4

AREAS OF LEADERSHIP IN THE GLOBAL ECONOMY

This chapter identifies metrics commonly used to determine strategic leadership positions in the global economy and provides an overview of those areas of the bioeconomy in which the United States currently maintains a leadership position. In particular, U.S. investments and outputs in science, innovation, and entrepreneurship are compared with those of other countries investing heavily in the bioeconomy. Although the United States has maintained leadership in many domains of science and innovation since World War II, the set of leading innovator nations has expanded substantially over the past few decades with continued growth in investments in education and innovative capacity on the part of such

countries as Germany, Israel, Singapore, South Korea, and, increasingly, China (Furman and Hayes, 2004; Furman et al., 2002).

Concerns about the future leadership of the United States in key segments of science and innovation have been raised in numerous forums (see, e.g., American Academy of Arts & Sciences, 2014; McNutt, 2019; NAS et al., 2010; NRC, 2007). Many of the foundational scientific and technical advances that enable the bioeconomy were pioneered in the United States. These advances include Herbert Boyer and Stanley Cohen’s invention of recombinant-DNA technology in 1973, which arguably launched the biotechnology industry. They also include subsequent advances in genome editing enabled by clustered regularly interspaced short palindromic repeats (CRISPR)/Cas-9 technology, initially demonstrated for potential use as a tool by Jennifer Doudna and Emmanuelle Charpentier in 2012 (Doudna and Charpentier, 2014; Jinek et al., 2012) and further developed by a number of research teams (Cho et al., 2013; Cong et al., 2013; Mali et al., 2013; Slaymaker et al., 2016; Suzuki et al., 2016; Qi et al., 2013). Leadership in initial scientific discovery does not, however, guarantee subsequent leadership in science or innovation. This observation is dramatically illustrated by the case of Great Britain’s early leadership in the chemistry of aniline dyes, the impetus having been provided by the early discoveries of William Henry Perkin in the mid-1850s. Britain’s leadership was subsequently eclipsed by the industrial scientific and technological leadership of the German chemical and dye industries in the 1860s and German leadership in biology, pharmaceuticals, and medicine in the subsequent decades of the 1870s and 1880s (Murmann, 2003).

LEADERSHIP IN SCIENCE IN THE BIOECONOMY

Paul Krugman (1991) famously stated that knowledge flows are exceptionally difficult to measure because, unlike physical goods, they do not leave a clear trace. This fundamental measurement problem has frustrated the study of knowledge creation, knowledge spillovers, and innovation despite the best efforts of researchers and policy makers. The measurement problems are even greater in the context of international studies of knowledge creation, leadership, and competitiveness, as such advances have different meanings in different contexts. For example, shop floor workers may achieve new-to-the-world innovations in manufacturing in mechanized factories with no immediate relevance to factories that rely on manual labor, whereas new-to-the-world innovations may be achieved in countries that rely on manual labor for manufacturing that may be of limited or no relevance in locations characterized by a high degree of factory automation. Adding to the difficulty of measuring knowledge creation across nations is the problem that countries, particularly those

not at the frontier of knowledge generation, have typically underinvested in the collection of data.

The measurement problem is particularly acute in the context of industry sectors, such as the bioeconomy, whose definition varies across countries and whose output is not measured in a systematic way, even within most individual countries. The following outline of the metrics for identifying strategic leadership positions in the global bioeconomy thus relies on a range of measures.

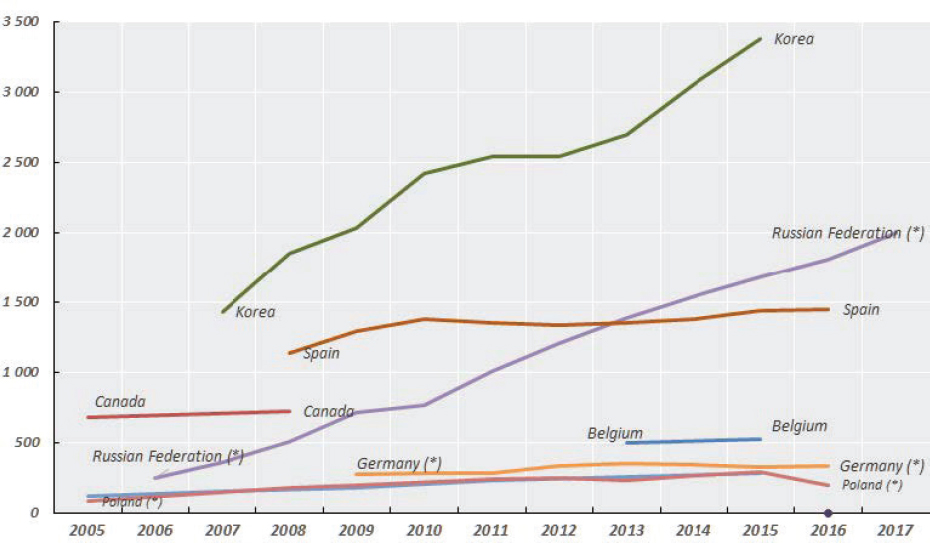

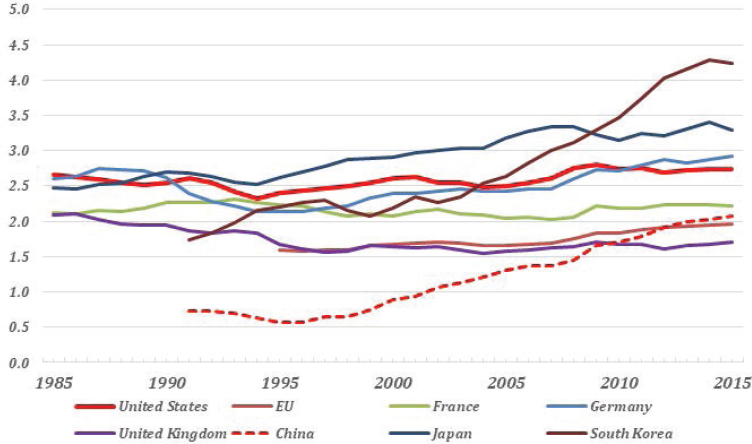

Comparisons of Government Research and Development Expenditures on the Bioeconomy

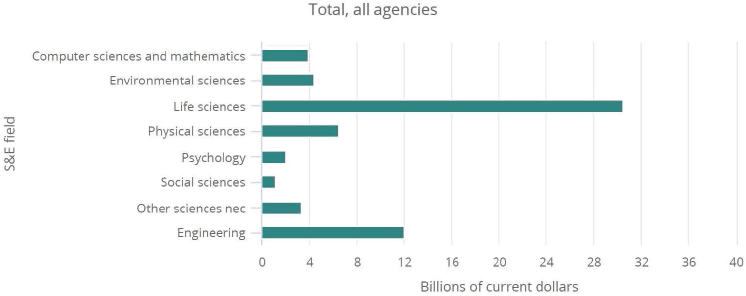

One valuable measure of scientific leadership in the bioeconomy would involve comparing time-series data on total government expenditures on research and development (R&D) in the bioeconomy. These data would ideally be converted into real rather than nominal dollars to capture the impact of inflation and would include measures of both the flows of expenditures (i.e., annual expenditures in each year) and the stock of expenditures (i.e., accumulated expenditures, adjusted to reflect the depreciation of knowledge over time). The committee was unable to find a historical data series of government expenditures on biotechnology or other aspects of the bioeconomy from either the National Science Foundation (NSF) or the Organisation for Economic Co-operation and Development (OECD) that compares the United States with a wide range of other countries. OECD does report a data series for a set of countries not including the United States (see Figure 4-1). This series compares intramural biotechnology R&D expenditures in the government and higher-education sectors as a fraction of total government and higher-education sector R&D expenditures. It is difficult to compare these data effectively across nations, however, because of differences in the mode of data collection. Nonetheless, one point that does appear clear is that relative to historical investment, South Korea, and, to some degree, Spain and the Czech Republic, have begun to accelerate investments in biotechnology. The data suggest that South Korea devoted nearly $3.4 billion to government and higher-education spending on biotechnology in 2016. A related though not directly comparable figure for the United States is that in fiscal year 2015, agencies of the U.S. federal government, principally the Department of Health and Human Services, obligated $30.5 billion to the life sciences (see Figure 4-2). Of this amount, $14.8 billion was targeted to general biological sciences, $10.9 billion to medical sciences, $1.3 billion to agricultural sciences, $0.8 billion to environmental sciences, and $2.6 billion to other life sciences (NSB and NSF, 2018, Appendix Table 4-25). While not all of the bioeconomy is based on life sciences, these

data suggest that the United States remains among the world’s leaders in government-led investment in the biological sciences.

