3

Legal and Regulatory Issues That Shape the Electric System

During the past century, federal policies have greatly shaped the character of power supply, operations, reliability, and prices of electricity in wholesale markets, with a significant push in recent years for competition as a means to ensure efficient and reliable supply. But state policies also greatly affect the functioning of the industry, the types of resources that provide electric supply, and the prices that consumers pay in their monthly electricity bills.

A long-standing federal/state jurisdictional split over transmission establishes that the Federal Energy Regulatory Commission (FERC) has authority over the terms and conditions of transmission service provided by a utility for others. The Federal Power Act (FPA) gives FERC responsibility to ensure such things as open access to transmission, just and reasonable rates for transmission service provided to others, transmission planning by transmission owners, and the reliability standards affecting electric transmission service. The states have responsibility for establishing rates for transmission service that are part of bundled electricity service and for determining whether transmission facilities may be sited and built within their state. This reality has created significant challenges for infrastructure build-out over the years.

This chapter focuses first on the influence of federal policy and regulation, and then informs that discussion with the imprint of highly varied state regulatory policies that affect the structure of the electric industry in different parts of the country. Because of the interconnected nature of the electric grid, both federal and state policies affect the degrees of freedom exercised by different players as the electric system undergoes its current transitions. Table 3.1 provides a high-level summary of state and federal jurisdiction over elements of the electric system, with the chapter providing much more information on these responsibilities and the jurisdictional framework that underpins them. (Note that in practice and as explained in this chapter, evolving issues are beginning to blur the lines that look quite bright in Table 3.1.)

Importantly, there are numerous findings and recommendations in this chapter (and others) related to government actions on one or another side of this federal/state jurisdictional divide. The findings and recommendations also point to gaps and areas of insufficient attention (e.g., mixed record of action by the federal government in establishing metrics, technologies, and standards for resilient electric systems, and mixed actions by states to address resilience except in reaction to extreme weather events that have led to significant hits to the electric grid). In some cases, the committee recommends actions to support not only these public goods but also other actions that will better equip the electric system for its transitions and tomorrow’s challenges. Examples of such recommendations include the following: Congress should authorize and appropriate actions to prevent the dire consequences of a catastrophic cyberattack on energy; state legislatures and utility regulators should encourage cost recovery of

TABLE 3.1 Jurisdictional Responsibilities of Federal Versus State Regulation over Functions, Entities, and Activities in the Electric Industry

| Subject Area | Federal Oversight/Regulation | State and Local Oversight/Regulation | |

|---|---|---|---|

| Industry Structure | Roles and responsibilities of the electric utility |

|

|

| Bulk Power System | Generation |

|

|

| Transmission |

|

|

|

| Reliability |

|

|

|

| Local Distribution System | Distribution |

|

|

| Fuel | Rates and delivery systems |

|

|

| Reliability of fuel delivery | [none] | [none] |

| Subject Area | Federal Oversight/Regulation | State and Local Oversight/Regulation | |

|---|---|---|---|

| Environmental Considerations | Emissions, water withdrawals, etc. |

|

|

| Communications | Access to communications channels |

|

|

| Provision of Public Goods and Services Enabled or Affected by the Electric System | Funding of R&D |

|

|

| Cyber |

|

|

|

| Universal service (equity and energy access) |

|

|

|

| Safety |

|

|

|

| Resilience and emergency response |

|

|

utilities’ investments and expenditures in cyber protection and distribution control systems. This is a preview of the many findings and policy recommendations that follow in this and other chapters.

In particular, this chapter identifies policies affecting the bulk power system, generation and transmission assets, and wholesale power markets; transmission planning, siting, and operations; local electric distribution service and prices; the trade-offs associated with satisfying competing regulatory goals for the provision of electricity to consumers; growing tensions at the intersection of state and federal policies; and key challenges and policy questions surrounding the structure of local distribution service for the decades ahead.

BACKGROUND

The electric industry is not monolithic. Countless different players engage directly or indirectly with the electric system. These players include operators of local and regional grids; utility and non-utility suppliers of varied electricity supply and delivery services; developers and vendors of the equipment needed by those suppliers; sellers of electric appliances, products, and services; investors and regulators affecting all of those entities and activities; households and businesses that use electricity day in and day out; and many others in the economy.1

The many players taking actions each day have important direct and indirect impacts on the performance of the electric system in different parts of the United States. And their actions are affected by the varied character of policy, regulation, and financial and economic conditions around the country. These policies greatly influence the speed and character of transitions—and in many locations, the lack thereof—in the nation’s electric system. At times and in different ways across the country, tensions have already emerged among policy, legal, and regulatory conditions on the one hand, and various economic, technological, and social drivers of change. Such tensions will likely grow in the future, as described further below.

This chapter focuses on the federal and state policies that directly affect owners and operators of the electric system itself, starting with the many publicly owned and investor-owned utilities that occupy the center of the classically “regulated electric industry.”2

Electric Utilities

Many observers consider the local electric distribution utility as the face of the entire industry, in part because it is the local utility that sends electric bills to consumers, dispatches the crews to restore power after an outage, and traditionally tended to own all of the physical assets associated with generating and delivering electricity to consumers. Historically, these utilities operated as monopolies, with heavy public oversight over the terms of entry and exit into the business, the obligations related to provision of electric service to consumers, and the prices that consumers pay for that service.

In recent decades, even as changes have occurred in many aspects of the structure and regulation of electric utilities, there has been less change in the structure of distribution systems, a segment of the industry that is central to its ability to meet the needs of consumers and the nation. Typically, investor-owned distribution utilities have remained rate-regulated as monopolies with exclusive franchises and obligations to serve, even as the dynamics of power supply and delivery have been changing dramatically at the local level.

Outside the community of regulated electric utilities sits a diverse group of publicly owned utilities (i.e., electric cooperatives, municipally owned utilities, and special purpose districts). These publicly owned utilities are

___________________

1Chapter 4 sets out eight categories of players that include four different types of operators—that is, traditional vertically integrated investor-owned electric utilities; cooperatively owned or municipally owned distribution utilities (some of which are vertically integrated and others that group together to form publicly owned generation and transmission associations); large federal power authorities; and restructured utilities that today are “wires-only” suppliers and independent power producers—and four different categories of vendors—that is, traditional vendors of heavy electric equipment; new vendors of centralized electric equipment, projects, and systems; vendors of decentralized modular equipment and systems; and fuel suppliers.

2 The reference here to the “regulated electric industry” focuses on investor-owned utilities, whose rates and terms of electricity service to retail customers are established by public utility regulators in the states. As described later in this chapter, the rates and terms of service for publicly owned utilities (e.g., municipally owned utilities; cooperatively owned utilities; special-purpose utility districts; state and federal power authorities) are typically set by the elected or appointed boards of directors of those entities.

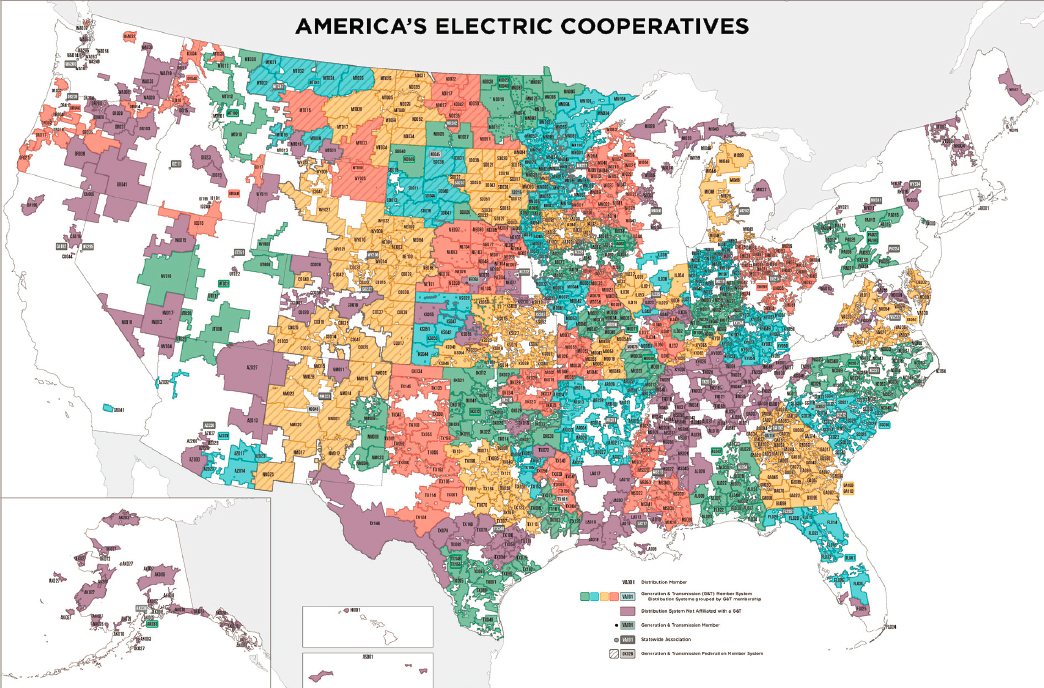

typically not regulated by state public utility commissions, are often exempt from certain laws (such as renewable portfolio standards [RPS]3) affecting investor-owned utilities, and are governed by their own elected or appointed boards. While many public power utilities are fairly traditional in their approach and operations, some, as discussed below, are highly innovative and hold the potential to be test-beds for a variety of new technologies and strategies. Figure 3.1 depicts the many publicly owned electric cooperatives.

In 2018, even though there are fewer than 200 investor-owned utilities (compared to approximately 2,900 publicly owned utilities4), about three-quarters of all retail power went through the local distribution systems of these investor-owned utilities (EIA, 2019a,b). Because cooperatives serve rural areas, the geographic footprint of their systems is often large (as shown in Figure 3.2), and more of their sales are to residential customers (more than 50 percent) as compared to other distribution utilities, whose residential sales account for about one-third of all retail sales.

