4

The Persistent Underinvestment in Electric Power Innovation

The “industry” for electric power services is not a monolith. Many different types of firms and other enterprises contribute to production, delivery, and sales, and these different types of organizations respond to different incentives. These varying incentives, including a large role played by regulation, affect the level of investment by firms and societies in research, development, and demonstration (RD&D) aimed at producing new technologies, services and other forms of innovation. In turn, those factors shape which innovations are deployed, how those deployments diffuse more widely into service, and the overall rate at which technology and other elements of the industry change.

As discussed in Chapter 1, throughout most of the history of the power industry the pipeline for innovation and deployment has largely been internal to the industry itself, including its suppliers. One of the biggest changes now under way is the growing importance of innovations that come from outside the traditional industry—for example, innovations in data processing and system controls developed in information technology (IT) sectors that are already having important impacts on the industry and could transform the future of the power industry.

This chapter looks at the incentives for innovation and deployment from the perspectives of two major categories of organizations: the operators of the U.S. electric supply system, and the vendors that provide equipment, services, and other inputs to that system. This system must remain fit for purpose in the face of massive challenges looming on the horizon, most notably the need for deep decarbonization.

In the old world—in which nearly all electric supply came from vertically integrated utilities or publicly owned organizations that performed similar functions—the entities that owned and operated the electric supply system did not, themselves, do much of the innovation. However, they had a long-term focus on reliability and, to varying degrees, on reducing costs for consumers. Those goals came from society and were reinforced, in part, by regulators and the monopoly-oriented structure of the industry—topics covered in the previous chapter. This market structure had a huge effect on the equipment and services that these utilities and publicly owned organizations bought from vendors who, themselves, did most of the innovation. Those vendors could make investments in RD&D because they knew that their main customers would pay for new equipment that embodied innovations that advanced the goals of reliability, low cost, safety, and other publicly enshrined missions. They had confidence that regulators would, to a point, allow regulated firms to purchase these new technologies and services; they had confidence, as well, that public power enterprises, which were not regulated because they were owned and managed directly for public purpose, had a similar set of incentives for the adoption of innovations. In many cases, the large utilities also played a role in innovation by assembling new equipment and services into new systems—for example, pollution control systems or large interconnected grid systems—and then learning how to operate these new systems

safely and reliably. Where regulated utilities and public power enterprises did invest in innovation, they often did that collectively—notably through the Electric Power Research Institute (EPRI)—and regulators usually approved recovery of the costs. The federal government, meanwhile, provided modest support for innovation, especially for technologies related to power generation. That federal investment, as documented here, focused initially on nuclear power (where goals of advancing electric power technology co-mingled with national security), then advanced combustion of fossil fuels, and, more recently, renewable sources of energy. The federal government also invested broadly in basic research across a wide array of fields where fundamental innovations pushed the frontier of what was technologically feasible. There was not a national, integrated strategy for innovation in the electric power industry so much as many dozens of overlapping strategies that all followed similar scripts.

That old approach to innovation has frayed, with the result that portions of the electric industry face a crisis of innovation—an underinvestment in new ideas and technologies—even as other segments of the industry are seeing a pace of innovation and technological change that is unprecedented.

Four factors have contributed to this fraying. One is growing uncertainty about the industrial organization of the sector and associated future regulatory regimes. While integrated utilities and publicly owned enterprises continue to account for the largest volume of sales and number of customers, other modes of organization are emerging. Many involve fragmentation of the sector—a trend that has allowed for more competition, experimentation, and innovation but also creates substantial new risks. Where industrial structure is changing quickly, traditional utilities and public sector organizations have often become wary that they can recover the costs of supporting research on and adopting innovations into a well-functioning electric power system. Indeed, new structures have emerged1 (O’Shaughnessy et al., 2019). However, these systems remain unproven and perhaps fleeting.

Second, as explained in the previous chapter, the highly regulated nature of the electric power industry can be a barrier to technological change. The regulatory system, for the most part, is organized to allow innovations that are familiar, readily proven, and aligned with the business models of the incumbents (Lehr, 2017). The disruptive nature of the new innovations affecting the industry, especially at the level of distribution and the interface with customers, often has opposite properties. Fear of regulatory disallowances and ratepayer intolerance of investments that do not pay off reliably, or that lead to cost overruns, make regulated firms wary of taking risks that might not yield a reliable return in line with what investors expect in the utility sector. In many states, as well as at the federal level, these uncertainties around regulatory incentives interact with and amplify uncertainties surrounding the whole structure of the industry. New forms of regulation could dampen these perverse incentives—for example, performance-based regulation, which would create stronger incentives for firms to adopt innovations that lead to tangible improvements in operational efficiency, and is used in different forms in some states—but the application of these methods is uneven and does not address the challenges associated with creating incentives for profound innovation that might not lead to prompt commercial advantage (Beecher, 2017).

A third factor is intensifying focus on environmental concerns, notably climate change. The challenges associated with addressing these concerns have created a massive need for innovation, yet there is ongoing uncertainty about the stringency and speed of policy action. Also, increasingly uncertain is the balance of effort between federal and state jurisdictions, with ongoing political gridlock in the federal government creating strong political and regulatory incentives for more states to act on their own. The clutching and gearing of this process of shared authority without clear strategic direction, however, has created new risks for innovators and adopters of these new technologies.2

Fourth is the changing nature of innovation relevant to the power sector discussed in Chapter 1. Innovations from other industries are spilling into the power sector, often aided by (and accelerating) fragmentation of the

___________________

1 Community aggregators that market electricity directly to customers, bypassing traditional regulated utilities, are currently authorized in eight states.

2 One area where environmental regulation in the form of technology-focused requirements or incentives has arguably led to important technology performance improvements and cost declines is that of policies to encourage adoption of solar PV and wind. However, even here an evaluation of the impact of U.S.-based policies requires looking beyond the U.S. borders because the technologies that have seen the most rapid declines in cost are traded globally. According to the International Renewables Energy Association, solar PV costs fell by 82 percent between 2010 and 2019 and onshore wind costs fell by 40 percent over the same time period (See the International Renewable Energy Agency, website at http://irena.org.).

sector. Some of these technologies have affected the cost of fuels, which in turn affects where the industry invests in generation technologies. For example, the development and commercialization of horizontal drilling technologies and fracking technologies have dramatically increased the supply of natural gas at low cost and spurred a decisive shift from coal to gas. Other technologies relate to configuration and operation of the grid itself, as discussed in Chapter 5. Large amounts of venture, philanthropic, and private funding for energy innovation may also alter the types of innovations that advance to commercial application—possibly favoring technologies that are highly disruptive to traditional and often highly regulated aspects of the electric power industry. These funds come from outside the sector and are often invested in innovations aimed at high-risk blockbuster-size returns rather than lower risk marginal returns. Although hard to assess, substantial funds that come from private individuals and families—often with supersized profits earned from software and information technology, rather than the traditional electric power industry—have seen personal investment into energy research and development (R&D) as a way to transform an industry they perceive as not moving fast enough to avert existential problems, notably climate change.

This exogenous innovation is allowing new technologies, such as self-supply systems and microgrids, to find users even when they are not valued by, understood, or even opposed by incumbent integrated utilities. On the one hand, such spillovers have radically raised the rate of change and level of innovation in some segments of the electric industry—especially around the edges of the grid (Chapter 5). On the other hand, the rising role for exogenous innovation has reduced the ability to direct innovation toward particular goals. This supply of innovation from other industries—for example, radically improved battery chemistry or advanced control systems—has created a host of intriguing new ideas that can be tested in the lab or in pilots. However, connecting such early-stage activity to actual field deployments at scale within the incumbent and highly regulated industry has proved much more challenging.

The needs for technological change in the power sector have risen sharply. As explored in Chapter 2, with new societal demands placed on the electric power system, such as the imperative of deep decarbonization, expand the social need for innovation in the electric power industry. The supply of innovation directed toward those goals, for the most part, has not kept pace. Whether exogenous innovation can fill this gap is unknown, but the committee considers it unlikely. Some of the most critical needs, such as testing and deployment of whole power plant systems with near-zero or negative emissions, will require activities uniquely tailored to the power sector—activities that boost investment in and steer the processes of innovation. In the old mode of organizing the electric power sector, the right approach to meeting that need was relatively straightforward: focus on the utilities and their vendors. In the new modes of organization, the processes of innovation are more dispersed and the need for a careful federal policy strategy more acute.