Comparisons of Scientific Output in the Bioeconomy

A second, valuable indicator of scientific leadership in the bioeconomy can be gleaned from measures of scientific output, that is, academic publications. Numerous sources, including Thompson Reuters Web of Knowledge, Elsevier’s Scopus database, and Microsoft Academic, provide primary information on numbers of academic publications. Categorizing publications according to scientific fields is a challenge, but data agencies, including OECD and NSF, compile indicators using these primary data. Individual researchers can do the same.

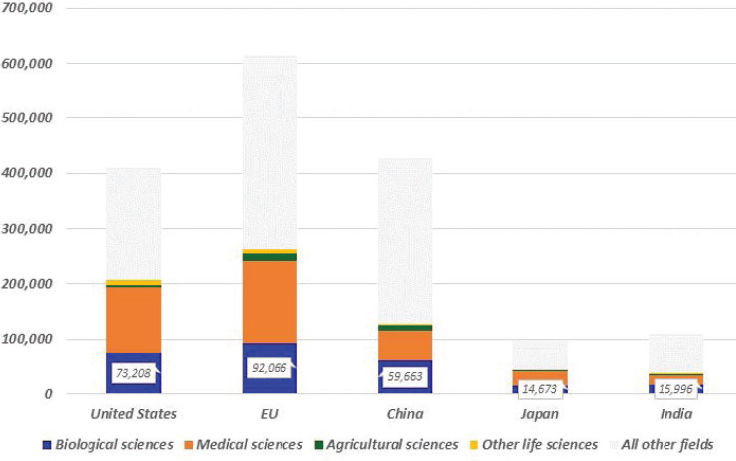

Figure 4-3 reports counts of science and engineering publications in Scopus, by selected region and field, for 2016, based on an analysis performed by NSF for the Science and Engineering Indicators (S&E).1 These data show that the United States leads the world in the production of publications in the biological and medical sciences (although the collec-

___________________

1 The use of academic publications and citations as indicators of scientific output and leadership has become the subject of a large body of research, including studies in the field of scientometrics (de Solla Price, 1976; Garfield, 1979; Leydesdorff, 2001; Schoenbach and Garfield, 1956). Research has noted the limitations of this approach, including the potential for strategic and reputation-based citation (Simkin and Roychowdhury, 2003). Nonetheless, country-level counts of publications have proven useful in understanding broad trends in scientific progress and as a result, are regularly included among the statistics gathered and reported by NSF’s S&E.

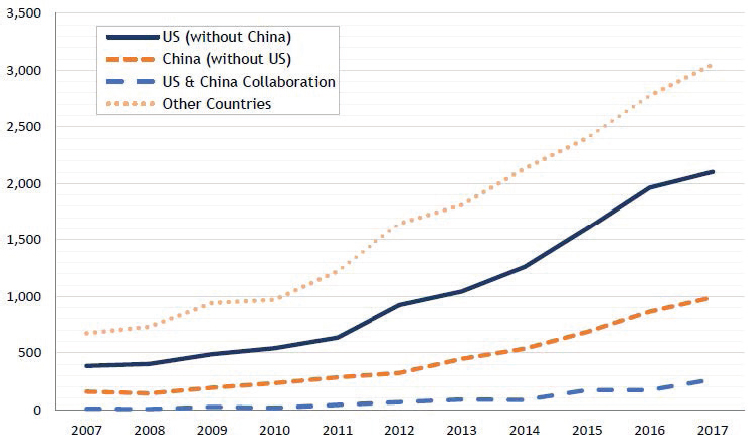

tive publication output of the countries of the European Union exceeds that of the United States). The output of publications in the biological and medical sciences with author addresses based in China is, however, quite striking, particularly compared with historical levels. The rise of Chinese biotechnology is documented in Figure 4-4, which reports annual biotechnology publications in the United States and China based on an analysis by Gryphon Scientific & Rhodium Group in its 2019 report China’s Biotechnology Development. The data shown in Figure 4-4 document a substantial rise in biotechnology research output over the past decade, with acceleration beginning around 2011 across a number of regions. While the biotechnology publication output for both the European Union and China

has risen substantially, these data do not suggest that either region is on a trajectory to eclipse the output of the United States in the short term.

Comparisons of Scientific Training for the Bioeconomy

A third important measure that can be used to compare global bioeconomy leadership is the training of scientific and technical personnel. As is true for both government investment and scientific output, there are limitations to the data on the bioeconomy workforce. In particular, it is easier to measure the output of recently trained graduates in particular scientific disciplines than to track the total count of employees in the bioeconomy workforce. This is due, in part, to the complexities of measuring the bioeconomy workforce. Whereas it is relatively straightforward to classify individuals with Ph.D.s in biology as potential contributors to the bioeconomy, it is more difficult to count the number of individuals trained in areas that are complementary contributors to the bioeconomy, including, for example, those with specific training in data analytics, computer

science, automation, the marketing of biologic medicines, or logistics for the transportation of biofuels.2

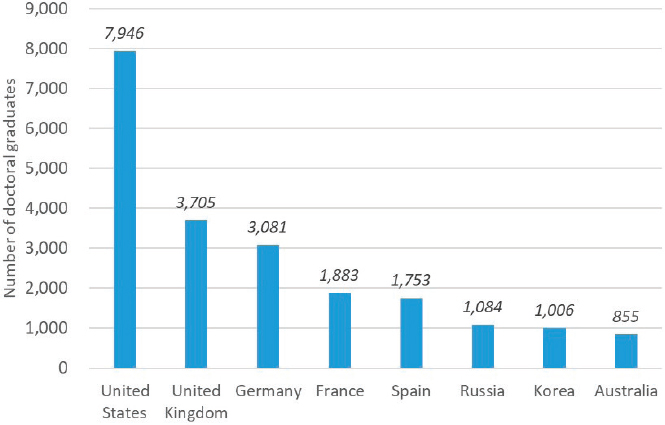

Cross-country comparisons of the count of doctoral graduates by field are available from OECD for 2016. Figure 4-5 reports these data for students identified as having completed degrees in “biological and related sciences.” In concordance with the publication and investment measures reported above, these data provide evidence of U.S. bioeconomy leadership. The United States awarded more than twice as many doctorates in 2016 as Germany, the next most prolific country for which data are available. Note, however, that OECD is not able to report either the total number of doctorates awarded in China or the number granted in biological and related sciences. Note as well that OECD data represent both imprecise estimates and underestimates of the total number of doctorate recipients in fields related to the bioeconomy. For example, NSF reports for 2016 that the United States produced 12,568 doctorate recipients in life sciences (which includes (1) agricultural and natural sciences, (2) biological and biomedical sciences, and (3) health sciences), plus another 1,089 doctorate recipients in bioengineering and biomedical engineering.3

Data that track over time the number of recipients of doctoral degrees

___________________

2 It is important to note that counts of doctorate recipients may not be fully consistent across countries, as countries do vary in their expectations for doctoral student work.

