6

Low Carbon Vehicles

The fifth session of the workshop addressed decarbonizing the transportation sector, with an emphasis placed on the light duty vehicle (LDV) fleet. Primary decarbonization technologies for the sector include hydrogen fuel cell vehicles (FCVs), battery electric vehicles (BEVs), and hybrid electric vehicles (HEVs). Though electric vehicles (EVs) are gaining market share in the United States, challenges remain in consumer acceptance, charging infrastructure, and load demands on the electric grid.

Carla Bailo (Center for Automotive Research, moderator) set the stage by discussing the current status of low carbon technologies in the LDV fleet of the United States compared to international trends. EV penetration in the United States rose from 3.3 percent in 2017 to 4.0 percent in 2018, led mainly by increasing sales at Tesla, she said. Though market penetration remains relatively low in the United States, the global trend toward EVs is driving product development internationally. Many disruptions for the automotive industry are on the horizon, including deployment of connected and autonomous vehicles as well as the transition to a sharing economy, she said. Bailo introduced the three speakers: Reinhard Fischer (Volkswagen), Max Parness (Toyota Motor North America), and Denise Gray (LG Chem).

ON THE WAY TO EMISSION FREE MOBILITY FOR ALL

Reinhard Fischer, Volkswagen

Reinhard Fischer introduced Volkswagen, which is comprised of twelve automobile brands worldwide that together sold 10.8 million vehicles in 2018 (12 percent of global market share). Fischer noted that 14 percent of global greenhouse gas emissions come from the transportation sector. Recognizing the need to decarbonize, Volkswagen has committed to achieving carbon dioxide neutrality by 2050. The company has committed to investing $50 billion through 2023 to develop 70 new EV models, with the goal of selling 1 million EVs by 2025. Reinhard presented details of Volkswagen’s plan to expand their plant in Chattanooga, Tennessee to build EVs for the United States and Canadian markets.

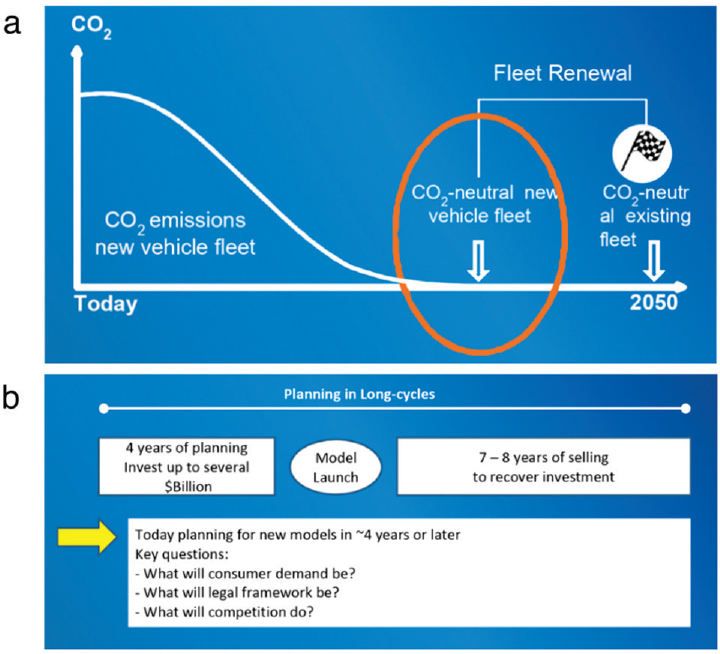

Fischer noted that achieving carbon dioxide neutrality by 2050 will require elimination of fossil fueled vehicles about 10-12 years sooner (as illustrated in Figure 6.1a) because LDVs have a long lifetime of use. He described Volkswagen’s “go to zero” strategy, which considers the entire life cycle of the vehicle, including emissions from the supply chain, manufacturing process, fuel supply, fuel use, and recycling. Where carbon dioxide emissions reductions are not achievable, Volkswagen will look for financial compensation measures to offset their emissions.

Fischer discussed his role in long-term product planning atVolkswagen, noting that the automotive industry is very capital and time intensive. To illustrate this point, he described the process of bringing a new vehicle model to market, which requires upwards of 4 years of planning and several billions of dollars of invested capital, as shown in Figure 6.1b. A typical vehicle may only recover this initial capital after 7-8 years of high volume sales. With such long product cycles, automakers have the difficult task of predicting consumer acceptance years in advance, especially tough for new technologies like EVs.

Fischer stated that Volkswagen believes EVs will be widely deployed in the future, and that belief has motivated the company’s significant investment in the area. He noted the importance of meeting the legal requirements for emissions reductions in various jurisdictions, and emphasized the importance of regulatory stability that allows automakers to plan product cycles in advance. The whole of society needs to buy-in to emissions reductions, and decarbonization of electricity generation will be necessary to ultimately decarbonize transport, he concluded.