The varied institutional, financial, and governance structures of these many types of utilities create different systems of incentives and constraints on their willingness and ability to innovate as they carry out their public service obligations. Box 3.1 highlights some of these differences among the nation’s more than 3,000 utilities.

These variations in corporation form and governance tend to lead to practical differences in a utility’s ability to make investments in and fund innovative technologies (such as grid investments). Unlike most cooperatives and investor-owned utilities (IOUs), many utilities that are part of traditional municipal governments lack access to commercial or publicly available loans and have to compete with other city functions and services for funding utility activities. Many tribal utility authorities are similarly constrained and yet have significant infrastructure funding needs and requirements, especially given low income levels of customers and poor baseline conditions in their electric systems. And with rare exceptions, these publicly owned utilities cannot take advantage of tax incentives available to IOUs (and other privately owned market participants).

Other Players in the Electric Industry

Beyond the utilities that generate and deliver power to customers is a diverse body of firms and other organizations: independent system operators (ISOs) and regional transmission organizations (RTOs); non-utility power producers; power marketers; retail electric service providers; companies that manufacture or sell equipment to utilities and others; energy-efficiency companies; companies that produce devices for customers to manage their use of electricity; investors in start-up companies; lenders; consultants and engineering firms; and many others in the industry. Many of these firms tend to carry out their business in segments of the market that are more or less competitive.

On one end of the range of firms are ISOs and RTOs (together, RTOs). Although they are technically not utilities, they are federally regulated nonprofit entities that operate transmission systems and administer wholesale market functions within a particular geographic area. Their governing boards are composed of independent directors with no affiliation with any “market participants” in these regions. Those market participants include utilities, marketers, and independent power producers, which own power plants and compete directly with each other and with utility-owned generation in many markets around the United States. RTOs conduct stakeholder processes that include the market participants, whose discussions and different points of view affect the proposals that RTOs make at FERC with respect to market rules and transmission tariffs. These RTOs’ markets are tightly affected by federal and state utility regulatory policies.

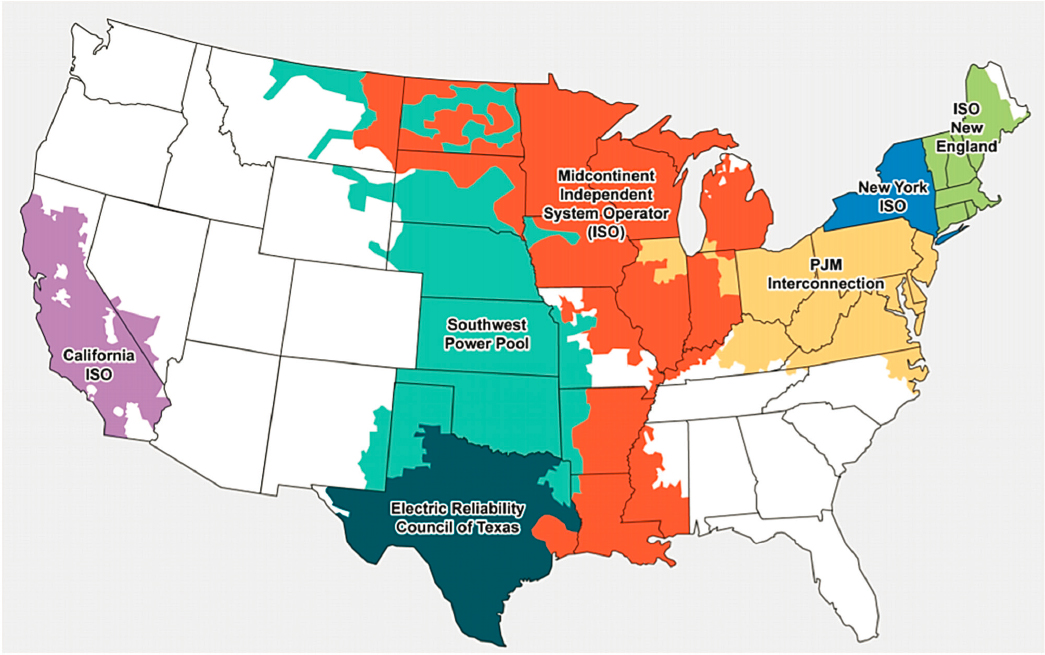

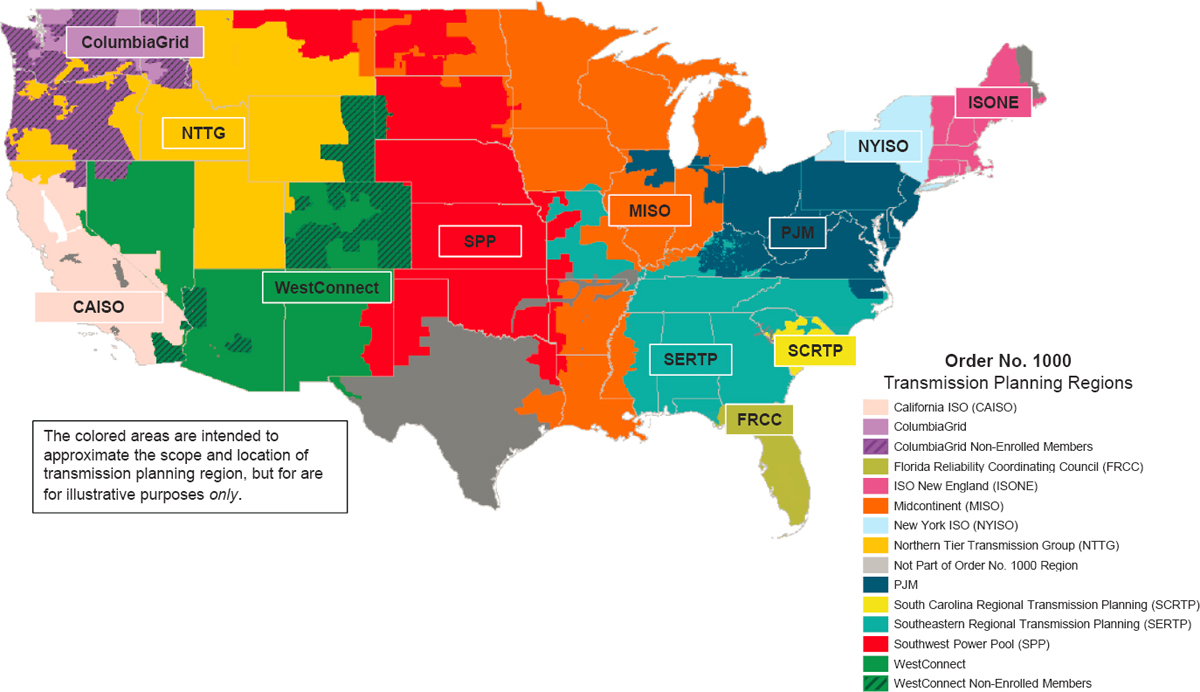

There are seven ISOs/RTOs in regions that provide electricity to two-thirds of electricity consumers in the United States.5 All but one (i.e., the Electric Reliability Council of Texas [ERCOT]6) are regulated by FERC.

___________________

3 Publicly owned utilities are often exempt initially from certain laws (e.g., RPS requirements) but later become subject to them in subsequent changes to statutes or through adoption of parallel policies by their own governing boards.

4 The number of publicly owned utilities is not easy to track because of inconsistent methods for counting one or another type of non-profit utility, with occasional double counting across categories. The committee uses the following sources of information:

Cooperatives: Approximately 900 cooperative electric utilities, comprising 834 distribution coops and 63 generation and transmission coops (NRECA, 2020).

Municipal utilities and other publicly owned utilities including special purpose districts: Approximately 2,000 (EIA, 2019c).

5 See the ITO/RTO Council website at https://isorto.org.

6 Because the ERCOT region of Texas is not electrically interconnected with the rest of the United States, its power system does not produce or deliver power in interstate commerce and ERCOT is not therefore regulated by the federal government, except with regard to the reliability authorities assigned to FERC under Section 215 of EPACT 2005.

However, there are many players in the electric industry that are less directly affected by such policies. Examples include firms participating in the markets for the production and sale of wind turbines to developers of wind farms, markets for the supply of fossil fuels to power plants, markets for heavy electric equipment (e.g., turbines, circuit breakers, transformers, air-pollution control systems), markets for the production and sale of smart thermostats and control systems for building heating and cooling systems, markets for back-up generators, markets for the sale and installation of rooftop solar systems, and so forth.

Federal and state policies affect these latter businesses but mainly through such avenues as tax or trade policy, environmental policies, labor standards, research and development (R&D) policy, and other policies more broadly affecting businesses in the economy in general, rather than by being directly under the supervision of federal and state utility regulators.

These later firms end up being greatly affected by the system of utility regulation primarily in places where their businesses directly interface with utilities themselves. For example, the structure of the electric industry in some parts of the country can end up preventing a solar company from directly selling output from a rooftop photovoltaic (PV) system even to the owner of the building on which the PV system is installed. In some regions, a prospective seller of power from a proposed wind farm may not be able to access buyers in distant population centers unless new transmission capacity is built by a utility, or, for example, unless that project wins in a competitive procurement process conducted by the utility that serves that population. Utility regulation also pervasively controls whether private and nonprofit firms can access energy usage data of retail customers, which the utility collects and analyzes. In most parts of the country, a developer seeking to operate a new microgrid to serve large skyscrapers on the other side of the street will likely be prohibited from doing so, unless the developer of the microgrid is the utility itself.