3 See https://www.nsf.gov/statistics/2018/nsf18304/data/tab12.pdf.

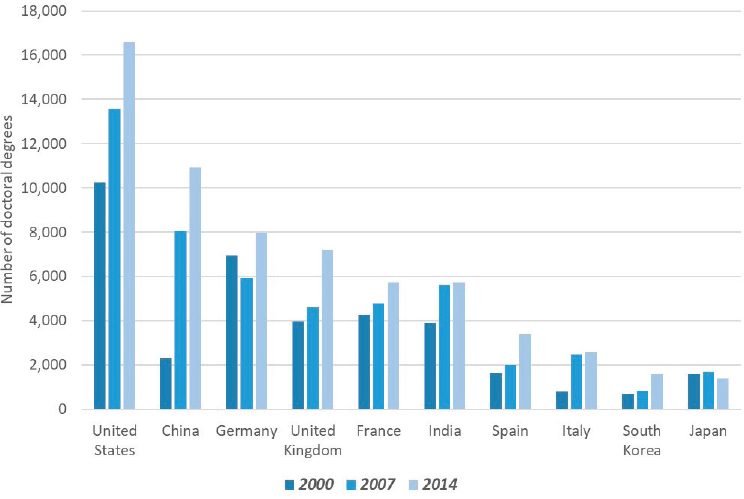

in the biosciences by country of citizenship are not publicly available in a curated dataset. The closest estimates come from the S&E, which collates data from various country sources on the number of degrees awarded in a country by broad academic field. Figure 4-6 shows an increase in the number of doctoral degrees in the combined category of physical and biological sciences, mathematics, and statistics for selected countries in the years 2000, 2007, and 2014. These data exclude some degrees that apply to the bioeconomy, such as bioengineering, yet because the data include degrees in mathematics, statistics, and physical sciences, they likely include doctoral students beyond those trained for specific work in the bioeconomy. These limitations notwithstanding, the key features of the data are that the United States leads in the number of doctoral degrees in fields pertinent

to the bioeconomy granted throughout the period (though the number of degrees from China saw the greatest growth over the period). If the current rates of growth persist, China will soon surpass the United States in the awarding of such degrees.

Given that doctoral trainees are the engine powering the advances in basic research at academic institutions, being able to supplement the United States’ bioeconomy workforce with talented students from around the world is a benefit. Among the roughly 45,000 recipients of doctoral degrees within the United States, about 30–34 percent are students on temporary visas, the largest fraction of whom are of Chinese origin. Table 4-1 reports a number of key facts about Ph.D. graduates of U.S. institutions between 2011 and 2017 who did not hold U.S. citizenship. Several facts are notable. First, citizens from China, India, and South Korea constitute the largest number of non-U.S. citizens who completed doctoral degrees at U.S. academic institutions in 2011 and 2017. Furthermore, among Asian countries, China experienced the greatest increase in the number of citizens completing U.S.-based doctorates, a boost of approximately 40 percent in 2017 relative to the nearly 4,000 Chinese citizen students who completed their degree in 2011. Interestingly, however, the fraction of doctoral students staying in the United States remained relatively constant across countries, including China, during the period 2011–2017.

For selected countries, S&E reports the total number of doctoral degrees awarded by U.S. institutions, by scientific field and citizenship of recipient, for the period 1995–2015. Data for China, India, South Korea, and Taiwan are presented in Table 4-2. Nearly 70,000 students with Chinese citizenship received doctoral degrees in science and engineering fields from U.S. institutions during this time. Of these individuals, 12,002 earned degrees in biological sciences, and 10,816 earned degrees in physical sciences.

Taken together, these indicators suggest that the United States continues to lead the world in government investments and outputs as well as the production of doctorate recipients in sciences related to the bioeconomy. This leadership does not, however, appear to be as secure as it once was. China, in particular, has begun to increase its investments at a rapid rate and appears poised to overtake the United States at least in the production of doctoral recipients in these bioeconomy-related sciences in the medium term (see Gryphon Scientific and Rhodium Group, 2019).

NATIONAL COMPARISONS OF PRIVATE INNOVATION INPUTS

Whereas the prior chapter highlighted government expenditures on R&D investments relevant to the bioeconomy, this section of this chapter

TABLE 4-1 Doctorate Recipients with Temporary Visas, by Year of Degree and Intent to Stay in the United States After Receiving Degree (All Degrees), by Country of Citizenship, 2011–2017

| Country of Citizenship | 2011 | 2017 | Total, All Years, 2011–2017 | Percent Change, 2011–2017 | ||||

|---|---|---|---|---|---|---|---|---|

| Number | % Staying | Number | % Staying | Number | % Staying | Number | % Staying | |

| All temp. visa holders | 14,235 | 70.1 | 16,323 | 74.2 | 109,476 | 71.5 | 15 | 6 |

| Americas | 1,449 | 57.3 | 1,443 | 56.6 | 10,370 | 56.4 | 0 | –1 |

| Asia | 9,568 | 74.5 | 10,659 | 80.0 | 73,431 | 76.4 | 11 | 7 |

| China | 3,988 | 82.1 | 5,564 | 83.2 | 34,458 | 81.9 | 40 | 1 |

| India | 2,165 | 84.6 | 1,974 | 88.6 | 15,335 | 85.8 | –9 | 5 |

| South Korea | 1,445 | 60.0 | 1,126 | 68.5 | 9,173 | 62.4 | –22 | 14 |

| Europe | 1,962 | 64.3 | 1,788 | 67.4 | 12,994 | 63.8 | –9 | 5 |

| France | 125 | 64.8 | 107 | 69.2 | 790 | 63.7 | –14 | 7 |

| Germany | 203 | 65.5 | 154 | 68.2 | 1,340 | 58.1 | –24 | 4 |

| Italy | 137 | 60.6 | 161 | 70.8 | 1,069 | 64.8 | 18 | 17 |

| Turkey | 493 | 61.9 | 498 | 61.0 | 3,275 | 61.0 | 1 | –1 |

| Middle East | 600 | 61.3 | 1,509 | 62.1 | 7,052 | 64.4 | 152 | 1 |

| Iran | 198 | 88.9 | 771 | 92.6 | 3,472 | 90.1 | 289 | 4 |

| Saudi Arabia | 49 | 14.3 | 340 | 10.3 | 996 | 11.9 | 594 | –28 |

NOTE: Percentages based on all doctorate recipients on temporary visas who indicated where they intended to stay after graduation (United States versus foreign location), not just those with definite commitments for employment or postdoctoral study.

SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, 2018 Survey of Earned Doctorates.

TABLE 4-2 Asian Recipients of U.S. Science and Engineering Doctorates on Temporary Visas, by Field and Country or Economy of Origin, 1995–2015

| Field | Asia | China | India | South Korea | Taiwan |

|---|---|---|---|---|---|

| All fields | 166,920 | 68,379 | 32,737 | 26,630 | 16,619 |

| Science and engineering | 146,258 | 63,576 | 30,251 | 20,626 | 13,001 |

| Engineering | 55,215 | 23,101 | 13,208 | 8,274 | 5,045 |

| Science | 91,043 | 40,475 | 17,043 | 12,352 | 7,956 |

| Agricultural sciences | 4,927 | 1,745 | 823 | 720 | 441 |

| Biological sciences | 25,149 | 12,202 | 5,654 | 2,459 | 2,374 |

| Computer sciences | 9,287 | 4,229 | 2,477 | 1,015 | 597 |

| Earth, atmospheric, and ocean sciences | 2,803 | 1,563 | 357 | 338 | 228 |

| Mathematics | 7,494 | 4,493 | 805 | 967 | 503 |

| Medical and other health sciences | 5,298 | 1,368 | 1,371 | 672 | 878 |

| Physical sciences | 20,528 | 10,816 | 3,516 | 2,216 | 1,305 |

| Psychology | 2,053 | 530 | 277 | 481 | 320 |

| Social sciences | 13,504 | 3,529 | 1,763 | 3,484 | 1,310 |

| Non–science and engineering | 20,662 | 4,803 | 2,486 | 6,004 | 3,618 |

NOTES: Asia includes Afghanistan, Bangladesh, Bhutan, Brunei, Burma, Cambodia, China, Christmas Island, Hong Kong, India, Indonesia, Japan, Kazakhstan, Kyrgyzstan, Laos, Macau, Malaysia, Maldives, Mongolia, Nepal, North Korea, Pakistan, Papua New Guinea, Paracel Islands, Philippines, Singapore, South Korea, Spratly Islands, Sri Lanka, Taiwan, Tajikistan, Thailand, Timor-Leste, Turkmenistan, Uzbekistan, and Vietnam. Data include temporary visa holders and non-U.S. citizens with unknown visa status who are assumed to be on temporary status.