SOURCE: Reinhard Fischer, Volkswagen, presentation to the workshop.

OEM PERSPECTIVE ON DEEP DECARBONIZATION IN THE LDV SECTOR

Max Parness, Toyota Motor North America

Max Parness discussed Toyota’s decarbonization goals, which include selling more than 1 million zero emission vehicles (ZEVs) by 2030 and a 90 percent reduction in tailpipe carbon dioxide emissions from 2010 levels within their vehicle fleet by 2050. Toyota is also considering life cycle emissions, including those caused by the manufacturing process, he highlighted.

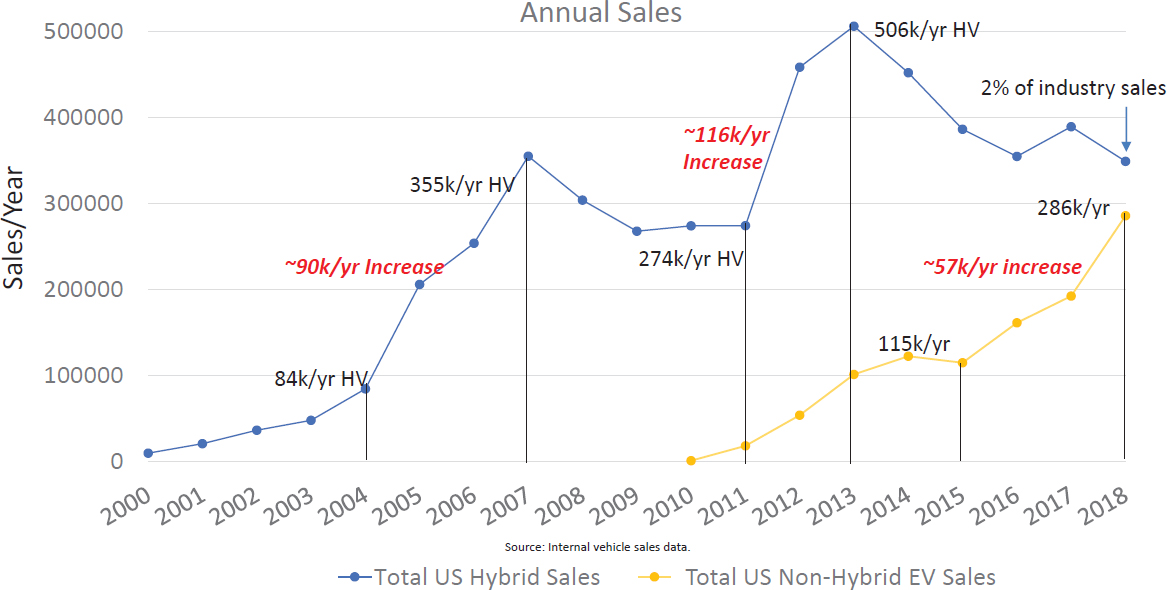

Parness described the scope of the required transition in LDVs to meet the 80-by-50 targets, highlighting the need for a 3-4 percent year-over-year increase in ZEV uptake (i.e., around 500,000 more ZEVs sold than the previous year) for the next 15 years, based on the findings of deep decarbonization studies.1,2 Parness noted the difficulty of hitting these sales targets, pointing to the historic trends in advanced technology vehicle sales (e.g., HEVs) which have never experienced sales increases greater than around 120 thousand additional vehicles per year (Figure 6.2 shows the historic trends for HEV and plug-in hybrid electric vehicle (PHEV)/BEV sales in the United States). Based on the findings of the deep decarbonization studies, this transition needs to accelerate and persist for next 15 years if we are to reach our targets, said Parness. Another trend in the automotive industry that occurred quickly was the transition from sedans to trucks (including sport utility vehicles) in the U.S. market. Around 10 years ago, cars and trucks had a roughly similar market share. However, over the past 10 years, trucks have steadily increased their market share and now make up 70 percent of the U.S. market with year-over-year sales increases of around 700 thousand vehicles. Parness suggested that the car-to-truck shift is an example of the kind of industry transformation required to meet deep decarbonization targets. However, there will be additional complications due to design changes and reconfiguration needed for electrification that will require high capital expenses and increase the risk for automakers, he said.

