3

Military Needs for Printed Circuit Technology

Computers and electronics are estimated to account for more than one-third of defense procurement spending, and this proportion is steadily increasing.1 Interconnection technologies in the form of printed circuit boards (PrCBs) are integral to all of these systems. Printed circuit boards are fundamental to the operation of military navigation, guidance and control, electronic warfare, missiles, and surveillance and communications equipment. High-density, highly ruggedized, highly reliable interconnection technology is essential to the implementation of much of this country’s superior weaponry. The importance of PrCBs to all military missions—legacy, current, and future—cannot be overstated.

However, as with many other industries, the acquisition of PrCBs poses a predicament to Department of Defense (DoD) purchasing. The difficulty lies in the DoD’s unique requirements, its diminishing purchasing position within the overall market, and its ever-increasing demand for higher technical performance at affordable cost. Industry investments by PrCB producers in both manufacturing equipment and manufacturing expertise are focusing on the high-volume, low-cost growth segment rather than on the high performance, reliability, and extreme environmental tolerances required for DoD products.

DEFENSE REQUIREMENTS

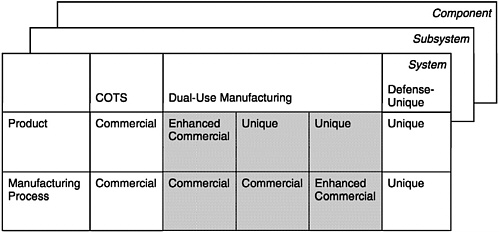

Goods manufactured for defense are very different from goods manufactured for commercial use in some obvious ways, although many similarities exist as well. In the area of electronics, the similarities may be the most apparent. Military trucks may be very different from commercial trucks of similar size, but the PrCB that controls the fuel injectors in both types of vehicles may be exactly the same. In another design scenario, however, they may be wholly different. Figure 3-1 shows one framework for these varying requirements.

In terms of defense priorities, DoD must first respond to DoD technology and product development requirements; second, DoD logistics must meet delivery requirements during peacetime and/or periods of conflict or international tension; and finally, all activities within these steps must preclude unauthorized transfer of technical information, technologies, or products within the United States or to third parties.2 These three points correspond to broad principles of strategic alignment, assured supply, and industrial security.

FIGURE 3-1 Product and process requirements in a commercial-military integration framework.

NOTE: COTS, commercial off-the-shelf. SOURCE: National Research Council. 2002. Equipping Tomorrow’s Military Force: Integration of Commercial and Military Manufacturing in 2010 and Beyond. Washington, D.C.: National Academy Press, p. 2.

Demands on Technology

Printed circuit technology as designed for military applications tends to be highly specialized, primarily because of the special functions and packaging requirements for DoD weapons systems. Military PrCBs are also produced at low volumes compared to those produced for nonmilitary PrCB applications. For example, one of the highest-volume systems planned for use across the military services is the Joint Tactical Radio System (JTRS), which had been projected to implement up to 30,000 units in the next 2 years, and potentially 108,000 over the next 10 years.3 Even this capacity is much lower than that for many of the least-popular commercially marketed radios or cellular telephones.

The requirements of electronics for military use also tend to be far more demanding than those of electronics for commercial applications. A commercial component is designed to have a typical lifetime of 2 to 5 years; after that much time in use the technology becomes obsolete, so it is not economical to design such components to survive very much longer. A typical military component can take substantially more time to design, qualify, and implement than is required for commercial components; the expected lifetime for military components is typically more than 5 years and is often extended to 15 years or longer. A prime example of how the military can extend a system’s life is described in Box 3-1 for the SLQ-32 Electronic Warfare System.

In addition to having long life, military components are generally expected to be more reliable, robust, and rugged than most commercial products are. Moreover, use conditions are in many cases quite different from those of commercial technologies: military electronic systems are expected to perform in battlefield conditions, with extremes in temperature, humidity, vibration, and impact, in addition to surviving the possibility of salt spray, blowing sand or dust, and solar radiation.

|

BOX 3-1 The AN/SLQ-32(V) Electronic Warfare System can be found on more than 150 ships of the U.S. Navy as well as on 13 U.S. Coast Guard cutters. It was the second-most-deployed combat weapons system in the U.S. Navy during Operation Iraqi Freedom, with 57 systems deployed from March through April 2003. The SLQ-32 (as it is commonly referenced) is designed to give ships early warning against anti-ship guided missiles (ASGMs) and to provide combat system support. In short, the system equips ships with the capability to defend themselves against ASGM attacks. The SLQ-32 Program was initiated by the Department of Defense (DoD) in 1972, with the first contract awarded in 1977 and the first product installed in 1979. In 1983, an improvement plan was initiated to enhance the system, but between 1996 and 2002, the funds were phased out and redirected to a newer system. When the development of the latter system was cancelled, the SLQ-32 was reinstated and required to remain tactically viable and supportable until at least 2025. The Navy’s Surface Electronic Warfare Improvement Program aims to improve the current SLQ-32 system by spiral development until the system meets the requirements of the original replacement program. While this development is under way, ships continue to rely on current SLQ-32 systems. Some components of the SLQ-32 will need to be supported for at least 20 more years. Keeping a steady supply for SLQ-32 components can be difficult: 171 assemblies in the SLQ-32 system contain obsolete components, and of these 171, 34 assemblies have less than a 5-year supply. The best approach is to keep suppliers running manufacturing lines that produce these components, but this is a challenge because of the low volumes—sometimes only a few per year are needed—and suppliers prefer to marshal their limited resources toward more lucrative orders. When no more suppliers are available or willing to bid on an order, the part becomes obsolete. When this situation is well understood, the government can evaluate whether the supplies in the inventory will be sufficient for the rest of service, and if not, can buy larger quantities of the component before manufacturing ends. There are several options when a part becomes truly obsolete: newer or off-the-shelf components can be qualified to replace the obsolete parts or subassemblies; new vendors can be developed (in the United States or abroad) for some products; or, finally, the government can step in and use existing capability to take over the manufacturing and maintenance of these components. The beam forming lens (BFL) is considered to be the most critical component of the SLQ-32. BFLs are used to achieve a 100 percent probability of signal intercept over a 360° field of view over the full frequency range of the Electronic Warfare System. BFLs are constructed of matched pairs, some of which are among the largest printed circuit boards made. Unfortunately, the original equipment manufacturer (OEM) had become unreliable: the last order that it produced took a year to arrive, and the OEM did not bid on a subsequent order for BFLs. Looking for other suppliers for BFLs, the government ran into a number of difficulties. Because only the OEM had the board design details, reproducing the board pattern was a challenge. Attempts to scan the pattern at a commercial site were unsuccessful, and prints provided in the drawing package were not adequate to reproduce the patterns. In the end, the government decided to mitigate risks by using in-house production capability to manufacture the component. This process was complicated and costly: it involved lengthy reverse engineering and now utilizes government manufacturing resources. Ultimately, industry support does not last the entire life of many military components, which can be more than 40 years in some cases. SOURCE: Naval Surface Warfare Center Crane Division. |

An array of nondefense applications—air-traffic control, postal sorting, and law enforcement uses—have elements similar to those of military components. Because these are also funded with taxpayer dollars, they are equally subject to cost pressures. Operating rates in these applications—whether for defense or nondefense purposes—can vary from the most demanding daily use to sitting at-the-ready for years between on-off cycles—both states involving rapid environmental changes. In addition to such requirements, military personnel routinely expect systems to operate outside the strict performance

parameters for which they were designed. Finally, with the growing degree of asymmetrical threats, the level of performance applied to electronics used in combat-ready equipment is also expected for tactical and support equipment. In short, defense requirements exceed commercial design standards in almost every category.

