedical instruments | 334510, 6, 7 | Gross output (GO) adjusted to gross value added (GVA) | 49,636 | 49,636 |

| 12. | Surgical and medical instruments | 339112 | GO adjusted to GVA | 28,153 | 28,153 |

| 13. | Bioeconomy R&D services | 541714, 541715pt | Annex 3-1 discussion | 43,090 | 43,090 |

| Intangible Investments Not Included in Value Added as Detailed Above | |||||

| 14. | Data services/software purchases | Private bioeconomy segments listed above | National accounts and INTAN-Invest | 5,615 | 7,880 |

| 14a. Memo: | Private health care organizations | INTAN-Invest | 15,194 | — | |

| Public and Nonprofit Sector Segments | |||||

| 15. | R&D | Life sciences, bioengineering, and biomedical engineering | National accounts, NCSES surveys | 44,546 | 44,546 |

| 16. | Software and data-related analytic services | Classification of functions of government, health | National accounts and SPINTAN project4 | 14,190 | 14,190 |

| Total5 | 343,730 | 571,569 | |||

NOTES:

1. Reports the source for the estimate of the share of national accounts value added in the “nearest” available detailed industry. The final value added estimate for each activity also includes the contribution of intangibles not in the national accounts developed from a detailed version of the estimates reported at www.intaninvest.net.

2. Estimate based on fraction of gasoline that is ethanol. Biomass electric power generation is not separately listed; available estimates suggest value added in this activity was $635 million in 2016.

3. Estimate based on Otto et al. (2014) and the National Center for Science and Engineering Statistics Business R&D and Innovation Survey data reviewed below in the section on the direction of the bioeconomy.

4. SPINTAN (Smart Public Intangibles) refers to a European Commission Framework–financed project whose research consortium included The Conference Board. See www.spintan.net. The estimates of public- and nonprofit-sector intangibles developed for the SPINTAN project are designed to complement those for the market sector found at www.intaninvest.net.

5. Excludes line 14a.

2014). Further study is needed to refine the estimates of potential biobased production in the delineated industries, especially pharmaceuticals (the Daystar et al. [2018] study does not include pharmaceuticals).

The actual and potential estimates of value added of existing industries serve a dual purpose. First, they are summed to value the bioeconomy. Second, the implied shares of value added of existing industries are assumed to approximate the bioeconomy’s share of the industry’s total investment in intangible assets (i.e., the potential column demonstrates the full value of all activities contained within the listed segments, demonstrating the potential for the bioeconomy to grow within a given segment). These shares are then used (1) to include own production of non-national accounts intangibles in value added; and (2) to calculate purchases of services related to software and biological data.

With regard to investments in intangible assets, the following was done. First, all value added estimates for segments shown in Table 3-2 were based on national accounts estimates of value added that include own production of software and R&D. Second, estimates of non-national accounts intangible assets for each bioeconomy segment listed in Table 3-2 were obtained using each segment’s share of value added in the industry-level data used to develop industry-level estimates of intangible investment; the industry-level intangible asset estimates were based on estimates that followed methods documented at www.intaninvest.net. Third, the value of purchased software assets and data analytic services was accounted for separately using the same shares. Finally, the conduct of bioeconomy R&D by the government or universities was included in the value of bioeconomy activity as a separate, delineated activity.

Regarding biological data, an assumption was made that a firm’s own production of databases is included in national accounts estimates of software; likewise for their purchases, to the extent a market transaction takes place. While this constitutes a lower bound, note that investments in data analytics by firms in the bioeconomy are reflected in their purchases of (1) computer design and related information technology consulting services and/or (2) management consulting services. These items are not included in the national accounts estimates of intangibles, but we have added available estimates of spending on these activities by bioeconomy firms. For the public sector, the value of the investments in software and computer design consulting (our best proxies for investments in data), as estimated for the function of government circumscribed as “health,” also is included.

Contribution of the Bioeconomy to U.S. Value Added

The sum of the direct impact of value added in bioeconomy industries shown in column 4 of Table 3-2 totals $402.5 billion, or 2.2 percent of GDP in 2016 (see Table 3-3). If biobased production were at its potential level, the value added figures shown in column 5 of Table 3-2 would be $571.6 billion, or 3.1 percent of GDP (note that only the private economy is affected by shifts toward biobased production within an industry). The subtotal for private value added in the bioeconomy was nearly 1.8 percent of GDP in 2016, and its estimated potential level was 2.7 percent of GDP.