Parness described a few of the operational difficulties required for electrification of Toyota’s LDV fleet. When electrifying a vehicle model, Toyota must build a new vehicle platform that makes space for the battery (or for FCVs, the hydrogen tank), which requires also building a new manufacturing line and establishing a new supply chain. With high capital expenses, the new plant must run for a long time to recoup the initial investment. With consumer adoption difficult to forecast, these projects carry high risk for automakers and their suppliers. The challenge for product designers is to incorporate flexible platforms that Toyota can adapt to align with changing market trends. Toyota recently partnered with Subaru to develop a flexible platform to accommodate several BEV configurations, allowing for the same vehicle to accommodate batteries with different vehicle performance and range, as well different vehicle widths.

___________________

1 J.H. Williams, B. Haley, F. Kahrl, J. Moore, A.D. Jones, M.S. Torn, and H. McJeon, 2014, “Pathways to Deep Decarbonization in the United States. The U.S. report of the Deep Decarbonization Pathways Project of the Sustainable Development Solutions Network and the Institute for Sustainable Development and International Relations,” Revision with technical supplement, November 16, 2015.

2 R. Lempert, J. Edmonds, T. Wild, M. Binsted, B.L. Preston, L. Clarke, E. Diringer, and B. Townsend, Pathways to 2050: Alternative Scenarios for Decarbonizing the U.S. Economy, Center for Climate and Energy Solutions (C2ES), 2019, https://www.c2es.org/content/pathways2050.

SOURCE: Max Parness, Toyota Motor North America, presentation to the workshop.

Parness also shared concern regarding supply and sourcing of critical materials such as lithium, cobalt, and nickel as EV production increases in scale. Currently large amounts of production are concentrated in relatively few countries. Whether existing material supply chains are ready to meet the projected demands of global vehicle electrification is unclear, said Parness, suggesting the need for innovation in alternative battery chemistries and FCVs.

He concluded by reminding the workshop that for automakers, the transitions to and EV fleet will not proceed smoothly, but rather in discrete steps defined by long product cycles. When Toyota commits to electrifying a certain subset of their fleet, the supply chain and manufacturing line built for the internal combustion engine version of the vehicle are written off as stranded assets, and thus Toyota requires strong signals of consumer acceptance to make such a costly decision. Parness concluded with the needs of current and future customers, including:

- Affordable vehicles which meet their needs in a variety of segments and customer classes, including use as a first-and-only vehicle as opposed to secondary vehicles,

- Ample and readily available national charging and fueling infrastructure, and

- Development of new, sustainable business models to support the deployment of more ZEVs, including ownership of used ZEVs and managing vehicle end-of-life.

FUTURE MOBILITY CHARGED WITH LG CHEM

Denise Gray, LG Chem

Denise Gray opened by discussing the current market for BEVs and PHEVs in the United States. Gray mentioned a recent projection from Bloomberg, which estimated a combined 12 percent market share for these two vehicle types by 2025. Gray suggested that, ultimately, the realized EV market share through 2050 will be decided by the countries and/or companies which take a leadership role in developing new technologies, pointing to China as an example of a country that is committed to being a technological leader in transportation.

Gray discussed the significant technological developments that have occurred recently in the transportation sector, including the transition away from crank windows and manual door locks toward speech and artificial intelligence controls deployed in LDVs. A parallel transformation has occurred in battery technology, where automakers used to simply fit a battery into a vehicle wherever there was space, and now EVs are

designed around a powerful battery. Automakers can provide consumers with even more features and functions if they carefully consider vehicle design, said Gray, and that this can help push customer adoption of EVs. Figure 6.3 illustrates the transition from modified ICE platforms to BEV dedicated vehicle platforms.

Gray pointed out a few desired EV battery capabilities, along with LG Chem’s goals toward achieving these capabilities:

- Quick charging. LG Chem aims to add 400 km of range with 20 minutes of charging, doubling the charging speed compared to today’s systems. She noted that consumers would like to be able to recharge their vehicles in the same time that it takes to refuel an internal combustion engine vehicle.

- Light-weighting. The company aims to achieve 20 percent weight reductions on top of the 20-30 percent reductions already achieved to promote energy efficiency.

- Model diversity. LG Chem is working to expand their sales to commercial vehicles (e.g., vans, taxis) and autonomous vehicles. Gray noted that battery supply prices are often higher in the heavy duty transportation sector than the automotive industry, simply because battery technology improvements are implemented first in LDV designs that do not easily translate to medium and heavy duty vehicles.

Gray mentioned that battery technology took a long time to develop, and that LG Chem was heavily involved in innovation for lithium ion batteries since 1995. Deploying low carbon vehicles at scale will require developing the supply base and working with battery manufacturers to develop new, flexible products. LG Chem has partnered with Ford, Chrysler, and the federal government to invest heavily in battery technology innovation, resulting in 163 million cells sold since 2009 with no major safety issues. The primary continuing challenge remains lowering costs to encourage consumer adoption, said Gray, who offered the following concluding remarks:

- The future of battery technology development and application will be influenced most by the companies and/or countries that strive for leadership.