INNOVATION ECOSYSTEMS IN THE ELECTRIC POWER SECTOR: INVESTING IN RESEARCH, DEVELOPMENT, AND DEMONSTRATION

Innovation in the electric power sector is the result of interactions among many diverse players. Some entities, such as the Department of Energy (DOE), primarily play a research and innovation funding role, while others including the national laboratories, universities, and private laboratories, including some run by equipment vendors, actually perform research or demonstrations that foster technological change within the sector. The various entities that are involved in this ecosystem are identified below, as well as the factors that determine their incentives to innovate.

U.S. Federal Government

The U.S. government is the largest single funder of early-stage innovations and demonstration projects in the electricity sector. U.S. federal investment in energy research and development—which includes generation technologies such as nuclear, fossil, and renewables, as well as technologies for power conversion, conditioning, and delivery—accounts for a small fraction (roughly 6 percent) of total non-defense R&D spending by the federal government, both historically and today (AAAS, 2019). Within the broad category of energy research and development, the majority of federal investment is directed toward energy and electricity production from different fuel

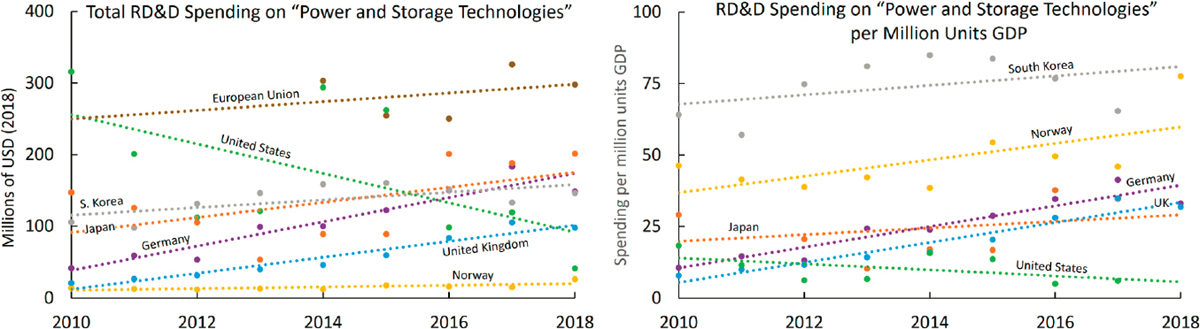

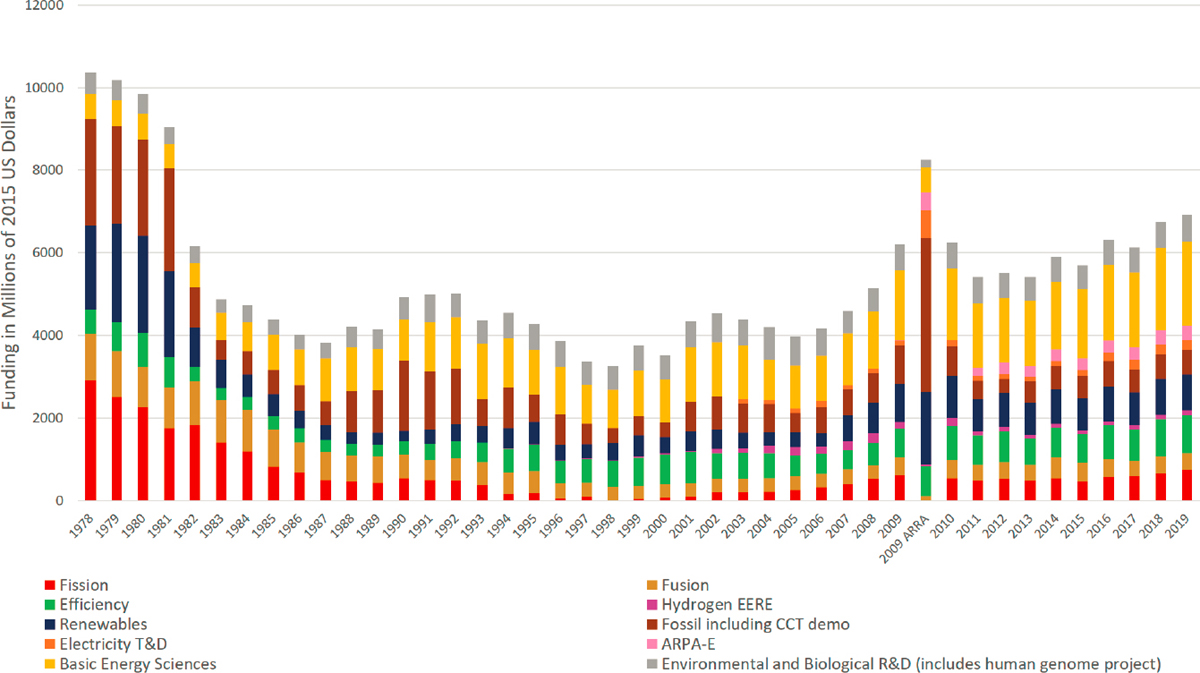

sources (e.g., nuclear power, renewables, fossil energy), as opposed to focusing on the components and infrastructure for electricity delivery. Since 1978, funding for the components and infrastructure for electricity delivery has been, and remains, a small fraction (less than about one-tenth) of DOE’s energy innovation budget (CRS, 2018).3

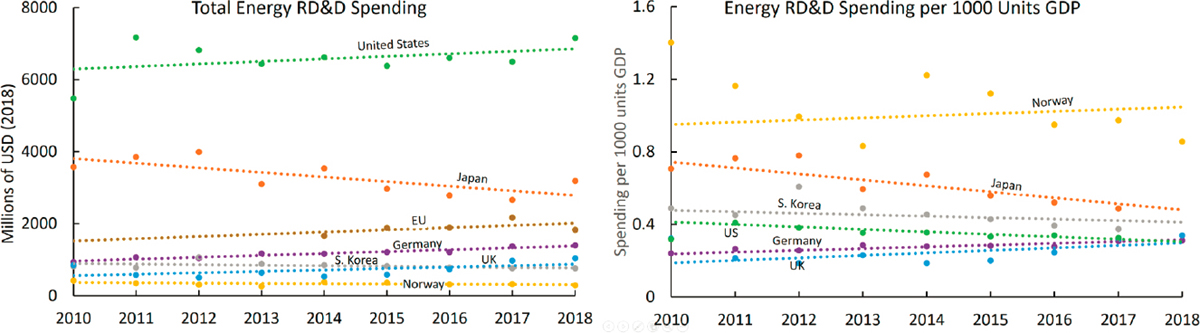

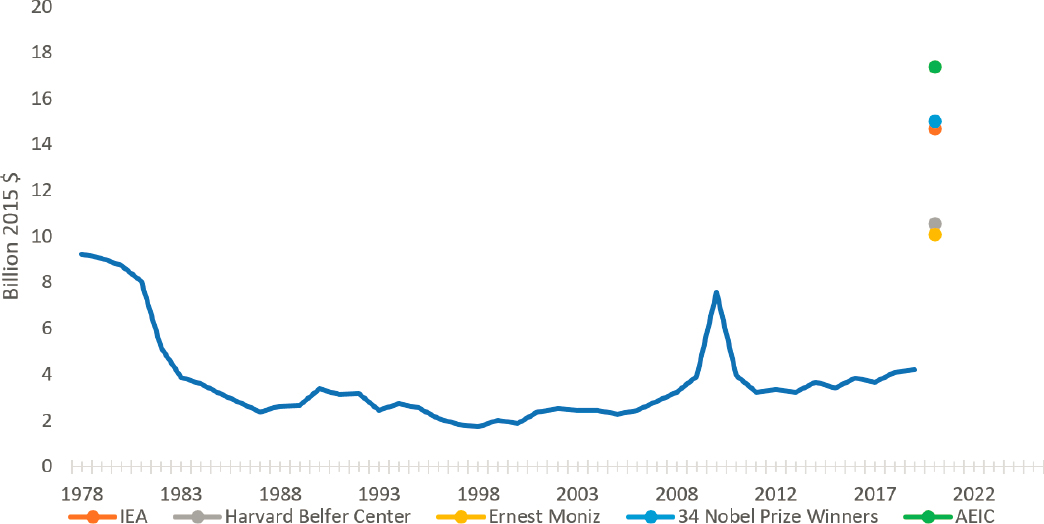

Comparing U.S. government investments in energy and electricity RD&D to other countries is challenging given limited data, different funding arrangements, and varied accounting systems that tabulate funding across different categories. Figure 4.1 shows the basic patterns for economy-wide government spending on energy RD&D in the United States and other leading Western countries over recent years using data compiled by the International Energy Agency (IEA, 2019a). As explained below, assessing what appears to be much larger investments in China is more difficult.