Demands on Supply Chains

The challenge to the military supply chain to ensure supply is further complicated because it must not only provide for current military needs, but it must also prepare for the far future while maintaining in readiness much equipment that was deployed in the distant past. A further complexity is that the supply chain must also operate laterally—supporting equipment in locations, conditions, and time frames different from those for which the equipment was originally designed.

The military needs to service and maintain equipment no matter when or where it is used. Many systems go through a number of application “lives” in various training or conflict situations or those requiring a military presence. As equipment is transferred from one soldier or unit to another, the military retains responsibility for it. Also, when a piece of equipment finally outlives its usefulness, the military pulls it back through a reverse supply chain and disposes of the item.

DoD must decide whether to “make, buy, or fix” components and systems as a matter of course throughout its supply chain. However, many times this decision step is not adequately factored in to current practices. The military services tend to maintain equipment no matter when a product was originally manufactured, in part because fielded equipment becomes the operating unit’s problem; it is no longer the producer’s responsibility. Many times, a particular PrCB part is no longer manufactured, and in some instances the original drawings and manufacturing specifications are not available. The ability to repair, replace, or reengineer legacy components is a valuable aspect of the DoD supply chain, but it is also very costly. Some OEM and aftermarket suppliers command very high prices for parts that are difficult to make with newer equipment, or parts for which the older design drawings are unavailable.

Different levels of technology needs are described according to time frames from past/legacy to far future in Table 3-1. Each time frame has different sources and requirements. For example, some older legacy PrCB components will have their own specific drawings and specifications; some will fall under MIL-PRF-55110; some will fall under the newer preference, MIL-PRF-31032; and still others will be specified only as to their performance and are intended to be purchased as commercial off-the-shelf (COTS), or may be specified to be made as per IPC-6012 Class 3. Ultimately, however, each decision point to determine the links and branches of the supply chain must result in good value to the warfighter. Decisions based on scenarios and consequences need to seek out robust rather than optimal strategies, and they need to employ adaptive strategies that can evolve over time in response to new information.4

Because of all of these constraints, as well as procurement processes, cycle time, qualification procedures, cost of shelf life, and a variety of other factors, DoD electronics tend to be more than one or two generations behind commercial technology. Experience has shown that commercial technology cannot be directly inserted for defense technology, but usually needs to be transitioned with thought and perhaps with constraints. For example, in cases where commercial technology can be directly inserted into military systems, the design goals, materials, and manufacturing processes should be known. In certain cases, some features required in government applications are so unusual that commercial technology cannot be modified but must be redesigned. To supply the warfighter effectively, government officials need to understand the manufacturing technology behind the needed component. This understanding implies a dual-use strategy rather than a pure COTS mode, in which components can be procured based on a strong dual (commercial and defense) industrial base.

Demands on Assurance

The Department of Defense has strong concerns about the unauthorized transfer of critical technical information, technologies, or products within the nation or to third parties. The problem is which

TABLE 3-1 Technology Assessment for Different Military System Time Frames

|

|

Past/Legacy |

Current |

Near Future |

Far Future |

|

When system was specified or purchased |

More than 10 years ago |

Fewer than 5 years to present |

Present to more than 2 years |

More than 5 years from now |

|

Level of technology |

Obsolete technologies with diminished manufacturing sources |

Existing technology |

Today’s known and some cutting-edge technology |

Not yet known |

|

Source of replacement (or repair) parts |

Combination of small shops and organic facilities |

Replacement parts bought when systems were procured |

Not yet known |

Not yet known |

|

Critical factor for success |

Part repair or replacement (including reengineering) |

Cost-effective replacement |

Design for support in today’s acquisition environment |

Design for support in a new acquisition environment |

|

Potential consequence of failure |

System failure, leading to new system design/acquisition |

High cost limits other needed acquisitions |

Continuance of today’s supply-chain challenges |

Inability to take advantage of new technologies |

technical information, technologies, or products are critical, because the cost penalties, in terms of operational restrictions, for protection against unauthorized transfer can be very high. It is for this reason that DoD minimizes the use of security classification as a means of protecting its information, capabilities, and technologies.

While many industries and companies are very protective of their technologies and trade secrets, many aspects of defense systems must be further protected under penalty of law. Therefore, reliance on third parties (other than the government and primary contractor) to manufacture some or all components or systems used by the warfighter can provide a variety of challenges and burdens on government acquisition practices. To achieve a high degree of assurance in a particular technology creates a major burden and challenge for the government owing to these constraints.

Attempts to limit defense manufacturing to operations within the United States have resulted in charges of protectionism. These attempts have not been supported by the current administration or the Congress. The chairman of the Federal Reserve Board, Alan Greenspan, states that “protectionism will do little to create jobs; and if foreigners retaliate, we will surely lose jobs. We need instead to discover the means to enhance the skills of our workforce and to further open markets here and abroad to allow our workers to compete effectively in the global marketplace.”5

The military thus is faced with a challenge: that of buying components in the global marketplace, while protecting technical specifications of those components from some of the participants in the same global marketplace. To address this dilemma, the United States has a number of controls on the export of technology that affect a number of existing and emerging technologies. While such controls are not currently mirrored worldwide, there is a growing trend toward the use of export and import controls by a growing number of countries.

In the United States, the Department of State’s Office of Defense Trade Controls and the International Traffic in Arms Regulations (ITAR) control the permanent and temporary export and temporary import of defense articles and defense services. This control is exerted primarily by the taking

of final action on license applications and other requests for approval for defense trade exports and retransfers, and by handling matters related to defense trade compliance, enforcement, and reporting. A major element contained in the ITAR is the U.S. Munitions List (USML), the official list of the types of items controlled by the Department of State.

The Export Administration Regulations (EAR) are issued by the Department of Commerce’s Bureau of Export Administration. The export control provisions of the EAR are intended to serve the interests of the United States in the areas of national security, foreign policy, nonproliferation, and short supply, and, in some cases, to carry out its international obligations. Some controls are designed to restrict access to dual-use items by countries or persons that might apply such items to uses opposed to U.S. interests. These provisions include controls designed to stem the proliferation of weapons of mass destruction and controls designed to limit certain countries’ military capability and ability to support terrorism. The EAR also include some export controls to protect the United States from the adverse impact of the unrestricted export of commodities in short supply.

The Militarily Critical Technologies List (MCTL) serves as a technical reference for licensing and export control by the U.S. Customs and Border Protection Bureau and the Departments of State, Defense, Commerce, and Energy. The MCTL is a compendium of existing goods and technologies that DoD assesses would permit significant advances in the development, production, and use of military capabilities of potential adversaries. Decisions about candidate technologies are made by technology working groups, composed of experts from business, government, and academia. While the MCTL provides guidance in the development of export control regulations, it is not authoritative. Items may be in the MCTL that are not export controlled and vice versa.