To estimate indirect and induced effects, a multiplier of 2.5 was applied to private bioeconomy economic activity; this multiplier is substantially lower than the implicit multiplier in Daystar et al. (2018) as a result of the inclusion of R&D services, pharmaceuticals, selected equipment, and other intangibles. These latter segments are large relative to other private biobased activity, and a multiplier closer to that for overall manufacturing (2.41 from Popkin and Kobe [2010] as quoted above) is more appropriate. Then a multiplier of 1.7 was applied to government and higher-education activity (from Popkin and Kobe [2010]). Without further study, it is impossible to be more precise, an observation that reinforces the need for a bioeconomy satellite account that details the appropriate interindustry linkages for relevant economic activities.

After applying the multipliers described above, economic activity driven by the bioeconomy is estimated to have accounted for nearly 5.1 percent of GDP in 2016, and would have accounted for 7.4 percent with biobased production at its estimated potential level. We stress that this guideline for the size of the bioeconomy is offered only as suggestive of the current state of the literature in the form of a rough estimate. It is rough because the committee’s definition of the bioeconomy is meant to be “living,” and there are significant gaps in the available data. Advances in technology will affect circumscribed activities and the evolution of the potential of bioeconomy production (e.g., this potential could be larger by 38 percent if a modest estimate of the delivery of biodata-based precision medicine solutions at the point of care were included in bioeconomy activities).33

___________________

33 Health care services (excluding drugs, insurance, and administrative costs) directly accounted for 10 percent of U.S. GDP in 2016, 27 percent of which represented physician services. If this figure is used as a marker for the value of point-of-care services, it suggests that another 2.7 percent of U.S. GDP is potentially (directly) impacted by the bioeconomy.

TABLE 3-3 Summary of Illustrative Bioeconomy Valuation Experiment

| Major Sector | Value Added in 2016 (billions of dollars) |

||

|---|---|---|---|

| Current | Potential | ||

| Direct contribution: | |||

| 1. | Private industry | 343.7 | 512.8 |

| 2. | Public/nonprofits | 58.7 | 58.7 |

| 3. | Total | 402.5 | 571.6 |

| 4. | Percent of GDP | 2.2 | 3.1 |

| Including indirect and induced effects: | |||

| 5. | Private industry | 859.3 | 1,282.1 |

| 6. | Public/nonprofits | 99.9 | 99.9 |

| 7. | Total | 959.2 | 1,381.9 |

| Percent of GDP | 5.1 | 7.4 | |

SOURCES: Table 3-2 and Box 3-4 for bioeconomy valuation. Bureau Economic Analysis for U.S. GDP in 2016, which was $18,715 billion.

SOURCES: Table 3-2 and Box 3-4 for bioeconomy valuation. Bureau Economic Analysis for U.S. GDP in 2016, which was $18,715 billion.

Valuation of the Bioeconomy’s Intangible Assets

A takeaway from the earlier discussion of the valuation of intangible assets is that using a national accounts approach to estimate the value of an asset stock requires a time series of investments in the asset and a rate of depreciation for the asset. From the above, estimates of the private bioeconomy’s intangible investments are available for 1 year (2016) (estimates of biobased production in an industry relative to the industry’s total production over time are not readily available). The lack of readily available time-series information on biobased production shares is another example of the need for more complete data on the bioeconomy such as would be provided by a satellite account.34

Regarding biological data, even if analysis in line with the bioeconomy components listed in Table 3-2 were possible, the results would not necessarily be comprehensive. Analysis of biological data requires identifying the sectors and activities that hold large quantities of such data. The public sector is, of course, a large holder, as previously described, but the private health care sector also invests heavily in biological data

___________________

34 One could consider the bioeconomy’s intangible investments via funding for R&D performed by the public and nonprofit sectors (the last two components listed in Table 3-2), which do not rely on production shares. All told, estimates of these values alone would not be informative as to the bioeconomy’s stock of intangible assets.

(although not necessarily genomic data), and these investments would not be included if valuation of biological data were confined to the bioeconomy as delineated in Table 3-2. For data services and software alone, spending by the private health care sector is nearly three times what is currently spent by private industries included in the bioeconomy (compare line 14a with line 14 in Table 3-2). The analysis of biological data stores requires a fresh look, beginning with defining the data types of interest and identifying where each type is being held throughout the economy at large.

