3

Globalization of U.S. Medical Product Supply Chains

The past several decades have been a time of rapid globalization for U.S. medical product supply chains. The trend toward globalization has been driven by a range of factors, including incentives for individual firms and the market as a whole. The coronavirus disease 2019 (COVID-19) pandemic placed an unprecedented strain to cope with global demand for key goods as it far outpaced global supply, as well as highlighting long-standing supply chain resilience issues with medical product shortages (Ellis, 2021).1 Challenges were exacerbated by export bans and countries, including the United States, favoring domestic use over foreign needs (Bown, 2021).

In response to the shortages of medical supplies that were spurred by the COVID-19 pandemic, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, addressing some of the gaps in medical product supply chains, as discussed in Chapter 2. COVID-19 also pushed several government actors to propose on-shoring of medical product supply chains—the domestic manufacture and production of medical products or critical components of those products—as a solution to make the supply chain more resilient.

The committee realized early in its deliberations that on-shoring entire medical product supply chains—from raw materials to finished production—would be logistically and economically challenging, while on-shoring only the final stage of production would not have a significant impact in reducing vulnerability to foreign shocks. Entirely domestic medical product supply chains, scaled to handle the expected demand in nonemergency times, would still be

___________________

1 This chapter references a report commissioned by the Committee on Security of America’s Medical Product Supply Chain titled Where There’s a Will: Economic Considerations in Reforming America’s Medical Supply Chain, by Phil Ellis (see Appendix D).

unable to immediately expand production sufficiently to meet the national needs in the case of a global health emergency (DoD et al., 2021). Proximity also does not necessarily imply resilience or scalability. Finally, if all nations responded to a U.S. on-shoring push by simultaneously trying to force the on-shoring of their own medical product supply chains, this could severely limit market opportunities for U.S. firms, fragment global production, cause severe shortages of manufacturing inputs, raise costs and reduce efficiency throughout the production system, and make an effective global response to the next pandemic even harder. This chapter provides context on the globalization of U.S. medical product supply chains and discusses the rationale for viewing on-shoring as one option among many, rather than as a panacea for improving global medical product supply chain resilience.

GLOBAL LANDSCAPE OF MEDICAL PRODUCT SUPPLY CHAINS

As mentioned in Chapter 1, the shift to overseas manufacturing of medical products is reflective of a broader trend on the part of the U.S. medical product industry. The shift to manufacturing outside of the contiguous United States began in the 1970s with production moving to Puerto Rico, then Europe, China, and India.2 Since the 1990s, companies have moved to adopt lean manufacturing strategies and globalize sourcing and production in pursuit of cost reduction (Iakovou and White, 2020).

The medical product industry has grown to rely on multilateral relationships and international trade (Bhaskar et al., 2020; Gereffi, 2020). Although the United States is both an importer and exporter of medical products, the discussion that follows evaluates the dependence of the United States on medical products that are sourced or manufactured outside of the United States, per the statement of task. Further, the share of domestically produced and exported medical products or inputs versus those that are imported is difficult to accurately determine and varies greatly by product category (CRS, 2020b). Despite this lack of specific data, it is clear that the United States is heavily reliant on other countries for medical products, including China, India, the European Union (EU), Mexico, and Canada (CRS, 2020b). Whether a finished medical product is manufactured in the United States, Germany, or China, it is likely that the product is composed of component parts—active pharmaceutical ingredients (APIs), excipients, glass vials, device components—that were manufactured by different firms in various countries.

Regional Landscape

Estimates from 2019 indicate that the majority of the import revenue from pharmaceuticals, medical equipment and products, and related sup-

___________________

2 Information given by testimony of Judith A. McMeekin (Senate Committee on Finance, 2020).

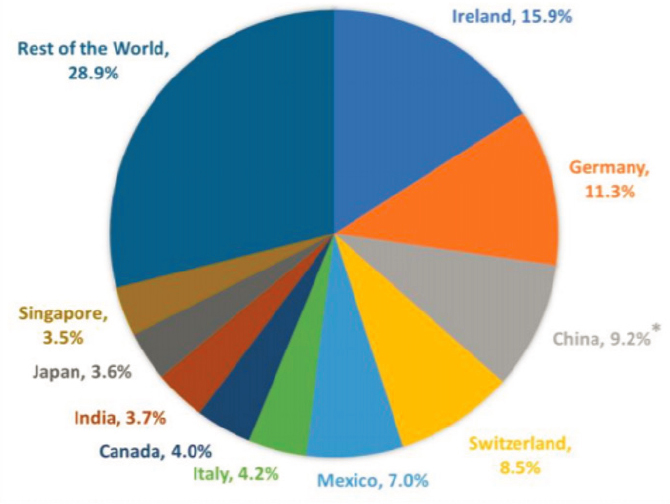

plies that the United States imports is from Europe (39.9 percent) and Asia (20 percent) (see Figure 3-1) (CRS, 2020a). Trends within these regions are discussed further in this section.

Europe

Medical research coming out of European institutions in the late 19th century led to groundbreaking discoveries, such as the X-ray and smallpox immunization, which helped pave the way for modern medicine (CDC, 2021; Karlsson, 2000; Peters, 1995; Tubiana, 1996). Given the region’s long history of medical research, some of the world’s largest medical product firms have European roots. For example, Philips & Co and Siemens Healthineers, two of the largest medical devices companies, were founded in Europe during the 1890s (Philips, 2022; Siemens, 2022). Several of the world’s largest pharmaceutical firms, such as Roche, Merck KGaA, GlaxoSmithKline, and Bayer, have origins dating back to 17th–19th century Europe (Bayer, 2021; GlaxoSmithKline, 2022; Merck KGaA, 2022; Roche, 2022).

* China’s 9.2% share of U.S. imports likely understates the extent to which the United States relies on China for pharmaceuticals and medical equipment, products, and supplies because of how these imports are classified.

SOURCE: CRS, 2020a.

Today, the United States relies on Europe for a significant portion of the medical products that it imports, particularly for more complex medical products, such as biologics and medical machinery (CRS, 2020a). Ireland in particular has been a prominent hub of medical device manufacturing (IDA Ireland, 2021). Since the late 1990s and early 2000s, Ireland was favored for medical device manufacturing due to its highly skilled, English-speaking workforce, and low tax rates. Ireland currently supplies e13 billion in exports annually and is the second largest exporter of medical technology products in Europe including diagnostic reagents, stents, artificial joints, and contact lenses (IDA Ireland, 2021).

Asia

In recent decades, Asian countries have come to represent a large portion of global medical product manufacturing because of a growing workforce that is both inexpensive and skilled, increased compliance with international standards, and local government incentives (NASEM, 2008). Multiple underlying factors are driving the shift toward globalization of drug manufacturing, particularly in China and India (Woo et al., 2008). A primary factor is that manufacturers are seeking to lower costs by sourcing finished dosage forms (FDFs), APIs, and other components from facilities in countries that can offer lower costs than U.S. facilities for labor, purchasing and shipping raw materials, and operations, including electricity, water, and coal (Marucheck et al., 2011).3

India

The emergence of India’s pharmaceutical industry as a major global player in the global generic drug market provides an illustrative example of how globalization of supply chains can generate competition and drive down prices in the medical product market. Beginning in the 1970s, patent laws in India allowed the country’s drug producers to engage in the practice of reverse engineering of drugs that were patent-protected by foreign companies, leading to rapid growth in its pharmaceutical sector. This practice was outlawed by changes to India’s patent laws in 2005 that brought the country into compliance with the World Trade Organization Agreement on Trade-Related Aspects of Intellectual Property Rights (Greene, 2007). Other developing countries, to which India had traditionally exported its patent-infringing products, also adopted stronger pharmaceutical patent laws. To replace lost sales at home and abroad, many of India’s leading drug

___________________

3 Information also given by testimony of Janet Woodcock (House Committee on Energy and Commerce, 2019a,b).

producers turned to the production and export of generics to the United States and countries in Western Europe. As part of this transition, many of the producers in India engaged with foreign pharmaceutical companies through research and development agreements, mergers and acquisitions, and other types of alliances (Greene, 2007).