The MCTL has two parts—the MCTL itself and the Developing Science and Technologies List (DSTL). The DSTL is a compendium of scientific and technological capabilities being developed worldwide that have the potential to enhance or degrade U.S. military capabilities significantly in the future. It includes basic research, applied research, and advanced technology development. Electronics technology is discussed in Section 8 of the DSTL, which was most recently updated in 2000. The lag of this update with respect to the ever-faster increases in new technology is significant. In addition, it is significant that neither the MCTL nor the DSTL covers manufacturing innovation explicitly.6

Export controls are not designed to meet the U.S. defense need for assured supply. They have little to do with providing assurance with respect to actual products or technologies that DoD would acquire; rather, their purpose is to keep some level of weapons technologies from potential adversaries.

DEFENSE MANUFACTURING ENVIRONMENT FOR PRINTED CIRCUIT TECHNOLOGY

The transformation of the military in the post-Cold War era has affected the defense industrial base in a number of ways. New demands on the rate of technology change have driven many of the changes in defense acquisition.7 Military leaders see a need to respond to a wholly different array of threats in the future, which has led to a focus on the transformation of the entire defense enterprise. According to Secretary of Defense Donald H. Rumsfeld, “The Department is in need of change and adjustment. The current arrangements, designed for the Cold War, must give way to the new demands of the war against extremism and other evolving challenges in the world. We face an enemy that is dispersed throughout the world…. Our enemy is constantly adapting and so must we.”8

A universal view of what constitutes the defense industrial base is difficult to pin down. This base evolved through the 1950s and 1960s into an assortment of companies that came to depend on the defense establishment as their primary and sometimes only customer, to sustain them. In turn, the military depended on these companies for a global technical advantage. Within this paradigm, defense spending drove the cutting edge of new technology, and these companies then spun some of these innovations out into commercial applications. Such innovations as computers, digital cameras, and hand-

|

6 |

The MCTL and DSTL can be accessed at http://www.dtic.mil/mctl/. Accessed October 2005. |

|

7 |

Office of the Deputy Under Secretary of Defense (Industrial Policy). 2003. Transforming the Defense Industrial Base: A Roadmap. February. Available at http://www.acq.osd.mil/ip. Accessed September 2005. |

|

8 |

Secretary of Defense Donald H. Rumsfeld. Remarks at the Base Realignment and Closure (BRAC) Commission Hearing, May 16, 2005. Available at http://www.brac.gov/docs/BRACHearingFullTranscript16MayPM.pdf. Accessed October 2005. |

held Global Positioning System units are all commercial technologies with strong roots in defense spending, reflecting the luxury that the nation once had of drawing on an indigenous and dominant technology innovation base.

Over time, beginning in the 1970s and continuing in the 1990s, all of this changed. Commercial spending on research and development (R&D) outstripped military spending, and technologies began to be spun into defense applications. Defense technology once came directly from military-focused R&D; it is estimated that during the Cold War, defense spending funded the vast majority of R&D in the United States. However, since the mid-1960s, the percentage has fallen to slightly more than half,9 and the overall R&D spending as a percentage of gross domestic product (GDP) has dropped from a high of nearly 3 percent to less than 1 percent.10 At the same time, graduate students became dominantly non-U.S. citizens. The paradigm is continuing to shift today as global universities are producing higher-quality graduates and the knowledge base is becoming truly global.11

As these changes have occurred, the traditional underpinning of defense spending for the high-technology economy in the United States has shifted as well. The interdependence of a strong national defense capability and a strong economy were axiomatic throughout the post-World War II era in any number of ways. One key differentiating element today is the growth in complexity that has been enabled by electronics. In the old paradigm, the sheer volume and mass of equipment in the warfighter’s control ensured dominance. In the new paradigm, the precision afforded by embedded electronics can provide the same dominance with much lower raw-material and manufacturing costs. And in this new paradigm, commercial technology dominates.

As a result, DoD initiated a number of policies to draw on commercial successes to insert new technologies into defense systems.12 These have not been sustained, however, through various defense administrations, and it is apparent from its acquisition decisions that DoD has never considered that supporting the U.S. economy is its responsibility.13 Yet the interdependence of the defense and commercial industrial base can be asserted; key factors include the importance of sustaining technological superiority, a declining production base for new weapons, and advantageous trends in the commercial manufacturing sector.

Much of the post-Cold War policy for defense acquisition has been targeted to encourage this kind of commercial-military integration. The transformation strategy implicitly relies on the rapid introduction of new technology and rapid industrial response for the replenishment of weapons, spare parts, and other consumables essential to readiness and sustainability. Transformation also has embraced a new drive for unmanned and remote systems, which need to be reliable with a minimum of hands-on maintenance.

Today, however, this integration is difficult to measure. A recent National Research Council report finds that “our military decision makers today are trapped in an acquisition strategy that depends on an industrial base that cannot respond quickly enough to meet the demand for new and modified military systems expected to result from the stepped-up tempo of future military operations.”14

Today, a handful of U.S. companies make up the defense integrated products industry and remain funded primarily by defense spending. The factors contributing to this consolidation include increased integration of commercial and military manufacturing and the escalating technological intensity of defense materiel.15 These companies produce “defense-unique” products for which the military is the primary customer. These products include tanks and armored vehicles, ammunition and ordnance, aerospace vehicles and ships, and a variety of electronics for search and navigation electronics, night vision, and other specialized applications.

|

9 |

American Association for the Advancement of Science. 2005. Federal Spending on Defense and Nondefense R&D. Available at http://www.aaas.org/spp/rd/histde06.pdf. Accessed September 2005. |

|

10 |

American Association for the Advancement of Science. 2005. U.S. R&D as Percent of Gross Domestic Product. Available at http://www.aaas.org/spp/rd/usg03.pdf. Accessed September 2005. |

|

11 |

R. Van Atta, M. Lippitz, and R. Bovey. 2005. Defense technology management in a global technology environment. IDA P-4017. Alexandria, Va.: Institute for Defense Analyses. |

|

12 |

J.S. Gansler. 1995. Defense Conversion: Transforming the Arsenal of Democracy. Cambridge, Mass.: MIT Press. |

|

13 |

U.S. Department of Defense. 2003. Transforming the Defense Industrial Base: A Roadmap. Washington, D.C.: DoD Office of Industrial Policy. |

|

14 |

National Research Council. 2002. Equipping Tomorrow’s Military Force: Integration of Commercial and Military Manufacturing in 2010 and Beyond. Washington, D.C.: National Academy Press, p. 10. |

|

15 |

K. Flamm. 2005. Post-Cold War policy and the U.S. defense industrial base. The Bridge 35:5-12. |

It is in the supply base for these defense-unique products that commercial-military integration is expected to occur. The fact that potential adversaries have easy access to the same commercial technology provides a compelling additional reason for concern. An excellent case in which to examine supply base issues is that of PrCBs, which are a broadly applicable, ubiquitous technology with equal importance to commercial and military needs.