With the exception of China, the United States spends the most in total on energy RD&D (more than $7 billion in 2018; Figure 4.1). This support has been flat since the end of the pulse of funding that came from the 2009 economic stimulus package and largely unchanged in real terms since the early 1980s (Glauthier et al., 2015). However, the United States lags behind many leading economies in investment per GDP, including Norway, Japan, and South Korea, ranking 13th in public energy R&D per thousand units GDP in 2018 (IEA, 2019b). A much smaller subset of these energy-related investments is directed toward technologies for electricity in particular (Figure 4.2). Similar to total energy R&D investments, U.S. expenditure on electricity system R&D when normalized to GDP is significantly less than other leading economies, and even lags behind the European Union, South Korea, and Japan in total dollar investments.

Most cross-country comparisons of public sector energy RD&D expenditure rely on data from the IEA. However, comparisons with countries that are not IEA members are even more difficult owing to lack of comparable data. In China, the State Grid Corporation of China (SGCC)—the state-owned entity that is responsible for most of the Chinese grid—alone reports spending approximately $1 billion on R&D every year for the past 5 years, a figure that dwarfs U.S. investment in electric sector R&D but is difficult to verify and compare with western innovation investments (SGCC, 2017). For the country as a whole, the Chinese government reports via Mission Innovation—a multilateral effort launched at the Paris Climate Conference in 2015 to double public sector spending on energy-related R&D4—that total annual expenditure on low-carbon RD&D was $6.3 billion, nearly double the level of 2015. That amount includes all low-emission technologies but is plausibly focused mainly on the power grid and electricity end uses such as electric vehicles; it includes $580 million for power and storage technologies, but it is unclear how that category overlaps with the State Grid expenditures (Mission Innovation, 2019).

Both in total and as a share of energy innovation expenditures, China appears to be investing much more in technologies for advanced power grids. State Grid’s spending on innovation in the sector is an order of magnitude larger than that of the Office of Electricity of the U.S. DOE, the U.S. federal entity most directly responsible for investing in grid technologies. But there are many differences in the organization of these governments and industries that make cross-country comparisons difficult. For example, State Grid, unlike DOE, directs deployment of technologies. Moreover, State Grid—as a single enterprise responsible for a single huge grid—co-mingles investments in physical components such as transformers and circuit breakers alongside simulation, modeling and advanced control systems because State Grid, itself, also runs China’s grid and thus benefits directly from investments that improve operational performance.

In the United States, it has proved particularly difficult for the beneficiaries of innovations in modeling and simulation tools—that is, the essential software needed for the planning and operation of a more reliable and efficient grid—to be organized and influential in steering the federal investment in innovation. These beneficiaries

___________________

3 According to a recent study done by the Congressional Research Service, since 1978 DOE has allocated approximately 37 percent of its energy-related funding to nuclear energy, 24 percent to fossil fuels, 18 percent for renewables, 16 percent for efficiency, and only 6 percent for electric systems. The last category is generally where most infrastructure and delivery spending is focused. The 2009 American Recovery and Reinvestment Act (ARRA) provided approximately $4.5 billion to the electric sector, which was matched by private sector funding, for one of the largest single federal investments in electric infrastructure. It is unclear whether this should be counted as an R&D investment, as much of it focused more on demonstration, hardware deployment and infrastructure improvement.

4 Independent assessments have pointed to the value of cooperative efforts such as Mission Innovation because the knowledge they yield is a global public good; those same assessments have underscored the gap between the goal of more global investment and production of new ideas and the reality on the ground (Cunliff and Hart, 2019).

NOTE: 1. The IEA RD&D Budget database is comprised of seven “groups” of energy technologies, primarily organized around fuel source such as fossil fuels, renewable energy, and nuclear. Group Six, “Other Power and Storage Technologies,” contains subcategories for electric power conversion, transmission and distribution, AC/DC conversion, control systems, load management, and other electric system research investments.

are highly diffused rather than a single or small collection of corporations. DOE recognizes the importance of systems research and has a separate Office of Electricity devoted to grid reliability that conducts such research. However, without well-organized industry champions for this research, this office has been consistently underfunded compared to research on physical components. In 2014, DOE, recognizing that the technological and policy changes affecting the grid will require significantly more systems research, started the Grid Modernization Initiative (GMI) that developed a roadmap for this research. DOE launched a research consortium comprising 14 national laboratories with support from five DOE offices in November 2014 to develop new architectural concepts, tools, and technologies that measure, analyze, predict, protect, and control the grid of the future, and on enabling the institutional conditions that allow for more rapid development and widespread adoption of these tools and technologies (“Grid Modernization Initiative,” DOE). This effort aims to deliver on the objectives outlined in DOE’s Grid Modernization Multiyear Program Plan across eight broad technical areas (“Grid Modernization Laboratory Consortium,” DOE). In 2017, the Electricity Advisory Board of DOE endorsed this plan, recommended its funding, and pointed out that the federal government would be the only entity to carry out such research for the national public good (Electric Advisory Committee, 2017). Actual funding of GMI, however, continues to lag behind the original plan. Fundamentally, the incentives for investment in grid innovation remain misaligned.

Finding 4.1: The United States lags behind international peers in federal investments made in energy R&D per unit of GDP and as a fraction of total public sector R&D. In the United States, the fraction of federal investment in electricity systems is small compared to investments in generation technologies and fuel sources. It is almost certainly the case that the United States lags behind Chinese investments, but the committee has been unable to obtain reliable and comparable numbers.

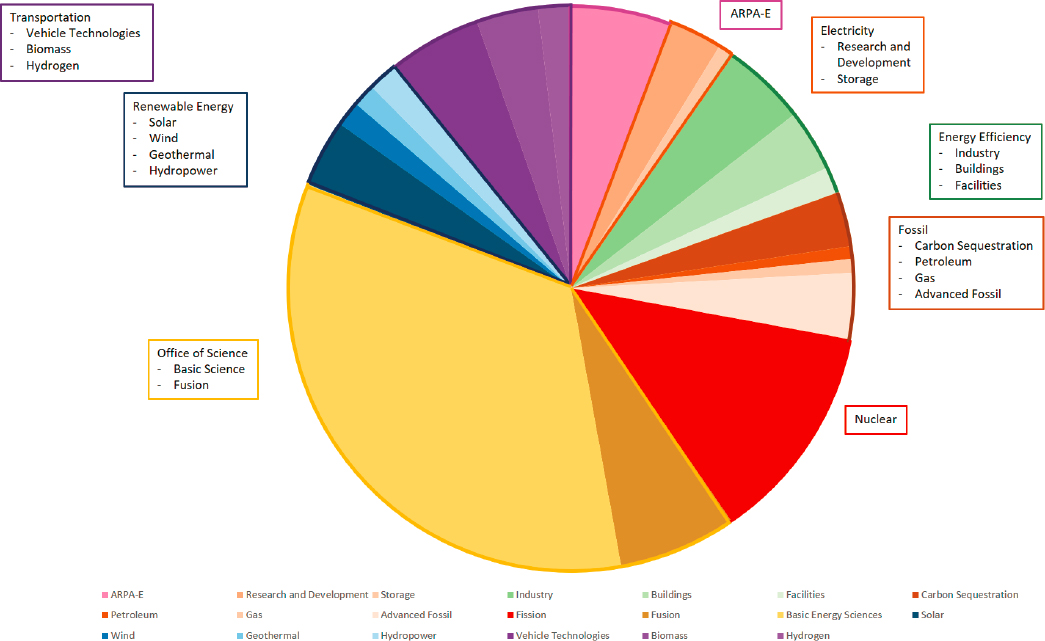

Assessing the U.S. federal government’s investment in innovation involves, first and foremost, looking at the roles of DOE. Funding, appropriated by Congress and flowing through DOE, is focused on a wide array of topical areas. Figure 4.3 shows all energy-related innovation because it is hard to separate “electricity” from the rest, especially with respect to basic sciences. In the future, even work on hydrogen—which, like electricity, is an energy carrier—could become highly relevant to the future power grid because hydrogen may become a commercially viable means of storing excess energy (e.g., from renewable electricity generators) and also the mechanism through which electricity and gaseous fuel grids become more tightly integrated while emissions of greenhouse gases from the energy system overall are reduced to very low levels. This figure also shows how money appropriated under the American Recovery and Reinvestment Act in 2009 in response to the 2008 recession resulted in a large influx of spending for clean energy—indeed, depending on how categories are counted, up to 15 percent of the full economic recovery package was devoted to clean energy investments (Strand and Toman, 2010). As the United States develops a plan to invest in new infrastructure that could be used to stimulate recovery from the COVID-19 related economic collapse, there could be similar opportunities to direct some of that investment toward clean energy development and deployment (C2ES, 2020; Hanna et al., 2020; IEA, 2020).