Today, India’s pharmaceutical industry is one of the most price competitive in the world. With low labor costs, low barriers to entry, and small capital requirements, the number of pharmaceutical companies in the country burgeoned from 2,257 to more than 20,000 between 1970 and 2005. This pushed down prices and profit margins. By the late 2000s, reports suggested that compared to the United States and countries in Western Europe, pharmaceutical firms in India were offering 40 percent lower infrastructure costs and up to 20 percent lower fixed costs, enabling the production of bulk generic drugs at 60 percent lower costs. In the U.S. market, the price competitiveness in the Indian market and other lower-cost countries has parlayed into less expensive generic drugs and expanded choices for consumers (Greene, 2007).

A 2009 analysis of API manufacturing by the World Bank found that the wage index may be as little as 10 for Indian API manufacturers, compared to the average wage index of 8 for Chinese API manufacturers and 100 for API manufacturers in Western countries (Bumpas and Betsch, 2009). According to a 2011 U.S. Food and Drug Administration (FDA) report, U.S. manufacturers could reduce costs by 30 to 40 percent by sourcing APIs from manufacturers in India (FDA, 2011). Relentless cost pressures and the logistical challenges FDA faces in regulating India-based producers have led some Indian producers to sacrifice product quality in pursuit of low prices—an issue this report will consider later (Eban, 2019). Nevertheless, low-cost Indian producers have helped lower generic drug costs and boost access for millions of American consumers.

China

China’s growing role in global medical product supply chains is particularly striking. The country has built up substantial industrial capacity in specific sectors through state-led industrial policies, such as a pharmaceutical “megaproject”—a large-scale goal-driven project led by China’s Ministry of Health (Naughton, 2021). A strong Chinese pharmaceutical sector could make for a multipolar and more resilient global pharmaceutical supply chain. For example, safe and effective vaccines produced in China could bolster the world’s insufficient supply by substantially expanding the number of vaccines on the market (Seligsohn et al., 2021).

Based on available data from China customs, China exported a total of $9.8 billion in medical supplies and $7.4 billion in organic chemicals

to the United States in 2019 (CRS, 2020a). Of note, the classification “organic chemicals” includes both APIs and antibiotics. Additionally, the Congressional Research Service (CRS) has estimated that the United States imported around $20.7 billion in pharmaceuticals, medical devices, and other medical products from China in 2019, accounting for 9.2 percent of all U.S. imports in that year (see Figure 3-2) (CRS, 2020a). However, this probably underestimates the extent of the United States’ reliance on China for medical products.

China produces almost all of the APIs used to manufacture such drugs as penicillin G, levodopa, and acetaminophen, and it produces two-thirds of the APIs used for other critical drugs such as antidiabetics, antihypertensives, and antiretrovirals (Ghangurde, 2020; Schondelmeyer et al., 2020). Other drugs that are highly reliant on Chinese manufacturers include heparin, chemotherapy drugs, antidepressants, and treatments for Alzheimer’s disease and epilepsy (Thiessen, 2020). India, which is the largest provider of generic FDF products to the U.S. market, depends on China for more than 70 percent of its APIs (Schondelmeyer et al., 2020). As highlighted during the COVID-19 pandemic, the global supply chain also depends heavily on China for personal protective equipment such as respirators and surgical masks.

GEOGRAPHICAL CONSIDERATIONS FOR MEDICAL PRODUCT SUPPLY CHAINS

In response to rising wages abroad, transportation costs, and intellectual property concerns, the U.S. government and private-sector companies had been considering policies and initiatives to strengthen and “rebalance” medical supply chains through greater reliance on domestic medical product manufacturing well before the COVID-19 pandemic (Dolega, 2012).4 However, the pandemic has sharpened the focus of these discussions as companies around the world have struggled to source APIs and other ingredients needed for medical product manufacturing, and global disruptions in medical product supply chains have threatened the U.S. health care system (Kajjumba et al., 2020; Lund et al., 2020). As a result, many policy makers have promoted on-shoring the production of medical product manufacturing, arguing that doing so would decrease America’s dependence on foreign nations and give the United States more control in responding to shortages (Sardella and De Bona, 2021; The White House, 2020).

In 2020, former President Trump issued two executive orders addressing U.S. manufacturing of “essential medicines, medical counter measures, and critical inputs,” and providing government agencies with additional flexibility to increase domestic procurement of certain medi-

___________________

cal products to respond to the spread of COVID-19 (The White House, 2020). President Biden’s 2021 Executive Order 14005, Ensuring the Future Is Made in All of America by All of America’s Workers, launched a whole-of-government initiative to increase the use of federal procurement to support U.S.-based manufacturing. In addition to the United States, several other countries have implemented measures to encourage the on-shoring of manufacturing capacities (The White House, 2021). For example, in late 2020, the Japanese government allocated $2.4 billion to subsidize the process of strengthening domestic supply chains, including medical supplies (Takeo and Urabe, 2020). The Indian government also invested $6 billion in domestic manufacturing capacity to end dependence on China for bulk API materials (McRae, 2016). This effort to on-shore API production in India was re-endorsed in 2020 by the Indian government’s “Production Linked Incentive Scheme” to promote domestic manufacturing of critical key starting materials, intermediaries, and active pharmaceutical ingredients by attracting large investments in the sector (McRae, 2016; Seth, 2020).

Dependence on Foreign Sourcing and Manufacturing

Foreign dependencies may manifest as dependence on a single nation for a particular source material, dependence on potential political adversaries, or dependence on foreign entities in a manner that exposes supply chains to geopolitical, economic, or climate shocks (The White House, 2021). In 2011, the Bureau of Industry and Security’s Office of Technology Evaluation conducted an industrial base assessment of critical foreign sourcing in the Healthcare and Public Health Sector (Department of Commerce, 2011). The evaluation focused on the scope of foreign dependencies in the U.S. health care supply chain for 290 pharmaceuticals and 128 types of medical devices and surgical equipment considered critical in various emergency scenarios.5 The study revealed a significant degree of foreign sourcing and dependency for critical components, materials, and finished products that are needed for U.S.-based manufacturing operations. Many of those components and products produced abroad had no alternative sources based in the United States. The breadth of these foreign dependencies was widely distributed. Pharmaceutical manufacturers reported suppliers in 47 countries, most commonly Italy, India, Germany, China, and France. Medical devices and surgical equipment manufacturers reported suppliers in 41 countries, most frequently China, Germany, Japan, Mexico, and the United Kingdom. About one-third of manufacturers reported mak-

___________________

5 One hundred sixty-one companies that produced at least one of those commodities participated in the study (70 pharmaceutical manufacturers, 75 medical devices/surgical equipment manufacturers, and 16 manufacturers of both).

ing attempts to reduce their foreign dependency, but many said that it is challenging because the components they need are not available in the United States at all (Department of Commerce, 2011).