- Generational maturity of requirements and learning phases allow for optimized designs, lower costs, and increased functionality to achieve customer satisfaction.

- Increasing production volumes of EVs will require large capital investment by automakers, battery companies, and suppliers along the value chain.

SOURCE: Denise Gray, LG Chem, presentation to the workshop.

- Committing to increased production volume is extremely important to establish and stabilize the supply chain and investment base.

DISCUSSION

A participant mentioned charging anxiety as a barrier to consumer acceptance of EVs, and asked the panel which group (e.g., automakers, suppliers, government) will solve the problem of limited access. They wondered also, what fraction of consumers do not have access to a home garage for daily plug-in charging? Gray mentioned that range anxiety used to be the major concern, and that a decrease in range anxiety has been a positive development. She said that for people who live in multidwelling locations without easy access to charging infrastructure, another option for charging might be at their workplace. As for who is responsible to build out charging infrastructure, Gray suggested that it may be a combination of individuals, cities, government, and companies, but it remains an open question. Parness noted that building EV charging infrastructure does not generate a large return on investment, and that in areas where it is difficult to build out the necessary charging infrastructure, hydrogen FCVs may provide a useful substitute due to their lower fueling infrastructure footprints. Reinhard stated that while many people will charge their EVs at home, a few cities are stepping up and ensuring that a certain percentage of public parking spaces have charging infrastructure, and a few companies like Shell are buying charging infrastructure companies to deploy charging stations at their gas station sites. He added that Volkswagen itself recently founded Electrify America, a subsidiary that builds EV charging infrastructure in the United States.

The panel was asked: what is the role of the automotive industry in influencing consumer preference toward EVs? Parness mentioned that the Toyota Prius led the way for increasing consumer adoption. He stated that the typical buyer of the original Prius was a technology savvy early-adopting buyer, but in 2019 the typical buyer is more economy-minded. He added that Toyota is not trying to target niche consumers, but rather build a diversified product line that will allow them to appeal to the overall market. Reinhard agreed that it is the responsibility of the automakers to bring EV products to market, but that the high price point of BEVs is unfortunately limiting market penetration. He stated Volkswagen’s intention to launch a new sport utility BEV in the United States in 2020 with an acceptable range and an attractive price point.

A participant asked how to reconcile the recent trend of increasing demand for large crossover vehicles with efforts to increase EV market share, which are typically smaller passenger cars? They wondered also,

how to increase EV penetration without incentives in the marketplace, and should we expect EV uptake to continue exponentially? Reinhard mentioned that Volkswagen recently launched the Audi e-tron, a mid-size sport utility BEV, which highlights their efforts to build a comprehensive product line of EVs that overlap with consumer preference trends. Gray added that as generational requirements have matured, LG Chem was able to optimize their product portfolio to focus on the specific types of battery footprints desired, allowing them to bring prices down. LG Chem essentially has two battery designs—one for sedans and one for SUVs. Bailo noted the importance of building flexible designs that allow a part to be used in different types of vehicle.

The panel was asked how automakers decide whether to invest in FCVs, BEVs, or both, and if they consider investing also in infrastructure for these technologies. They wondered also, are there fundamental science challenges left for FCV or BEV development? Parness said investing in both FCVs and BEVs is important, as Toyota would like to build a product mix with vehicles aimed at different customer segments. Some customers may value the fast refueling times of FCVs, and thus pursuing both vehicles types is sensible. Bailo inquired about Toyota’s work in building hydrogen fueling infrastructure in the United States, and Parness mentioned Toyota’s partnership with companies like Shell in California and Air Liquide in the Northeast. Parness noted that infrastructure costs are still high, and there is yet little certainty regarding a return on this investment, so Parness hopes that tax incentives and state funding will increase in the Northeast, following California’s example. Gray mentioned that fundamental science challenges remain in the manufacturing of battery technology—primarily focused on achieving higher energy density.

A participant asked about the scale of infrastructure buildout needed to create accessible charging, especially in low-income neighborhoods that would benefit from electric buses and shared mobility taxis, and in the shipping industry for electrified delivery trucks and semi-trailer trucks. They wondered if utilities will be able to accommodate these high loads of fast charging. Reinhard mentioned that though the medium and heavy duty sectors are lagging behind in electrification, he believes these products will enter the market soon. He added that in building Electrify America’s fast charging network across the United States, the biggest challenge is working with utilities to bring this level of power to the charging locations. Though you can find convenient charging locations near major highways, that does not mean that the utilities have the infrastructure in place to power that station, and building out that capability can take years. Volkswagen has instead partnered with retailers like Walmart and Target, locations that already have access to power infrastructure to run charging stations.