While the military provided the original testbed for many computers and microelectronics, defense needs are not the driver for the newest technologies in these fields in most cases. Consumer demand for many advanced electronic products has far outstripped the volume required by the military.16 At the same time, the military depends increasingly on electronics to meet its mission as a smaller, more agile, transformed military force. Today, costs for military electronics are estimated to account for almost 50 percent more than costs for military aircraft—75 billion dollars for electronics versus 50 billion dollars for aircraft.

Electronics is perhaps the easiest of all defense technologies to globalize because of the direct ties to commercial technology. Because of this globalization, the connection between technology investment in direct support of defense capabilities and economic strength has been severed. This severing was intentional, because as a nation the United States does not want to limit commercial production and sales to the United States. This would make no economic sense in today’s global markets. However, it does not follow that DoD cannot help this nation be a strong global competitor.

It has become clear that the DoD’s technology investment is more closely tied to commercial applications than ever before. These new commercial technologies can provide worldwide benefits in electronics, transportation, medicine, and energy, to name a few examples. Because the benefits extend beyond defense, however, does not mean that DoD should stop investing. Instead, DoD needs to find ways to invest that will allow it to best capture the benefit. Admittedly, this is not a trivial problem.

Scoping the Challenge

The Department of Defense purchases items with more than 8 million different part numbers, or National Stock Numbers (NSNs).17 The Defense Logistics Agency (DLA) provides supply support and technical and logistics services to the military services and to several civilian agencies. The DLA manages over 5.2 million items that support individuals and the services’ weapons platforms. As part of this mission, it supplies 95 percent of repair parts for critical assets such as aircraft, tanks, and other weapons platforms.

Every day, the DLA receives more than 54,000 requisitions. The agency processes nearly 8,200 contract actions daily and does business with nearly 24,000 different suppliers. More than 21,000 persons are employed by the DLA to carry out this mission, although this total is reduced substantially from 65,000 in 1992, just after the end of the Cold War.18,19

For printed circuit boards, the logistics data are mixed. A cursory look at the suppliers of boards20 to the DoD Defense Logistics Agency yields a list of the following top 11 companies:

-

Northrop Grumman Systems Corporation;

-

Lockheed Martin Corporation;

-

Agilent Technologies, Incorporated;

-

Litton Systems, Incorporated;

-

Rockwell Collins, Incorporated;

|

16 |

K. Flamm. 2005. Post-Cold War policy and the U.S. defense industrial base. The Bridge 35:5-12. |

|

17 |

A National Stock Number (NSN) is a 13-digit number assigned to an item of supply. It consists of the 4-digit Federal Supply Class (FSC), and the 9-digit National Item Identification Number (NIIN). The NSN is used as the common denominator to tie together logistics information for an item of supply. An NIIN is a unique code assigned to each item of supply purchased, stocked, or distributed within the federal government; when combined with the FSC, it composes the NSN. |

|

18 |

Facts and Figures About the Defense Logistics Agency. Available at http://www.dla.mil/public_info/facts.asp. Accessed September 2005. |

|

19 |

K. Horn, C. Wong, E. Axelband, P. Steinberg, and I. Chang. 1999. Maintaining the Army’s “Smart Buyer” Capability in a Period of Downsizing. Santa Monica, Calif.: RAND Corporation. |

|

20 |

Federal Supply Class 5998: Electronic Assemblies; Boards, Cards, Associated Hardware. |

-

Smiths Aerospace;

-

BAE Systems;

-

ITT Industries;

-

Honeywell;

-

Boeing; and

-

Raytheon.

It should be noted that only three of these companies, Lockheed Martin, Litton Systems, and Rockwell Collins, are board manufacturers. The rest purchase boards for their systems. These other eight companies, therefore, outsource the manufacturing of the boards and, given the observed trends, it is certainly possible that many of them source these components worldwide. DoD does not currently track this possibility, nor does it require its contractors to do so.

The inability to trace the sources of potentially critical components, such as PrCBs, is a potential difficulty for DoD. Understanding sources and supply chains for both new and replacement parts is a best manufacturing practice for any large or small organization. It is possible that policy changes (and the resulting decreased workforce in defense acquisition and logistics) have contributed to a diminished requirement to manage the supply chain of these types of components.

It is also interesting to note that most of the companies on the list above are primarily defense suppliers. Post-Cold War acquisition practices have led to a massive consolidation of defense suppliers (both vertically and horizontally). This change, in turn, has created a perceived separation of the defense industrial base from commercial industrial base. This phenomenon is understood to be driven by a number of well-known factors, primarily the burdensome paperwork and separate accounting systems required to satisfy defense contracting, which has resisted the streamlining forced in the commercial sector by competitiveness, and shrinking markets and declining defense budgets. This separation is observed even in companies that supply similar products to military and commercial markets.

An overarching factor has also been the increasing dematerialization of warfare—which is realized by more electronic and smarter systems in use at all levels of combat and correspondingly fewer tons of metal per warfighter. This dematerialization has resulted in a greater dependence of national security efforts on information and information technology and less dependence on material-intensive tanks and planes.

Risk and Sustainment

A system can fail for want of a structural or supporting component even though the component does not directly enable the sought-after warfighter capability. However, the idea of making timely and detailed assessments of every one of the more than 8 million components that DoD buys is untenable. Current DoD practices require DoD to rely on the market but to watch out for developing problems. Program managers have the freedom to emphasize use of standard components and open system architectures in order to maximize the number of sources available to their programs. However, as issues arise, DoD must have the ability to link the component through the systems to warfighter capabilities and to integrate impacts and remedies into defense decision making.21

In current DoD assessments, circuit boards do not appear as a critical technology, nor do they appear as a critical component in the subset of critical technologies that warranted further analyses in the MCTL or DSTL. This is because electronics interconnection technology does not provide a “direct warfighter capability”—the main criterion used to identify critical technologies and components. However, this does not mean that circuit board technology is not important to the defense enterprise. Indeed, it is a prime example of the structural and supporting technologies that must be available to implement critical technologies and to deliver systems to the warfighter. These enabling technologies and components far outnumber currently identified critical technologies and must also be available to DoD when necessary.

The intent of acquisitions decision makers is to assess the risk that supply of materiel brings to mission success. Such risk can be assessed in a reactive or proactive manner. DoD may choose to be more proactive regarding critical technologies and components and to focus its attention on those items

while allowing itself to adopt a reactive posture regarding other important technologies, especially where there are large commercial forces at work. The difference in approach depends on a number of factors.

For example, a number of options exist for improving the reliability of access to PrCB functionality. Some proactive approaches are to stockpile raw materials or to allocate more funds to keep a larger number of manufactured parts in inventory. It is important to realize that some of these options would support innovation and others would not. Buying too far ahead is not a simple option because PrCBs have a solderability shelf life of between 6 months and 2 years. The shelf life is limited by a number of factors, such as humidity, packaging media, and coating composition. DoD may choose, in some cases, to keep populated boards for specific high-value applications, and may also invest in higher-cost storage to extend the shelf life of bare boards.

A potentially costly alternative is to manufacture unneeded parts in order to keep captive manufacturing in operation. This means that highly reliable capabilities will be available when needed. These manufacturing capabilities can be in-house, on military reservations, or in captive small shops. Standing capacity can also be achieved through agreements forged with larger manufacturers so that they maintain needed capabilities in their integrated organizations and provide priority production as necessary.