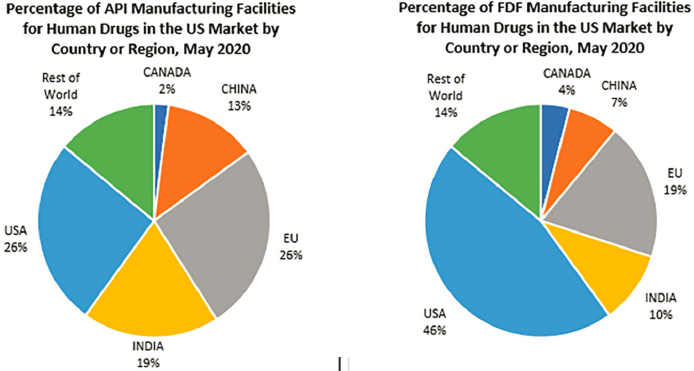

Historically, the United States has had a negative balance of trade for pharmaceuticals. In 2020, the United States imported nearly $94 billion, and exported almost $32 billion in human and animal drugs (FDA, 2020). The dependence on overseas production is particularly acute for APIs for generic drugs. According to FDA’s Center for Drug Evaluation and Research (CDER) Site Catalog, only 46 percent of manufacturing facilities producing FDFs for U.S. consumption and 26 percent of facilities manufacturing APIs for U.S. consumption were located within the United States (CDER, 2021). The rest were located abroad (see Figure 3-2).6

Medical device manufacturing is also rapidly globalizing and increasingly reliant on complex, interconnected global networks of supply chains driven by specialization, global competition, and efficient capacity use. In 2020, the United States imported more than $68 billion and exported almost $59 billion in medical devices (FDA, 2020). The volume of imported products and components grew by an average of 25 percent annually between 2001 and 2007 (Seaborn, 2013). Likewise, the number of foreign Class I and II medical device manufacturing facilities nearly doubled during this same period, with an estimated 70 percent of medical device makers engaged in manufacturing arrangements with China (Rhea, 2007).

NOTE: API = active pharmaceutical ingredient; FDF = finished dosage form.

SOURCE: Senate Committee on Finance, 2020a.

___________________

6 Information given by testimony of Judith A. McMeekin (Senate Committee on Finance, 2020).

Geographical Concentration

Concentrating the production of individual products or components among a limited number of firms and sites can increase manufacturing efficiency through the realization of economies of scale for production (Gagnon and Volesky, 2017). However, across the links in supply chains for certain medical products, the increasing concentration of production in certain geographies, facilities, and suppliers also magnifies risks of disruption. Given the vast geography of such countries as India and China, the fact that a large share of medical products comes from these countries is not, in itself, a dangerous level of concentration. If, however, a large share of a product or material is concentrated in a single site or among few firms in the same location, a natural disaster, a localized health emergency, or political upheaval in that region could endanger the reliability of the entire global supply chain (Schondelmeyer et al., 2020). For example, Wuhan was a major center within China for PPE production and export. As the original epicenter of the global COVID-19 pandemic, its production shutdowns immediately disrupted global supply chains for these essential products (Bradsher and Alderman, 2020).

APIs and FDFs

As of August 2019, CDER’s global geographic breakdown of the 1,788 API manufacturing facilities for all regulated drug products—including prescription, over-the-counter, and compounded drugs—indicated that 28 percent were located in the United States, 230 (13 percent) were in China, and 1,048 (59 percent) were in the rest of the world.7 Since CDER does not measure or record the volume of production at any facility, a caveat to these figures is that the percentages of APIs actually produced at these facilities are indeterminate. The apparent global geographic dispersion of production sites could conceal high degrees of regional, national, or local concentration that could create bottlenecks inhibiting supply expansion and contribute to supply chain disruptions (NASEM, 2021). Furthermore, the markets can also be constrained and concentrated for certain products that require specific inert starting materials (e.g., talc for inhalers) or unique dosage forms (e.g., sterile injectables) (NASEM, 2021). The packaging and labeling needed to contain, transport, distribute, and administer products often relies on foreign sources for components such as resin-based bottles and films, paper cartons and labels, and stainless steel needles (Jung, 2020). The consistent availability of those components is necessary for uninterrupted supply of the finished product.

___________________

7 Information given by testimony of Janet Woodcock (House Committee on Energy and Commerce, 2019a).

Generic Drugs

The generic drug manufacturing market has grown increasingly outside of the United States, with low-cost, off-patent generic drugs, likely to be outsourced to manufacturers in developing countries (Marucheck et al., 2011). In parallel, declines in manufacturing quality have led to an increased frequency of supply disruptions among some generic manufacturers in the global supply chain—particularly at the finished dosage level (Fox and McLaughlin, 2018).

Two recent studies have analyzed the geography of the foreign manufacture of generic drugs intended for the U.S. market. The first analyzed the locations of API and FDF facilities for generic drugs between 2013 and 2017 (Berndt et al., 2017). Data on the location of manufacturing provided under the Generic Drug User Fee Amendments of 20128 offered an “unprecedented window” into how generic drug manufacturing markets have evolved in recent years to become increasingly foreign. The proportions of both API and FDF facilities became increasingly foreign between 2013 and 2017. Almost 90 percent of API sites and around 60 percent of FDF sites for generics produced for use in the United States were located outside of the country. By 2017, the number of domestic FDF facilities was about 2.5-fold greater than the number of domestic API facilities. Moreover, there was a decrease in the total number of domestic and foreign registered API and FDF manufacturing facilities, with the greatest decline in the United States (Berndt et al., 2017). These data were confirmed to have remained unchanged by the White House’s 100-Day Reviews under Executive Order 14017 (The White House, 2021).

The Berndt et al. study also explored the extent to which a small number of holding companies with huge portfolios own a disproportionate share of FDA-approved generic drug applications, called Abbreviated New Drug Applications (ANDAs) (Berndt et al., 2017). According to a list of ANDA sponsors publicly released by FDA in 2017, the 10 largest portfolio sponsors (of a total of 676) held more than 30 percent of the share of almost 10,000 approved ANDAs. Moreover, the number of API and FDF facilities declined by 10 to 11 percent between 2013 and 2017, further indicating growth in market concentration.

The second study used data made newly available by FDA to describe levels and trends in the manufacturing locations of the most commonly used prescription pharmaceuticals and off-patent generic drugs intended to be consumed by Americans (Kaygisiz et al., 2019). The analysis found that APIs for generics continued to be overwhelmingly manufactured outside the

___________________

8 To implement fees under the Generic Drug User Fee Amendments of 2012, FDA required self-reported data to be submitted on generic manufacturing practices at API and FDF facilities (FDA, 2015).

United States. Between 2013 and 2019, foreign production of API intended for the U.S. market remained relatively stable at around 87 percent, largely concentrated in India (26 percent) and China (18 percent). During the same period, the number of U.S. sites producing API for generic drugs decreased by 10 percent. By 2019, the number of foreign FDF sites manufacturing drugs for consumption in the United States had increased by more than 5 percent—to about 60 percent of the overall share. The number of domestic FDF sites remained stable. FDF manufacturing was still dominated by the United States (41 percent), but India and China had growing shares of 21 and 8 percent, respectively. Again, the absence of production volume data means the true geographic distribution of production remains unknown to U.S. regulators (Kaygisiz et al., 2019).