Federal support for innovation flows through grants and contracts that fund three broad categories of research performers. First, DOE supports a network of 17 science and technology laboratories located throughout the United States. While some of these laboratories are largely devoted to national security, others focus on research related to energy production, delivery, and utilization.5 Most of the energy research funded by DOE is either conducted by or managed by the national laboratories, but DOE also funds research at universities across the country, largely through its Office of Science. By DOE’s count, in 2018, energy-related research was funded at more than 300 universities (DOE, 2018). DOE also funds educational programs at universities to support future workforce development in emerging energy fields, with recent funding levels of roughly $20 million (DOE, 2020a). Last, DOE provides research contracts to private organizations, such as firms and nonprofit research institutes. However, because of congressional mandates that require cost share, even for fairly fundamental work,

___________________

5 Much of the research that DOE’s Office of Electricity is funding and that the laboratories are doing, particularly related to system modeling, is devoted to energy resilience (DOE, 2020b).

many universities find it difficult or impossible to bid on RFPs issued by DOE, whereas DOE laboratories often do not face such challenges.

Assessing the allocation of DOE effort between early-stage basic research and later applied and demonstration activities is surprisingly difficult. The data are organized along budgetary lines and are focused on the different offices of DOE and their substantive focus areas. (Figure 4.4 shows detail for the most recent year.) On the logic that the Office of Science focuses on basic science and some funds spent through the Advanced Research Projects Agency-Energy (ARPA-E, discussed in more detail later) also support basic research, perhaps one-third of the DOE energy innovation budget goes to basic science. Most of that basic research is performed through the national laboratories, with a large dose of those funds in nuclear fusion and fission—interesting prospects but plausibly not of near-term practical importance for the electric power system. The remaining two-thirds of the DOE energy innovation budget is devoted to applied research and development. The data shown in Figure 4.4 include grants for demonstration of advanced fossil fuel technologies but exclude other methods by which DOE supports early-stage commercialization of new technologies—notably through loan guarantees. At present, the loan program for electricity projects—which works by lowering the cost of capital for firms that seek to move toward commercialization of their new technologies by ensuring that their financing debt will be repaid—has a budgetary cost of roughly $29 million in administrative costs and loan guarantee authority of close to $25 billion for qualified projects related to electricity (DOE, 2020b; Title 17).6 The experience with the loan programs has been positive and generally finds that the portfolio of the loan guarantees actually makes money (Energy Futures Initiative, 2018; Jackson, 2019).

___________________

6 The broader loan guarantee program includes an additional $17 billion in loan guarantees available for advanced technologies vehicle manufacturing and $2 billion for partial loan guarantees for energy projects on tribal lands.

Overall, then, the rough proportion of DOE energy-related innovation funds that go into basic research is about one-third; the rest goes to development and demonstration. And the role of loan guarantees is focused essentially exclusively on early-stage commercialization. These proportions come from looking at the whole of DOE’s energy innovation budget, of which about one-quarter is related to electricity. (The role of the loan guarantee program, however, is disproportionately allocated to electricity—in particular, clean energy generation projects.)

Other Non-Federal Public Sector Organizations

While the federal government is the largest national public sector funder of innovation, a diverse array of other funders also exists. They include state agencies. Both California and New York, as leading examples, provide substantial funds to innovation and especially deployment of new technologies. Most strikingly, the California Energy Commission currently operates with a budget of about $600 million per year (CPUC, 2017). Most of those funds are spent on deployment of mature technologies, such as electric vehicle charging infrastructure or solar home systems, but about $120 million per year is devoted to public interest energy R&D (Doughman, 2020).7 More modestly, the New York State Energy Research and Development Authority (NYSERDA) has a current budget plan of about $600 million per year, which it devotes to an array of deployment, innovation and demonstration programs—for example, in energy storage. Of that total, NYSERDA spends about $60 million to $75 million per year on innovation and research through its Clean Energy Fund (NYSERDA, 2015). NYSERDA also plays an active role in aligning state-level regulatory systems and best practices so that innovations can be deployed more readily—a role it has played, most recently, for offshore wind (Kauffman, 2020).

In the states that have systems for trading carbon emission allowances, these can be important sources of support for innovation (Cullenward and Victor, 2020). The funds raised by those systems are mostly allocated to a variety of clean energy projects—although mainly deployment of known technologies. In the Regional Greenhouse Gas Initiative (RGGI), for example, the states of New York, Maryland, and Massachusetts spend about $200 million per year on clean energy projects, mainly involving deployment of mature (or nearly mature) technologies related to energy efficiency and renewables (RGGI, 2019). Because these sources of funds are raised in many cases through auction revenues for cap-and-trade programs, they are subject to a fair amount of uncertainty; during the economic shock in 2020, in California revenue from auction sales that could be used for such purposes plummeted more than 10-fold (Brown, 2020).8

Owners and Operators of Electric Supply Equipment

The firms that produce and deliver electricity to customers are also an important part of the innovation ecosystem. As discussed in Chapter 3, the structure of the electric supply industry varies across regions and consists of both investor-owned and publicly owned entities of various types. The types of innovation conducted and funded by these firms depends on the incentives that confront them.

Vertically integrated utilities will tend to favor innovations that comport well with regulatory rules and practices. Innovations that are capital intensive are attractive because, in most cases, the regulator-sanctioned deployment of capital into the “rate base” is how these firms grow and earn a rate of return. Utilities themselves, especially the smaller firms, generally spend a very low fraction of their revenue on RD&D. Because regulation is central to this process, these firms also prefer innovations that will pass state regulators’ screens for being “prudent”

___________________

7 The largest source of funds in California is the Electric Program Investment Charge (EPIC), a program that is funded from investor-owned utility customers and approved by CPUC on 3-year budget cycles. The latest number (3rd round) for EPIC is $555 million for the 2018–2020 approval cycle, of which about 80 percent goes to CEC, the rest to the state’s three investor-owned utilities (10 percent to PGE, 8.2 percent to SCE, and 1.8 percent to SDGE). See https://www.cpuc.ca.gov/energyrdd/. Within CEC, EPIC funding is allocated across Applied Research and Development (~$159 million per 3 years), Technology Demonstration and Deployment (~$172 million per 3 years), and Market Facilitation (~$66 million per 3 years). See Table 6 in https://ww2.energy.ca.gov/2020publications/CEC-500-2020-009/CEC-500-2020-009.pdf.

8 The recent addition of a cost containment reserve to the RGGI allowance market, which makes allowance supply more price responsive, should help to limit allowance revenue uncertainty in the future (Burtraw et al., 2020).

as well as “used and useful” so that costs of research or of adopting new technologies can be recovered reliably from rate payers. The implementation of these approaches varies from state to state, but generally they are likely to promote a level of risk aversion that limits a utility’s willingness to explore or adopt wholly new or relatively unproven technologies (Lehr, 2017; Beecher, 2017). In addition, monopoly utilities may be interested in innovations that will help to preserve or advance their monopoly status. This outcome can be accomplished by creating or enhancing economies of scale, creating larger and longer-lived capital stocks that would be stranded in case of policy changes, and erecting barriers to entry to potential entrants.