FRAMEWORK OF POLICIES AFFECTING THE BULK POWER SYSTEM AND WHOLESALE MARKETS

The Influence of Federal Policy and Regulation

Given the traditional and tightly held division of federal versus state authority over various functions in the electric industry, federal policy focuses on several elements of the functioning of the grid: the terms and conditions of access to transmission service; the terms and conditions of sales for resale of electricity (i.e., wholesale transactions); and the operational reliability of the bulk power system.7

Since the mid-1930s, the fundamental premises of such federal regulation rests on the intersection of interstate commerce with the functioning of the interconnected electric system and the need for regulation to address the potential abuse of monopoly power by utilities.8

___________________

7 For a further discussion of federal versus state authority over elements of the electric industry, see Chapter 2 of National Academies of Sciences, Engineering, and Medicine, 2017, Enhancing the Resilience of the Nation’s Electricity System, Washington, DC: National Academies Press.

8 Congress enacted the Public Utility Act (PUA) in 1935, in large part to address concerns about abuses of market power by utilities that had arisen over the prior decades.

Title I of the PUA was known as the Public Utility Holding Company Act of 1935 (PUHCA), and authorized the Securities and Exchange Commission (SEC) to address transactions among utilities that were parts of companies and to oversee proposed mergers and acquisitions of utilities.

Title II (Part II) of the PUA was known as the Federal Power Act (FPA) of 1935 (16 U.S.C. §§ 791 et seq.). The FPA is the primary federal statute governing the interstate transmission of electricity and the wholesale sale of power, and assigns regulatory authority for such activities to the Federal Energy Regulatory Commission (FERC), which is the successor agency to the Federal Power Commission that was established by the FPA. Sections 205 and 206 of the FPA give FERC the authority to review and approve rates for the transmission or sale of wholesale electricity by electric companies and to address rates that are “unjust, unreasonable, unduly discriminatory or preferential.”

Congress has amended the FPA and PUHCA on numerous occasions since 1935. See CRS (2017).

Operators and operations in the generation and transmission segments of the electric sector have undergone significant change in recent decades. Much of this has occurred in response to federal law and regulation. For example, the Public Utilities Regulatory Policies Act of 1978 (PURPA) stimulated the development of competition in generation among utilities and third-party owners of generating assets by requiring that utilities purchase power from certain non-utility facilities if such power was cheaper than what it would cost the utility to produce the power itself. To enable those third-party generators to access potential utility power buyers, they needed to move their power over transmission facilities owned by others.

The Energy Policy Act of 1992 (EPACT 1992) authorized the Federal Energy Regulatory Commission (FERC) to set the terms and conditions under which interstate transmission projects could provide others with nondiscriminatory access to the capacity on that transmission system. EPACT 1992 further expanded the potential for competition in the generation segment of the power system by establishing a new class of power producers—Exempt Wholesale Generators (EWGs)—which were not considered utilities under the Public Utility Holding Companty Act of 1935 (PUHCA) and the Federal Power Act (FPA).9 Using authorities under the FPA as amended by EPACT 1992, FERC eventually required vertically integrated electric utilities to separate the operations of their generating assets from the parts of their business responsible for transmission, and required transmission owners to interconnect power plants owned by others.

In the Energy Policy Act of 2005 (EPACT 2005), Congress enacted several other important amendments to the FPA. First, and following upon several events that blacked out significant portions of the electric grid, including the largest North American blackout occurring in 2003,10 EPACT 2005 determined that the reliability of the nation’s electric grid required the establishment of mandatory and enforceable reliability standards for the power sector by an Electric Reliability Organization (ERO). Before then, the industry operated under voluntary reliability standards. EPACT 2005 established Section 215 of the FPA, which authorized and directed FERC to certify some entity to function as the ERO (and in 2006, FERC chose the North American Electric Reliability Corporation [NERC] to serve as the ERO, subject to FERC supervision).11 Section 215 establishes the role of the ERO in developing and proposing standards to address issues that could affect the reliable operation of the bulk power system. Once a proposed standard is approved by FERC, it is then enforceable by NERC and the regional reliability organizations to which NERC delegates certain monitoring and enforcement functions. Unlike many other provisions of the FPA that address rate regulation only for transmission services and wholesale activities of investor-owned utilities, Section 215 applies to the reliability activities of publicly owned utilities.12 Section 215 does not reach local reliability considerations in light of the scope of NERC’s responsibilities that focus on the reliability of the bulk power system.

Since the establishment of this overall reliability framework, NERC has adopted standards covering a wide array of systems and activities affecting the operational reliability of the bulk power system.13

With the institutional/governance/enforcement changes introduced by EPACT 2005, NERC has become part of the regulatory process and the power industry now tends to view NERC the same as a regulator. This has led to an unintended consequence: the changes in NERC’s role have made it difficult if not impossible for NERC to conduct the previously useful, post-mortem, lessons-learned assessments that it had historically performed on major electric system blackouts.

Before FERC designated NERC in 2006, NERC was funded and supported by the electric industry. This original NERC had been set up after the 1965 Northeast blackout under a tacit understanding with the federal government that the power industry would self-regulate with respect to system reliability. A particular task that naturally fell to NERC was the investigation of any major disturbance in the bulk power grid (e.g., a blackout affecting thousands of customers). These post-event analyses were conducted very thoroughly and openly and the

___________________

9 See CRS (2017).

10 See NASEM (2017), p. 13; NERC (2004).

11FERC Staff (2016), pp. 5–6.

12FERC Staff (2016), p. 6.

13 Examples include cybersecurity, emergency preparedness, balancing authority control, resource adequacy analysis, system protections, voltage and reactive controls, frequency response, transmission operations, interconnection reliability coordination, interchange scheduling, and many others (NERC, 2020).

processes used to conduct such post-mortems of blackouts were emulated all over the world. NERC, which in essence was an arm of the power industry, had access to all of the relevant data, information, and personnel who had some relationship with a blackout. Moreover, NERC was able to draw upon the technical expertise of a wide range of experts to perform such an investigation.

The change in NERC from a voluntary and collaborative arm of the industry to a regulator and enforcer has had many important benefits but has also significantly changed NERC’s ability to conduct such investigations. Power companies involved in an event are reluctant to openly share the information necessary for technical experts to conduct detailed analysis of the event. After the Southwest blackout in 2011,14 for example, every step of the technical investigation ended up as an adversarial process with concerns about exchanges of information that could have potential enforcement implications, and this relationship extended all the way through to the findings that appeared in the final report (Dombek, 2012). There is broad consensus that it was an untenable situation in which those power companies that could provide access to relevant information relating to the outages could also trigger enforcement actions if they did so.15

The committee is concerned that there is an inherent institutional conflict of interest for NERC to expect that power companies will be fully forthcoming in providing fulsome information to NERC when NERC also has the ability to apportion blame and determine fines related to particular events.16 This creates a significant challenge for the industry’s ability to glean important learnings from such major incidents. Although rare, major blackouts reveal gaps in the nation’s and even states’ electric system reliability standards (with the latter reflecting potential issues in resource adequacy issues not covered by NERC and FERC). Without the ability to thoroughly and objectively analyze the causes of such low-probability events, it will be difficult for grid operators and regulators (and the nation) to address any deficiencies in the nation’s reliability processes related to low-probability but high-impact events. Given the outlook for increasing cyber threats and more outages owing to natural disasters like storms (NASEM, 2017)—with California experiencing rolling blackouts in the midst of the combination of heat storms and wildfires in the summer of 2020—the industry needs to be able to assess events, learn lessons, and identify gaps.

A possible solution would be to empower an independent organization to conduct event analysis, and for that organization to be separate and distinct from the organizations involved in developing, promulgating, and enforcing reliability standards. One notable template for this separation of duties is the National Transportation Safety Board (NTSB), which investigates all transportation accidents, including aviation accidents that usually attract much public interest. The investigations are quite structured, and end with a report to the board, an abstract of which is made public at the end of the process. The full report includes conclusions with respect to probable cause(s) of the accident and safety recommendations for the industry that result from the learnings gleaned from the investigation.17 The NTSB’s technical expertise and impartiality in investigating such accidents is so well known that they are sought all over the world. In particular, the NTSB is not affiliated with the Federal Aviation Administration (FAA), which is the regulator of the industry, even though both are organizationally under the Department of Transportation (DOT). Using this as a model of separation of duties, the committee finds that there needs to be an independent agency that investigates major power system disturbances and can remain independent

___________________

14 The bulk power reliability coordinator responsible for the Western power system (i.e., the Western Electricity Coordinating Council [WECC]) could have taken better precautionary steps to avoid the conditions that led to this particular blackout (NERC and FERC Staff, 2012). At the time, however, the WECC was the entity also responsible for compliance enforcement associated with the conduct of operations for reliability coordinators. Subsequent to the 2011 blackout, WECC divested its reliability coordinator functionality to an independent organization called Peak Reliability, which provided this function in much of the Western Interconnection until 2019, when other entities took on the reliability coordinator role (Walton, 2018).

15 The electric industry did set up the North American Transmission Forum (NATF) to promote the sharing of best practices and operational excellence (including peer reviews). The NATF was fashioned along the lines of the Institute for Nuclear Power Operations (INPO), and is a forum where Reliability Coordinators share information. NATF’s findings are shared among members, but not necessarily with NERC or the public. See https://www.natf.net/about/about-the-natf.

16 Similar institutional conflicts appear in the relationship between NERC’s regulatory arms/functions and the Electricity Information Sharing and Analysis Center (E-ISAC), which is part of NERC. E-ISAC provides members of the industry with resources to prepare for and mitigate physical and cybersecurity risks and threats. See https://www.nerc.com/pa/CI/ESISAC/Pages/default.aspx.