Geographic Location Considerations for Manufacturing

In some instances, on-shoring and near-shoring (see Box 3-1 for definitions) may help to reduce supply chain risk and promote more efficient and robust markets. For example, geographical proximity can reduce transportation and shipping distances, which in turn may lower the risk of supply chain disruption. Shifting manufacturing capacity from overseas to U.S.-based locations may also enable more control and access to medical products for the U.S. government and health care systems and reduce the time to market. The impossibility, in the short term or the long term, of complete reconstruction of entire global medical product supply chains within the borders of any one country suggests that the United States will remain reliant on global supply chains for the foreseeable future.

Several of the inherent challenges related to globalization are broadly discussed further in Chapter 4. The committee concludes that on-shoring, near-shoring, or friend-shoring may resolve some barriers, but these are not a one-size-fits-all solution to the problem of increasing the resilience of medical product supply chains. For example, transforming a diversified, global supply chain into a concentrated, domestic supply chain could reduce supply chain resilience.

Furthermore, on-shoring a supply chain in its entirety can be exceedingly expensive, both in terms of the fixed cost of moving facilities and infrastructure as well as the variable cost of production. These costs prevent the private sector from pursuing widespread on-shoring of its own accord and make it politically difficult for government to force on-shoring via regulatory or financial incentives. Costs may include higher costs of production, which will be passed on to U.S. medical product consumers in some form, exacerbating the existing problem of high U.S. medical costs. If the higher costs of on-shored and near-shored production are offset by ongoing subsidies, this will divert public expenditure from other social

priorities like education, infrastructure, and access to health care, and U.S trading partners could, under international trade rules, retaliate against the United States with tariffs or other sanctions for implementing trade-distorting subsidies. Other nations may also imitate American efforts to on-shore or near-shore, fragmenting global production in ways that lower efficiency and raise costs. Given the multiple stages of production involved in most medical products, and the geographic distribution of these stages across multiple countries, on-shoring or near-shoring only the final stage of production could still leave U.S. consumers as vulnerable to foreign supply disruptions as before the on-shoring or near-shoring because the production

of final goods would be impossible without access to imports. Finally, the concentration of production within one region of the United States could expose U.S. consumers to disruption if that region suffers a natural disaster.

Multiple considerations are involved in choosing the appropriate relationship with a foreign service provider. For example, one approach holds that offshore outsourcing is the most suitable option if the project in question is routine and scoped (Trefler et al., 2005). However, foreign direct investment may be more appropriate if the project is too difficult or complex to fully describe and scope from the outset, as is more often the case with innovative projects with the potential to generate the greatest added value (Trefler et al., 2005).

The committee notes that medical product supply chains consist of multiple stages. Even when on-shoring improves resilience, on-shoring a single stage of medical product supply chains, such as final assembly, can leave remaining aspects vulnerable to disruption. The current push toward onshoring is intended to assuage U.S. national security concerns, largely through “security-driven, China-focused policy and regulatory developments affecting private-sector businesses” (Gorelick and Preston, 2020). In the United States, increasing calls to support American manufacturing—coupled with a push to strengthen pandemic preparedness—may engender congressional support for initiatives, such as tax incentives or loans, for reshoring the manufacturing of medical products. Firms considering reshoring may perceive uncertainty and increasing risk in U.S. trade policy, which might work against on-shoring efforts for firms that serve global markets (Ellram et al., 2013). In some scenarios, reshoring could negatively affect employment for job seekers in the United States and other Western nations (Gray et al., 2013).

Economics of Geographical Location Considerations

On-shoring

Decisions about on-shoring require considering what can and cannot be on-shored at a reasonable cost. These decisions may be determined by the limits of the labor market, individual business considerations, national security policy, and federal on-shoring incentives. A nation’s ability to implement on-shoring policies is limited by the availability of skilled labor on one end and prohibitive labor costs on the other. Developing countries may lack skilled labor that is available—but expensive—in developed countries (Kajjumba et al., 2020). For example, estimates suggest that in the United States domestically produced PPE and generic drugs may cost 20 to 50 percent greater than the price of these products produced abroad (Ellis, 2021). Thus, evaluating the economics of on-shoring, near-shoring, and offshoring decisions requires case-by-case business calculations that are context and company specific. On-shoring may optimize and streamline the

supply chain and therefore add value for some companies with local, agile operations, but that is not always the case (Gyarmathy et al., 2020).

The economics of on-shoring can also be shaped by national security policy. COVID-19 has encouraged on-shoring by revealing supply chain insecurities to government and industry. The economics of on-shoring will likely be driven by national security and company-level supply chain risk assessments. Some have predicted that COVID-19 will give rise to a “rebirth of United States manufacturing in the form of the on-shoring of pharmaceutical and other critical manufacturing back to the United States as a national risk-reduction measure” (Zwiefel, 2020).

To protect national security, it is conceivable that the federal government could adjust national foreign policy to mandate that a proportion of the critical pharmaceutical manufacturing sector be on-shored (Zwiefel, 2020). Government action has deterred further outsourcing to China, but action could be taken to encourage the economics of on-shoring through tariffs and incentives. For instance, tariffs on Chinese exports have made manufacturing in China less profitable, leading many firms to explore other countries in the region with low-cost labor—but with similar potential for supply chain vulnerabilities—before considering on-shoring to the United States. Given that the pharmaceutical manufacturing base comprises private investment, the existing corporate tax incentives for on-shoring critical manufacturing will likely be insufficient (Zwiefel, 2020). Without substantial federal incentives, however, firms will not have the economic impetus to on-shore API production (Zwiefel, 2020). As the committee has already noted, however, efforts by the United States to induce on-shoring could (and likely would) be countered or copied by U.S. trading partners’ policies in ways that could place additional stress on global supply chains.

Near-shoring and Friend-shoring

Definitions of “near-shoring” and “friend-shoring” involve a measure of ambiguity. For example, established proximity to qualify as “near-shoring” is not widely agreed upon. For European multinationals, “near-shoring” often moves activity to Eastern Europe or North Africa. For U.S. multinationals, “near-shoring” often moves activity to Latin America or the Caribbean. The committee also disagrees with the notion that a production site is necessarily more reliable or desirable simply because it is more geographically proximate to the United States mainland or its overseas territories. If a more proximate site is more prone to natural disasters or geopolitical upheaval or if it lacks the local skill base to meet requisite quality requirements or transportation infrastructure to receive components and export finished products, it could be strictly inferior to the more distant site it replaces in a supply chain, in terms of promoting resilience.

The same ambiguity applies to the notion of “friend-shoring.” In discussions of “friend-shoring,” it is uncertain as to what types of politically or economically motivated relationships qualifies a friend or ally. “Friendly” trade relationships are also not necessarily a proxy for “reliable” relationships. Notably, nations may change treaty relationships or impose restrictions in a time of crisis, as experienced during the COVID-19 pandemic. The reality of complex, multistage supply chains also makes the “near-shoring” or “friend-shoring” of the final stage of production of a drug or medical device of potentially little consequence if critical inputs remain concentrated in locations of questionable reliability.