A longer-term option would be to standardize parts and part numbers where possible, or even to standardize manufacturing technologies, part configurations, or component modules. Such standardization would mean that fewer parts would be needed in inventory and more parts could be available in each category. This strategy would require a very top level logistics approach to warfighting. While it would be possible to implement such an arrangement on a small scale, it is unlikely that many systems would readily sacrifice the functionality that comes with custom-designed components. However, if a standard complement of boards were designed and their availability was guaranteed and secure, it is possible that future system designs could make good use of them.

To truly mitigate the risk to DoD’s mission, a decision tree for sustainment is needed. In that decisions are made, a decision-making method exists to a certain extent in the services and the DLA for legacy systems. New paths on this tree will need to be added in order to deal with innovation, future systems, and currently unpredicted supply-chain changes.

THE DEFENSE INDUSTRIAL BASE

As the U.S. industrial base has changed, so has the U.S. defense industrial base. The defense product and systems integrators have consolidated, whereas the supply chain—which serves both defense and commercial products—has become increasingly distributed.

The commercial industrial base has become more innovative and faster moving; products are increasingly complex and depend on advanced electronics and other technology. At the same time, production has become more distributed. A more distributed industrial base means that technology no longer resides only in large centralized companies with major R&D laboratories.

A prime example of these changes is the role of small and medium enterprises (SMEs). Smaller companies, many with fewer than 100 employees, are now technology leaders in many emerging fields and represent some of the most active and innovative businesses in the United States. This trend is driven by the following:

-

The ability of small companies to get sustainable funding through venture capital government funding;22

-

The increase in outsourcing (but not necessarily offshoring) by large companies of research, development, innovation, and services; and

-

The increase in the availability and capability of contract manufacturers.

SMEs typically provide capabilities that their larger customers do not have or cannot cost-effectively create, such as the following:

-

Agility in responding to changes in technologies, markets, and trends;

-

Efficiency due, in part, to less bureaucracy;

-

Initiative and entrepreneurial behavior on the part of employees, resulting in higher levels of creativity and energy and a greater desire for success;

-

Access to specialized proprietary technologies, process capabilities, and expertise;

-

Shorter time to market because operations are small and focused;

-

Lower labor costs and less-restrictive labor contracts;

-

Spreading the costs of specialized capabilities over larger production volumes by serving multiple customers; and

-

Lower-cost, customer-focused, and customized services, including documentation, after sales support, spare parts, recycling, and disposal.23

While SMEs have many advantages, one concern of DoD is that SMEs tend to form, fail, and change hands more often than large businesses do, so the technologies fostered by SMEs may be more easily lost. The United States has traditionally welcomed foreign direct investment and provided foreign investors fair, equitable, and nondiscriminatory treatment, with few limited exceptions designed to protect national security.24 However, this regulatory framework for mergers and acquisitions does not have the same restrictions on small businesses, so key defense technologies may be easily acquired by foreign firms. In addition, the purchase of a leading small company producing a particular new technology by a defense prime product integrator can dampen the entire market. Because of the alignment and consolidation among the defense prime firms, the resulting lack of competition can lead to the purchase or failure of several similar companies and can eliminate future innovation.

A more intrinsic concern is that many small companies focus on a single application for an innovative technology. DoD is interested in ensuring the survival of a relevant embryonic technology and is also interested in the technology’s ability to supply a multiplicity of applications that may exist in the defense enterprise. To foster such development, new defense funding models are needed. For example, under current regulations, a small firm can receive millions of dollars of federal funds for research, equipment, and personnel development, and then be sold, packed up, and moved to foreign soil.

Because defense acquisition processes are designed for large, dedicated companies, DoD is generally seen as a difficult customer for small businesses or commercial businesses. DoD seeks to expand the defense industrial base to commercial sources of technology—large or small. Today, few of these firms are seeking defense contracts despite the defense need for their products. Defense shares technology needs with the medical community, commercial information technology, and law enforcement, among others.

The demographics of the PrCB industry in the United States have changed, and most of the larger entities have closed, leaving a field predominated by SMEs. According to industry sources, the number of PrCB manufacturing plants is about one-third of what it was a decade ago. A few dozen of these companies are qualified to produce PrCBs for DoD. Logically, even with a smaller number of sources, it is possible to ensure price competitiveness and adequacy of innovation. However, the discussion here is meant to show that merely having multiple sources is not enough and that other factors must be considered.

A key issue is that the PrCB is a subtier-of-a-subtier product and is acquired many levels below the direct purview of DoD purchasing managers. DoD, therefore, has had little visibility into who makes which intermediate product for a pedestrian element of a subsystem that a prime contractor then integrates into a purchased item. Over the past decade, when the commercial PrCB business went offshore along with many other elements of commercial electronics, DoD was confronted with a new situation. It is now faced with the task of tracking something that it had not previously tracked in any way.

Buying American

While the Department of Defense does not exclusively “buy American,” the Buy American Act of 1933 continues to carry the force of law in the United States. The act was passed with the purpose of providing preferential treatment for domestic sources of manufactured goods and construction materials. The act has been a source of some debate because of “its complicated nature, the requirement for certification of compliance by defense contractors, and its continued existence in an era of acquisition reform.”25

Note that the Buy American Act applies only to end products and not to their components and subcomponents. “End product” can mean an unmanufactured end product that has been mined or produced in the United States, or an end product manufactured in the United States if the cost of its components mined, produced, and/or manufactured in the United States exceeds 50 percent of the cost of all of its components.

Policy makers recognize these challenges and bypass them by imposing domestic content ratios. The Buy American Act specifies that, unless exempt, government agencies must buy products for which at least 50 percent of the costs were incurred in the United States. Likewise, car companies selling more than 100,000 vehicles have minimum domestic content ratios. These policies attempt to define what an American product is, but their effectiveness is doubtful. They loosely address the locality of manufacturing but are not concerned with ownership—that is, where profits go—nor with office locations, in particular that of headquarters, where decisions are made.

As of a result of this legislation, companies can manufacture parts overseas and then assemble them in the United States into U.S.-made products. To meet the targets in the legislation, cost reports may be represented in a variety of ways. For example, the calculation may include full overhead in the U.S. plant but only labor costs for the overseas production. Congress has considered ways to strengthen these requirements, including an increase in the domestic content ratio in the Buy American Act to 75 percent. However, doing so will not resolve the definition of an American product or an American company.

The approach that Congress has taken to the question protects the manufacturing segment to an extent. The integration of components, subsystems, and systems has become an important function of the manufacturing industry. But according to that definition, Honda Motor Corporation is classified as an American company. And according to that definition, Iranian companies that comply with the standards can also be labeled as American. This raises security issues: the Buy American Act is particularly concerned with defense expenses. Can an Iranian company be a trusted supplier to DoD? Can a company owned and operated by antiwar extremists be a trusted supplier to DoD?

The popular view that DoD should buy American is not held by all. If foreign content is low and likely will remain so, limiting defense expenses to American products can be seen as shortsighted. If the highest-quality or most cost-effective or most innovative component is not made in the United States, it would be negligent of the defense acquisition corps not to purchase it for the warfighter.