17 See https://www.ntsb.gov/investigations/process/Pages/default.aspx.

of FERC and NERC. Such an independent entity could be housed organizationally in DOE (in the same way that FERC, an independent agency, is housed within DOE).

Another reason to keep such an agency independent of FERC and NERC is that their jurisdiction encompasses only the high-voltage bulk power system and not the distribution system. With more generation being connected to the distribution system, future disturbances will likely involve aspects of both the transmission and distribution systems, and such an investigative agency must have jurisdiction over the whole power system to be able to extract lessons learned and recommendations for enhancing reliability and resiliency.

Finding 3.1: The nation needs a federal, independent, nonregulatory entity to be responsible for leading blackout investigations and for gathering information (including through subpoena powers) and disseminating key lessons learned for future enhancements to reliability.

Recommendation 3.1: Congress should instruct the Department of Energy (DOE) to create a joint task force that includes the Federal Energy Regulatory Commission (FERC), the North American Electric Reliability Corporation (NERC), the Electricity Information Sharing and Analysis Center (E-ISAC), and representatives from the electric industry to develop recommendations and identify any new legislative authority that is needed so that the industry and its regulators can understand in a timely manner why a significant physical and/or cyber disruption occurred in the electric power grid. Some mechanisms and institutional capabilities, similar to the data collection and investigative function held and carried out by the National Transportation Safety Board (NTSB) for accident investigations, are needed to provide legal authority to independent investigators to gain access to pertinent data needed to reconstruct the disruption, analyze the data, and deliver reports with lessons learned in a timely manner after the disruption has occurred. (See Recommendation 6.4 for other tasks that would be assigned to this joint task force.)

Another issue that was also addressed by EPACT 2005 relates to transmission. A new Section 216 that amended the FPA addressed the tenacious challenges associated with permitting of interstate transmission lines: it gave FERC and the Secretary of Energy certain new but relatively narrow “backstop” authorities to address congestion on the interstate transmission system (CRS, 2010). Traditionally, states, and not the federal government, had had exclusive jurisdiction to determine whether to allow a new transmission facility to be sited within their borders.18 In light of the increasing regional scope of electricity markets as well as considerable difficulty in siting transmission facilities that cross state boundaries, Congress established a set of circumstances in which FERC would be authorized to issue approvals for certain interstate transmission facilities.19 First, the Secretary of Energy could designate certain areas experiencing transmission constraints as “national interest electric transmission corridors” (NIETCs). Second, such a designation would allow FERC to act upon proposals to construct interstate electricity transmission facilities in a NIETC if a state touched by that corridor has taken longer than a year to decide whether to approve or disapprove that facility.

Federal actions under Section 215 of the FPA (federal mandatory reliability authority) have had a more significant impact on the industry than have actions under Section 216 (the backstop role for the federal government in siting interstate transmission lines). To date, the Section 216 framework has not directly resulted in transmission additions (CRS, 2010; Swanstom and Jolivert, 2009), even though in 2007 the Secretary of Energy designated two NIETCs—one in the Southwest (affecting parts of Arizona and Southern California) and another in the Mid-Atlantic area (encompassing parts of eight states and the District of Columbia). A federal appeals court held in

___________________

18 This jurisdictional split is different for interstate natural gas pipelines: under the Natural Gas Act, FERC exercises siting authority when it determines whether a new pipeline project is in the public interest (88 FERC ¶ 61,227).

19 Section 1221 of EPACT 2005 (Section 216 of the FPA [16 U.S.C. § 824p]).

2011 that these designations were defective and remanded them back to DOE for further review.20 As a result of those decisions and DOE’s reaction to them, there have been no further NIETC designations after these court decisions (even though DOE has conducted additional congestion studies) and there has been no action by FERC to implement FPA Section 216.

Finding 3.2: The current framework that relies on the Secretary of Energy’s authority to designate National Interest Electric Transmission Corridors and FERC’s ability to exercise limited backstop authority to act upon proposals to construct interstate transmission has been ineffective in addressing federal/state jurisdictional tensions over the siting of new transmission projects.

Even taking into consideration the difficult issues related to siting interstate transmission facilities, federal law and regulation have led to profound changes in wholesale power markets, including opening up the grid for suppliers of central-state and distributed generation to compete with each other and enhancing the reliability of the nation’s bulk power system.

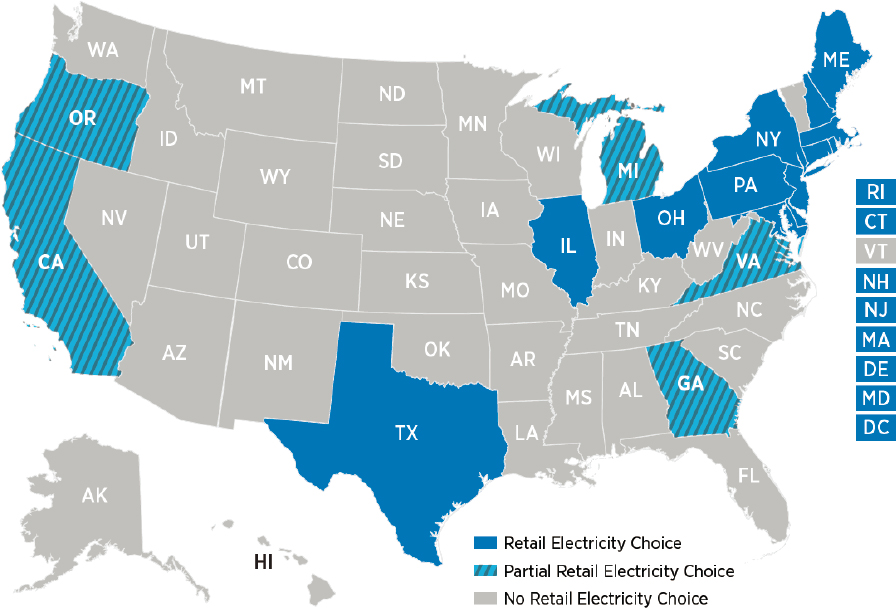

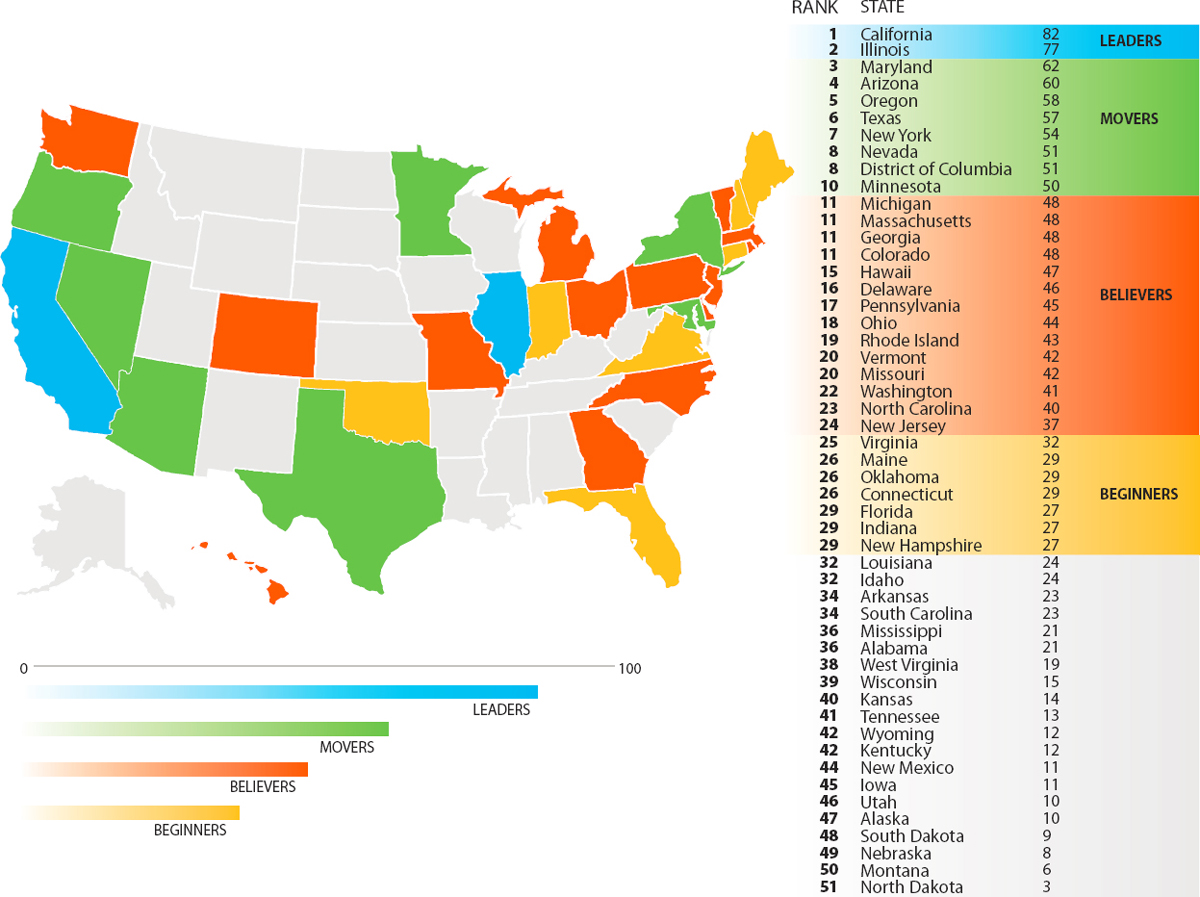

The Imprint of State Regulatory Policies

Despite the dominant role of the federal government in regulating aspects of the bulk power system and wholesale markets, states have also played an important role. In the late 1990s, for example, many states with relatively high electricity prices sought to make the benefits of wholesale electric competition available to retail customers through a number of structural changes in vertically integrated utilities. Many states in the Northeast and Mid-Atlantic regions, along with states like California, Texas, Illinois, and Ohio, adopted laws and/or regulations to allow all or a subset of retail customers to choose their electricity supplier. These policies led electric distribution utilities in many of those states (shown in dark blue in Figure 3.3) to divest their power plants and provide only wires service.