SOURCE: Science and Engineering Indicators 2018, National Science Foundation, National Center for Science and Engineering Statistics, 2015 Survey of Earned Doctorates.

transitions to focus on overall national investments and investments from the private sector. These data tell a story similar to that in prior sections of this chapter. While the United States maintains leadership in bioeconomy investments, questions arise about the nation’s ability to maintain its historical leadership position across science and engineering sectors.

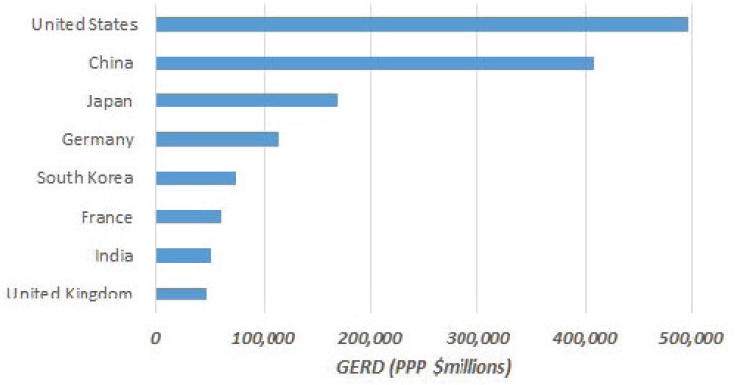

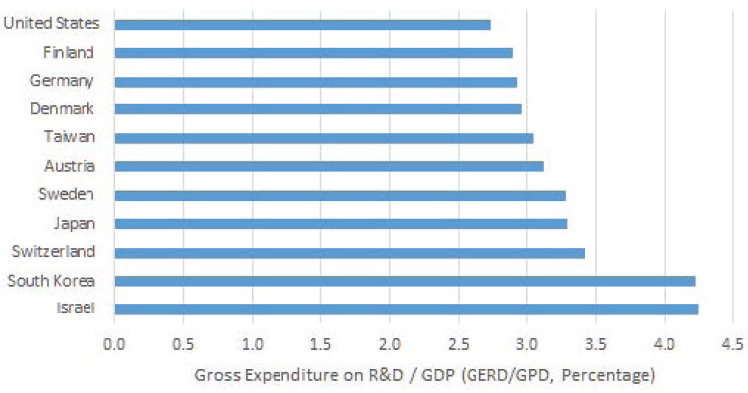

Figures 4-7 and 4-8, respectively, report total national expenditures on R&D and the percentage of gross domestic product (GDP) devoted to R&D for countries allocating the most resources to R&D for the year 2015. Figure 4-7 shows that the United States continues to lead the world in total investment in innovation, with nearly $500 billion invested in R&D in 2015. China, however, is now investing an amount that is increasingly close to that of the United States, with more than $400 billion having been invested in 2015. Both countries invest more than the total invested by the European Union, which was $386.5 billion in that same year. Indeed, no country other than China invests even half as much in innovation as does the United States. It is not the case, however, that the United States leads the world in investment relative to the size of its economy. Figure 4-8 shows that numerous countries, including Austria, Denmark, Finland,

Germany, Israel, Japan, South Korea, Sweden, Switzerland, and Taiwan, invest a higher fraction of GDP in R&D relative to the United States, while Figure 4-9 demonstrates that U.S. R&D investment as a share of GPD has remained stable even as that of other countries, such as South Korea and Japan, has continued to rise.

NATIONAL COMPARISONS OF INNOVATION IN BIOTECHNOLOGY AND OTHER AREAS OF THE BIOECONOMY

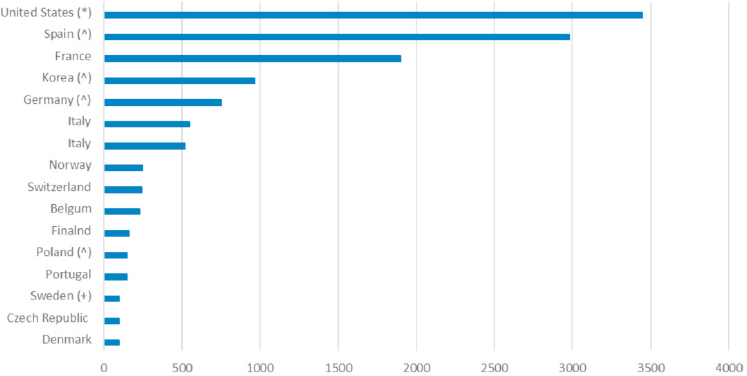

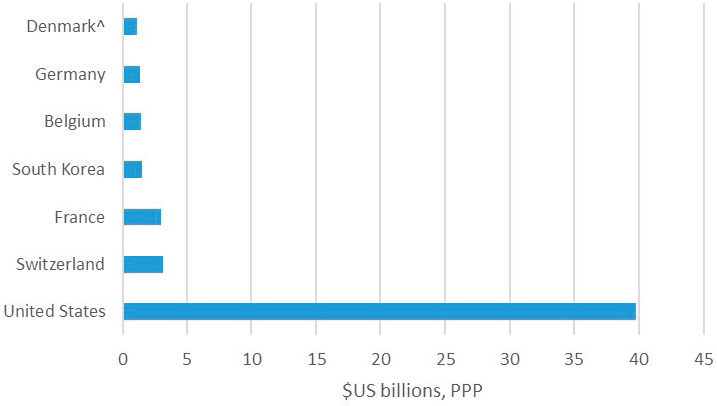

Ideal data on country-level investment in the bioeconomy are difficult to obtain. Indeed, it is difficult to obtain reliable data on R&D investment for even the largest bioeconomy segments, including one of the oldest, biotechnology. OECD compiles data on the number of firms active in biotechnology (see Figure 4-10). The presented data do not include China, for which information on aggregate R&D investment in biotechnology does not appear to be available in a reliable way (see Gryphon Scientific and Rhodium Group, 2019, pp. 13 and 36). The data in Figure 4-10 suggest, however, that the United States contains the largest number of biotechnology

firms of any country in the world—more than 3,000 in 2015. Furthermore, U.S. private-sector firms invest an order of magnitude more heavily in biotechnology relative to firms in other countries. According to OECD, U.S. firms invested approximately $40 billion in biotechnology R&D in 2015, an amount that exceeded the combined investments of other leading countries in biotechnology (i.e., Belgium, Denmark, France, Germany, South Korea, and Switzerland) (see Figure 4-11). The United States is also a clear leader in OECD’s counts of firms active in biotechnology R&D (see Figure 4-10), although these data are particularly difficult to compare across countries.