DIRECTION OF THE U.S. BIOECONOMY

This section reviews the current status and growth of the bioeconomy by examining indicators of activity in many of its sectors. Given the multiple challenges of measuring the bioeconomy, an approach that relies not on a single indicator but on a range of metrics that capture the varied aspects of the bioeconomy is warranted. Our analysis relies whenever possible on public data sources, ideally those published by federal agencies, such as the U.S. Census Bureau or the U.S. National Science Foundation (NSF), and international organizations, such as the Organisation for Economic Co-operation and Development. In some cases, we relied on data collected by private organizations. A complete analysis of the full range of data available for measuring all of the subsectors of the bioeconomy would be ideal, but this would require a dedicated staff of independent researchers. Also included in the bioeconomy, as described earlier in this chapter, are the social benefits of the bioeconomy’s contribution to human and environmental health. Measurement of these benefits, also a complex job, is not included in this chapter’s analysis.

National Investments in the Bioeconomy

NSF collects data on R&D funded and performed by U.S. government agencies, federally funded research and development centers (FFRDCs), state governments, academic institutions, nonprofit institutions, and businesses. This information is collected in separate surveys of federal government agencies, of state governments, of institutions of higher education (the Higher Education Research and Development [HERD] survey), and of businesses (the Business Research and Development Survey). A new survey of nonprofit institutions would be useful for studying developments in R&D funded and performed by these institutions in the near future.35

___________________

35 Also, the business survey has been redesigned and renamed the Annual Business Survey. The new survey, which is forthcoming as of this writing, will focus on for-profit, nonfarm U.S. businesses with one or more employees, beginning with the data year 2017.

Consistent with the vision expounded by Vannevar Bush in his 1945 Letter to President Roosevelt, “Science the Endless Frontier,” the U.S. government devotes the majority of its nonmilitary R&D investments to basic and applied scientific research, including research at universities. Business spending is devoted predominantly to product development (Arora et al., 2019; Bush, 1945). Summarizing R&D trends in the bioeconomy using federal data is challenging, as measures are broadly characterized by discipline and subfield. The most widely used subaggregate within total federal and university R&D spending is “life sciences,” which includes as major subcategories biological and medical sciences (bioengineering and biomedical engineering data are not measured). Data on business R&D spending are collected by industry. NSF’s survey also asks respondents to classify their spending according to “technology focus,” one such focus being biotechnology. This allows industry-level R&D spending and performance to be cross-classified by focus field.36 Unfortunately, the statistics on biotechnology are not regularly compiled for purposes of science policy analysis, nor are they reviewed in the biannual publication of the National Science Board, Science and Engineering Indicators (S&E).