Many of these states required or encouraged these utilities to form ISOs or RTOs to administer competitive wholesale markets and to ensure open access to transmission. (See Figure 3.2.) In so doing, these states’ actions shifted price regulation of generation and transmission facilities and rates to FERC, because these states unbundled retail electric service, formally separated the entities that own generation from those that own the wires, and then retained jurisdiction over the residual activities of distribution companies.

Additionally, in many states (e.g., Minnesota, Washington, Georgia, Colorado, and Florida) where vertically integrated utilities own generation and transmission, there are requirements that the utility seeks competitive offers from third parties when the utility needs to add new resources. The utilities in many of such states—for example, in the Upper Midwest and along much of the Mississippi River—have joined RTOs (e.g., SPP, MISO). Similarly, traditional utilities in Western states have joined the CAISO’s Energy Imbalance Market (which has grown to cover a significant portion of the West).21

Thus, many states, along with the owners and operators of generation and transmission facilities, have taken countless steps over the past two decades in order to gain the benefit of more integrated electric systems and

___________________

20 As explained by the Congressional Research Service: “Two judicial decisions have hamstrung the exercise of the Section 216 authority granted to the agencies. In Piedmont Environmental Council v. FERC (558 F.3d 304 [4th Cir. 2009)), the U.S. Court of Appeals for the Fourth Circuit held that FERC may not permit transmission facilities if a state has denied the applicant’s request to site transmission facilities; FERC may permit the transmission facilities only in the event the state has not acted on the applicant’s request. And in California Wilderness Coalition v. U.S. Dep’t of Energy (631 F.3d 1072 (9th Cir. 2011)), the U.S. Court of Appeals for the Ninth Circuit vacated the Department of Energy’s first two NIETC designations, finding that the agency had failed to consult adequately with the states as required by the FPA. Since the Ninth Circuit’s 2011 decision, the Secretary of Energy has made no further NIETC designations” (CRS, 2010).

21 This is now called the Western Energy Imbalance Market, and its geographic footprint is not shown in Figure 3.2.

markets. In both centralized (also called “organized”22) wholesale markets (e.g., in the Northeast, Mid-Atlantic region, and the Midwest, Texas) and RTOs with a strong imprint of vertically integrated utilities that own generation, transmission, and distribution assets (e.g., in the Southeast, the Rockies, the Upper Midwest), the 2010s witnessed significant transitions in generation resource mixes. These changes were largely driven by lower commodity prices for natural gas, the comparative economics of coal-fired generation versus output at gas-fired power plants, the declining costs of renewable generation, and dynamics of energy production and use on customers’ premises (Hibbard et al., 2017; Mills et al., 2019).

POWER GENERATION, WHOLESALE MARKETS, AND THE BULK POWER SYSTEM

Federal/State Tensions in Wholesale Power Markets and Generation Mixes

Over the past two decades, the dominant federal policy in the electric industry has been to support the reliability of the grid and the efficiency of wholesale market transactions and system operations, with regulatory

___________________

22 Traditionally, individual utilities have undertaken a variety of mechanisms (e.g., owning generation, buying power from a power plant under a long-term power purchase agreement, buying from the short-term electricity market, implementing energy efficiency programs to avoid added resources) to arrange for the portfolio of resources that will provide adequate capacity for the utility’s needs. In an organized capacity market operated by some RTOs (PJM, NYISO, ISO-NE), utilities rely upon a period auction administered by the RTO to identify the set of resources that offer the lowest-cost means to future resource adequacy needs, with the utilities and other load-serving entities paying for their share of the resulting capacity portfolio. In MISO, SPP, and California, the RTO does not run a central capacity auction, and the utilities assemble their resource portfolio under state supervision.

supervision to ensure suppliers’ nondiscriminatory access to transmission service and to mitigate the potential exercise of market power.

Apart from the outcomes of this federal policy support for wholesale power-market competition, the federal/state jurisdictional split over elements of the electric industry has remained relatively stable, with states having authority over resource adequacy, technology/fuel preferences affecting the mix of generating resources and relationships between end-use consumers and power providers, and power plant siting, and with federal authority over system reliability, transmission access and wholesale power pricing.23 But in recent years, this split has shown signs of increasing tension.

Such tensions have arisen, for example, in the context of FERC support for so-called organized capacity markets as the means to determine which resources win the right to receive capacity payments in the PJM, NYISO, and ISO-New England capacity markets, and states’ policy interest in selecting preferred technologies and particular projects, including in support of low-carbon electricity supply.24 As of summer 2020, regulators in several states in PJM—for example, Maryland, Illinois, and New Jersey—are considering whether to withdraw from participating in that RTO’s capacity market while still otherwise remaining in PJM (Morehouse, 2020a). And FERC itself held a technical conference on carbon pricing in organized electricity markets in September 2020 to explore legal, economic, and other technical issues about the extent to which FERC might approve a proposal to incorporate the cost of carbon directly into wholesale market rules, given the many states that have adopted laws and/regulations to eliminate carbon emissions from their economies (FERC, 2020b).

Finding 3.3: The traditional lines that define jurisdiction of federal versus state regulation over the electric industry have shown signs of increasing tension in recent years. These have occurred in instances where FERC’s efforts to create rules for regional wholesale electricity markets have run counter to state policies promoting or mandating the use of low-carbon and/or renewable resources.

FERC was asked to find that states’ net-energy metering policies (that promote the entry of rooftop solar installations) are preempted by the FPA and that FERC, and not the states, should set the rates for surplus electricity from such solar systems that goes into the grid.25 (FERC subsequently dismissed the request.26)

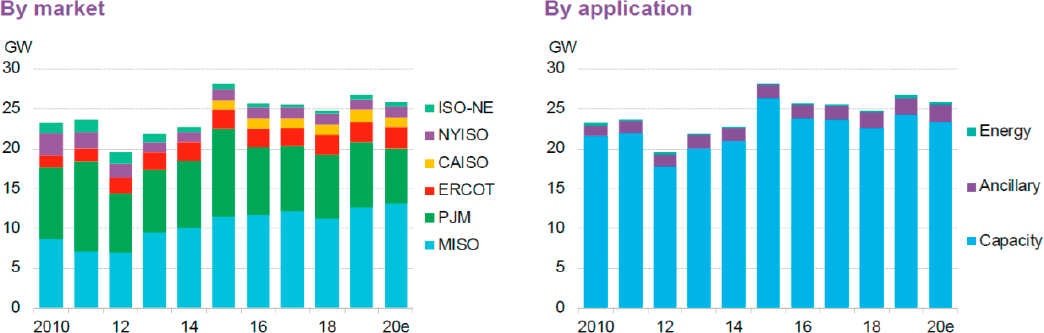

In another example, FERC has sought to encourage the role of demand response on end-use consumers’ premises as a resource in wholesale energy and capacity markets (FERC, 2020d; Morehouse, 2020b), but some states’ policies (e.g., relating to adoption of advanced metering of retail customers’ energy use, their ability to see real-time electric energy prices, constraints on whether non-utility aggregators may offer retail customers’ demand response into wholesale markets) greatly affect retail consumers’ participation in demand response (FERC Staff, 2019). Also, in some states, the distribution utilities are not part of an RTO market. Table 3.2 shows for each ISO/RTO the percentage of peak supplied by demand resources.

Figure 3.4 provides additional information about the extent to which demand-side resources are relied upon to provide capacity (e.g., on peak) rather than energy in RTOs/ISOs. Were there to be more price-responsive demand, enabled by a combination of advanced meters and real-time pricing to retail customers along with appropriate wholesale market rules, there might be greater opportunity to provide flexibility services into wholesale markets. Additional possibilities presented by these demand-side resources include dynamic pricing, direct load control, and incentive payments to reduce customers’ demand for electricity during peak hours. This could be achieved through direct load control of heat pumps and water heating, along with management of EV charging to provide cost-effective means for enhanced reliability and resilience (Smith and Brown, 2015).

___________________

23 Policies of the states, rather than FERC, dominate issues relating to the siting of new transmission facilities. This is discussed in the next section, on transmission.

24 See, for example, FERC (2017); FERC (2019); FERC (2020).

25 New England Ratepayers Association, Petition for Declaratory Order Concerning Unlawful Pricing of Certain Wholesale Sales, Before the Federal Energy Regulatory Commission, Docket No. EL20-42, April 14, 2020. See https://assets.documentcloud.org/documents/6843679/Nera-Proposal.pdf.

26 Federal Energy Regulatory Commission, Order Dismissing Petition for Declaratory Order, 172 FERC ¶ 61,042, Docket No. EL20-42, July 16, 2020. See https://elibrary.ferc.gov/eLibrary/filelist?document_id=14877450&accessionnumber=20200716-3099.

TABLE 3.2 Demand Resource Participation in Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) (2017 and 2018)

| RTO/ISO | 2017 | 2018 | Year-on-Year Change | |||

|---|---|---|---|---|---|---|

| Demand Resources (MW) | Percent of Peak Demand* | Demand Resources (MW) | Percent of Peak Demand* | MW | Percent | |

| CAISO | 1,2931 | 2.6% | 2,4009 | 5.2% | 1,107 | 85.6% |

| ERCOT | 3,0092 | 4.3% | 3,26210 | 4.4% | 253 | 8.4% |

| ISO-NE | 6843 | 2.9% | 35611 | 1.4% | -328 | -48.0% |

| MISO | 11,6824 | 9.7% | 12,93112 | 10.6% | 1,249 | 10.7% |

| NYISO | 1,3535 | 4.6% | 1,43113 | 4.5% | 78 | 5.8% |

| PJM | 9,5206 | 6.7% | 9,29414 | 6.3% | -226 | -2.4% |

| SPP | 07 | 0.0% | 07 | 0.0% | 0 | 0.0% |

| TOTAL | 27,541 | 5.6% | 29,674 | 6.0% | 2,133 | 7.7% |

NOTE: Footnotes in the table are explained in the source document.