To the extent that near-shoring actually improves the functioning of supply chains, firms are likely to pursue these opportunities on their own, without the need for government subsidy or coercion. This laissez-faire approach leaves the definition of “near” in the hands of the private-sector players whose capital investments create the supply chains in the first instance. Frequently cited benefits of near-shoring include shorter delivery times, faster product cycles, and easier communication largely due to reduced time zone differences and, in some cases, greater cultural similarity (Haar, 2021). Frequently, “near-shoring” involves reducing reliance on China, which can bring the added benefit of greater control over intellectual property. However, “near-shoring” generally results in increased costs (Haar, 2021). Given the capital at risk, firms managing supply chains have a strong incentive to balance potential benefits against costs in a cost-minimizing manner.

IMPACTS OF GLOBALIZATION

Decades of research in international economics have established multiple impacts of globalization that can benefit consumers and society at large. Firstly, moving from a national economy to a global economy enlarges the potential set of competitors. More competition means lower prices and greater variety, both of which benefit consumers (Krugman, 1980). Greater competition among input suppliers can also benefit firms that use these products as inputs. Greater quality and variety of inputs (and lower costs of inputs) can—and generally does—lead to firm productivity gains (De Loecker et al., 2016; Goldberg et al., 2010). Because global markets are larger than national ones, a shift from national markets to global ones also leads to an expansion of production by the most productive firms, the exit of the least productive firms, and the displacement in a national market of less productive domestic firms by the products of more productive foreign ones. This leads to increases in industry productivity within countries and across countries, also providing consumers with better products at better price levels (Melitz, 2003).

There is also strong evidence that increasing globalization has spurred the invention and production of new medical devices and new drugs far beyond what access to only a national market would have induced (Bertrand and Mol, 2013; Department of Commerce, 2016; Nieto and Rodríguez, 2011; Vrontis and Christofi, 2021). The prospect of exporting to a bigger market can induce firms to invest more in raising their quality or lowering their price than they would in the absence of export opportunities (Lileeva and Trefler, 2010). If these forces lead to increased incentives for research and development and an increased flow of better ideas, then globalization could induce a faster growth rate for an industry or even an entire national economy (Grossman and Helpman, 1993; Sampson, 2016). There is also growing evidence that exporting firms can obtain useful ideas from foreign customers and partners that make them more productive (Atkin et al., 2017).

Incentives for Innovation

Global markets create greater rewards for successful producers. Operating at a global level, producers can achieve greater economies of scale and producers of specialized inputs have a greater incentive to compete. Increasing globalization has laid the groundwork for the United States to take a leading role as an innovator in the biomedical field. When the United States is engaged in open trade with other countries by, for instance, purchasing less expensive medical products abroad, it also allows the United States to focus its medical device manufacturing industry on the export of innovative products around the globe. In 2015, the U.S. medical device market was valued at more than $140 billion, accounting for nearly 45 percent of the global market (Department of Commerce, 2016). U.S. and European firms, biotech startups, universities, and the U.S. National Institutes of Health also play a growing role in the development of new drugs for the global market—a phenomenon illustrated by the role of American companies in collaborating with other firms, as well as U.S. government investment to bring new, effective vaccines to market in the immediate aftermath of the COVID-19 crisis (see Box 3-2 for example).

Continued investment to spur innovation by U.S. firms is critical for maintaining the domestic industry’s competitive advantage in the global market (Trefler et al., 2005). In some cases, research into advanced manufacturing technologies that enable efficient and scalable small-scale production would promote diversified foreign and domestic production without limiting incentives for innovation, primarily because of reasons of efficiency rather than as a result of trade restrictions. However, a large push for U.S. on-shoring through regulatory requirements, if followed suit by other countries, would fragment markets for medical products, resulting in higher prices, poorer health care, and greater vulnerability to shortages during regional disasters.

Competition and Resilience

The degree of competition in a global market is greater than what would exist in just one national market, even one as large as the United States. This greater competition reduces medical product costs, lowers health care costs for American consumers, and creates more choices in terms of specialized drugs and medical products. Foreign drug manufacturers have the potential to help expand and sustain affordable access to essential off-patent drugs of appropriate quality in the United States even more than they currently do (Gupta et al., 2018). In 2015, Medicaid spent almost $700 million on generic drugs that did not have sufficient competition from other domestic manufacturers. However, there were foreign manufacturers approved by peer regulatory agencies abroad that could have brought generics to the U.S. market to bolster competition and bring down prices (Gupta et al., 2018).

A global market, whose production assets are distributed across multiple countries, may also be more resilient in the face of certain kinds of shocks. Natural disasters can disrupt supply chains where they occur—but if other sources of supply exist in countries far from the site of a national disaster confined to one country, the world can substitute foreign sources of supply while the domestic production facilities are rebuilt after the disaster (see case studies in Chapter 4). A similar logic can apply in the case of certain human-engineered disasters, such as acts of terrorism, war, or political instability.

Economic Growth

Global trade in medical products has grown over the past few decades as a result of increasing trade across all industries. Imports of finished pharmaceutical products grew by nearly 14 percent in the two decades following adoption of the 1994 Agreement on Trade in Pharmaceutical Products (WTO, 1994). In 2017, the global pharmaceutical drug market was valued at $934.8 billion, which is expected to triple by 2060 (Ledger and Opler, 2017). As of 2020, imports and exports of medical goods were valued at $2,343 billion (WTO, 2020).

Worldwide demand for medical devices, attributed to increasing health care spending in lower-income countries and aging populations in middle- and upper-income countries, has also contributed to a doubling of the global market (Bamber et al., 2020; Fortune Business Insights, 2021). Since 2015, this market has expanded at an annual rate of more than 4 percent compound annual growth rate (CAGR) (Jiang and Hassoun, 2021). Market research estimates suggest that in 2019, the global market for medical devices achieved $457 billion in sales (Jiang and Hassoun, 2021). This growth in the global medical device market has also helped to create further investment opportunities for U.S. device manufacturers. According to data from the Pharmaceutical Research and Manufacturers of America’s annual membership survey, biopharmaceutical companies invested $500 billion in research and development between 2010 and 2020 (PhRMA, 2020).

Certain countries have benefited from global markets. Exports of PPE and medical devices from countries such as Belgium, France, Germany, Italy, Japan, the Netherlands, the United Kingdom, and the United States increased by 45 percent between 2008 and 2018. At the same time, exports from large, newly industrialized manufacturing hubs, such as China and Mexico, as well as smaller specialized manufacturing locations, such as Costa Rica, Malaysia, New Zealand, and Singapore, grew twice as fast (Bamber et al., 2020). As of 2020, the United States, Japan, China, Switzerland, and the United Kingdom had the largest pharmaceutical markets globally (see Table 3-1) (Wee, 2017).

Between 2017 and 2022, growth in the global market for pharmaceuticals has been catalyzed by the continued growth in developing markets such as the Indian subcontinent—which is expected to have a CAGR of 10 percent—as well as the Commonwealth of Independent States (8 percent CAGR), Latin America (7.8 percent CAGR), and Africa (7.3 percent CAGR). Significant growth is also predicted in existing markets such as North America (estimated 6.4 percent CAGR) (Ledger and Opler, 2017).