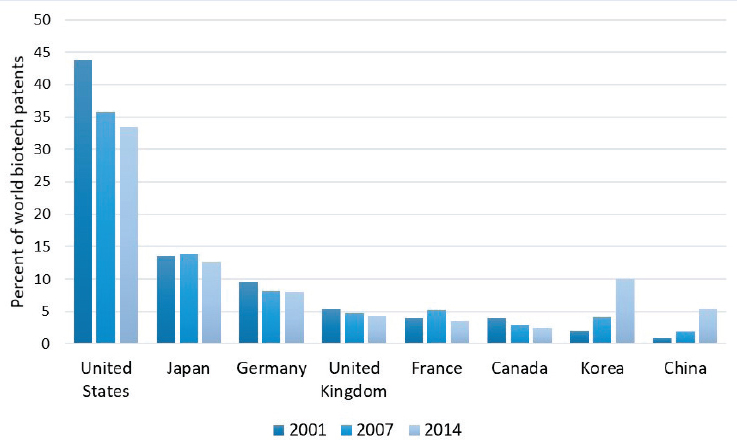

Data on international patenting suggest that U.S. leadership in biotechnology R&D remains substantial (see Figure 4-12). OECD compiles data on the fraction of biotechnology patents originating from inventors in each country, counting patents based on the fraction of inventors that come from that country.4 For example, a patent that lists three total inventors, one each from the United States, Canada, and Germany, would be measured as contributing one-third of a patent in each of those countries. The data refer to patent families filed under the Patent Cooperation Treaty within the Five IP Offices (which includes the European Patent Office [EPO]; Japan Patent Office; Korean Intellectual Property Office; National Intellectual Property Administration, PRC; and U.S. Patent and Trade-

___________________

4 See https://www.oecd.org/innovation/inno/keybiotechnologyindicators.htm.

^ Data for these countries include biotechnology companies, not just biotechnology R&D firms.

+ For Sweden, data include only firms with 10 or more employees.

* For the United States, the number of firms includes only those that actually responded to the survey. The data are adjusted to the weight to account for missing responses. The survey was administered only to firms with five or more employees.

NOTE: Data include biotechnology R&D firms, unless otherwise noted. Data not available for China or Japan. SOURCE: OECD, Key Biotechnology Indicators, http://oe.cd/kbi, updated October 2018.

mark Office [USPTO]), with members filed at the EPO or at the USPTO, by the first filing date. These data document the United States’ leadership in biotechnology innovation over the past 20 years, but also the relative erosion of that leadership position. The United States contributed more than 40 percent of patents in 2001, but only slightly more than 35 percent in 2007 and less than 35 percent in 2014. The U.S. percentage is, however, more than twice the fraction contributed by any other country. Japan represents the next-highest fraction of patents at less than 15 percent of the overall total. South Korea and China experienced the greatest increase in the fraction of international biotechnology patents during 2001–2014, with South Korea increasing its fraction from 2 percent to 10 percent and China increasing its fraction from 1 percent to 5 percent.

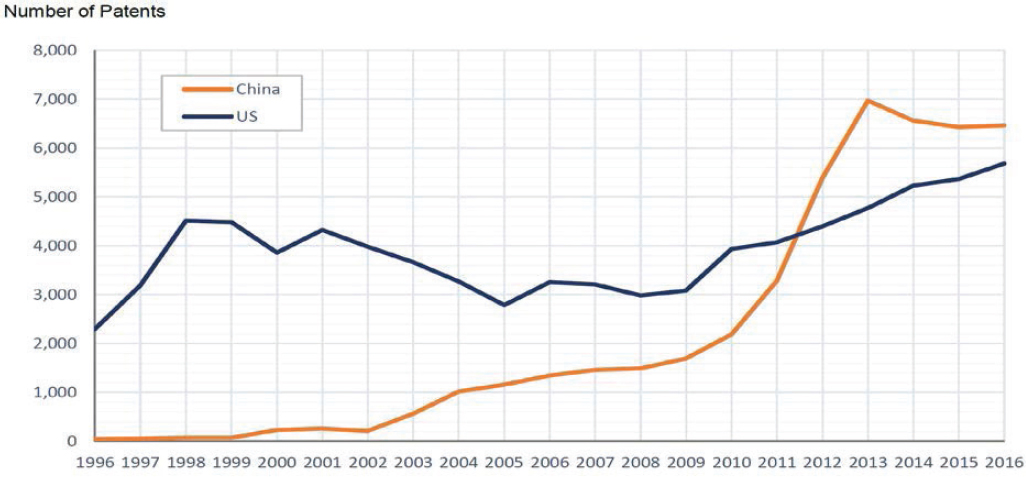

A different story emerges based on World Intellectual Property data, which compare annual biotechnology patents issued in the United States and China (see Figure 4-13). Unlike the OECD data, these data do not

SOURCE: Gryphon Scientific and Rhodium Group (2019) from World Intellectual Property Organization.

reflect international patents (i.e., patents registered in multiple domains), but rather just patents filed in the United States and China, respectively. These data suggest a substantial increase in biotechnology patenting in China. It is not clear, however, whether these patents reflect innovation at the world’s technological frontier, but they may signal China’s potential to begin innovating at the world frontier of biotechnology.

More broadly, the extent of commitment by foreign countries to their overall innovation infrastructure and the increasing investments in biosciences by countries, particularly by countries with defined R&D strategies, such as China and South Korea, suggest that U.S. leadership in biosciences and bioeconomy innovation is unlikely to be maintained in the future at the same level as it has been in the recent past.

In terms of the deployment of agricultural biotechnology, the United States leads the world in acreage planted with bioengineered crops, with 40 percent (75.0 million hectares) of the world total in 2017 of 189.8 million hectares. The next four largest shares are in Brazil (26 percent, 50.2 million hectares), Argentina (12 percent, 23.6 million hectares), Canada (7 percent, 13.1 million hectares), and India (6 percent, 11.4 million hectares). Over the first 21 years of the commercialization of bioengineered crops, from 1996 to 2016, the United States captured the largest cumulative economic benefits from the technology (ISAAA, 2017).

NATIONAL COMPARISONS OF ENTREPRENEURSHIP/VENTURE CAPITAL FUNDING

The entrepreneurial culture of the United States has long been considered an important feature of the national institutional environment, an aspect that has contributed to the nation’s technological leadership and economic dynamism. Economists have, however, pointed out that the historical dynamism—such as rate of entrepreneurship, fraction of workers in small and growing firms, and rate of new job creation—that historically characterized the U.S. economy has been showing signs of decline (Decker et al., 2014; Haltiwanger, 2015). While declining dynamism may be an issue in the U.S. economy overall, however, it does not appear to affect the bioeconomy in particular.