SOURCE: FERC Staff, “2019 Assessment of Demand Response and Advanced Metering Pursuant to Energy Policy Act of 2005 section 1252(e) (3),” December 2019, https://www.ferc.gov/legal/staff-reports/2019/DR-AM-Report2019.pdf.

Finding 3.4: Flexible demand offers to provide opportunities for more efficient operations and prices in wholesale/bulk power segments of the electric industry. Because flexible demand can also provide resources of value to retail/distribution segments, it will be important to establish protocols and other standards about who (i.e., wholesale versus retail) has first call on demand-response and other flexible demand resources.

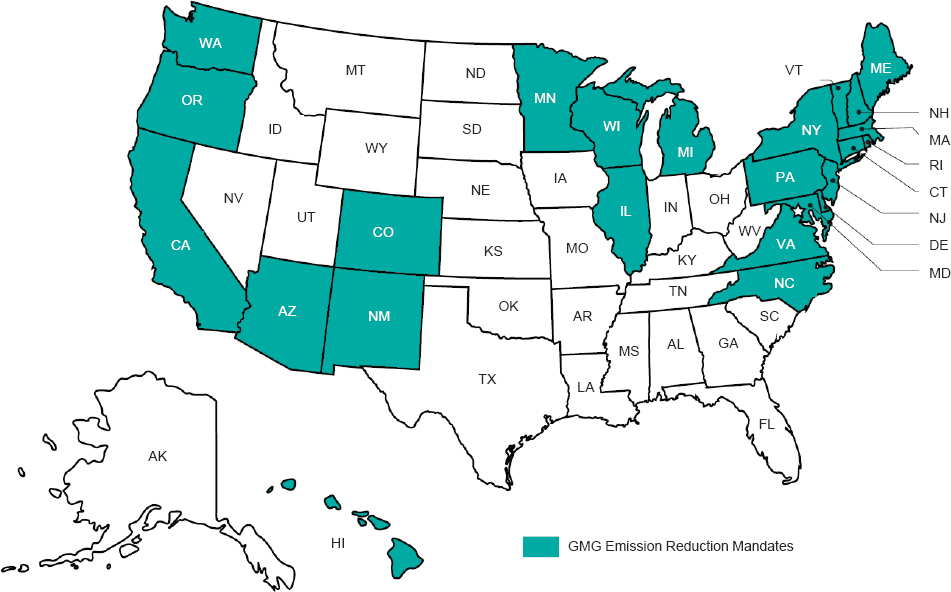

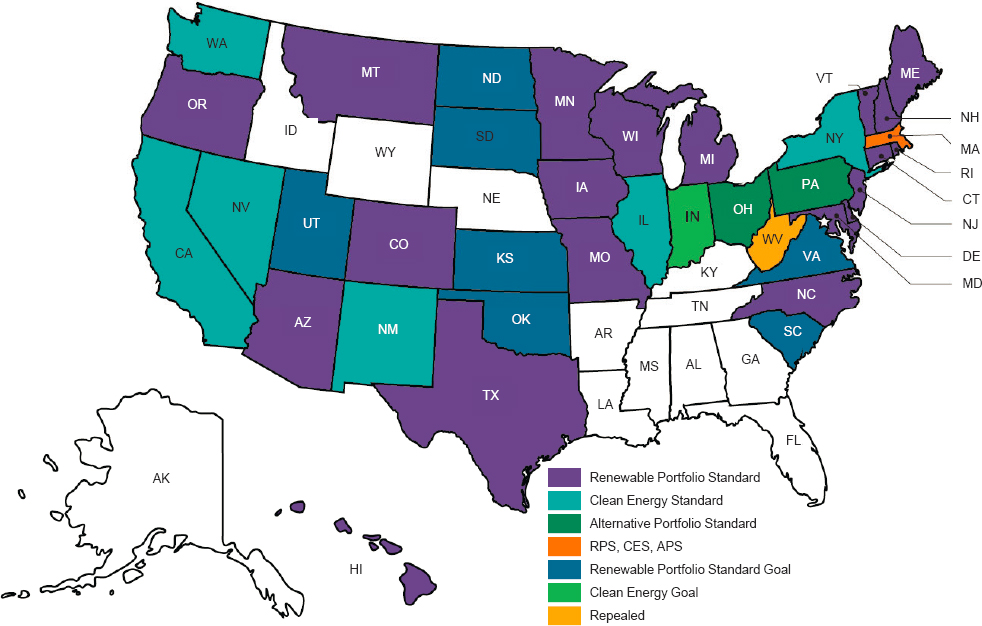

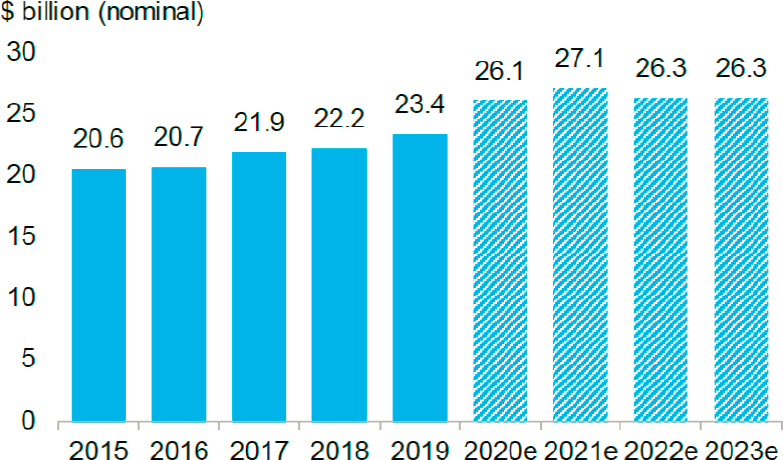

A strong policy direction of many states is to encourage continued reduction, and in some cases, full elimination, of GHG emissions from electricity generation. As of the beginning of 2020, 22 states plus the District of Columbia have adopted specific GHG-emissions reduction targets, either for the economy as a whole or in the power sector in particular. (See Figure 3.5.) Many of those states also have clean-energy or renewable targets for their electricity sectors: 29 states and the District of Columbia have mandatory standards, and another 8 states have voluntary power-sector standards. (See Figure 3.6.)

In response to such policies as well as the increasingly attractive costs for renewable energy, customer preferences for renewable and other zero-carbon power supplies and the scientific consensus on the need to curb GHG emissions, many utilities have committed to achieving net-zero emissions from the power sector by 2050 if not earlier. As of October 1, 2020, 68 percent of retail customer accounts and 30 utilities have goals to be carbon free or have net-zero GHG emissions by 2050 (with a total of 57 utilities having carbon-emission reduction commitments) (Smart Electric Power Alliance, 2020).

Federally Regulated Wholesale Markets in a Low-Carbon Electric System

The substantial reduction and eventual elimination of GHG emissions from the electric sector over the next 20 to 30 years that will be required to meet some increasingly aggressive state climate policies will pose important challenges to the design and operation of regional, FERC-regulated, organized wholesale electricity markets.

These markets, administered by ISOs and RTOs, largely determine generator dispatch and set wholesale prices for electric energy. These markets are designed to make it optimal for generators with no market power to bid their marginal generation cost (i.e., the operating and fuel cost to produce the next increment of energy) as the offer price for producing that additional energy. In the absence of reliability considerations, generators are dispatched in economic merit order to meet demand, with the bid price of the last one dispatched to meet load setting the clearing price for all generators operating at that time.27 If the marginal generator is a fossil fuel plant, its operating

___________________

27 In traditional generation dispatch and in regions without a bid-based approach tied to offers at marginal cost, power plants and other resources are dispatched in economic-merit order so as to minimize the overall production costs on the system. The bid-based market was developed as an efficient market design to optimize the dispatch of resources as well as the overall costs to consumers.

costs will largely reflect its fuel costs. When the marginal generator has no fuel cost (e.g., as for a wind turbine), market clearing energy prices can fall to zero (or even negative).28

In the future, most of the costs associated with zero-carbon electric resources will be fixed capital costs, regardless of the level of output, and with low-to-no costs to produce power. As the share of electricity supplied by renewable generators grows, they will have very low power production costs, which will tend to lower energy-market clearing prices and revenues.

In the context of organized wholesale markets with low natural gas prices and high penetration of zero-carbon resources, the combination of energy and capacity markets arguably do not always provide revenues to cover the fixed costs of capital-intensive power plants (e.g., existing nuclear plants, solar facilities) in the absence of contracts or other means to cover such costs outside of the energy market. Nor are they well-equipped to provide signals to generators to encourage investment in either new technology or research.29 Indeed, much of the investment in zero-carbon/renewable sources of generation has been encouraged and financed by a combination of federal tax

___________________

28 Sometimes, energy prices will be negative if the marginal generator receives a production tax credit for each MWh produced. These incentives make it worthwhile for that facility to generate power even if participation in the energy market yields no revenue and actually results in a cost to the generators, as long as that cost falls below the rewards from the incentives. Also, a utility with a PPA to purchase resources that qualify for generating renewable energy credits (RECs) may be willing to pay an additional negative energy price in circumstances where the utility was paying for energy that is curtailed and not supplying RECs and where the utility would otherwise have to replace the RECs that were not generated at this project.