The Buy American Act is only one of the dozens of rules that affect the U.S. military industrial base. These rules have all been implemented with national security, fair and open competition, and the U.S. economy in mind.26 The Buy American Act provides very good examples of the intended and unintended consequences of such legislation. Acquisition reform has had added an additional layer of complexity, but it is difficult to tell if it has resulted in true improvement in an era of constantly shifting strategic challenges.27

The Buy American Act does not explicitly address the issues of either innovation or trust. The writers of the act may have intended this, but there is nothing in the procedures that address these issues; therefore they remain unaddressed in many cases.

Global Companies and Their Complexities

The question of American products and American companies is a complex one. Globalization is abolishing the meaning of these terms to the point that any definition has become an approximation. While some people think of companies such as Intel Corporation or General Motors as U.S. companies, this may not be the case, because they are employing more and more people overseas and their customers are increasingly overseas. Most companies view it as their responsibility to their stockholders to source the most attractive resources around the world. It is difficult to know how a company’s allegiance to the home country of its headquarters influences its decisions.

Looking at ownership can be a better way to determine what an American company is: it is in the interest of the United States as a whole to buy from companies that employ American workers and that have American owners, because profits will then stay in America. But for publicly owned companies, stock will not necessarily stay in American hands even if a company was originally wholly American-owned. Nokia Group represents another side of the same argument: while it is largely recognized as a foreign company, the majority of its stock is held by Americans.

Nokia is considered foreign because its headquarters are outside the United States, but all of the products that it sells on the American market are manufactured on American soil—whereas the American company Motorola, Inc., manufactures most of its telephones abroad. Whether Motorola is more American than another company merely because its headquarters are in the United States is a difficult question.

Many traditional U.S. companies now receive a majority of their revenue from foreign sources, and a majority of their employees, operations, and/or resources are overseas. Many of these companies never repatriate their foreign income, meaning that they yield little ultimate benefit to the U.S. economy. This perspective can lead to some interesting conclusions; a company such as Toyota may be incorporated in Japan at the parent level and may be culturally Japanese, but it may be as much of a U.S. company as other multinationals are. The multinational business community increasingly views itself in this light, as it is primarily in the business of increasing shareholder value.

The question is what is a U.S. company? If we look into the law, a U.S. company operating within the boundaries of the United States, even if it is Honda Motor Corporation, is a U.S. company. Foreign corporations operating within the United States are defined as U.S. corporations because they operate within our soil.28

The most important consideration in this discussion is the lack of understanding of the relationship of these issues to the long-term economic stability of the United States. This view of the business world relies on a level playing field. A level playing field, while sounding desirable, really implies a reliance on markets and competence and a lack of reliance on statecraft and leverage that can leave national and economic security at risk.

Policy Implications for PrCBs

It has become increasingly difficult to buy PrCBs under the provisions of the Buy American Act. First, the military dependence on COTS electronic systems for both new and old weapons and equipment is increasing. At the same time, the ability of U.S. companies to supply those technologies is lagging. Hong Kong, Japan, Taiwan, and the United States are investing millions of dollars in manufacturing capacity in China.

The existing printed circuit board manufacturers in the United States are small to medium-size enterprises. Along with this trend in company size, the military has seen increasing cases of single-source and no-bid conditions for some of its most critical leading-edge printed circuit board requirements.29

Former Deputy Under Secretary of Defense for Industrial Policy Suzanne Patrick has argued that a Buy American approach designed to strengthen the U.S. industrial base would adversely affect the defense supply strategy. Current studies carried out by the Department of Defense find no national emergency in acquisition policy nor the defense industrial base.30 The prevailing policy for defense acquisition is currently to buy globally the best value. According to Ms. Patrick:

From the extensive semiconductor study we have underway it appears that for most of the military requirements, we currently have a sufficiently large and robust semiconductor industry here in the United States—domestic capacities significantly exceed the demand for defense-specific semiconductors. The fact that our semiconductor companies are responding to global demand elsewhere by building additional facilities to address that demand only will strengthen the commercial viability, innovativeness, and pricing capability of those companies, to our advantage.31

While Ms. Patrick’s comments are directed at the semiconductor industry, the policy applies to the entire defense industrial base. Again, a number of countervailing views are readily available. Most predominantly, the President’s Council of Advisors on Science and Technology found that, “in the face of global competition, information technology manufacturing has declined significantly since the 1970s, with an acceleration of the decline over the past five years. While the U.S. has largely remained dominant in leading edge design work, U.S. industry experts are increasingly anxious over losing this advantage.”32 Again, this applies to all aspects of information technology—PrCBs, semiconductor chips, and supporting software.

DoD remains concerned about diminishing manufacturing sources and material shortages, defined by DoD as the loss or impending loss of the last capable manufacturer or supplier of raw material, production parts, or repair parts. Various strategies have been identified for addressing particular diminished and diminishing sources, and some are currently being implemented.

Foreign Sources, Foreign Sales

An outdated paradigm is that the U.S. military is the primary and sometimes the only customer for many of the products made using the most advanced military technologies. In the case of the defense-unique equipment, the military has come to expect the companies that produce them for the United States to expand their sales to U.S. allies, thereby lowering the cost through economies of scale. A decade ago, defense suppliers were encouraged to work with foreign sources. By doing so, they brought better technology to DoD while saving the government money.

This strategy had the added benefit of allowing the government to create an international dependence on U.S. industries for global security. This is a very complex shift from the previous model, by which the U.S. government would defend a country or region directly with U.S. troops and U.S.-owned equipment rather than allowing the country or region to defend itself by purchasing U.S.-manufactured defense goods. However, shrinking global military budgets have reduced the demand for military equipment, creating a buyer’s market. At the same time, increased international competition can allow buyers to negotiate very favorable deals with manufacturers.

This strategy is complicated by a number of factors. “Offset agreements” are side deals forged between the defense manufacturers and the countries purchasing their products. These agreements require a supplier to direct some benefits, usually component production or technology development, back to the purchaser as a condition of the sale.

Offset agreements can be a result of either defense or nondefense sales, and they can be direct or indirect. Through direct offsets, the purchasing country receives contracts for production or technology development directly related to the sale. Indirect offsets may involve unrelated investment in the buying country or the transfer of technology unrelated to the weapons being sold. Both types of offsets send

|

30 |

Office of the Deputy Under Secretary of Defense (Industrial Policy). 2004-2005. Defense Industrial Base Capabilities Studies. Available at http://www.acq.osd.mil/ip. Accessed September 2005. |

|

31 |

Manufacturing News. 2005. What is the real health of the defense industrial base? An interview with Suzanne Patrick, Deputy Under Secretary of Defense for Industrial Policy. 12(4):1-9. |

|

32 |

President’s Council of Advisors on Science and Technology. 2004. Sustaining the National Innovation Ecosystems: Report on Information Technology and Manufacturing Competitiveness. Available at http://www.sia-online.org/downloads/PCAST_Report_January_2004.pdf. Accessed October 2005. |

work overseas, but direct offsets also raise serious security concerns, as they assist the development of foreign arms industries.33

It is true in many cases that companies are offshoring to the allies of the United States. The complexities of global conflict today, however, have led to ambiguous support from some of our traditional allies for current war efforts. This troubles some policy makers; some believe that even the closest allies of this nation may not adequately control the flow of technology to non-allies. There is currently no comprehensive monitoring of technology transfer to China via our allies, or through deemed exports.