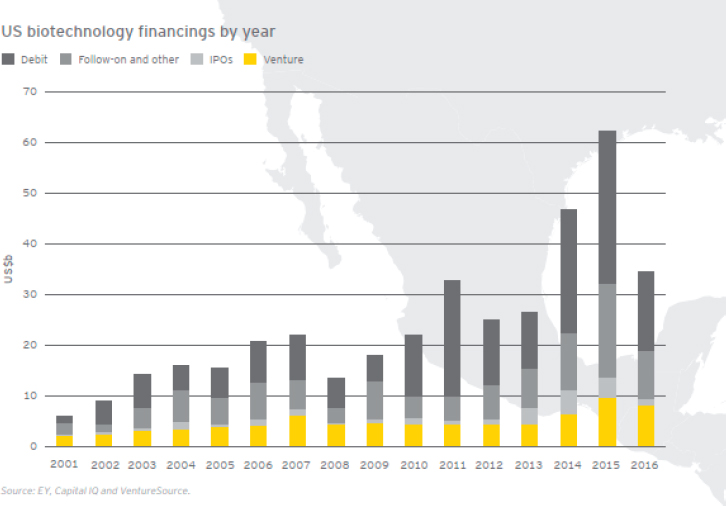

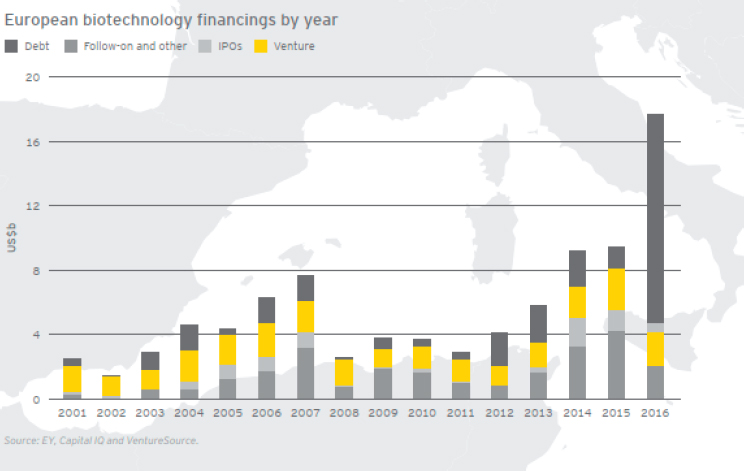

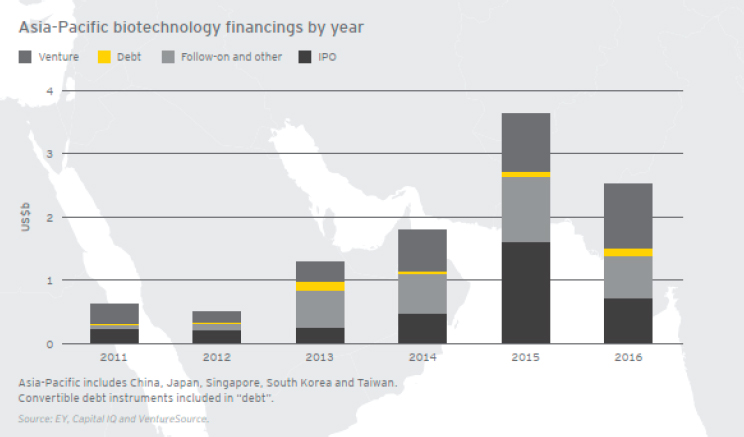

There are a number of sources for information on international entrepreneurship and venture funding, but none of them appear to provide consistent, historical data across the full set of sectors encompassed by the bioeconomy. As a result, we surveyed results for several principal bioeconomy sectors and sources, beginning with one of the economically largest sectors of the bioeconomy, biotechnology. The EY Biotechnology Report 2017 compiles and reports on financing, initial public offerings (IPOs), and venture capital investments based on Capital IQ and VentureSource. These data suggest that the scale of biotechnology venture

financing in the United States continues to greatly exceed that of Europe and leading Asian countries.

Figure 4-14 tracks financing for biotechnology firms in the United States between 2001 and 2016 and demonstrates how venture funding, follow-on funding, and debt funding rose, on average, throughout the 15-year period, while IPO proceeds fluctuated. These patterns are similar to those occurring in the European biotechnology sector during the same period, although of a substantially greater magnitude. Whereas total U.S. biotechnology financing had reached $10 billion by 2003, it did not achieve this level in Europe until 2015 (see Figure 4-15). And although biotechnology ventures in China and South Korea have received substantial investment in the past few years, the data as of 2016 suggest that biotechnology ventures in China, Japan, South Korea, and Taiwan lag substantially behind those in the United States and Europe, having not reached $4 billion in financing in any year prior to or including 2016, the last year of the Ernst and Young (EY) data (see Figure 4-16).

These comparisons rely mainly on venture investment data. Other valuable indicators of competitiveness and leadership in this area would include measures of business dynamics, such as measures of entry (e.g., counts of new firms) and exit (e.g., IPOs, acquisitions, and firm failings).

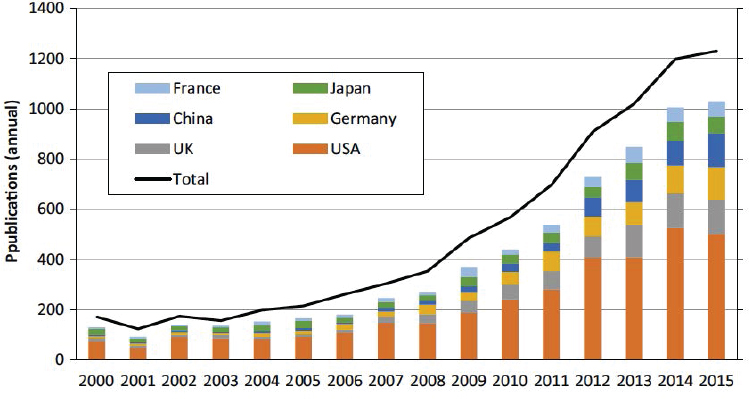

U.S. LEADERSHIP CASE STUDY: SYNTHETIC BIOLOGY

Synthetic biology is one of the most dynamic areas of biological science and one of the most interesting emerging subsectors of the bioeconomy. It is also an area in which evidence of U.S. leadership exists in innovation, entrepreneurship, and scientific and economic success. Figure 4-17 reports counts of academic publications in synthetic biology published in journals indexed by Web of Science from 2000 to 2015, showing the worldwide total and the numbers for leading countries by author affiliation. During this period, the number of such publications grew annually from fewer than 200 to more than 1,000. In each year since 2000, the United States has produced more than half of the total global publications in this area.

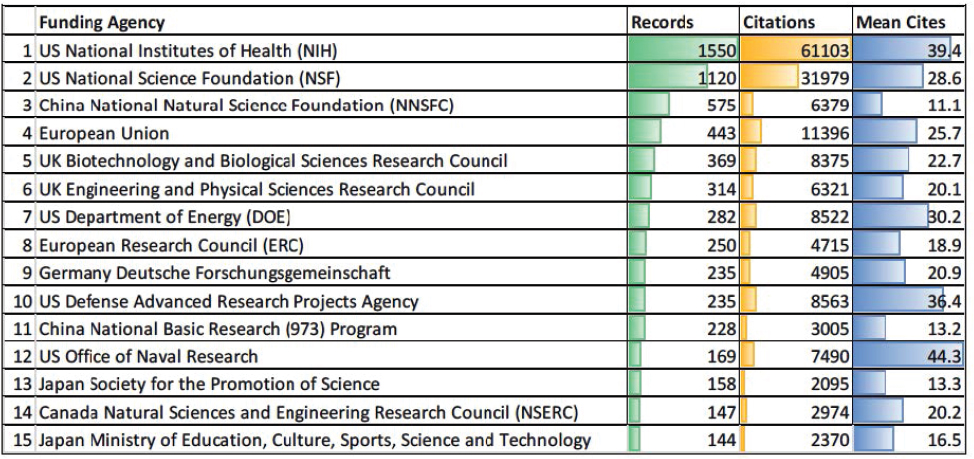

A University of Manchester and Georgia Tech study by Philip Shapira, Seokbeom Kwon, and Jan Youtie classifies synthetic biology papers indexed by Web of Science that were sponsored by the top 15 synthetic biology funding agencies worldwide based on the agency that originally provided their funding, and derives a series of measures related to these publications (Shapira et al., 2018; see Figure 4-18). Their analyses document that the National Institutes of Health and NSF fund the largest fraction of synthetic biology publications worldwide and that these publications garner more citations than those funded by other agencies. Along with papers funded

by the U.S. Office of Naval Research, the Defense Advanced Research Projects Agency, and the U.S. Department of Energy, these government-funded papers also receive the highest average number of citations per paper. The National Natural Science Foundation of China funds the third-largest number of synthetic biology papers, but as of 2018, those papers were receiving substantially fewer citations on average relative to those funded by the other agencies tracked by the coauthors. These findings suggest substantial leadership by the United States in the science of synthetic biology. More generally, they suggest the fact that this leadership may be driven, to a significant degree, by investments made by the U.S. federal government.