29 Just as the restructuring of the communications industry gave rise to a precipitous drop in support for Bell Labs (which had long been a source of technical innovation with impacts well beyond that sector), so too did the restructuring of the electricity industry, which resulted in a large drop in research investment by electric utilities as they become more narrowly focused on their bottom line.

credits, state standards, and long-term contracts either for energy or for renewable energy credits (or for both). While those mechanisms have helped to spur investment in clean generators, their effect has been to reduce energy (as well as capacity) prices in the three RTOs with organized capacity markets30 and, as noted above, have led to actions by the FERC that are in tension with states’ policies to prioritize resources like storage, wind, solar, and other zero-emitting resources in those RTO regions.31 FERC’s actions have raised tensions with states that seek to use their resource-adequacy authority to shape the fuel/technology profiles of their electric supply.

Another important limitation to current wholesale market designs is the lack of price responsiveness on the demand side of the market. Importantly, the introduction of price-responsive demand in wholesale markets depends to a large degree on retail customers being exposed to and informed about time-varying prices with capability to respond. To a significant degree, the design of retail prices is a matter of state policy (for investor-owned distribution utilities) and decisions of boards of publicly owned utilities. At present, just over half of all end-use customers in the United States have the technical ability to see real-time prices (because they have advanced meters) although very few customers pay rates that vary in real time. Although some states have endorsed nearly universal deployment of automated metering infrastructure (AMI),32 there are some states in organized RTO markets where virtually no end-use customers have AMI and therefore cannot see real-time prices.33 Despite substantial evidence about the economic efficiency gains and electricity cost savings associated with various forms of time-varying prices for retail customers, there is little appetite among state regulators in some states for this type of pricing as the default pricing regime. Most of this reluctance is driven by concerns about exposing customers to high prices in peak time periods when those customers may have limited or no options to reduce their exposure to those high prices. And yet some of the states with low deployment rates for AMI also have aggressive goals for GHG emissions reductions, renewable energy, and electrification.

In the future and as described in Chapter 2, price-responsive demand could play a key role in grid operations and wholesale markets: this begs for changes in wholesale-market and retail-rate design. In an electric system rich in renewables, flexible demand raises the value of the incremental renewable resources and potentially helps to better integrate renewable sources of generation at lower cost by reducing potential curtailment of renewable resources and increasing electricity supply for a given level of investment in renewable generators.34

How electricity markets will and should evolve in the future remains an open question and is the subject of much debate. The committee is aware of several perspectives on future wholesale market design. One sees a role for even greater reliance on: genuine scarcity competitive wholesale electric energy markets; integrated markets for essential ancillary services required for system stability; flexible generating assets and price-responsive loads; voluntary bilateral contracting; and complementary policies such as carbon pricing or tradable clean-electricity requirements (Gramlich and Hogan, 2019). Alternative perspectives see a greater role for centralized long-term procurement of capacity resources to provide adequate compensation to low-carbon resources with relatively high fixed costs and to ensure adequate capacity of resources with various functionalities needed to support system operations and provide relevant services (Corneli et al., 2019; Pierpont and Nelson, 2017).

Reforming wholesale electricity markets is a complex undertaking, and changes that would be helpful today cannot be implemented quickly. The unsettled state of the world with respect to wholesale market designs as of 2020 creates many questions for federal and state policy discussions that could be informed by new research and analysis. For example, what wholesale market designs might do the following:

___________________

30 The three RTOs are PJM, NYISO, and ISO-NE.

31 Examples of states with large utilities with 100 percent or nearly full deployment of AMI are Alabama, Georgia, Illinois, Michigan, Nevada, Oklahoma, Oregon, Pennsylvania, and Texas. Committee analysis of EIA (2019a).

32 For example and using the most recent data available (EIA 861 data from 2017): in PJM, a small portion of customers in Ohio and New Jersey have AMI; in NYISO, most customers do not have AMI; in ISO-NE, virtually no retail customers in Connecticut, Massachusetts, and Rhode Island have AMI (EIA, 2019a).

33 See, for example: PJM, n.d.; Hale et al., 2018; Muratori et al., 2014; O’Connell et al., 2014.

34 As explained in more detail in Chapter 2, new types of electricity demand that could arise with broader decarbonization—including demand from charging electric vehicles or electrification of building energy services like space heating and water heating—offer opportunities for decentralized energy storage, for demand-and-supply flexibility, and for separating the timing of electricity production from energy consumption. Such end-use technology could be particularly amenable to responding to price signals to shape demand in response to renewables abundance in particular periods (e.g., the sunniest times of day).

- Promote efficient and reliable electricity supply on a future grid dominated by low- to zero-cost variable generation resources?

- Incorporate mechanisms to compensate generators and load-side measures for their provision of flexibility services into a wholesale market?

- Integrate with greater reliance on decentralized resources feeding into the local grid?

- Introduce carbon-pricing mechanisms, along with meaningful carbon prices, to provide for more efficient entry and exit of resources?

- Take advantage of the learning from successes and failures based on experience in other countries?

- Accommodate the diversity of interests and priorities of market participants?

- Align with the regulatory and institutional constraints that need to be addressed or honored in discussions for how market designs should evolve?

These considerations all motivate the need to understand how different socioeconomic and sociodemographic market segments will respond to different programs, pricing policies, and other elements of flexible demand. Corresponding effects on issues of diversity, equity, and inclusion will also be important areas for study and consideration.

Finding 3.5: The performance of current market designs in organized wholesale electricity markets in some regions of the country is being challenged by the changing composition of the resource mix and increased reliance on power supplies with zero marginal costs. One limitation to current wholesale market designs is the lack of sufficient price responsiveness on much of the demand side of the market. More economic and other social science research and analysis is needed to inform future market designs and policy making related to them.

As part of its exploration of these issues in bulk power systems, the committee hosted a workshop on the state-of-the-art modeling approaches. (The workshop also addressed modeling for transmission systems and distribution systems; see the Modeling Workshop Summary in Appendix F.) The key themes that emerged from the workshop are highlighted in Box 3.2.

Generation Planning for Tomorrow’s Grid

This chapter has not focused on generation planning. In the past and in many regions, such planning took place on a regional basis, often conducted by holding companies (e.g., Southern Company, Entergy, AEP) that provide electricity services in many states and sometimes carried out by groups of utilities in a regional area (e.g., New England). Such long-term planning encompassed both generation and transmission issues in an integrated fashion. With the significant movement in many regions to unbundle transmission from generation (which resulted in large part from federal regulatory decisions), planning for generation is now uncoupled with planning for transmission.

Further, with the deregulation of generation in many parts of the country—especially in New York, Texas, much of the 13 states that are part of the PJM footprint, and New England—generation planning changed dramatically. There, independent power companies conduct their own planning as part of developing projects. At FERC’s direction, RTOs conduct regional transmission planning processes, with involvement of stakeholders, in part to inform such private-sector plans.

By contrast, in places where investor-owned utilities are vertically integrated (e.g., most of the Southeast, Colorado, Arizona, and many other places) and where publicly owned utilities (e.g., the Los Angeles Department of Water and Power, Tennessee Valley Authority, Tri-State Generation and Transmission Association) provide generation and transmission services outside any RTO footprint, these entities continue to do long-term planning for generation (and transmission). This also happens in places where vertically integrated utilities are part of RTOs (e.g., in the SPP, MISO, and CAISO regions); the individual utilities conduct planning to ensure that their plans meet reliability standards for resource adequacy, as well as cost and other objectives relating to the resource portfolio. In these places, resource planning processes lead to the timing and type of new generation addition to meet those standards.

In light of relatively flat demand in recent years along with low natural gas prices, the key drivers of additions of new generation capacity are state-mandated renewable portfolio standards, competitive procurements with attractive prices for many wind and solar projects, and retirements of fossil power plants. Such resources enter the market when either price signals in wholesale energy and forward capacity markets warrant such additions; state-sponsored competitive procurements identify approved resources; or integrated resource planning analyses point to the combination of generation and demand-side resources needed to meet anticipated future customer requirements or mandated renewable energy standards.

One consequence of the decoupling of generation planning from transmission planning in many regions is that there are often chicken-and-egg problems associated with developing and siting power plants, on the one hand, and the development and siting of transmission facilities, on the other (Americans for a Clean Energy Grid, 2014; Burke et al., 2020; Zichella, 2012). For example, development of wind projects in regions with high-quality wind (e.g., in the Upper Midwest and Plains states, or in areas offshore of the Northeast and Mid-Atlantic states) depends upon expansion of the interstate transmission system to connect those regions with load centers that can absorb the output of those projects. The policies that have helped to support greater competition in wholesale power markets may have made it harder to permit transmission facilities especially in a multistate context.

Finding 3.6: Generation planning is now uncoupled from transmission planning in many parts of the country, especially in regions with RTOs. This often amplifies chicken-and-egg problems associated with the development and siting of power plants, on the one hand, and the development and siting of transmission facilities, on the other. Policies (like the unbundling of transmission service from generation) that have helped to support greater competition in wholesale power markets may have made it harder to plan for and permit transmission facilities in a multistate context.

For at least the next decade or two—or longer—the electric system will include gas-fired power plants. In 2019, electricity generation based on natural gas accounted for 38 percent of total supply, well above the share fueled by coal (23 percent). As such, another key variable in the performance of the system is those plants’ access to gas supply when they are dispatched to produce power. Although there are no apparent limitations on the supply of gas itself, constraints on the gas pipeline system affect the economic and operational performance of the electric grid in parts of the country.

To be sure, some of these delivery constraints result from physical limitations on the installed capacity and performance of existing gas infrastructure at any point in time and space. Others stem from outages on the gas pipeline system. But some constraints also result from a more complicated set of factors, including policies related to the gas industry.