Trusted Sources

A number of concerns regarding “trustedness” have arisen in this new paradigm in the context of the criticality of security. The trusted-source issue has emerged in the past two decades as DoD has come to realize that it could not rely on defense-specific sources for defense-unique components. Because such sources were becoming increasingly costly and falling behind their commercial counterparts, DoD turned from highly regulated captive vendors to sourcing components from commercial industry. The prospect of some adversary’s compromising the component increased, raising the level of concerns regarding trust and security.

For example, DoD must be concerned about potential for tampering, especially for components that are traceable to critical defense applications. Tampering is a broad term; it may range from intentionally poor manufacturing practices intended to cause early, random, or unpredictable failures, to sabotage that may include Trojan horses, trapdoors, triggered failures, tracking devices, or other hidden failure modes. The current ability to test, upon delivery, very complex components for their reliability to perform as required—with no additional hidden features—is difficult to gauge.

In a large system such as DoD, the responsibility for such testing may rest with the manufacturer, the system integrator, or the government. Unfortunately in many cases, such testing is not considered by DoD policy at all. This possibility introduces special concerns to the low-volume, high-mix production environment and highlights the need for explicit built-in measures for assurance and trustedness. Currently, a number of electronic components are produced in classified facilities, but the percentage of all electronics produced this way is very small. Production is made classified if a particular chip, PrCB, or associated section of software code contains explicit classified information. Most electronics contain some information related to their final use, if only the basic information of how many are being ordered and where they are being shipped. It may be prudent to keep this information within a trusted circle of suppliers even if it is not classified.

The controversy in this discussion lies in the numbers. Electronics may be used in battle, in direct analysis or support of battle situations, or in a variety of logistics, personnel, and other indirect support situations. The argument can be made that some or even all of these components are critical to battlefield success; the counterargument is that treating every light switch or fastener as critical, vulnerable, and under threat will add unreasonable costs to an already costly system. While it is possible to produce some, or even all, of these components as classified components to achieve assurance, this is untenable. The added and onerous production, distribution, operation, and logistics constraints and costs are so high that no system can or would want to use the components in anything but the most highly classified systems applications. Therefore, both the vulnerability and the criticality of the component must be assessed before a decision can be made in this regard.

A simple risk assessment can be made step-wise as follows.34 The numbers in parentheses below refer to areas on the risk model in Figure 3-2.

-

Identify components that are critical to a mission (1);

-

Identify vulnerabilities in these components that exist regardless of threat exposure (2);

-

Identify threats that exist regardless of component exposure to them (3);

-

Separate critical components with known vulnerabilities, but without known threat exposure (4);

FIGURE 3-2 A simple risk model.

-

Separate critical components with no known vulnerabilities, but with specific threat exposure (5);

-

Separate noncritical components with known threats and known vulnerabilities (6);

-

Protect critical assets with known, specific threats and known vulnerabilities (7); and

-

Ensure regular, frequent, and repeated examination of the steps above.

With respect to the first item—identifying components that are critical to a mission—assessing the critical nature of a component can be done in a number of ways. Consider that the definition of the word “critical” implies that the component is needed to avert a crisis. In today’s warfare situations, it is difficult to predict that one particular component could win or lose a war, but certainly any conflict is made up of a number of potentially critical events. Therefore, the criticality of a component must be determined by the person or organization doing the assessment.

Regarding the second item, assessing vulnerability involves its own complexity. Sources of the tools of warfare can be vulnerable to a number of factors—for example, a manufacturing plant that is a single source for a component could be shut down because of a natural disaster, a terrorist attack, or a labor strike. Note that these events may not affect the plant directly, but could affect power, water, or subcomponent suppliers with the same effect. A source might also be cut off because of a parent company’s business decision not to supply the military, or because a company or plant ceases operation, or simply because of a failure to meet DoD quality standards. An additional potential vulnerability is that exporting military designs may allow others to gain a technology advantage or to match the perceived U.S. advantage. All of these factors, however, can be assessed.

In addition, a vulnerability assessment needs to consider the potential for tampering. This can happen at the manufacturing plant at the component or subcomponent level, at any place in the supply chain.

Regarding the third item, assessment of threats: If there is no threat, then the vulnerability may never be exposed. Simply being dependent on a foreign source, as an example, does not imply vulnerability. Many foreign sources are very reliable and are long-term partners in global security. However, dependence is worth tracking in order to understand vulnerability. Critical vulnerability in this sense can describe a potential to lose a sole source of a material or component or to have that component compromised.

Once components are adequately labeled, those parts that do not fall into the danger zone where criticality, vulnerability, and threat coincide, can be procured anywhere reliably. In the end, components that are critical, vulnerable, and under threat will be a small fraction of the total. These will cost more per part owing to the security value, rapidly variable quantities required, and consequences when the part is not available. But such risk is rarely included in the procurement decision, except in classified cases.

This approach implies that dependence on any source or set of sources is not in and of itself something to inherently avoid. While a sole source implies vulnerability, reliance on a variety of foreign

sources may be very robust. In addition, reliance on foreign sources can be part of coalition warfare and other forms of well-structured statecraft, and these have had substantial benefits. Shared dependence through shared economic and global security goals can be shown to improve U.S. national security in many ways. According to a recent DoD report:

Part of a DIBCS [Defense Industrial Base Capabilities Study] assessment is to evaluate how domestic industrial capabilities compare with foreign capabilities. This is necessary because, in order to provide the best capability to the warfighter, the Department wants to promote interoperability with its allies and take full advantage of the benefits offered by access to the most innovative, efficient, and competitive suppliers—worldwide. It also wants to promote consistency and fairness in dealing with its allies and trading partners while assuring that the U.S. defense industrial base is sufficient to meet its most critical defense needs. Consequently, the Department is willing to use non-U.S. suppliers—consistent with national security requirements—when such use offers comparative advantages in performance, cost, schedule, or coalition warfighting. For this reason, the Department and many friendly governments have established reciprocal procurement agreements that are the basis for waiving their respective “buy national” laws and put each other’s industries on par as potential suppliers.

U.S. sources for those technologies and industrial capabilities supporting warfighting capabilities for which it has established leadership goals to be ahead or be way ahead of potential adversaries could reduce certain risks associated with using non-U.S. suppliers. However, the Department must be, and is, prepared to use non-U.S. suppliers to support critical warfighting goals when necessary and appropriate, and when the supplier and the nation in which it resides have demonstrated reliability in:

-

Responding to DoD technology and product development requirements.

-

Meeting DoD delivery requirements during peacetime and/or periods of conflict or international tension.

-

Precluding unauthorized transfer of technical information, technologies, or products within the nation or to third parties.35

What is not possible for any component, therefore, is to rely only on COTS for both routine and specialized capabilities. DoD has few internal capabilities left for developing new technologies, and it rarely invests in internal specialized needs. These capabilities in many areas are not adequate for assessing the state of commercial technology or for assessing the technology needs of the warfighter. The intelligence community has pushed for higher internal capabilities and trusted foundries for microchips. At the same time, DoD has shied away from the most cutting-edge technology in order to avoid risk. While many needs may be met with commercial sources, it is unknown where the lines are best drawn, and there is no existing policy to create this knowledge.