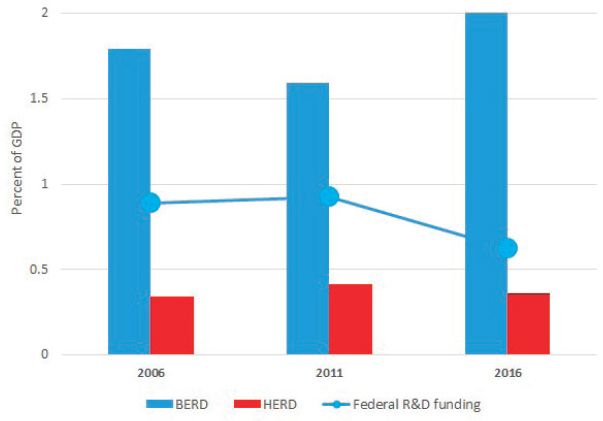

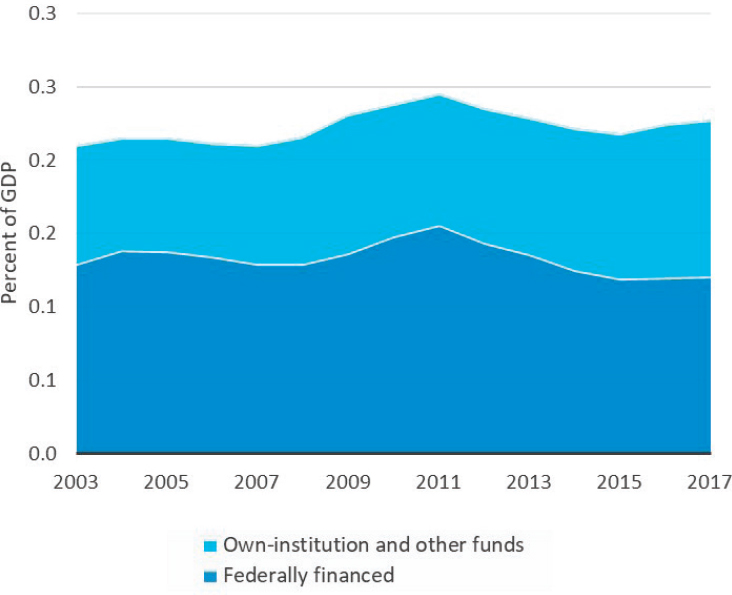

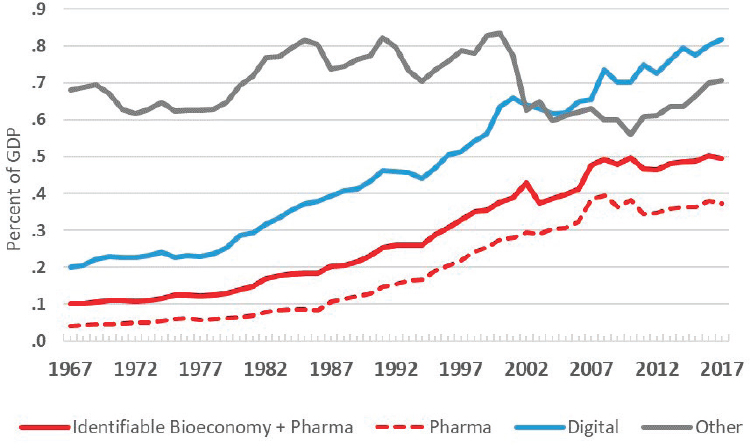

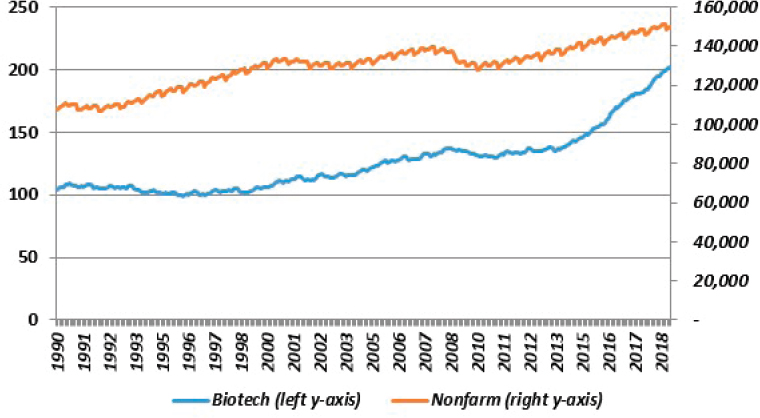

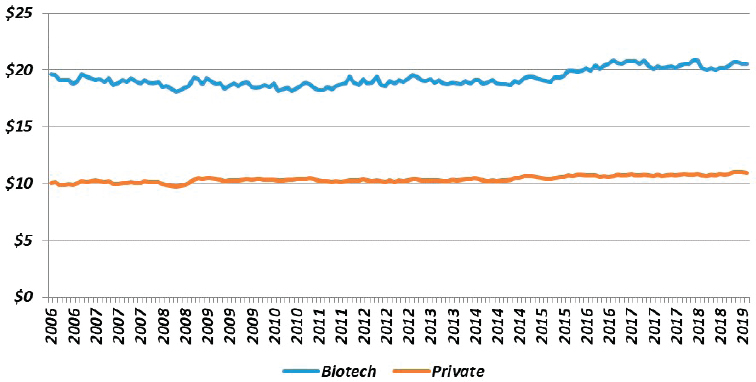

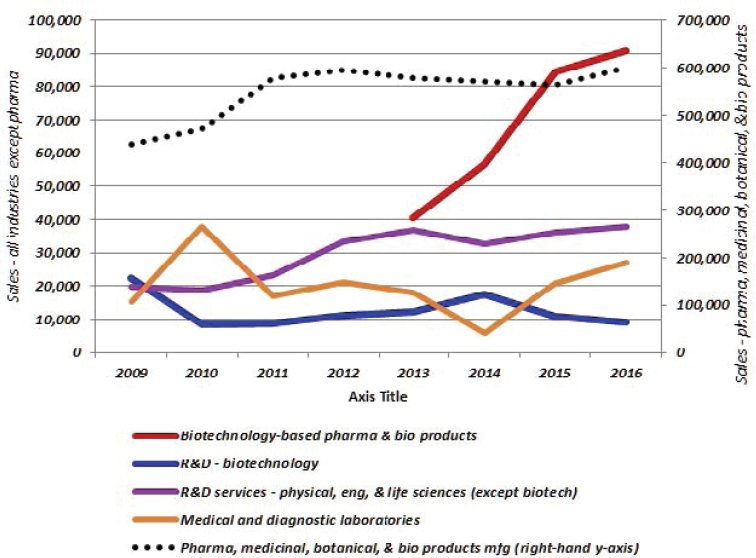

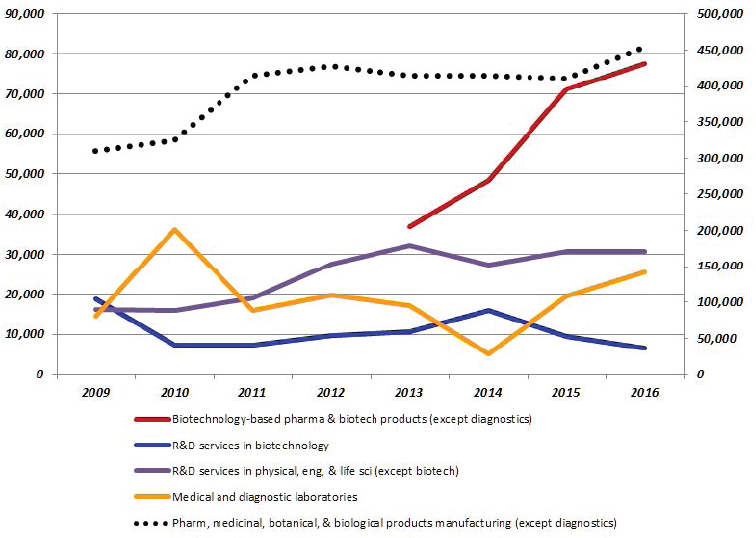

Before reviewing these sources of information on R&D investments in the bioeconomy, the past decade of funding for the major performers of R&D (by size) in the United States in the business and higher-education sectors were considered. This was based on the most recent data available