Federal power agencies include both the four Power Marketing Administrations (PMAs), the federal agencies that own the hydroelectric generators from which the PMAs derive their power, and the Tennessee Valley Authority (TVA). The PMAs and TVA are largely wholesalers but have founding statutes that require them to keep their rates low, and pressures from their constituents point in the same direction. They thus have an incentive to invest in technologies aimed at boosting performance of their systems and some have allocated revenues for that purpose. With restrictions on their customer base and rate levels, PMAs face some financial restrictions on investing in innovation. TVA has more freedom in its ability to raise the financing needed to invest in innovation—in part because its rates are set by its own board and in part because its borrowing costs are exceptionally low.

Cooperatives, municipal power companies, and state power companies have tended not to invest heavily in innovation, although a few are notable exceptions. Most have small loads, which reduces their ability to amortize the benefits of successful innovation. Moreover, their customer ownership tends to be in areas that are less fortunate economically, making them risk averse and focused on more immediate and central goals of reliable power service at minimum cost. The exceptions tend to be publicly owned utilities that serve larger service territories or municipalities in higher density service territories and with larger technical staffs—areas owing to scale and political interests that may be more inclined to support new technologies or to be innovative in other ways, such as willingness to experiment with rate design to facilitate greater learning (Fowlie et al., 2017).9

In most states, the fact that municipal utilities are not under the jurisdiction of state utility regulators—their public mission is defined by their owners and governing boards—could facilitate some forms of innovation where owners demand that outcome. Indeed, some municipalities have used this freedom to invest in innovation. For example, LADWP will be decommissioning its remaining 1800 MW coal plant and replacing it with an 840 MW combined cycle gas plant capable of burning 30 percent hydrogen when it comes online in 2025. On a parallel path, LADWP will develop green hydrogen on an adjacent site using over-generation of renewable energy in the spring and fall, and water that is processed through electrolyzers to strip off the hydrogen to be compressed for longer duration storage (potentially not just hours, but weeks and months) and later used at a time that coincides with customer demand. This innovative and first of a kind generation project in the United States will use future major outage inspections and repairs for incremental upgrades to the combined-cycle units transitioning to a 100 percent green hydrogen burn, producing carbon-free energy.

A similar logic can explain incentives for innovation at state power agencies such as in New York, Oklahoma, and South Carolina. The New York Power Authority (NYPA)—a state power agency formed in 1931 and that offered a partial model for federal power corporations TVA and BPA—has been a reliable and large investor in testing and deployment of new technologies such as grid control systems and digitalization, including in collaboration with overseas partners (NYPA, 2017, 2020). TVA and its local power providers have similarly launched notable power delivery innovations and energy equity programs including the “Extreme Energy Makeover Program” (Brown et al., 2020; NASEM, 2016). The same budgetary freedoms that allow these organizations to take risks also, at times, yield costly wrong turns—evident, among other places, in SCANA’s mismanagement of investment in nuclear power and TVA’s rollback of some of its innovation programs.

Restructured utilities and independent power producers face varying incentives for innovation that depend on the type of activity the firm is engaged in. For generation, the unregulated utility generation affiliate or independent power producer may have little or no direct incentive to innovate. The IPPs operating in markets where electricity

___________________

9 With one exception being when constrained by law, such as Proposition 26 in California.

is a commodity are engaged in fierce competition in competitive wholesale markets mainly around short-term costs of supply, with few incentives for long-term innovation. Instead, they are often highly effective deployers of mature technologies. Restructured utilities—which have some commodity-like generation options and other regulated arms of business—have incentives for innovation that are a blend of IPP operations and regulated enterprises discussed above. However, the uncertainties associated with restructuring (and re-restructuring) since the 1990s have had the overall effect of undermining incentives for long-term investment in innovation. For example, the anticipation of restructuring led utilities to slash R&D budgets by about one-third, with EPRI’s budget bearing much of the brunt (Rezendes, 1998). For T&D, the incentives to innovate are similar to those of traditional integrated utilities. For retail, the incentives to innovate depend on the type of retail model in place. In markets where retail competition has been opened widely—such as in Texas or England, among other markets—there have been strong incentives for customer-facing innovation, such as with new business models and marketing.

Membership Organizations Collaborating with Utilities

Economists have long recognized that innovation is subject to significant spillover externalities and thus individual firms acting alone are generally unable to reap the full benefits from investments in innovation (Arrow, 1962). When the industry works in concert with itself, joint efforts will be greater and the value from innovation applies to a larger set of actors. EPRI is the key model. Absent such a collective, there would be less innovation in the industry, along with lower capabilities to move insights from one firm to another and weakened ability for regulators to understand which innovations define the frontier. Traditionally, the members of this collective were mainly firms with exclusive franchise territories—rather than direct competitors for customers—and thus were more willing to collaborate and faced fewer constraints regarding potential anti-trust violations from their cooperation in this realm. Utilities were also in a position to make longer term financial commitments to EPRI when their regulators, working with traditional regulatory methods that allowed EPRI costs to be recovered, allowed for more certain funding for long-term research projects. When the industry, in much of the country, shifted to more competitive business models, investment in long-term innovation shrank quickly. In the mid-1990s, for example, over just 4 years industry funding for electricity R&D shrank by one-third (Rezendes, 1998). Reflecting those changes, EPRI both shrank and had to fund much of its work through shorter term and smaller funding commitments that tend to limit their ability to take on longer term and higher risk research initiatives that they embraced in the past under utility regulation.

Similar models, at a much smaller scale, work in other segments of the industry—for example, NRECA organizes the rural cooperatives in ways that enable innovation and member utility guided and funded research is an important part of the NRECA mission. In the gas supply industry, the Gas Technology Institute (GTI) has historically played this role in issues related to the reliability and cost of gas supply—although retail gas market restructuring in many states on the heels of commodity deregulation and, more recently, the hydraulic fracturing revolution that has further fragmented the industry combined with regulator reluctance to allow cost recovery for research expenditures have lessened GTI’s role in shaping the future. In 2019, EPRI and GTI launched a 5-year cooperative effort to accelerate the development and deployment of low- and zero-carbon energy technologies, including both low-carbon generation technologies and low-carbon energy carriers such as hydrogen.

These collective systems have allowed for greater scale, efficiency, and impact from collective innovation. They have not eliminated the need for individual utilities to develop effective methods to incorporate and commercialize innovations. That process has been easier for innovations that are based on existing business models and whose benefits from commercialization are readily apparent. The commercial commitment from utilities for more diverse innovations is harder to parse.

Equipment Vendors

Two types of electric equipment vendors—vendors of traditional heavy electric equipment and vendors of modular equipment—have historically played a role in the electric innovation landscape. Alongside those two,

a third type of vendor has emerged to play critical roles as electric supply systems and networks become more decentralized: vendors of services and devices at the grid edge.

Traditional heavy electric vendors have been the backbone of innovation in the electric industry for the past century. They supplied power line technologies, turbines, and nuclear plants along with control systems. Their incentives to innovate were anchored in the reliability of regulated utilities and public power companies as long-term purchasers of new equipment—a growth that was the product of a stable regulatory environment and expansion in electricity sales and the size of electric grids. However, for several decades this sector has seen a decline in the United States. Currently, there are only a small number of U.S.-based manufacturers of large transformers—critical assets for the reliability of the high-voltage transmission system—and those firms are following trends across the industry of diversifying manufacturing into a larger number of overseas operations. If a few of these critical transformers were to fail, that could leave the reliability of the backbone of the U.S. electric grid, serving tens of millions of customers, in jeopardy; the replacement times for these devices, many of which are bespoke to their particular use and for which there is no spare inventory on hand, are long (NASEM, 2017b). Europe faces similar situations, with some remaining capacity, but that industry is waning as well—as nearly all growth in long-distance transmission investment moves to the emerging economies, especially in Asia. The incentives to innovate in this industry are rooted in the markets they serve; most of the growth in heavy equipment applications comes from markets dominated by state-owned corporations, including state-owned (or closely state connected) vendors—an industrial organization that has required greater use of joint ventures and supply arrangements that align with local political and economic organization.

Finding 4.2: The electric power system relies on many different technologies. But a few are pivotal, such as large transformers that must be designed for specific applications. If a few of these critical transformers were to fail, that could leave the reliability of the backbone of the U.S. electric grid, serving tens of millions of customers, in jeopardy. The capacity of the United States to provide these critical assets for its own use is waning. This lack of U.S. manufacturing capacity for large high-voltage and extra high-voltage manufacturing equipment can extend power outages and cause supply chain shortages.