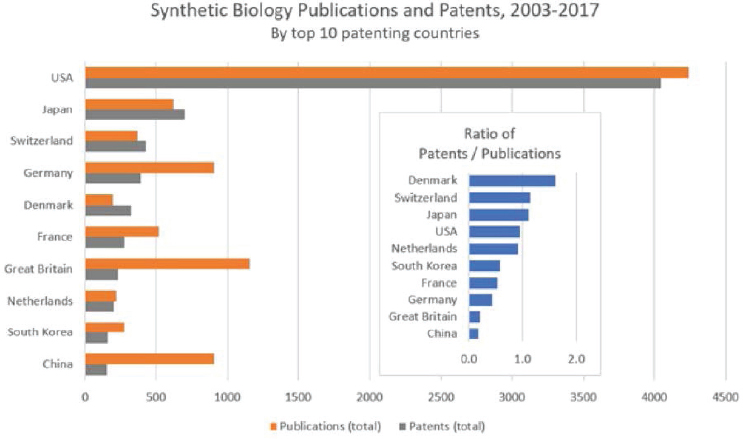

In further work, Shapira and Kwon (2018) demonstrate the relationship between synthetic biology publications and patents for the 10 countries that generate the largest number of synthetic biology patents (see Figure 4-19). These data, too, document U.S. leadership. Between 2003 and 2017, the authors link more than 4,000 synthetic biology patents to inventors in the United States. The closest country to the United States in the count of patents included in the PATSTAT database (of international patent families) is Japan, which recorded fewer than 1,000 patents during the same period. Authors with affiliations in the United States also published more than 4,000 articles, while the closest country, Great Britain, generated fewer than 1,500. Because these data are based on a longer

time period, they may underestimate the recent progress made by such countries as South Korea and China; however, the data do make clear the historical leadership of the United States, both in science and in intent to commercialize synthetic biology.

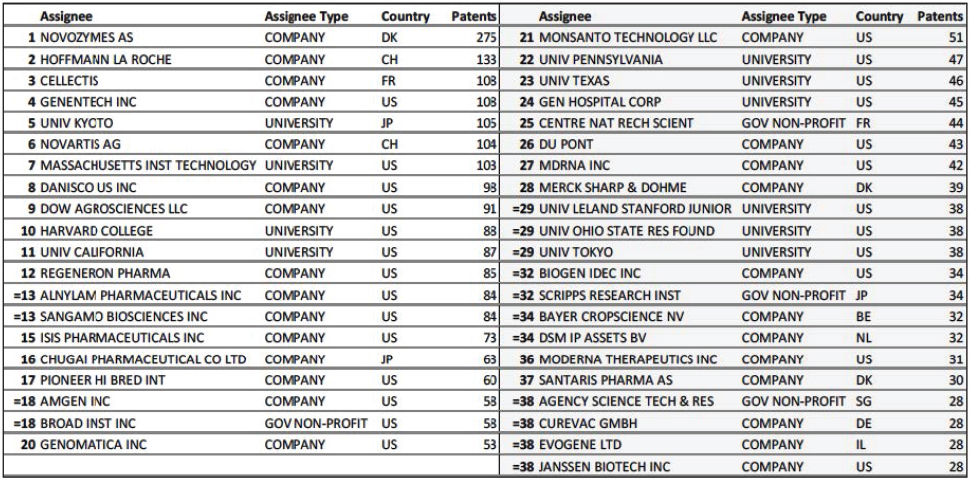

Although the United States maintains a substantial advantage overall in synthetic biology science and innovation, this advantage is not hegemonic. Indeed, the two firms that patent the most in this area are a Danish firm, Novozymes AS, and a Swiss firm, Hoffmann-LaRoche (see Figure 4-20). Headquartered outside of Copenhagen, Denmark, Novozymes is one the world’s leading producers of industrial enzymes and microorganisms. Headquartered in Basel, Switzerland, Hoffmann-LaRoche is a global pharmaceutical conglomerate that encompasses multiple R&D centers in the United States, including the main location of initially U.S.-based biotechnology firm Genentech, which has the fourth-highest number of synthetic biology patents identified by Shapira and Kwon (2018) over the period of their study. While 5 of the 6 organizations with the most synthetic biology patents are not based in the United States, 17 of the next 18 are. Overall, more than 60 percent of the 40 organizations with the most synthetic biology patents are based in the United States.

U.S. leadership in synthetic biology is not limited to academia, but appears to extend to entrepreneurship as well. As of early 2019, SynBioBeta had identified more than 350 U.S.-based firms in this subsector, while the countries with the second- and third-most firms, the United Kingdom and France, had only 87 and 27 such firms, respectively (see Figure 4-21). Among the entrepreneurial ventures leveraging synthetic biology in the United States are such firms as Ginkgo Bioworks, which designs microorganisms for commercial use, and two firms funded in 2018—Impos-sible Foods, which develops plant-based meat substitutes, and Moderna Therapeutics, which develops drug therapies based on messenger RNA.

U.S. LEADERSHIP IN THE BIOECONOMY: SYNTHESIS

Taken together, the data the committee reviewed suggest that the United States is a clear leader in developing research that leads to bioeconomy innovation. The data suggest, however, that other countries, particularly South Korea and China, are increasing their investments in science and innovation.

As is true for other areas of science and innovation, the United States has historically attracted and to a great extent retained the best and the brightest scientific talent to attend its graduate schools, enroll in postdoctoral training, and serve as researchers and faculty. While the data up until 2017 suggest that the United States has continued to attract and retain talented individuals from around the world, scientists and policy makers are beginning to raise questions about the nation’s ability to continue

to do so, both because of the increasing investments in science by other countries and because of the threats to the historical consensus regarding the national priority of investing in science and innovation in the United States, as discussed in Chapter 7 of this report (Alberts and Narayanamurti, 2019; Kerr, 2019; Peri et al., 2014).

While the overall innovation ecosystem and historical stock of investments protect U.S. leadership in the bioeconomy, a series of other policies and choices that are relevant to future competitive success in this sector deserve consideration both on their merits and with regard to their impact on the bioeconomy. For example, the Information Technology and Innovation Foundation estimated in 2012 that the United States offered R&D tax incentives that were only 27th among the 42 countries it had studied (Stewart et al., 2012). Economists studying tax credits have found evidence that such policies can stimulate R&D investment, and it is possible that greater support5 for such policies in the United States could contribute to greater bioeconomy competitiveness (Agrawal et al., 2019; Rao, 2016). Given that work characterizing bioeconomies is in a relatively early stage, however, it is likely too soon to make definitive statements about which policy levers have the most influence on bioeconomy leadership. This is particularly true considering the multiple industrial applications for the science and innovation underlying the bioeconomy. The committee hopes that research efforts will engage with these topics.

CONCLUSIONS

This chapter has examined the available data to assess the status of U.S. leadership within the global bioeconomy, providing a discussion of the strengths and caveats of each metric.

Conclusion 4-1: The United States is a clear leader in the global landscape in multiple areas related to the bioeconomy, including federal funding for biological sciences; the production of science, innovation, and entrepreneurship in synthetic biology; and the generation and adoption of bioengineered crops. This leadership has been based to a substantial degree on the country’s historical edge in science and the production of new-to-the-world knowledge.

Conclusion 4-2: The current U.S. international position is one of general leadership in those areas built on research and development in the life sciences—leadership that has been built as a result of and not

___________________

5 It should be noted that the U.S. R&D tax credit was made permanent in 2015. However, it was not changed in magnitude (https://www.eidebailly.com/insights/articles/rd-taxcredit-enhanced-and-becomes-permanent).

despite, open scientific borders. Continued leadership will involve (1) careful analysis of the policies and ecosystem features that under-gird the bioeconomy, and (2) continued commitment from the federal government to world-leading investment in sciences.

REFERENCES

Agrawal, A., C. Rosell, and T. S. Simcoe. 2019. Tax credits and small firm R&D spending. NBER working paper 20615. https://www.nber.org/papers/w20615 (accessed September 7, 2019).