for the period 2006 to 2016. Over this period, as seen in Figure 3-5, business enterprise expenditures on R&D (BERD) became increasingly important to American innovation, but federal funding flagged. Higher-education expenditures on R&D (HERD) were slightly down, reflecting mainly the impact of a decline in federal funding. Taken together, total U.S. R&D, public and private (which includes some small components not shown in Figure 3-5), moved roughly sideways relative to GDP during this period.

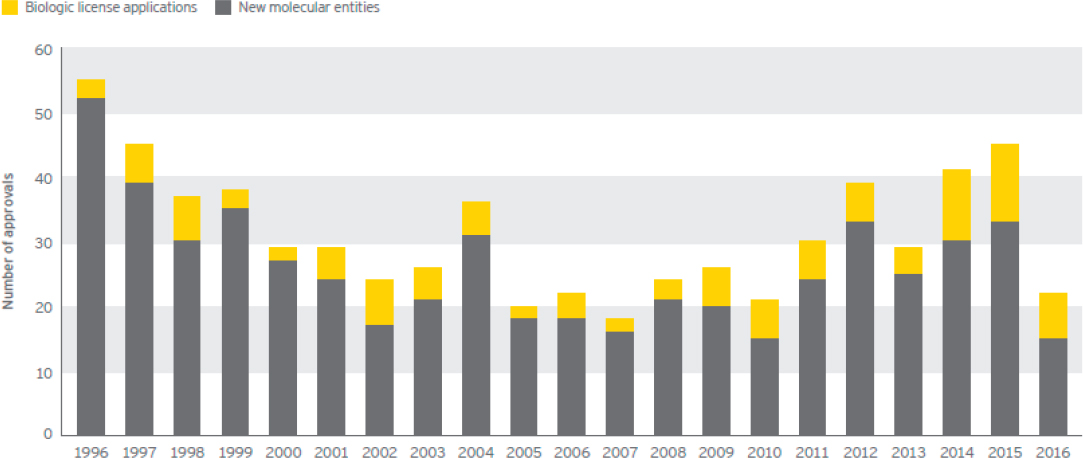

Federal Investments in the Bioeconomy