Modular electric equipment vendors include sellers of gas turbines, solar and wind technologies, and grid-scale batteries. Until recently, sales had been expanding in U.S. markets; even as U.S. and other Western sales flagged, global sales have continued to expand modestly—which has helped to fuel continued innovation. For decades, the gas turbine industry offered an iconic example of learning-by-doing as each new frame performed better than the last, and improvements accumulated with experience (Grubler et al., 1999). In the West, the gas turbine supply industry has now largely flattened, with all major vendors experiencing financial distress as flat electric loads and a shift to renewables have sapped potential sales.10 In wind and solar, modular production accounts for huge reductions in cost and also great advantages in scale. For solar panels, in particular, the globalization of supply chains—away from markets such as Japan, the United States, and notably Germany that were the early funders of solar deployment and toward lower cost global suppliers notably in China—has had a huge impact on the costs of supply and further deployment of the technology (Ball et al., 2017; Nemet, 2019). A similar pattern is now unfolding in batteries, with the extra complexity that learning in battery systems is coming largely from deployments in other sectors (e.g., electric vehicles) that are yielding innovations that, in turn, spill into the power sector. In these modular supply firms, innovation is aggressive but largely constrained to their niche of the industry—leading to a pattern of innovation that is highly uneven and concentrated in a few areas such as in production techniques, where innovators reap large and proximate rewards, while avoiding completely others (Zimmerman, 2019). Geographically, these producers of more modular equipment are spread across the planet—although the center of gravity has shifted to Asia, such as for solar cell and battery production. Supply chains are global and thus vulnerable to deglobalization, and concerns about state-connected vendors remain acute.

___________________

10 A similar, vibrant industry has not emerged in the emerging economies because the price of natural gas is higher and the fuel is less attractive for power generation, although most long-term energy models envision a rise of gas-fired generation in those markets.

Services and devices at the grid edge: A similar logic of modularity and associated innovation may now be unfolding for decentralized elements of the grid and at points of interface with customers. Startup firms aimed at scaling power management systems for large customers have emerged—based on a business model that storage technologies are commodities, while standardized software packages can help users tap the advantages of on-site storage and other forms of power management. Enthusiasm about the Internet of Things (IoT), which could allow large loads to be controlled or to interact directly with power markets, is based on a similar logic of learning and scaling. From an innovation perspective, what is potentially transformative is the sheer number of devices that could be implicated in the coming decades, and the powerful effects of competition as users are able to observe and select better performing equipment. Innovation in this part of the electricity industry raises particularly profound questions about the openness of the sector to true disruption from rapid development and adoption of new technologies at scale. Adoption processes controlled by utilities and their regulators tend to limit the rate at which adoption at scale can occur, but much of the investment around grid edge, such as in IT, operates in other industries with business models based on much more rapid rates of technological change. This mismatch appears to be orphaning many potential innovations and has created pressure for new forms of standard setting—for example, interoperability rules—to align better the nature of investment in these technologies and the practice in the electricity industry.

For all three of these types of vendors, over the past few decades the most important shift in industrial organization to affect incentives for innovation has been toward more global markets. Much of this is associated with the rise, over the past two decades, of China as a global supplier—a pattern reinforced and then catalyzed by China joining the World Trade Organization (WTO) in 2001 along with many other global economic institutions. While much attention has focused on China as an emerging dominant supplier of technology in global markets, the reverse flows are also important—the growing potential, in the right policy and investment environment, for U.S. firms to sell goods and services globally, including in China.

Finding 4.3: The geography of innovation in the electric sector has shifted rapidly. Public- and private-sector investment in innovation is rising in parts of the world where electricity demand is growing and governments are committed to investment in building and sustaining the electric power industry—a pattern evident in the emerging economies, especially China. As a consequence, equipment vendors are also focusing their businesses on these dynamic markets, and with that shift they have also moved their investments in innovation, adoption of new technologies and marketing to those new geographies. As a further consequence, the United States is becoming increasingly reliant on foreign suppliers and on the technologies that they are developing for these foreign markets, and that reliance is unlikely to change.

Finding 4.4: The complex and rapidly shifting nature of the processes of innovation, stagnation in federal budgets, and fragmentation of the national system of innovation have made it harder to “take the pulse” of the innovation—to identify places of underinvestment and also harder to identify and implement the suite of policy instruments that could substantially increase and redirect innovation efforts and practical applications. With globalization and with shifts in the frontier of innovation outside the traditional electricity industry, not only have the historical policy instruments and institutions focused at the U.S. federal level become a smaller part of the overall innovation picture but also the policy instruments have shifted from a focus on tools such as traditional R&D spending and utility regulation to include a much wider array of policies encompassing competition, trade and investment.

Recommendation 4.1: In light of the increasing dispersion in the sources of innovation in the sector, the Department of Energy (DOE) should periodically issue a request for proposals from non-DOE affiliated entities to conduct an independent assessment that “takes the pulse” of the global and U.S. innovation systems that are relevant to the electric power sector. Such pulse-taking efforts should look widely at diverse sources of innovation both domestic and international. It should also assess the track record of various efforts to steer innovation, and varied policy and market incentives and barriers to adoption of innovations.

By itself, the globalization of this industry does not harm U.S. interests. However, rising concerns about state-connected vendors in supply chains (as is common in Asia, especially China) along with growing trade and investment tensions could make the geographic shift in equipment supply much more problematic for U.S. interests. Disputes over international trade and cross-border investment could make long supply chains for equipment more fragile and less reliable; they could lead to political pressure to prohibit or regulate tightly the import of critical infrastructure equipment. Indeed, when the COVID-19 pandemic hit these fragile supply chains were severely disrupted. That, along with more nationalistic political forces, has led to pressures to repatriate key supply chains; if those trends continue, the Asian shift in many of these technology supplies could reverse.

Also unpredictable are the responses in the United States and other countries that could arise. Ongoing disagreements over the best policy strategies in response to a more competitive China—and the co-mingling of commercial technology with matters that affect national security—has led to divergent policy strategies on critical topics, such as the permissibility of certain cross-border investments. The lack of broad agreement in the United States on the right policy strategies has introduced an extra element of uncertainty that has led, in part, to some deglobalization of supply chains in an effort to reduce policy and supply risks. Since the 1940s the direction of U.S. foreign economic policy has pointed to greater integration of economies—what today is often called globalization—at first focused on Europe and Japan and then more broadly as the global economy expanded and old geopolitical tensions with the Soviet Union abated. Today, that direction is less certain and there are many signs of deglobalization. One example of that deglobalizing tendency is an Executive Order (EO) in early May 2020 aimed at restricting the role of foreign suppliers for technology in the bulk power system. Interpreted expansively, the EO could require removal of equipment sources from foreign supply chains with replacement by onshore manufacturing (U.S. President Executive Order, 2020).

Recommendation 4.2: In light of the globalization of the electric equipment supply industry, and with it the globalization of much of the innovative activity in the industry, the United States needs to develop better regulatory tools and capabilities for dealing with imported equipment and cross-border ownership of firms producing critical equipment. The Department of Energy (DOE) should consult with the National Security Council (NSC) and explore whether there is need for more extensive cross-department collaboration, including the Departments of Commerce and State, to set standards for imported equipment and cross-border investments, along with implementation of those standards. Any effort in this area will need to establish a few standards for control over imported equipment along with incentives for advancing U.S. manufacturing where it is essential to have these capabilities in U.S. industry. An effective control program should begin with a narrow list of critical technologies for which U.S. (or U.S.oriented) manufacturing and control over supply chains is established. For a small number of critical technologies, such as high-voltage transformers and grid protection and control systems, the United States must maintain the capacity to innovate and manufacture on its own territory.

Recommendation 4.3: Because today the large potential for benefits from international collaboration in the domain of precompetitive energy research and technology development is not being tapped effectively, the United States should devise strategies to support and encourage such collaborations, while remaining mindful of national differences in attitudes toward intellectual property and technology policy. The White House should establish an interagency process under which the Departments of State, Homeland Security, Commerce, and Energy review all arrangements that limit such international research collaborations and make prudent reforms to allow for greater precompetitive researcher interactions between U.S. scholars and researchers in other countries.