The gas industry operates under quite different institutional, regulatory, reporting, and reliability policies and standards, as compared to the electric industry. Unlike the reporting of outages of generating units on the electric power system, for example, gas pipeline outages and many other performance metrics are opaque.35 And yet, in recent years, disruptions in gas deliveries to power plants occurred at an average rate of a thousand events per year and affected one in five plants between January 2012 and April 2016.36

Information about such important operational factors of gas delivery systems (e.g., system pressure, fluctuations in pressure and flows) is hard to acquire under current gas-industry standards and policies,37 even as the electric system’s reliability increasingly depends upon the reliability of various elements of the natural gas industry. Reliability events for gas pipelines are reported to various entities, but with reporting thresholds that vary by jurisdiction.38

Although FERC, for example, has jurisdiction over the siting of and rates charged by interstate pipelines, FERC does not have authority to require pipeline owners to report various reliability and other delivery events on their systems. Nor does FERC have authority to adopt reliability standards for the gas industry, which FERC holds with respect to the wholesale electric industry.

In light of the increasing integration of the nation’s electric and gas systems, it is important that reliability data be available to electric system operators for both interstate and intrastate pipelines, and that such data be available both in real time and at other time scales. Because the U.S. natural gas industry has neither gas-delivery reporting requirements nor a central reliability organization for the interstate gas delivery system (or, for that matter, other elements of the gas supply chain), operational risks may be shifted to the electric system.

___________________

35 For example, in some instances it may require a time-consuming Freedom of Information Act request to obtain such information in many if not most states (Apt et al., 2018).

36 NERC Generation Availability Data System (GADS), as analyzed and reported in G. Freeman et al., n.d., pp. 79–84.

37 This is not a new message. In 2013, NERC released a report titled “Accommodating an Increased Dependence on Natural Gas for Electric Power.” Among other things, NERC called on the natural gas transmission sector to work with NERC to establish a central pipeline outage database that would make it possible to conduct reliability analyses of the dual-grid system.

38 FERC has authority to regulate “transportation of natural gas in interstate commerce” (which includes interstate natural gas pipelines, storage facilities, liquefied natural gas facilities) to ensure that the rates, terms, and conditions of service by such facilities are just and reasonable and not unduly discriminatory, and to issue certificates to allow for the construction and operation of interstate natural gas pipelines. The Pipeline and Hazardous Materials Safety Administration (PHMSA) regulates interstate and intrastate pipeline safety. State regulators have jurisdiction over intrastate pipeline systems (e.g., those of local distribution companies and, in some states, intrastate high-pressure gas facilities).

Finding 3.7: The electric industry has become increasingly dependent on natural gas for power generation. Electric system operational performance would benefit from greater transparency on deliveries and flows on the gas transportation system. Federal reporting requirements related to conditions leading up to and reflecting actual disruptions on the gas pipeline system are inadequate to provide the level of situational awareness needed by the electric system. Additionally, no federal entity has authority to establish and/or enforce standards for the operational reliability of the gas pipeline system. This creates planning and operational challenges for operators of power systems.

Recommendation 3.2: Congress should build on the example it set in the electric power system when it established in the Energy Policy Act of 2005 an Electric Reliability Organization with responsibility to set and enforce reliability standards for the electric industry, and authorize the Federal Energy Regulatory Commission (FERC) to designate a central entity to establish standards for and otherwise oversee the reliability of the nation’s natural gas delivery system. Congress should also authorize FERC to require greater transparency and reporting of conditions occurring on the natural gas delivery system to allow for better situational awareness as to the operational circumstances needed to help support electric system reliability.

TRANSMISSION: THE ROLES OF THE FEDERAL AND STATE GOVERNMENTS IN PLANNING, INVESTMENT, SITING, AND OPERATIONS

Transmission facilities have always been essential to the efficient and reliable operation of the electric grid. Transmission infrastructure connects generation facilities with consumer loads and allows for the reliable balancing of supply and demand across increasingly large electrical regions. Transmission enables the continuous delivery of power as supply and demand conditions change continuously over time, as decentralized generation (e.g., rooftop solar) picks up and drops off at certain times of day, as extreme weather conditions present taxing conditions on the resilience of the grid, as outages occur on the system, and so forth.

Both the states and the federal government play important roles in regulating aspects of transmission service. In the past, when much of the country was served by vertically integrated utilities (or, for example, distribution cooperatives served by generation and transmission cooperatives), states played a dominant role in reviewing utilities’ transmission planning and plans, project development, and facility permitting processes.39 More recently, with more of the country served by federally regulated RTOs, some states no longer play a direct oversight role over transmission plans,40 although everywhere, states are the front-line regulators in reviewing proposals to site new transmission facilities.

The jurisdictional split between an increasing role for FERC in transmission planning and ratemaking and the states’ role in siting of transmission facilities, combined with changes in industry structure that have separated the generation function from the transmission function (even within companies that own both types of assets), have introduced challenges for a grid in transition. As noted previously, FERC’s decades-old policies for ensuring open access to transmission have supported competition, but one unintended consequence is that the type of integrated planning for generation and transmission does not occur in many—if not most—parts of the country. This, in turn, has had spillover effects that have made it harder to permit transmission facilities especially in a multistate context.

___________________

39 For example, many states, utilities, and stakeholders in the West—where utilities are largely structured traditionally—have undertaken voluntary efforts to gain efficiencies through joining regional energy imbalance markets, participating in regional planning processes, and reducing the number of balancing authorities.

40 In many parts of the country where electric utilities remain vertically integrated and do not participate in an RTO, state regulators require long-term, 10-year transmission plans, which undergo formal review by the commission and interveners.

Since 2011, FERC has required transmission companies (and RTOs/ISOs) to conduct more open and participatory regional transmission planning processes41 and has supported incentives for investment in transmission.42 Under these processes, transmission companies (and where relevant, RTOs/ISOs, on behalf of the transmission companies) conduct long-term analyses of transmission enhancements needed for reliability, economic, and/or public policy purposes. As shown in Figure 3.7, the planning regions often cross multiple states.

The committee makes several observations about the connections between such regional planning efforts and outcomes for the transmission system, as follows.

First, where anticipated changes on the grid indicate violations of reliability standards in the future, transmission companies and grid operators tend to be successful in justifying proposals to add new single-state or multistate transmission facilities and to get them approved by state regulatory agencies. By contrast, it is harder to gain approvals in situations where transmission enhancements might provide net social economic benefits (e.g., by opening up a congested electric corridor) or support for facilities that are needed for meeting state policy objectives (e.g., renewable or zero-carbon portfolio standards, which may depend on opening up access to regions with high-quality wind or solar resources). This will potentially frustrate the aspirations of many states to eventually eliminate GHG emissions from their power sectors.

Second, even where regional transmission planning processes identify that a particular new multistate line would produce economic benefits for the region, regulators in a state crossed by that line might find insufficient in-state economic benefits to overcome the environmental and other burdens of hosting the proposed line. There are countless examples where transmission projects have been denied owing to such circumstances. Single-state RTO/ISO systems (e.g., like Texas43 and New York44) have been able to address these challenges, because the grid operator’s geographic footprint aligns with that of state regulators (from the point of view of state energy goals or facility-siting approvals).

Third, as noted above, Congress sought to address the challenges of siting new multistate transmission facilities through Section 216 of EPACT, which authorizes the Secretary of Energy to designate National Interest Electric Transmission Corridors (“any geographic area experiencing electric energy transmission capacity constraints or congestion that adversely affects consumers”).45 DOE has conducted four transmission congestion studies (in

___________________

41 FERC’s policy is “intended to achieve two primary objectives: (1) ensure that transmission planning processes at the regional level consider and evaluate, on a nondiscriminatory basis, possible transmission alternatives and produce a transmission plan that can meet transmission needs more efficiently and cost-effectively; and (2) ensure that the costs of transmission solutions chosen to meet regional transmission needs are allocated fairly to those who receive benefits from them. In addition, this Final Rule addresses interregional coordination and cost allocation, to achieve the same objectives with respect to possible transmission solutions that may be located in a neighboring transmission planning region” (FERC, 2015).

42 EPACT provided authority (under a new Section 219 of the FPA) for FERC to establish incentive-based ratemaking for investments in interstate transmission. FERC has relied upon this authority in many transmission rate cases since then.

43 Texas’s ERCOT is not only a single-state grid operator but it is also not regulated by FERC for transmission service and wholesale prices. ERCOT is regulated by the Public Utility Commission of Texas (PUCT). Texas state law required PUCT to designate Competitive Renewable Energy Zones (CREZ) and develop a plan for adding transmission between wind-rich zones and load centers. PUCT identified nine transmission companies to build out its preferred combination of transmission projects amounting to “3,600 right-of-way miles of 345 kV transmission lines. … The CREZ project has enabled installed wind capacity in the state to increase from 1,854 MW in 2005 to 15,764 MW in 2015” (Orrell et al., 2016).

44 NYISO is a single-state RTO regulated by FERC, and the siting of transmission facilities in New York is subject to state approvals. For decades, there were no new major transmission facilities constructed in the state. Over time, this created congested transmission corridors that constrained downstate load centers from accessing relatively economical and low-carbon/renewable energy located in upstate New York. State policy makers determined that a continuation of this congestion would frustrate the state’s ability to meet its energy goals. Working with stakeholders and public officials, the NYISO adopted a Public Policy Transmission Planning Process, which was approved by FERC. In this process, New York regulators identify Public Policy Transmission Needs and then NYISO solicits and selects proposals to address them. Since the process began in 2014, NYISO selected two projects from different transmission providers to increase transfer capacity between upstate and downstate New York. As of early 2020, the projects are in development and will be submitted to state regulators for approval (NYISO, 2019).

45 7 16 U.S.C. § 824p(a)(2).