The committee concludes that market forces create powerful incentives for medical product supply chains to remain globalized. These global supply chains provide efficiency, innovation, and, in some cases, diversification benefits. However, such global supply chains also pose transparency and

TABLE 3-1 Countries with the Largest Global Pharmaceutical Markets in the World

| Rank | Country | Value of Pharmaceutical Market (in millions of $) |

|---|---|---|

| 1 | USA | 339,694 |

| 2 | Japan | 94,025 |

| 3 | China | 86,774 |

| 4 | Germany | 45,828 |

| 5 | France | 37,156 |

| 6 | Brazil | 30,670 |

| 7 | Italy | 27,930 |

| 8 | UK | 24,513 |

| 9 | Canada | 21,353 |

| 10 | Spain | 20,741 |

SOURCE: Wee, 2017.

coordination challenges. International cooperation can help address these challenges, strengthen medical product supply chain resilience, and minimize the effect of shortages. To achieve this, nations and manufacturers must be better equipped to understand and manage the challenges of global medical product supply chains, including issues related to transparency, regulatory authorities, and national security. In Part II of this report, the committee discusses ways that benefits of globalization can be harnessed while contending with the transparency challenges that globalized markets bring. The committee recommends steps the federal government can take, within its own jurisdiction, to increase transparency within medical product supply chains (see Chapter 6). The committee also recommends the exploration of possibilities for international information sharing between governments, especially during global public health emergencies (see Chapter 9).

CONCLUDING REMARKS

The globalization of U.S. medical product supply chains has brought supply chain efficiencies, expanded market access, and greater affordability. Increasing the resilience of medical product supply chains will require multiple solutions and cooperation across sectors and borders. Policy makers and other key decision makers should reconsider the trade-offs between offshoring and on-shoring medical product supply chains. An effective supply chain resilience strategy must be more nuanced, diversified, and comprehensive than simply incentivizing or mandating more domestic production. This observation motivates the remainder of the report, which develops a

systematic framework for building increased resilience into medical product supply chains in order to identify and motivate strategic, cost-effective recommendations.

REFERENCES

AstraZeneca. 2018. What science can do: Astrazeneca annual report. https://www.astra-zeneca.com/content/dam/az/Investor_Relations/annual-report-2018/PDF/AstraZeneca_AR_2018.pdf (accessed December 20, 2021).

Atkin, D., A. K. Khandelwal, and A. Osman. 2017. Exporting and firm performance: Evidence from a randomized trial. The Quarterly Journal of Economics 132(2):551-615. https://doi.org/10.1093/qje/qjx002.

Austin, J., and E. Dezenski. 2020. Re-forge strategic alliances and check China abroad, rebuild economy at home. Newsweek, July 12.

Bamber, P., K. Fernandez-Stark, and D. Taglioni. 2020. Four reasons why globalized production helps meet demand spikes: The case of medical devices and personal and protective equipment. https://blogs.worldbank.org/developmenttalk/four-reasons-why-globalized-production-helps-meet-demand-spikes-case-medical (accessed December 20, 2021).

Bayer. 2021. History of Bayer. https://www.bayer.com/en/history (accessed January 24, 2022).

Berndt, E. R., R. M. Conti, and S. J. Murphy. 2017. The generic drug user fee amendments: An economic perspective. Journal of Law and the Biosciences 5(1):103-141.

Bertrand, O., and M. J. Mol. 2013. The antecedents and innovation effects of domestic and offshore R&D outsourcing: The contingent impact of cognitive distance and absorptive capacity. Strategic Management Journal 34(6):751-760.

Bhaskar, S., J. Tan, M. L. A. M. Bogers, T. Minssen, H. Badaruddin, S. Israeli-Korn, and H. Chesbrough. 2020. At the epicenter of COVID-19—The tragic failure of the global supply chain for medical supplies. Frontiers in Public Health 8(821).

Bown, C. P. 2021. How COVID 19 medical supply shortages led to extraordinary trade and industrial policy. Asian Economic Policy Review 9999:1-22.

Bradsher, K., and L. Alderman. 2020. The world needs masks. China makes them, but has been hoarding them. The New York Times, March 14, B05.

Browne, R. 2020. What you need to know about Biontech—The European company behind Pfizer’s COVID-19 vaccine. In Health and Science. CNBC.

Bumpas, J., and E. Betsch. 2009. Exploratory study on active pharmaceutical ingredient manufacturing for essential medicines. In The World Bank’s Human Development Network. The World Bank. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/848191468149087035/exploratory-study-on-active-pharmaceutical-ingredient-manufacturing-for-essential-medicines (accessed December 20, 2021).

CDC (Centers for Disease Control and Prevention). 2021. History of smallpox. https://www.cdc.gov/smallpox/history/history.html (accessed January 25, 2022).

CDER (Center for Drug Evaluation and Research). 2021. Report on the state of pharmaceutical quality: Fiscal year 2020, edited by CDER’s Office of Pharmaceutical Quality. Silver Spring, MD: FDA. https://www.fda.gov/media/151561/download (accessed December 20, 2021).

CRS (Congressional Research Service). 2020a. COVID-19: China medical supply chains and broader trade issues. https://crsreports.congress.gov/product/pdf/R/R46304 (accessed December 16, 2021).

CRS. 2020b. Medical supply chains and policy options: The data challenge. https://www.everycrsreport.com/files/2020-09-16_IF11648_fadf375c447b7698544a1dac3dc999b5e8358617.pdf (accessed August 26, 2021).

De Loecker, J., P. K. Goldberg, A. K. Khandelwal, and N. Pavcnik. 2016. Prices, markups, and trade reform. Econometrica 84(2):445-510.

Department of Commerce. 2011. Reliance on foreign sourcing in the healthcare and public health (HPH) sector: Pharmaceuticals, medical devices, and surgical equipment. https://www.bis.doc.gov/index.php/documents/other-areas/642-department-of-homelandsecurity-dhs-assessment-impact-of-foreign-sourcing-on-health-related-infra/file (accessed December 20, 2021).

Department of Commerce. 2016. 2016 top markets report: Medical devices. https://legacy.trade.gov/topmarkets/pdf/Medical_Devices_Top_Markets_Report.pdf (accessed December 20, 2021).

DoD (U.S. Department of Defense), HHS (U.S. Department of Health and Human Services), DHS (U.S. Department of Homeland Security), and VA (U.S. Department of Veterans Affairs). 2021. National strategy for a resilient public health supply chain, edited by Department of Health and Human Services, Department of Defense, Department of Homeland Security, Department of Commerce, Department of State, Department of Veterans Affairs, and The White House Office of the COVID-19 Response. Washington, DC. https://www.phe.gov/Preparedness/legal/Documents/National-Strategy-for-ResilientPublic-Health-Supply-Chain.pdf (accessed October 29, 2021).

Dolega, M. 2012. Offshoring, onshoring, and the rebirth of American manufacturing. Council of Development Finance Agencies, TD Economics. https://www.cdfa.net/cdfa/cdfaweb.nsf/pages/13816/$file/md1012_onshoring.pdf (accessed December 20, 2021).

Eban, K. 2019. Bottle of lies: The inside story of the generic drug boom. New York City, NY: HarperCollins.

Ellis, P. 2021. Where there’s a will: Economic considerations in reforming America’s medical supply chain. Commissioned by the Committee on Security of America’s Medical Product Supply Chain.

Ellram, L. M., W. L. Tate, and K. J. Petersen. 2013. Offshoring and reshoring: An update on the manufacturing location decision. Journal of Supply Chain Management 49(2):14-22.