Fuel Suppliers

Traditionally, innovation in the fuel supply industry has focused mainly on expansion of supplies. Most striking has been the rise of prodigious supplies of natural gas from innovations in hydraulic fracturing and horizontal drilling—those innovations have emerged from a mix of federal support for key technologies, co-funding of

deployment and then a private sector dominated expansion of the technology (Trembath et al., 2012). In earlier eras, federal investments also focused on methods for expanding supply of coal and conversion of coal to other fuel types, such as gas (NRC, 2001). They also focused on improvements in the design and supply of nuclear fuel for conventional reactors (Abdulla et al., 2017). Those innovations that could have had a big impact on the electric system had natural gas remained scarce. But fuel markets changed, and today’s U.S. power supply industry is dominated by legacy plants in coal, nuclear, and hydro and growth in renewables and natural gas.

The role of the fuel industry as a supplier of innovation may be changing as electric power generators look beyond the role of natural gas in enabling “shallow decarbonization” toward much deeper decarbonization. Since 2005, when commercial supplies of shale gas began to flow in significant volumes, CO2 emissions from the U.S. electric power sector have declined about 30 percent owing to rising market shares for gas-fired electricity and sharp reductions in coal. The U.S. Energy Information Administration estimates that this replacement of coal by other fuels, mainly gas and increasingly renewables, will continue for another 5 years and then level as closure of older and costlier coal units becomes largely complete (EIA, 2020).11 While a substantial contribution, significantly reducing CO2 emissions will require much deeper cuts, especially if extra efforts are needed in the power sector to compensate for other sectors such as heavy industry, freight, and aviation, where deep decarbonization at present looks technologically and economically much more challenging (Victor et al., 2019). Looking beyond CO2 emissions, the U.S. gas industry faces many other challenges—such as links between natural gas production through fracking and increased seismic activity, pollution of groundwater, and possibly enhanced emissions of methane, a potent warming gas. These factors may limit the politically viable extent of reliance upon conventional natural gas in many parts of the United States and could increase gas prices more widely.

Two potential directions are relevant. One is decarbonization of natural gas supply through massive scaling of biomethane or clean hydrogen production and blending those new supplies with conventional gas. Innovations in this area are systemic and will require coordination across many diverse industries (Davis et al., 2018). Bold claims for biomethane potentials have been made by industry, but at this stage it is difficult to know the scalable volumes and costs (ICF, 2019). They will also have implications for both how electricity is produced in the future and how much electricity is demanded as innovations in gas with lower net emissions could affect calls for electrification of heating and other gas end uses.

The other potentially important direction is application of carbon capture technologies to natural gas plants, either as retrofits or with new kinds of power plants—here, too, innovation requires cross-industry collaboration. Modest projects are under way on all these fronts—reflecting the uneven and uncertain incentives for decarbonization. Hydrogen could prove particularly important because it may offer a means of storing energy much more cheaply than batteries and for longer periods of time and it could be a key feedstock for other decarbonizing industries such as steel and plastics. Much of the innovation and testing appears likely to occur outside the United States, such as in Europe. Scouting and learning about innovations globally could be very important.

Finding 4.5: Concerns about decarbonization extend outside the power sector to fuels—in particular, natural gas. Major innovations to decarbonize gaseous fuels, capture carbon pollution from gas plants, and in the production and utilization of hydrogen could profoundly alter the strategies that are followed for decarbonization of the whole electric power system. More cost-effective decarbonization of power would expand the role for electrification as a strategy for decarbonizing many other sources of emissions from industry. More cost-effective decarbonization of gaseous energy carriers—most likely, hydrogen—could also reduce the need to shift end uses to electricity as a means of decarbonization. While many discussions of deep decarbonization of the economy focus on electrification, the potential for hydrogen research to elevate its role as a prominent energy source could have a profound impact on the future size of the electric grid and its role in decarbonization.

___________________

11 These projections assume no change in policies or regulations affecting the electricity sector beyond those in existence when EIA published its 2020 Annual Energy Outlook. Efforts that focus on near-term shallow decarbonization initially and exclusively run the risk of leading to dead ends that can temporarily derail efforts to achieve deep decarbonization goals (M.G. Morgan, 2016).

Regulators

While regulators are not directly responsible for either funding or conducting research or innovation, their oversight role within the regulated parts of the sector have an important influence on the incentives for innovation and adoption of new technologies.

Where regulators have seen appropriable public good in innovation—and seen investment in innovation as aligned with their mission—they have been sympathetic to regulated utilities spending resources on this function. That spending has led to innovation in many forms and modes. Regulatory oversight of these innovative activities varies across the states, as does the use of alternative rate setting mechanisms designed to reward greater efficiency and innovation (Beecher, 2017; Lehr, 2017). Regulators also have influence on technology adoption and diffusion in their role as overseers of what technologies can be attached to the grid. To some degree, regulators have been comparing experiences and learning “best practices” through regulatory forums such as NARUC. (See also Chapter 3.)

Finding 4.6: Regulatory procedures dispersed across local, state, and federal levels have had a huge impact on the incentives for utilities to invest in innovation and adopt new technologies. Uncertainties in those rules, such as pass-throughs of costs of innovation, have reduced the incentives to invest in innovation. New approaches to regulation, such as performance-based regulation, could reorient those incentives but are used in highly uneven ways around the country.

Recommendation 4.4: Achieving greater deployment of advanced electrical technologies will require states to implement regulatory reforms that allow utilities to recover the costs of larger research and development (R&D) budgets alongside other forms of regulatory approval that encourage more adoption of new technologies. In addition, in a few states that provide direct funding for technology demonstration programs, state policy makers should expand those programs and ensure reliable long-term provision of funds. These programs can be models for other state-based innovation funding, especially where they put attention on the need not just for larger spending but also stronger incentives for adoption of new technologies, including those coming from outside the regulated sector.

PERFORMANCE OF THE INNOVATION ECOSYSTEM TODAY

The broad expanse of the relevant innovation ecosystems—from equipment vendors to many types of electric utilities and state-connected firms to fuel suppliers, with a growing fraction of the relevant innovations coming from outside the country and outside the sector—make any attempt at a comprehensive assessment of the performance of the entire system challenging. However, as discussed below, there have been various efforts to assess pieces of that ecosystem that offer some important insights. As a general rule, those studies suggest that U.S. policy-directed efforts to steer innovation have been effective and a sound investment; the United States underinvests in RD&D despite having evolved numerous mechanisms to spend those public resources wisely; and the problem of underinvestment has become, with globalization of ideas and technology markets, a global problem that requires a measure of international cooperation.

In terms of evaluation, the iconic study remains a 2001 National Research Council independent review of the societal returns on a collection of DOE programs from 1975 through 2000 (NRC, 2001). The study, which focused on DOE-funded research in the areas of energy efficiency and pollution control, found that these programs yielded benefits roughly three times the cost of the initial research. In that study, and in all retrospectives on major early-stage investments in innovation, a full assessment of the benefits has proved elusive because successful innovation spills into so many parts of the industry and economy.

That NRC analysis concluded that the highest net benefits accrued to programs focused on end-use energy efficiency where the research prompted changes in DOE issued minimum energy efficiency performance standards that boosted adoption of the newly developed technologies and products. Scientific discovery, funded by DOE, informed the creation of new regulatory incentives to require adoption of these innovations—including not just on efficiency but also many elements of pollution control regulation for power plants. DOE-backed research

coupled with commercial investment also helped bring about steady improvements in cost and performance of these technologies, such that once the energy system was redirected onto a more efficient and cleaner path, required investments became more self-sustaining. By contrast, net benefits tended to be smaller in areas where there was not a ready market for the newly developed products, or where regulatory or legal barriers impeded their adoption. As is typical of studies that assess a broad portfolio of early-stage investments, a small fraction of the investments generated most of the benefits. By implication, it would have been unknowable ex ante which parts of the portfolio would perform best.

For decades, there have been concerns that DOE-funded research has been inherently conservative—focused on familiar innovations, deployment of technologies within existing structures in the industry, and overly supportive of established organizations such as the national laboratories, utilities, and universities. Support for those concerns has come from anecdotal analysis and the heavy overlap between ideological debates around the proper role of government in the modern economy and the particular question of whether and how government should be directing investment into innovations that the private sector, on its own, should support. Some early studies argued that energy-related RD&D—especially the costlier process of demonstration, which involves typically a blend of public sector investment with private capital at risk—was tilted heavily toward incumbents rather than profound innovation (Cohen and Noll, 1991). That view remains persistent despite a plethora of more recent evidence suggesting that public and private returns on these investments are robust (Lester and Hart, 2011). In a few areas, more recent and careful analysis of portfolios of investments suggest that the problem of conservatism and tilt toward incumbents remains in places where budgets have been volatile and the government is unable to place the level of strategic bets on new technologies that would be needed to break this bias toward the familiar (Abdulla et al., 2017). Overall, the story about government-organized innovation is encouraging, and the variety of methods by which government policy can effectively fund and catalyze innovation has grown markedly.