Because of the commitment of DoD to performance-based contracting and the sustained downsizing of the DoD acquisition workforce, the ability to understand the manufacturing base, and the potential for technology development and application, many of these concerns are never adequately addressed, and certainly never on a systematic basis. Understanding what is needed in a source is difficult in today’s global manufacturing environment. The definitions of a trusted source, a qualified source, and a reliable source are evolving. Currently, DoD does not appear to have an adequate methodology to understand how any of these definitions should be applied to individual PrCB components.

Conflicting Requirements

In the course of the debate over the role of the defense industrial base, two divergent opinions have emerged. One view is that the vast majority of dollars collected through taxes should be spent to benefit U.S. taxpayers. This may be through procurements or other spending at U.S.-owned companies and in U.S.-based facilities, to pay salaries in the United States, and to reinvest in infrastructure to support this base. Restrictions on trade such as export controls, military critical technologies, intellectual property controls, and directed tariffs are seen as ensuring these benefits to the taxpayer.

|

35 |

Foreign Sources of Supply: Assessment of the United States Defense Industrial Base. 2004. Available at http://www.acq.osd.mil/ip/docs/812_report.pdf. Accessed October 2005. |

The opposing view is that the United States is part of a global economy and that spending globally will always come back to benefit the United States. This view holds that although there may be an imbalance in certain commodities, industries, or locations in the short term, the overall result of trade is a benefit to the U.S. taxpayer. This benefit may be in the form of low-cost imported consumer goods; improved technology for U.S. energy, communication, and transportation systems; and exciting global opportunities for U.S. workers.

Defense acquisition seems to be in a transition period, from the past to the future, but different parts of the defense supply chain have very different views of the future. For example, the government has gone only part of the way toward adopting commercial acquisition practices. Commercial companies have come up with very effective ways to manage outsourcing, but the government still relies in many ways on specifications (admittedly performance specifications rather than military specifications) to guarantee quality.

One major commercial practice that has emerged during the shift toward outsourcing is to minimize risk through supply-chain management. While many models and theories for supply-chain management exist, few fit the military model, and so adopting the way that cellular telephones or automobiles are managed can be problematic. DoD rarely purchases more than a few thousand items at a time, and many purchases of large items (vehicles and artillery) are only in the hundreds; replacement parts are often in the single digits. A better model than consumer electronics, perhaps, is that used for biomedical devices or for high-rise elevators. These industries have similar safety, volume, and complexity constraints, and an integrator must be able to know who makes every part of its system, down to the circuit card and beyond.

Good commercial practice is to follow and understand one’s supply chains in order to minimize risk. When the government does not do this, systems may need to be redesigned more often than previously, because it is easier to replace a large subsystem than individual parts. However, because the government has delegated the responsibility for system integration to a handful of prime contractors, the best interest of the government is not always driving the decision, or even well articulated or understood. And because the assumptions underlying these decisions are not well understood, these conflicting priorities are almost ubiquitous.

A number of additional reasons have slowed progress in DoD toward efficient procurement practices that truly integrate commercial and military manufacturing. Culture and history are most often cited, and the evidence for these are clear. Defense acquisition uses a system very different from that of commercial companies—everything from accounting practices to acronyms and jargon tends to be unique to defense procurement. This means that supply-chain managers who are uncomfortable with change will look first to historical sources of defense materiel.

The political reality of defense procurement is also important. True integration very often has led to charges that defense purchases can subsidize commercial product development and that this may upset free and fair trade. In addition, a number of high-profile charges of conflict of interest have exacerbated the confusion and have resulted in a retreat to heightened separation.

An obvious conclusion is that DoD must redress its hands-off role and provide more systematic oversight of requirements and acquisition. The move to commercial practices can work, but only with a commitment to success including a clear definition of exceptions. Can the government move faster to reach a real transition? Yes, with a strategy that analyzes and understands dependence, vulnerability, and critical vulnerability.

An interesting additional observation is that many commercial supply-chain practices are moving toward those of DoD in the days of military specifications. The level of tracking that was required by DoD contractors in the era before performance-based contracting was very rigorous, adding substantial cost to many products. However, this tracking was very valuable and has been found to result in very high quality and consistency. In the commercial world, many factors are driving OEMs toward better production tracking; among them are more geographically distributed outsourcing, which means that in-person process oversight does not happen, as well as evolving environmental regulations and the expectation that the OEM is responsible for the environmental footprint of a product. But the biggest driver for improved production tracking is the availability of new technologies, sensors, and controls that can accomplish this level of tracking at a very low cost. This type of tracking is fast becoming something that OEMs will be able to do remotely and globally with little additional cost. However, it is important to remember that tracking does not mean that quality is understood or integrated.

KEY FINDINGS AND CONCLUSIONS

The committee finds that without publishing or legislating a defense industrial policy, the United States has a de facto policy, one that is in many ways inconsistent, is not well understood, and has a number of unintended consequences. This confusing array of current requirements does not allow the government to obtain the best value for the warfighter.

It is clear that DoD cannot—and should not—buy the more than 8 million different items that it needs from trusted sources. Nor should the government own the facilities to make all of these parts. There is a clear benefit to purchasing many of these from the private sector. However, some parts clearly should be procured from trusted sources. This is complicated because DoD rarely requires more than a few thousand of any one part, meaning that the number of replacement parts needed is often in the single digits.

A top-level need exists for finding a robust way to categorize parts, including components that warrant special attention for U.S. national security. This assessment must consider that there is a spectrum of needs and that there is no one-size-fits-all solution. Because producers and DoD program managers may be reluctant to incur the costs of such identification, this strategy must also have a way for program managers to incur the costs of their part numbers being so identified.

In conjunction with such a strategy, procedures are needed to develop and provide ongoing support for production of such critical components, either through subsidies to commercial businesses, through the creation of joint ventures, or through the use of a government manufacturing facility. Before this decision can be made, the ability and willingness of the commercial sector to respond to these needs must be assessed, as well as the ability and willingness of government facilities to respond. This strategy should also include an effort to incentivize industry in areas that matter to business and that do not encourage inefficient processes.

Government-owned production, such as that located on a military reservation or at a national laboratory and operated by government or contractor personnel, could be an attractive and potentially cost-effective option. This would be most appropriate for legacy parts, such as PrCBs for the SLQ-32 Electronic Warfare System, for parts with classified elements, or for any part for which assessment results in critical vulnerability.

These options appear to be desirable compared to a trusted production agreement with a commercial vendor. A government-owned facility has some well-documented downsides, including cost, the permanent nature of civil service employment, fewer incentives for improving productivity, and little opportunity for cost sharing with commercial production. An ideal government-industry partnership network would have to consider such key factors as cost, responsiveness, and contribution to innovation. A final consideration is the need for the government to maintain some capability to be a smart buyer.

Current program management and defense contracting practices do not appear to support the limitations imposed by a sole-source trusted supplier. To use a sole-source trusted supplier effectively, DoD procurement managers would need to apply judgment about matters on which they are currently not prepared, educated, or paid to do. However, absent a set of better analytical tools, a trusted supplier may be the only viable choice.