FDA (U.S. Food and Drug Administration). 2011. Pathway to global product safety and quality. https://www.hsdl.org/?view&did=4123 (accessed December 20, 2021).

FDA. 2015. GDUFA glossary. https://www.fda.gov/industry/generic-drug-user-fee-amendments/gdufa-glossary (accessed October 12, 2021).

FDA. 2020. FDA at a glance: Regulated products and facilities. https://www.fda.gov/media/143704/download (accessed December 20, 2021).

Fortune Business Insights. 2021. Medical devices market size, share & COVID-19 impact analysis. https://www.fortunebusinessinsights.com/industry-reports/medical-devices-market-100085 (accessed December 20, 2021).

Fox, E. R., and M. M. McLaughlin. 2018. ASHP guidelines on managing drug product shortages. American Journal of Health-System Pharmacy 75(21):1742-1750.

Gagnon, M.-A., and K. D. Volesky. 2017. Merger mania: Mergers and acquisitions in the generic drug sector from 1995 to 2016. Globalization and Health 13(1):62.

Garde, D. 2016. Ego, ambition, and turmoil: Inside one of biotech’s most secretive startups. STAT News, September 13.

Gereffi, G. 2020. What does the COVID-19 pandemic teach us about global value chains? The case of medical supplies. Journal of International Business Policy 1-15.

Ghangurde, A. 2020. How India API manufacturing stacks vs China, addressing challenges. https://scrip.pharmaintelligence.informa.com/SC142101/How-India-API-Manufacturing-Stacks-Vs-China-Addressing-Challenges (accessed December 20, 2021).

GlaxoSmithKline. 2022. Our history. https://www.gsk.com/en-gb/about-us/our-history/ (accessed January 24, 2022).

Goldberg, P. K., A. K. Khandelwal, N. Pavcnik, and P. Topalova. 2010. Imported intermediate inputs and domestic product growth: Evidence from India. The Quarterly Journal of Economics 125(4):1727-1767.

Gorelick, J., and S. Preston. 2020. US decoupling from China and the onshoring of critical supply chains: Implications for private sector businesses. https://www.mondaq.com/unitedstates/inward-foreign-investment/988594/us-decoupling-from-china-and-the-onshoring-of-critical-supply-chains-implications-for-private-sector-businesses#:~:text=The%20effects%20of%20this%20decoupling%20from%20China%20and,to%20microprocessors%2C%20rare%20earth%20minerals%20and%20permanent%20magnets (accessed December 20, 2021).

Gray, J. V., K. Skowronski, G. Esenduran, and M. J. Rungtusanatham. 2013. The reshoring phenomenon: What supply chain academics ought to know and should do. Journal of Supply Chain Management 49(2):27-33.

Greene, W. 2007. The emergence of India’s pharmaceutical industry and implications for the US generic drug market. Washington, DC: US International Trade Commission, Office of Economics Washington, DC. https://www.usitc.gov/publications/332/EC200705A.pdf (accessed December 20, 2021).

Grossman, G. M., and E. Helpman. 1993. Innovation and growth in the global economy. Cambridge, MA: MIT Press.

Gupta, R., T. J. Bollyky, M. Cohen, J. S. Ross, and A. S. Kesselheim. 2018. Affordability and availability of off-patent drugs in the United States—the case for importing from abroad: Observational study. BMJ (Clinical Research Ed.) 360:k831.

Gyarmathy, A., K. Peszynski, and L. Young. 2020. Theoretical framework for a local, agile supply chain to create innovative product closer to end-user: Onshore-offshore debate. Operations and Supply Chain Management: An International Journal 13(2):108-122.

Haar, J. 2021. Nearshoring: Panacea, quick fix or something in between? The Hill, November 22.

House Committee on Energy and Commerce and Subcommittee on Health. 2019a. Safeguarding pharmaceutical supply chains in a global economy. Testimony of Janet Woodcock, MD, Director of the Center for Drug Evaluation and Research. October 30. https://www.fda.gov/news-events/congressional-testimony/safeguarding-pharmaceutical-supply-chains-global-economy-10302019 (accessed December 20, 2021).

House Committee on Energy and Commerce. 2019b. Securing the US drug supply chain: Oversight of FDA’s foreign inspection program: Congressional testimony of Janet Woodcock. December 10. https://www.fda.gov/news-events/congressional-testimony/securing-us-drug-supply-chain-oversight-fdas-foreign-inspection-program-12102019 (accessed December 10, 2021).

Iakovou, E., and C. C. White. 2020. How to build more secure, resilient, next-gen U.S. supply chains. Brookings. https://www.brookings.edu/techstream/how-to-build-more-secure-resilient-next-gen-u-s-supply-chains/ (accessed December 20, 2021).

IDA Ireland. 2021. Medical technology sector in Ireland. https://www.idaireland.com/doing-business-here/industry-sectors/medical-technology (accessed December 20, 2021).

Jiang, K., and H. Hassoun. 2021. The globalization of medical devices and the role of US academic medical centers. MedTech Outlook January–March:8-9.

Jung, A. 2020. COVID-19: Risks and resiliency in the drug supply chain. https://www.ey.com/en_us/strategy-transactions/covid-19-risks-and-resiliency-in-the-drug-supply-chain (accessed January 5, 2021).

Kajjumba, G. W., O. P. Nagitta, F. A. Osra, and M. Mkansi. 2020. Offshoring-outsourcing and onshoring tradeoffs: The impact of coronavirus on global supply chain. IntechOpen. doi:10.5772/intechopen.95281.

Karlsson, E. 2000. The Nobel Prize in physics 1901–2000. https://www.nobelprize.org/prizes/themes/the-nobel-prize-in-physics-1901-2000 (accessed January 23, 2022).

Kaygisiz, N. B., Y. Shivdasani, R. M. Conti, E. Bernt, and National Bureau of Economic Research. 2019. The geography of prescription pharmaceuticals supplied to the U.S: Levels, trends and implications. National Bureau of Economic Research.

Krugman, P. 1980. Scale economies, product differentiation, and the pattern of trade. The American Economic Review 70(5):950-959.

Ledger, M., and T. Opler. 2017. The future of the global pharmaceutical industry. New York, NY: Torreya. https://torreya.com/publications/torreya_global_pharma_industry_study_october2017.pdf (accessed December 20, 2021).

Lileeva, A., and D. Trefler. 2010. Improved access to foreign markets raises plant-level productivity… for some plants. The Quarterly Journal of Economics 125(3):1051-1099.

Lund, S., J. Manyika, J. Woetzel, E. Barriball, M. Krishnan, K. Alicke, M. Birshan, K. George, S. Smit, and D. Swan. 2020. Risk, resilience, and rebalancing in global value chains. McKinsey Global Institute. https://www.mckinsey.com/business-functions/operations/our-insights/risk-resilience-and-rebalancing-in-global-value-chains (accessed December 20, 2021).

Marucheck, A., N. Greis, C. Mena, and L. Cai. 2011. Product safety and security in the global supply chain: Issues, challenges and research opportunities. Journal of Operations Management 29(7-8):707-720.

McRae, N. 2016. India plans to end dependence on China bulk imports by 2020. https://scrip.pharmaintelligence.informa.com/SC089232/India-Plans-To-End-Dependence-On-China-Bulk-Imports-By-2020 (accessed January 18, 2022).