Finding 4.7: Historically, there has been a large social benefit from public and private sector investments in innovation that affects the electric power system. Those benefits have far exceeded the costs, and it is highly likely that the logical case for investment in innovation will grow as society places greater requirements on the power sector (e.g., deep decarbonization, electrification of more energy uses) and remains highly dependent on reliable and affordable electric power service.

Over the past two decades, there has been a periodic search and application of new models for government funding of innovation. Many of those efforts have sought models that would emulate the character of the Defense Advanced Research Projects Agency, DARPA—a funding mechanism that has reliably invested in over-the-horizon technologies that have generated large benefits across the U.S. economy (Weinburger, 2017). Applied to energy, the most important impact of these discussions is reflected, in 2008, with the creation of an early-stage investment program modeled partly on DARPA: the Advanced Research Projects Agency—Energy or ARPA-E.

Established under the auspices of DOE but with a very specific mission and a structure and set of operating principles that are much more flexible than standard DOE granting, ARPA-E funds both high risk and potentially high reward early-stage projects and seeks to create better connections between supported research and eventual adoption and diffusion. The idea of this kind of system, based in part on the DARPA experience, is rooted in many earlier studies—including the National Research Council’s expert consensus report, Rising Above the Gathering Storm (NAS-NAE-IOM, 2007a). The agency relies on a rotating staff model with term limits (to keep the staff fresh, and well-connected to frontier industry and scholarship, and to introduce new thinking on a regular basis). The agency gives authority to its director to direct research funding beyond and outside of a traditional peer review process so that ARPA-E experts can support projects that they see as strategically important. Along the way, funded projects have a series of milestone gates—with contingent funding—to help ensure ongoing progress. This kind of model that gives autonomy to staff and promotes close interactions with the frontier of knowledge is echoed in many studies that call for bigger and well-spent investments of resources in innovation to advance national competitiveness and to advance industrial policy around major national missions such as deep decarbonization (CNEE, 2014; Manyika and McRaven, 2019; Rodrik, 2014).

Evaluations of ARPA-E suggest that the experiment is working, with success on measures of scientific achievement, product development and, to a more limited extent, bringing of products to market (Hart and Kearney, 2017; NASEM, 2017a). Firms that have attracted ARPA-E funding tend to attract more and larger dollars from private investors than do other firms.12 These evaluations all propose expanded funding for ARPA-E and even support the creation of an ARPA-E Foundation funded by federal revenues from fossil fuel leases that regularly allocates one source of ARPA-E funds. Recent years have seen much more attention to the question of how the federal government can be organized effectively to promote innovation—along with attention to a diversity of models from DoD, NIH, and other arms of government that offer guidance (NASEM, 2020).

Finding 4.8: New models for early stage innovation and support of technologies have emerged, showing that it is possible for DOE to utilize substantial new resources for innovation. The leading example is ARPA-E, whose success is rooted in many factors including autonomy to staff and procedures such as staff rotation that encourage close interactions with the frontier of knowledge, notably with industry and frontier research laboratories. While these innovations are most visible at ARPA-E, similar practices of devolving authority to informed program officers, relying on extensive review and market assessment, and allowing nimble adjustment of project and program priorities in light of experience help explain the improving quality of government RD&D programs. These experiences help define a playbook for best practices in public sector innovation.

In addition to the challenges of cultivating successful models for developing new products and getting them to market, the sector also faces important operational challenges as it moves toward deep decarbonization and integrating large amounts of variable and intermittent renewable resources as well as monitoring and integrating distributed renewables and other behind the meter resources often undetectable by grid operators. Typically, system operation has largely taken the approach of adjusting electricity supply to meet a fixed level of demand, and such an approach worked well as long as a substantial amount of the available generators were dispatchable in response to economic or other signals from system operators (or centralized energy markets). With growing variable resources, system operation will be about finding ways to use pricing, energy storage, and other mechanisms to enhance flexibility in electricity demand shifting consumption from periods of low renewable energy supply to periods of abundant supply in order to maintain reliability. Managing the use of energy constrained resources, such as batteries and other forms of energy storage, will also become increasingly important as the system evolves, and developing better forecasting tools and better price signals could help address this management challenge.

Recommendation 4.5: Government support for key electricity research initiatives such as grid modernization and development of technology necessary for deep decarbonization should be sustained for sufficient periods of time to enable new areas of discovery. Congress should appropriate multiyear (minimum of 5-year) funding streams for proposed initiatives in key areas of national interest such as those identified, and the Department of Energy (DOE) should implement long-term funding for projects that demonstrate alignment with critical national needs, technical success, potential net economic benefits, and cost-shared funding where appropriate. Such programs should follow best practices that include ensuring that DOE program managers have the knowledge and authority to oversee projects effectively and efficiently and clear criteria to govern advancement of projects.

Recommendation 4.6: Greater deployment of advanced electrical technology is essential and will require expanded support for Department of Energy (DOE)-backed demonstration projects, including through loan programs and support for industrial consortia that deploy critical technologies. Such expanded support should follow best practices in the implementation of technology demonstration and deployment programs. Programs should be designed for rapid learning (and course corrections where needed) and periodic assessment of the overall portfolio for its performance. Proposals for funded projects should

___________________

12 The ITIF study of ARPA-E also concludes that ARPA-E funding is not crowding out private funding in innovation as some have suggested (Hart and Kearney, 2017).

include a clear articulation of how a demonstration could be commercialized, including a budget for such activities—so that a larger fraction of successful demonstration projects lead to wider deployment.

Recommendation 4.7: Given the structural, technological, economic, and operational changes under way in so many regions of the U.S. electric industry, it will be important for the federal government to fund and support research and analysis to help mitigate operational and planning uncertainties. The Department of Energy (DOE) should sponsor research that will enhance the temporal flexibility of net electricity demand and enhance other services vital to grid reliability through pricing or other mechanisms. This will be important for supporting the entry of resources and services that can meet states’ and consumers’ desires for low-carbon electricity supply.

The question of the performance the national laboratory system is a perennial topic in U.S. innovation policy and highly relevant to improving the efficacy of federal investment in energy-related R&D (DOE, 2017). The national laboratory system has been the subject of more than 50 reports, with many recommendations for reform but few being adopted. In 2014, Energy Secretary Moniz established an expert Commission to Review the National Laboratories. That commission found that the laboratories are not succeeding in working in concert with DOE and that the Government Owned and Contractor Operator model for the laboratories is not working as intended owing to a lack of trust between the laboratories and DOE; poor trust has resulted in DOE policies that limit the autonomy of laboratories and add to bureaucratic oversight—factors that, in turn, limit the value of the research and the contributions of the research to the agency’s mission (Glauthier et al., 2015). A more recent study from the Belfer Center at Harvard echoes these concerns (Bin-Nun et al., 2017). At the same time, there have been a growing number of examples of partnerships between private firms and the laboratories that appear to be generating value and accelerating the diffusion of laboratory technology into service (Gould, 2020).

A perennial finding is the call for more autonomy for laboratory directors, more rotation of staff between the laboratories and DOE and fewer barriers to collaboration between laboratory scientists and academics as well as the private sector. Breaking down these barriers should help with dissemination and ultimate adoption of new discoveries. Studies of particular research programs—for example, advanced nuclear research—have found that a large portion of allocated resources to the laboratory system get consumed with overhead, volatile budgets make multiyear patient investments in innovation hard to sustain, and conservative priorities emphasize research with reliable near-term benefits to well-organized industries rather than more pathbreaking research (Abdulla et al., 2017; Cunliff, 2020).

While it remains very difficult to take the pulse of how the various efforts to boost innovation in energy—including innovation focused on electricity—a large number of studies examine elements of the system. They have looked at budgets, organizational effectiveness, and impacts on what ultimately matters—innovation. Increasingly, these studies are also looking at how such national efforts can be (and are) coordinated internationally (Cunliff and Hart, 2019).

How Much Should the United States Be Spending on Energy RD&D?