Alberts, B., and V. Narayanamurti. 2019. Two threats to U.S. science. Science 364(6441):613.

American Academy of Arts & Sciences. 2014. Restoring the foundation: The vital role of research in preserving the American dream. https://www.amacad.org/publication/restoring-foundation-vital-role-research-preserving-american-dream (accessed September 7, 2019).

Cho, S. W., S. Kim, J. M. Kim, and J. S. Kim. 2013. Targeted genome engineering in human cells with the Cas9 RNA-guided endonuclease. Nature Biotechnology 31(3):230–232.

Cong, L., F. A. Ran, D. Cox, S. Lin, R. Barretto, N. Habib, P. D. Hsu, X. Wu, W. Jiang, L. A. Marraffini, and F. Zhang. 2013. Multiplex genome engineering using CRISPR/Cas systems. Science 339(6121):819–823.

Cumbers, J. 2019. Defining the bioeconomy. Presentation to the Committee on Safeguarding the Bioeconomy. January 28. http://nas-sites.org/dels/studies/bioeconomy/meeting-1 (accessed March 10, 2020).

de Solla Price, D. 1976. An extrinsic value theory for basic and “applied” research. Policy Studies Journal 5:160–168.

Decker, R., J. Haltiwanger, R. Jarmin, and J. Miranda. 2014. The role of entrepreneurship in U.S. job creation and economic dynamism. Journal of Economic Perspectives 28(3):3–24.

Doudna, J. A., and E. Charpentier. 2014. Genome editing: The new frontier of genome engineering with CRISPR-Cas9. Science 346(6213):1258096.

EY Biotechnology Report. 2017. Ernst & Young LLP. https://www.ey.com/Publication/vwLUAssets/ey-biotechnology-report-2017-beyond-borders-staying-thecourse/$FILE/ey-biotechnology-report-2017-beyond-borders-staying-the-course.pdf (accessed August 1, 2019).

Friedrichs, S., and B. van Beuzekom. 2018. Revised proposal for the revision of the statistical definitions of biotechnology and nanotechnology. OECD Science, Technology and Industry Working Papers, No. 2018/01, OECD Publishing, Paris, https://doi.org/10.1787/085e0151-en.

Furman, J. L., and R. Hayes. 2004. Catching up or standing still?: National innovative productivity among “follower” countries, 1978–1999. Research Policy 33(9):1329–1354.

Furman, J. L., M. E. Porter, and S. Stern. 2002. The determinants of national innovative capacity. Research Policy 31(6):899–933.

Garfield, E. 1979. 2001: An information society? Journal of Information Science 1(4):209–215.

Gryphon Scientific and Rhodium Group. 2019. China’s biotechnology development: The role of U.S. and other foreign engagement. https://www.uscc.gov/sites/default/files/Research/US-China%20Biotech%20Report.pdf (accessed September 7, 2019).

Haltiwanger, J. 2015. Top ten signs of declining business dynamism and entrepreneurship in the U.S. http://econweb.umd.edu/~haltiwan/haltiwanger_kauffman_conference_august_1_2015.pdf (accessed September 7, 2019).

ISAAA (International Service for the Acquisition of Agri-biotech Applications). 2017. Global status of commercialized niotech/GM crops in 2017: Biotech crop adoption surges as economic benefits accumulate in 22 years. ISAAA brief no. 53. Ithaca, NY: ISAAA.

Jinek, M., K. Chylinski, I. Fonfara, M. Hauer, J. A. Doudna, and E. Charpentier. 2012. A programmable dual-RNA-guided DNA endonuclease in adaptive bacterial immunity. Science 337(6096):816–821.

Kerr, W. 2019. The gift of global talent. Palo Alto, CA: Stanford Press.

Krugman, P. 1991. Increasing returns and economic geography. Journal of Political Economy 99(3):483–499.

Kwon, S., J. Youtie, and P. Shapira. 2016. Building a patent search strategy for synthetic biology. Working paper. Atlanta, GA: Tech Program in Science, Technology and Innovation Policy. http://bit.ly/2E3Py7T (accessed September 1, 2019).

Leydesdorff, L. 2001. Scientometrics and Science Studies. Bulletin of Sociological Methodology/Bulletin de Méthodologie Sociologique 71(1):79–91.

Mali, P., L. Yang, K. M. Esvelt, J. Aach, M. Guell, J. E. DiCarlo, J. E. Norville, and G. M. Church. 2013. RNA-guided human genome engineering via Cas9. Science 339(6121):823–826.

McNutt, M. K. 2019. Maintaining U.S. leadership in science and technology. Statement before the Committee on Science, Space, and Technology, U.S. House of Representatives, March 6. http://www8.nationalacademies.org/onpinews/newsitem.aspx?RecordID=362019b (accessed September 7, 2019).

Murmann, J. P. 2003. Chemicals and long-term economic growth: Insights from the chemical industry. Cambridge, UK: Cambridge University Press.

NAS/NAE/IOM (National Academy of Sciences, National Academy of Engineering, and Institute of Medicine). 2010. Rising above the gathering storm, revisited: Rapidly approaching category 5. Washington, DC: The National Academies Press. doi: 10.17226/12999.

NRC (National Research Council). 2007. Rising above the gathering storm: Energizing and employing America for a brighter economic future. Washington, DC: The National Academies Press. doi: 10.17226/11463.

NSB and NSF (National Science Board and National Science Foundation). 2018. 2018 Science & Engineering Indicators. https://www.nsf.gov/statistics/2018/nsb20181/assets/nsb20181.pdf (accessed September 11, 2019).

Peri, G., K. Shih, C. Sparber, and A. M. Zeitlin. 2014. Closing American Doors. New York: Partnership for a New American Economy.

Qi, L. S., M. H. Larson, L. A. Gilbert, J. A. Doudna, J. S. Weissman, A. P. Arkin, and W. A. Lim. 2013. Repurposing CRISPR as an RNA-guided platform for sequence-specific control of gene expression. Cell 152(5):1173–1183.

Rao, N. 2016. Do tax credits stimulate R&D spending? The effect of the R&D tax credit in its first decade. Journal of Public Economics 140:1–12.

Schoenbach, U. H., and E. Garfield. 1956. Citation Indexes for Science. Science 123(3185):61–62.

Shapira, P., and S. Kwon. 2018. Synthetic biology research and innovation profile 2018. Publications and Patents. doi: 10.1101/485805.

Shapira, P., S. Kwon, and J. Youtie. 2017. Tracking the emergence of synthetic biology. Scientometrics 112:1439–1469.

Simkin, M. V., and V. P. Roychowdhury. 2003. Read before you cite! Complex Systems 14:269–274.

Slaymaker, I. M., L. Gao, B. Zetsche, D. A. Scott, X. Winston, W. X. Yan, and F. Zhang. 2016. Rationally engineered Cas9 nucleases with improved specificity. Science 351(6268):84–88.

Stewart, L. A., J. Warda, and R. D. Atkinson. 2012. We’re #27!: The United States lags far behind in R&D tax incentive generosity. Washington, DC: Information Technology and Innovation Foundation.

Suzuki, K., Y. Tsunekawa, R. Hernandez-Benitez, J. Wu, J. Zhu, E. J. Kim, F. Hatanaka, M. Yamamoto, T. Araoka, Z. Li, M. Kurita, T Hishida, M. Li, E. Aizawa, S. Guo, S. Chen, A. Goebl, R. D. Soligalla, J. Qu, T. Jiang, X. Fu, M. Jafari, C. R. Esteban, W. T. Berggren, J. Lajara, E. Nuñez-Delicado, P. Guillen, J. M. Campistol, F. Matsuzaki, G. H. Liu, P. Magistretti, K. Zhang, E. M. Callaway, K. Zhang, and J. C. Belmonte. 2016. In vivo genome editing via CRISPR/Cas9 mediated homology-independent targeted integration. Nature 540:144–149.