Melitz, M. J. 2003. The impact of trade on intra industry reallocations and aggregate industry productivity. Econometrica 71(6):1695-1725.

Merck KGaA. 2022. History. https://www.emdgroup.com/en/company/history.html (accessed January 24, 2022).

Miller, J. 2021. Moderna plans mix of COVID-19 vaccine doses with new Lonza deal. Reuters, June 2.

NASEM (National Academies of Sciences, Engineering, and Medicine). 2008. The offshoring of engineering: Facts, unknowns, and potential implications. Washington, DC: The National Academies Press.

NASEM. 2021. The security of America’s medical product supply chain: Considerations for critical drugs and devices: Proceedings of a workshop—In brief, edited by A. Nicholson, E. Randall, L. Brown, C. Shore, and B. Kahn. Washington, DC: The National Academies Press.

Naughton, B. 2021. The rise of China’s industrial policy (1978-2020). Ciudad de México: Universidad Nacional Autónoma de México. https://dusselpeters.com/CECHIMEX/Naughton2021_Industrial_Policy_in_China_CECHIMEX.pdf (accessed December 20, 2021).

Nieto, M. J., and A. Rodríguez. 2011. Offshoring of R&D: Looking abroad to improve innovation performance. Journal of International Business Studies 42(3):345-361.

Peters, P. 1995. W.C. Roentgen and the discovery of x-rays. In Textbook of radiology. New York: GE Healthcare. https://archive.is/20080511205052/http:/www.medcyclopaedia.com/library/radiology/chapter01.aspx (accessed January 24, 2022).

Philips. 2022. Our history. https://www.philips.com/a-w/about/our-history.html (accessed January 24, 2022).

PhRMA. 2020. 2020 Biopharmaceutical research industry profile. https://phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Org/PDF/G-I/Industry-Profile-2020.pdf (accessed December 20, 2021).

Pollack, A. 2013. Astrazeneca makes a bet on an untested technique. The New York Times, March 21.

Rhea, S. 2007. US-Sino safety pact called ‘modest start’. Experts say more must be done to ensure safe drug, medical device imports. Modern Healthcare 37(50):12-13.

Roche. 2022. Roche milestones. https://www.roche.com/about/history.htm (accessed January 24, 2022).

Sampson, T. 2016. Dynamic selection: An idea flows theory of entry, trade, and growth. The Quarterly Journal of Economics 131(1):315-380.

Sardella, A., and P. De Bona. 2021. Safeguarding the United States pharmaceutical supply chain and policy considerations to mitigate shortages of essential medicines. St. Louis: Washington University in St. Louis. https://wustl.app.box.com/s/wpqr6704f02eywivqsz7h1vfn8seb848 (accessed August 26, 2021).

Schondelmeyer, S. W., J. Seifert, D. J. Margraf, M. Mueller, I. Williamson, C. Dickson, D. Dasararaju, C. Caschetta, N. Senne, and M. T. Osterholm. 2020. Part 6: Ensuring a resilient us prescription drug supply. In COVID-19: The CIDRAP viewpoint, edited by J. Wappes. Minneapolis, MN: Regents of the University of Minnesota. https://www.cidrap.umn.edu/sites/default/files/public/downloads/cidrap-covid19-viewpoint-part1_0.pdf (accessed December 16, 2021).

Seaborn, A. 2013. FDA imports overview—APO import forum. FDA—Division of Import Operations. https://www.fda.gov/media/86269/download (accessed October 15, 2021).

Seligsohn, D., J. L. Ravelo, D. Russel, E. Uretsky, and E. Noor. 2021. Will China be a global vaccine leader? https://www.chinafile.com/conversation/will-china-be-global-vaccine-leader (accessed December 20, 2021).

Senate Committee on Finance. 2020. COVID-19 and beyond: Oversight of the FDA’s foreign drug manufacturing inspection process: Congressional testimony of Judith A. McMeekin. June 2, 2020. https://www.fda.gov/news-events/congressional-testimony/covid-19-and-beyond-oversight-fdas-foreign-drug-manufacturing-inspection-process-06022020 (accessed January 25, 2022).

Seth, A. 2020. India promotes domestic manufacturing of APIs to become ‘self-reliant’. https://generics.pharmaintelligence.informa.com/GB150106/India-Promotes-Domestic-Manufacturing-Of-APIs-To-Become-Self-Reliant (accessed January 18, 2022).

Siemens. 2022. Our innovation legacy. https://www.siemens-healthineers.com/company#innovation-legacy (accessed January 24, 2022).

Takeo, Y., and E. Urabe. 2020. Japan allocates $2.4 billion to beef up supply chains. Bloomberg Law, November 20.

Thiessen, M. 2020. It’s time to practice social and economic distancing from China. The Washington Post, March 19.

Thomas, K., D. Gelles, and C. Zimmer. 2021. Pfizer’s early data shows vaccine is more than 90% effective. The New York Times. https://www.nytimes.com/2020/11/09/health/covid-vaccine-pfizer.html (accessed February 15, 2022).

Trefler, D., D. Rodrik, and P. Antràs. 2005. Service offshoring: Threats and opportunities [with comments and discussion]. Paper read at Brookings trade forum.

Tubiana, M. 1996. Wilhelm Conrad Röntgen et la découverte des rayons X [Wilhelm Conrad Röntgen and the discovery of X-rays]. Bulletin de L’Académie Nationale de Médecine 180(1):97-108. French.

Vrontis, D., and M. Christofi. 2021. R&D internationalization and innovation: A systematic review, integrative framework and future research directions. Journal of Business Research 128:812-823.

Wee, R. Y. 2017. Biggest pharmaceutical markets in the world by country. https://www.worldatlas.com/articles/countries-with-the-biggest-global-pharmaceutical-markets-in-the-world.html (accessed January 23, 2022).

Weisman, R. 2013. Moderna in line for $240M licensing deal. Boston Globe.

The White House. 2020. Combating public health emergencies and strengthening national security by ensuring essential medicines, medical countermeasures, and critical inputs are made in the United States. https://www.federalregister.gov/documents/2020/08/14/2020-18012/combating-public-health-emergencies-and-strengthening-national-security-by-ensuring-essential (accessed December 20, 2021).

The White House. 2021. Building resilient supply chains, revitalizing American manufacturing, and fostering broad-based growth: 100-day reviews under Executive Order 14017. Washington, DC: Department of Commerce, Department of Energy, Department of Defense, and Department of Health and Human Services. https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf (accessed October 20, 2021).

Woo, J., S. Wolfgang, and H. Batista. 2008. The effect of globalization of drug manufacturing, production, and sourcing and challenges for American drug safety. Clinical Pharmacology and Therapeutics 83(3):494-497.

WTO (The World Trade Organization). 1994. The WTO’s pharma agreement. In Trade topics. The World Trade Organization. https://www.wto.org/english/tratop_e/pharma_ag_e/pharma_agreement_e.htm (accessed October 20, 2021).

WTO. 2020. Trade in medical goods in the context of tackling COVID-19: Developments in the first half of 2020. https://www.wto.org/english/tratop_e/covid19_e/medical_goods_update_e.pdf (accessed September 17, 2021).

Zwiefel, J. 2020. Anticipated new phase in U.S. manufacturing. https://info.burnsmcd.com/white-paper/pharma-onshoring (accessed December 20, 2021).

This page intentionally left blank.